Fundamentally strong stocks with huge price corrections. Is this an opportunity?

After 7 consecutive weeks of closing lower, the S&P 500 (as represented by the SPY ETF, in this example), saw a “much-welcomed” rally last week when the index rallied by approx. 6%. Is this just a bear market rally, or does it signify that a bottom has already been reached and blue skies are ahead?

I don’t have a crystal ball in front of me to say with certainty that either one of the above 2 scenarios is the right one. But if I am to render a guess (and yes, it is just my personal “guestimate” so please do not take it as the gospel truth), grey clouds with showery thunderstorms are what I am envisioning at the moment (read between the lines, ya)

Nonetheless, there are always opportunities for both investors and traders alike, to capitalize even in the current uncertain market scenario.

In this article, I will be highlighting 3 fundamentally strong stocks that have witnessed a substantial share price decline of over 40% from their recent peak. However, those declines are not accompanied by expectations of earnings decline, but instead, these companies are expected to demonstrate YoY EPS improvements in 2022.

These companies have also demonstrated the ability to grow earnings over the past 4 years, even during the height of COVID-19 (during the years 2019-20).

This provides an opportunity for long-term investors to capitalize on these fundamentally robust stocks which might be unfairly “beaten down” from an earnings standpoint.

From a shorter-term trading perspective, 1 of these 3 counters is also demonstrating early “signs” of an increase in price momentum which could pay off big time if the current market rebound is to take legs. Which of these 3 counters might have a short-term trading angle to it, according to the TradersGPS platform?

Disclaimer: This is not a recommendation to BUY/SELL any of the counters highlighted in this article, so please do your own necessary due diligence work and note the suitability of these counters based on your risk profile.

Fundamentally strong stocks #1: Generac Holdings (GNRC)

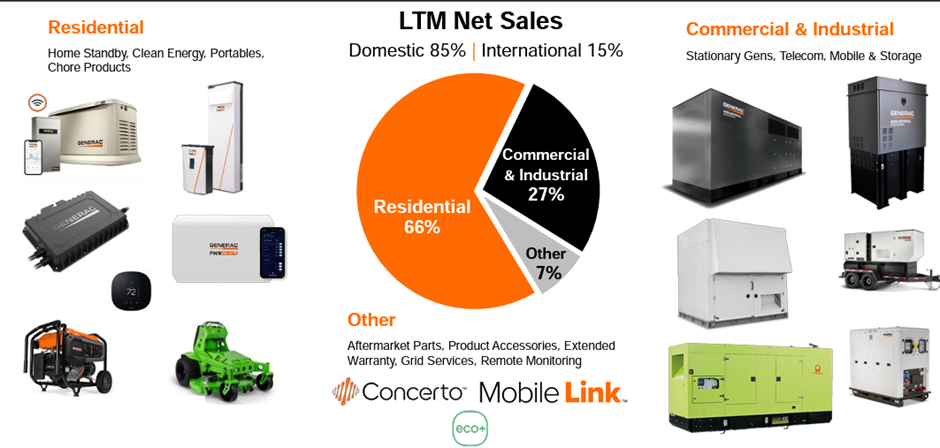

Not many would be familiar with the counter, Generac Holdings, ticker GNRC, although this is a USD16.3bn market cap company. The company is the number 1 manufacturer of home backup generators in the US. It also serves the commercial and industrial segments.

Below are some of the megatrends highlighted by management that bodes well for the company.

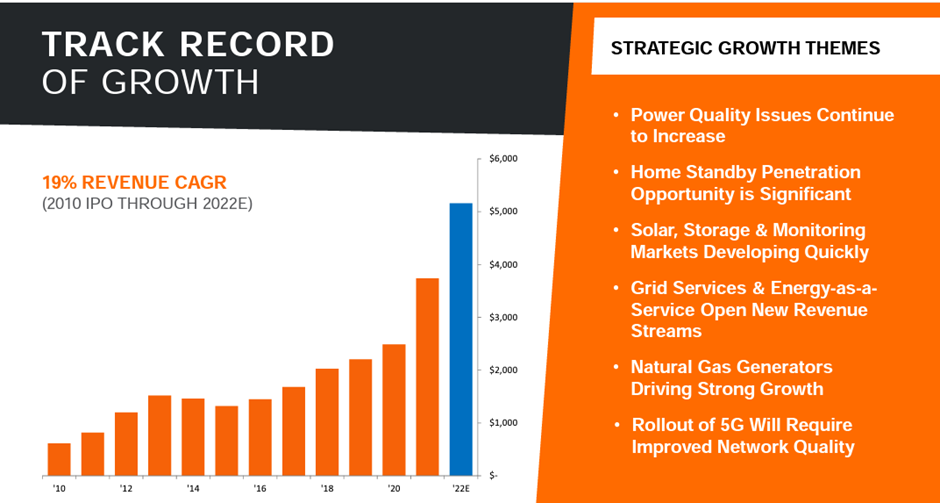

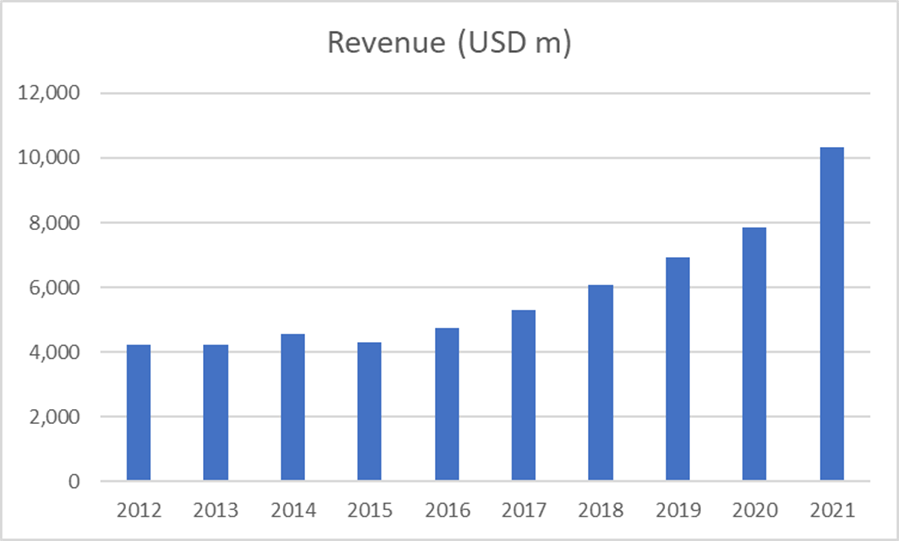

The company has demonstrated top-line growth since 2015 and this is a company that is expected to show strong top-line growth in 2022 when most other companies are faltering.

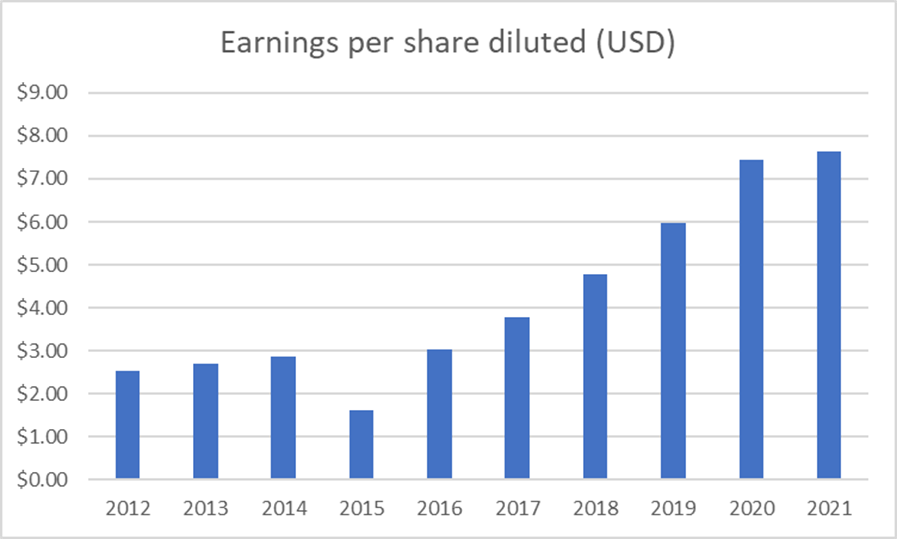

Generac’s EPS has been growing steadily since 2015, increasing from US$1.53 to US$6.75 in 2021. EPS is expected to grow to US$11.81 in 2022, or a 75% increment, according to the street estimates, using data from Seeking Alpha. EPS growth is expected to continue into 2023, hitting US$14.26.

Based on its current share price of US$256/share as of this writing, this profitable growth counter is expected to trade at a forward PER multiple of just 21.7x, with that multiple declining to 18x in 2023. That compares pretty favorably to its multiple of 45x P/E at the start of the year.

Buying into GNRC at the current juncture (when the price has declined more than 50% from its peak) looks like a steal, in my view, if its earnings growth momentum can be sustained. However, that does not mean that the bottom is here and a long-term investor should not be in a hurry to “ape” into this counter, but possibly engage a Dollar Cost Average (DCA) approach.

While I do like the counter based on its strong earnings growth potential in the coming years, a major risk factor in my view is the possible erosion of margins ahead. This will be a key area in which I will like to see an improvement over the coming financial quarters.

Fundamentally strong stocks #2: Intuit (INTU)

Intuit, ticker INTU, is a provider of small-business accounting software (Quickbooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of the US market share for small-business accounting and DIY tax-filing software.

While it’s business (accounting, tax) might seem pretty boring to the normal laymen, it is exactly this kind of boring business that is going to be recurring, recession or not. If you are running your own business, you are still going to be required to file your taxes and have your books in place even in a recessionary environment.

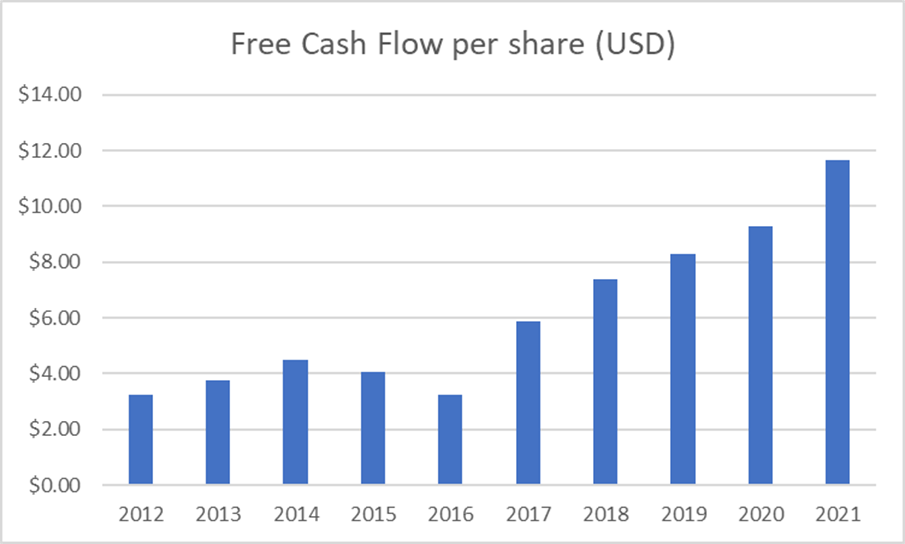

This is pretty evident from the steady rise in revenue and EPS, even during the heights of COVID-19. This is the kind of company that is not just generating strong earnings, it is also being accompanied by an equally strong free cash flow generation.

That has allowed the company to be in a net cash position and engage in corporate activities such as consistently growing dividend payments. The company has been growing its dividends at a double-digit rate since 2014 and this is likely to be sustainable, given a high dividend coverage ratio of 3x.

Looking ahead, the street is expecting the counter to grow its EPS from the current 2021 level of US$7.63 to US$11.75, or an EPS growth rate of 54%. This will translate into a forward PER multiple of 36x, with this multiple declining further to 30.5x in 2023 as expected EPS increase to US$13.8 in that year.

While still a seemingly large PER multiple, the counter is currently trading at its cheapest PER multiple over the past 5 years, as evident from the chart above.

Similar to GNRC, this is one counter where its forward earnings growth potential looks bright, one which can continue to generate higher profitability, recession, or no recession. However, one has got to be wary that it is not the cheapest stock out there, on a PER multiple basis.

Having said that, this remains a growth counter that is well-supported by strong earnings growth and I see the c.50% decline in its share price as more of an opportunity to accumulate a fundamentally strong stock vs. buying into a sexy hyper-growth story.

Fundamentally strong stocks #3: Autodesk (ADSK)

The last counter in this list is Autodesk, ticker ADSK. Autodesk is an application software company that serves industries in architecture, engineering and construction, product design and manufacturing, and media and entertainment.

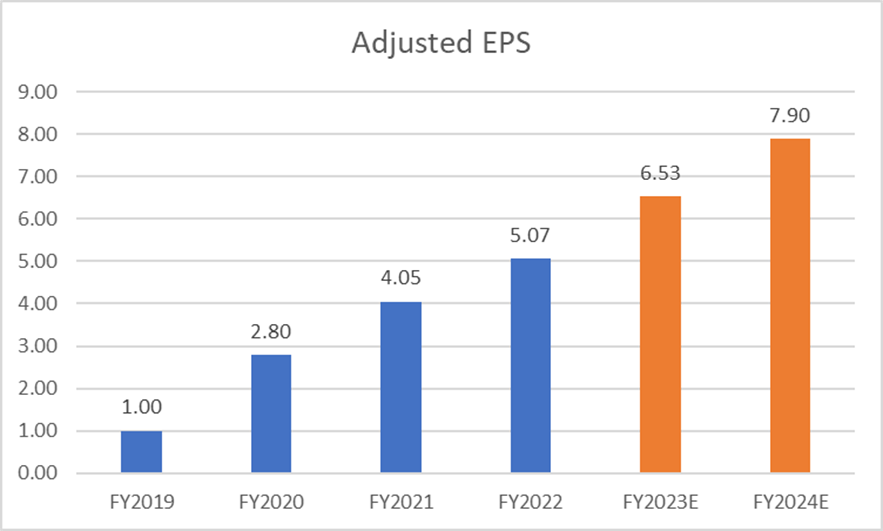

It was not too long ago that this company was still loss-making. The company generated substantial operating losses in FY2017-18 to the tune of approx. US$400m. However, it turned profitable from FY2019 onwards, with an adjusted EPS of US$1.00. Adjusted EPS continued to grow in FY2020 to US$2.80 and US$4.05 in FY2021.

The company last reported FY2022 adjusted EPS of US$5.07. This EPS figure is expected to increase to US$6.53 in FY2023 (28% YoY growth) and further to US$7.90 in FY2024 (21% YoY growth).

Based on a forward EPS figure of US$6.53, the company is trading at a forward PER multiple of 32x, which looks pretty hefty on a standalone basis but is the cheapest it has been since being profitable.

ADSK looks like a decent buy at the current price based on its longer-term earnings potential, according to the street’s growth estimate.

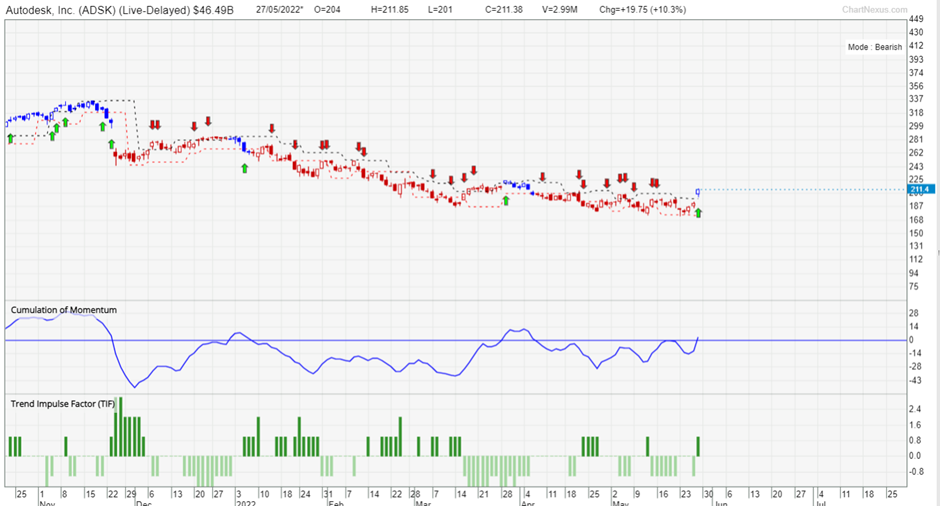

However, on a shorter-term basis, this is also a counter where I am spotting a trading opportunity, with its share price showing strength on the back of the recent 1Q23 earnings beat.

Using the TradersGPS platform, the counter is showing the first BUY signal.

While it remains in a Bearish mode, the latest bump in its price as a result of a good earnings beat could set the motion/momentum in place for further short-term gain in this stock. Supported by what I view as pretty strong fundamentals, this could be one counter which could garner more attention from the market as capital flows from riskier loss-making growth stocks into these growth names backed by strong earnings.

For those who are interested in finding short-term trading opportunities, the TradersGPS platform, developed by Collin Seow, might just be the right one for you. It is an intuitively simple platform beginner traders will find extremely easy to use to find the RIGHT stock to be trading at the RIGHT time.

Conclusion

While there is no guarantee that the nice 6% bump in the S&P500 last week marks the end of the market drawdown (likely not), such a bear market often presents longer-term investors with the opportunity to buy into good stocks now trading at a much better price.

In this article, I have identified 3 fundamentally strong stocks, in my view, which are forecasted by the street to generate earnings growth in the coming years despite a possible global recessionary backdrop.

These stocks have all seen a price decline above 40% from their recent peak and now trading at a level that is more “palatable” from a valuation angle.

While all 3 fundamentally strong stocks are on my radar to DCA into, with a longer-term horizon in mind, ADSK is one which I might engage in a short-term trade, with the belief that its positive price momentum, on the back of a strong 1Q23 earnings performance, can continue.

Once again, this is not a recommendation to be BUYING/SELLING any of the counters highlighted in this article, and please assess your risk profile before deciding to take action on any of these stocks.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- How to double dividend yield using this simple strategy

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Strong Dividend Growth Stocks Increasing Dividends by up to 19% in 2020

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- A list of “Best” Dividend Growth Stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.