Table of Contents

Dividend Aristocrats 2023

Dividend aristocrats are companies that not only pay dividends consistently but have also grown their annual dividend payments amount consecutively over the past 25 years.

Only companies with some of the best financials and cash generation profiles (predictable cash flow) can consistently demonstrate dividend growth year after year and for at least 25 years.

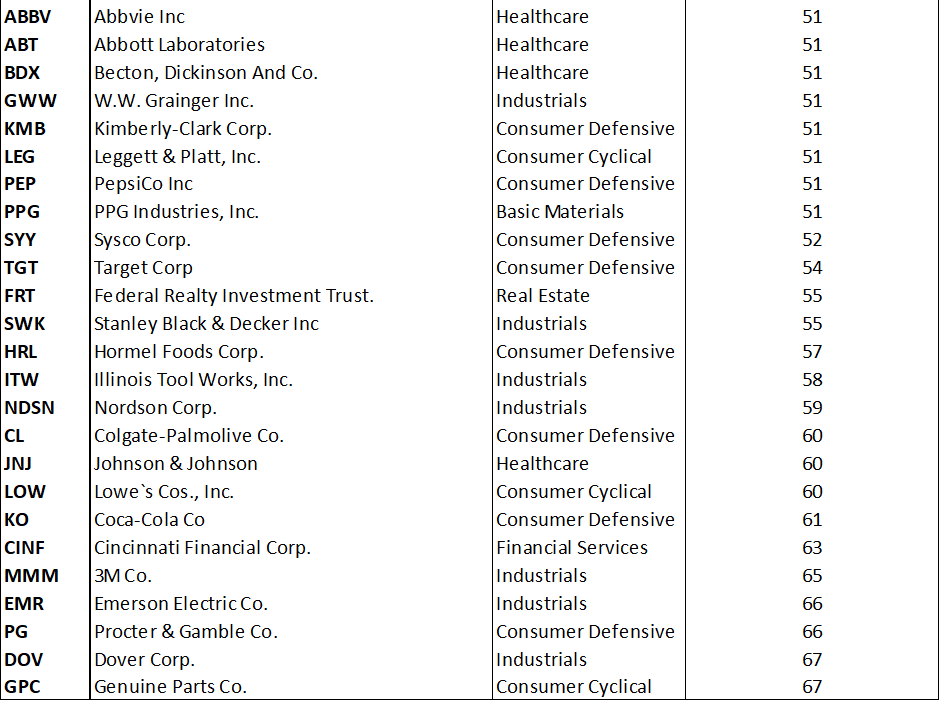

The best of the best are known as Dividend Kings. Dividend Kings are dividend-paying companies that have demonstrated 50 consecutive years of dividend increases!

To be considered a Dividend Aristocrat stock, the company needs to not only fulfill 25 years of consecutive dividend growth (ie annual dividend increases) but also several other criteria:

1) Member of the S&P 500 index,

2) Have a market capitalization of at least $3bn,

3) Average at least $5m in daily share trading value for the prior 3 months.

According to the latest data from suredividend.com, there are currently a total of 66 dividend aristocrats at present.

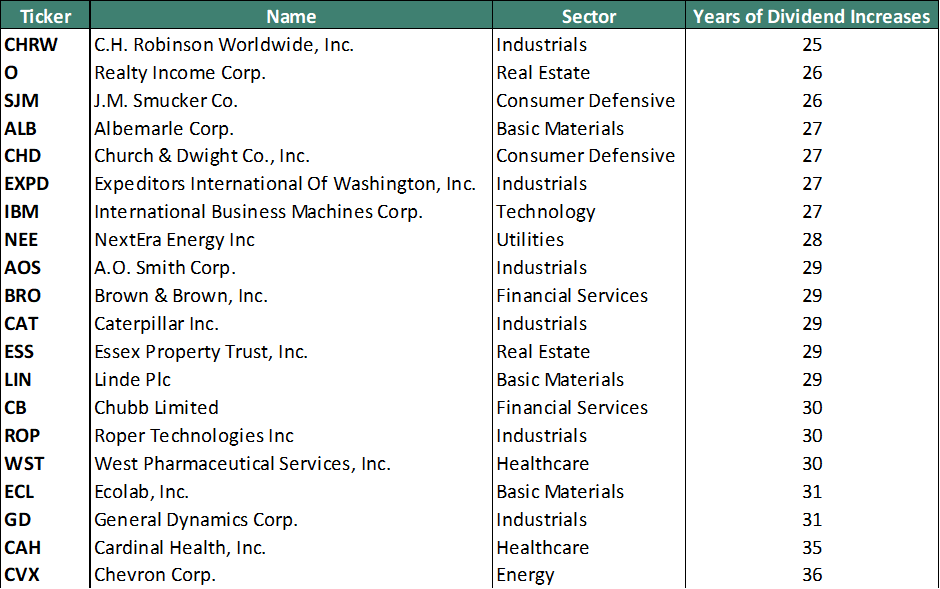

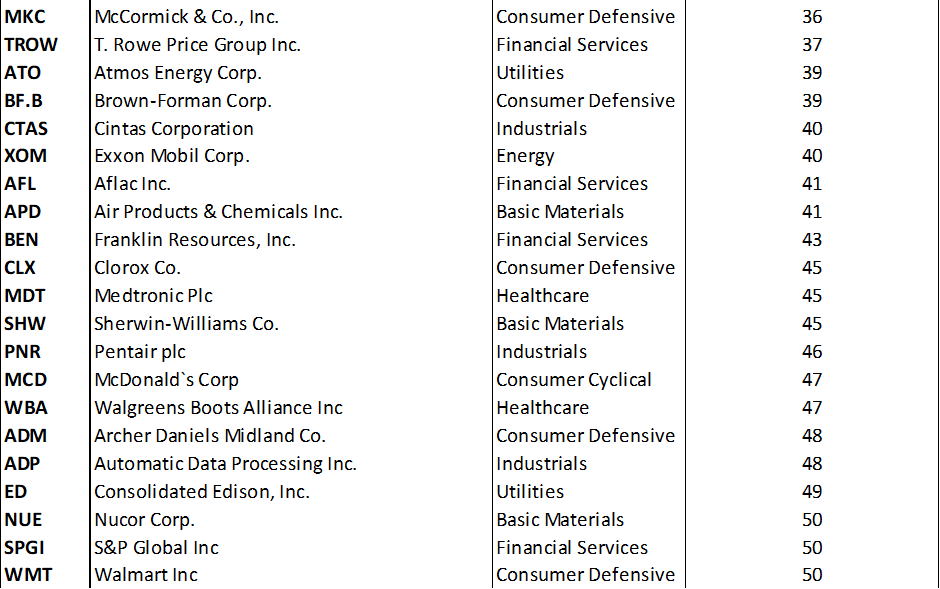

C.H.Robinson Worldwide (CHRW) just makes the dividend aristocrats list with 25 years of consecutive dividend payments while Genuine Parts Co (GPC) and Dover Corp (DOV), both dividend aristocrat companies owning the honor of having the longest dividend growth track record, currently standing at 67 years.

The table below shows the latest list of dividend aristocrat 2023 companies:

Some of the most well-known dividend aristocrats include companies such as West Pharmaceutical services, Walgreens boots alliance, McDonald’s, T-Rowe Price Group, Exxon Mobil, Lowe’s Companies, etc

Additional Reading; How to invest in Dividend Stocks

Buying dividend aristocrats through exchange-traded funds

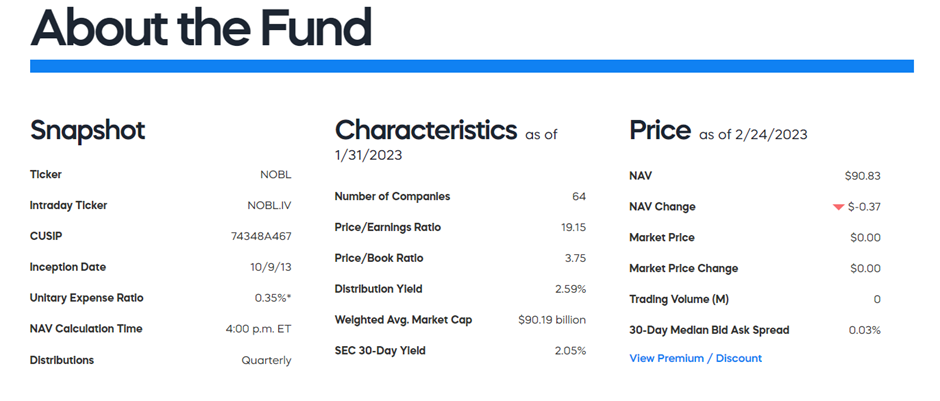

For investors who wish to seek a simpler way to purchase a basket of all the dividend aristocrat companies, one simple way to do that is through the ProShares S&P 500 Dividend Aristocrats ETF (NOBL).

The ProShares S&P 500 Dividend Aristocrats is an exchange-traded fund (ETF) issued by ProShares, with the goal of allowing investors to purchase high-quality companies that have not just paid dividends but achieved dividend growth for at least 25 consecutive years, with most doing so for 40 years or more.

The strategy has a demonstrated history of weathering market turbulence over time, though a relatively short one.

Since this ETF was incepted only back in Oct 2013. According to its website, $10,000 invested since inception would have an ending portfolio of $27,422 (as of 24 Feb 2023), a cumulative return of approx. 170%.

This, however, pales slightly in comparison with the S&P 500 (as represented by the SPY ETF), which generated a return of 184% during the same period.

Nonetheless, over the past 2 years, the NOBL ETF has indeed outperformed the SPY ETF by 10%.

NOBL Dividend Yield

Most investors would be interested in NOBL dividend yield, which currently stands at 2.59%, according to its website. NOBL dividend yield is superior vs the SPY dividend yield of 1.58%.

One thing to note is the higher expense ratio of the NOBL ETF at 0.35% vs. the SPY ETF at just 0.09%.

Potential dividend withholding tax

For investors, like those residing here in Singapore, there is another expense consideration, which is the 30% dividend withholding tax that is levied on US-incorporated companies with the bulk of their operations in the US itself.

Hence, the effective net dividend yield, even on a dividend-focused ETF like that of the NOBL ETF, would amount to just 1.8% in this instance.

While getting a regular stream of dividends from dividend aristocrat companies that have a great track record of dividend growth is great, the primary goal should be to achieve as much capital appreciation as possible with these dividend-growth stocks

However, the data at present seems to indicate that buying into a basket of dividend aristocrat stocks (as represented by the NOBL ETF) does not have a significant outperformance vs. buying into the broader base market such as the S&P 500 (as represented by the SPY ETF).

Coming back to our article topic, which might be some of the best-performing individual dividend aristocrat stocks that you could have purchased over the past decade and how would $10,000 invested in each of these companies amount to today?

Additional Reading: 7 Golden Rules of Dividend Investing

Best dividend aristocrats over the past 10 years

To be on this list, the dividend aristocrat stocks need to have at least 35 years of consecutive dividend increase ( ie 10 years ago, their dividend growth track record would have been at 25 years, hence, qualifying as a dividend aristocrat)

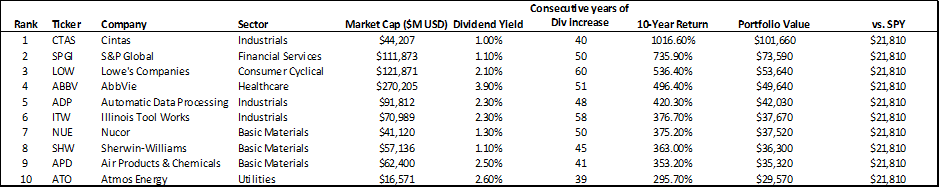

The table shows the Top 10 best-performing dividend aristocrats based on the above criterion and how an investment of $10,000, vested at the start of the decade in each of the above 10 stocks would have amounted to today.

The honor of best dividend aristocrats stock over the past 10 years goes to Cintas (CTAS). The stock generated a total return of more than 1000% over the past 10 years. $10,000 invested in this counter 10 years ago would have generated an ending value of slightly more than $100,000 today.

This would have significantly outperformed the SPY ETF, which would have an ending portfolio of approx. $21,800.

Notice that many of these dividend aristocrat stocks, while consistently growing their dividend payments, are not your high dividend yield stocks, with dividend yields in excess of 4%. The highest dividend yield stock in this list is ABBV, which has a yield of 3.9%.

This means that many of these dividend aristocrats have seen their share price appreciate alongside their dividend payment increase, the magnitude of those share prices increase more than that of the dividend growth.

The table above illustrates the Top 10 best-performing dividend aristocrat stocks over the past 10 years. Have those stocks been equally consistent in their outperformance over a short period?

Most consistent dividend aristocrat outperformers

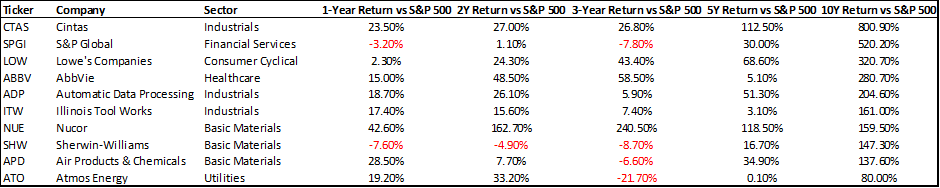

The table below shows the same 10 dividend aristocrat stocks, but details their price outperformance vs. the S&P 500 over a 1-year, 2-year, 3-year, 5-year, and 10-year horizon

There are a handful of dividend aristocrats that have consistently outperformed the S&P 500 based on the above-stated durations.

CTAS, once again stands out as among the most consistent dividend aristocrats, in terms of its price outperformance vs. the S&P 500.

Other notable dividend aristocrats include Lowe’s Companies, Abbvie, Automatic Data Processing, Illinois Tool Works, and Nucor. These dividend aristocrats have outperformed the S&P 500 across all stated time-horizon above.

The next BIG question: Can these dividend aristocrat stocks continue their outperformance over the next decade?

While no one can say with absolute certainty, these dividend aristocrats that have demonstrated consistency in their price outperformance vs. the S&P 500, likely possess certain financial characteristics that will allow them to maintain that edge over their peers and hence continue their outperformance in the foreseeable future.

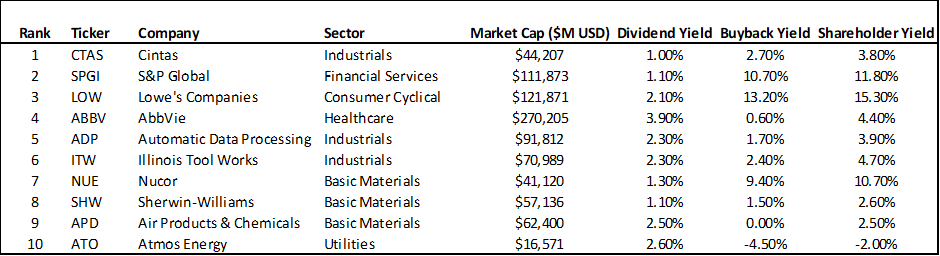

While looking at their current dividend yield is unlikely to provide many insights pertaining to their “investability”, one way I look is the dividend aristocrats’ overall shareholder yield.

Additional Reading: Dividend Yield Theory. The Underappreciated Valuation Tool

Dividend Yield vs. Shareholders Yield

I have written a pretty comprehensive article previously on a counter’s shareholders’ yield, which takes into account its buyback activity.

Most of the dividend aristocrats highlighted above have shareholder yields greater than their dividend yield. This means that the company is actively buying back shares.

Of the above dividend aristocrats, SPGI, LOW and NUE have double-digit shareholder yields. While their dividend yield might not be that attractive, they are returning value indirectly to shareholders in the form of share buyback, of which these companies have been reducing their share base by 10% over the past year.

That is highly attractive. These dividend aristocrats not only demonstrated their ability to increase dividend payments consecutively over at least the past 25 years, but they have also continued to supplement such corporate actions by buying back shares, thus returning even more value to shareholders.

One of the dividend aristocrats in the list, Automatic Data Processing (ADP) is an Alpha Blueprint Candidate, a stock that fulfills a set of financial metrics that I termed as the Power of 5.

The Power of 5 helps to identify high-quality blue-chip stocks with a strong competitive advantage over their peers that allow them to consistently generate long-term growth and consequently price outperformance.

For those who are interested in learning more about Alpha Blueprint Stocks, blue-chip counters that can withstand the test of time, do click on the button below for more details.