Investment thesis:

- Coupa Software is the widely recognized leader in business spend management, with a cloud-native platform that has allowed it to become a leader over larger incumbents.

- An acceleration in dollar-based net retention points to customer loyalty and a growing opportunity to add more products around the core platform.

- Management sees a $56 billion addressable market continuing to grow with new offerings like direct business-to-business payment and financing.

Investing in a business that has just had a remarkable run in the market is challenging. The natural reaction is to wait until the stock sees a significant pullback. However, the risk is that the stock continues to surge and you miss the opportunity entirely. A good strategy is to build a position over time, adding on any pullbacks, rather than committing a significant amount of capital all at once.

Who is Coupa Software?

Coupa Software is one such business. The company provides a cloud-based, Business Spend Management (BSM) platform that gives users greater visibility and more control over their costs.

The problem with similar procurement platforms is that they are too cumbersome and purchases made by businesses is nothing like shopping through Amazon.

Solution

Coupa Software aims to create a shopping experience that is simple and familiar for end users, just like how one shops through Amazon, yet addresses a highly sophisticated range of needs.

Think of every way a large enterprise spends money, from purchasing raw materials to stocking up on fountain pens, and you’ll realize how complex it gets. Coupa’s software makes sure purchases are being made by approved employees, and that those people are using preferred goods and services (or going through the right channels if they are unusual/special purchases).

It checks purchases against company policy and contracts; it tracks negotiated prices, discounts, and rebates. It manages invoices and payments, reconciles purchases against relevant budgets and bank accounts, and more. Just as important, it helps users visualize and optimize spending, so they can see if different parts of an organization are doing things more or less efficiently.

Over time, that core focus on procurement has been expanded to include tools for expense management, contract management, budgeting, inventory, analytics, and even direct business-to-business payments and financing using Coupa Pay.

How Coupa Software makes Money (from sticky customers)

Businesses pay Coupa Software a subscription to access their platform of over 5 million suppliers. You could think about it as an Amazon marketplace for major corporations. This end-to-end integrated application allows them to source goods, manage expenses, and optimize inventory levels.

More importantly, those customers are incredibly loyal. Because Coupa Software’s core procurement platform is highly complex and integrated, getting a large company up and running on the platform can take months. High switching costs encourage customers to stay on the platform (gross renewal rate is consistently over 95%), but customers are consistently choosing to add more services.

Around the time of its IPO in 2016, Coupa Software’s dollar-based net retention was in the 104%-107% range (meaning the average customer was not just sticking around but spending 4%-7% more on the platform than they had the year before). You wouldn’t necessarily expect a very high figure here, because the core platform is pretty comprehensive and add-ons were relatively modest in comparison.

Nonetheless, this metric has continued to improve with time, trending in the 110% to 112% range for the past couple years. Management now believes that it can reach 120% – remarkable for a company of this type.

COVID-19 booster

The outbreak of CV-19 was a Black Swan event that caught everyone by surprise. Supply chains were greatly disrupted and capital markets were thrown into chaos. At the time of writing this, the pandemic still seems far from over.

Fortunately, the first outbreak in Asia was brought under control quite quickly, meaning factories in China and elsewhere could reopen faster than anticipated. However, I would be shocked if business leaders allow themselves to be put in that situation again.

Coupa Software’s platform can help businesses diversify their supply chain and better manage their spending, which will be crucial in any economic downturn that comes as a result of the outbreak.

Differentiation from competitors

Coupa Software competes against some of the biggest names, with Oracle and SAP being their main rivals. However, Coupa Software consistently comes out on top in industry rankings, achieving the coveted Leader distinction in Gartner’s Magic Quadrant for procure-to-pay suites.

There are technical reasons to favor Coupa Software. The promise of SaaS is that users are constantly getting the best, most up-to-date incarnation of software tools without having to go through a painful upgrade cycle.

But in reality, vendors can’t afford to tear down their software and build it anew over and over again. So, they get locked into old architectures and legacy pieces of code. That is a major advantage of Coupa Software over larger, more entrenched rivals like SAP and Oracle.

SAP, for instance, largely got its procurement platform from the 2012 acquisition of Ariba. Because of the complex integrations involved with various pieces of software, Coupa Software claims that even upgrading from one version of Ariba software to a newer one has taken some clients as long as two years. Coupa Software was built from the ground up for the cloud.

Strong growth opportunity

Despite the size and tenure of its chief rivals, Coupa Software is universally considered the leader in business spend management.

Coupa’s management believes they have an addressable market of $56 billion, not including Coupa Pay. Even if that turns out to be overly optimistic, it’s certainly a far cry from where they are now, with a market capitalization just shy of $25 billion and trailing revenue of just under $500 million. The company estimates it has less than 10% market penetration among large enterprises, and less than 1% of the mid-market.

The opportunity to grow comes not just from new customers, but from new products as well. In November, the company announced the $1.5 billion acquisition of Llamasoft, a company that manages supply chain design and planning by using AI to model scenarios and optimize decisions about purchasing.

It’s reminiscent of Salesforce, which similarly was able to overcome seemingly immovable incumbents with cloud-native software, albeit with a focus on sales and marketing rather than finance.

Like Salesforce, Coupa Software can leverage a deeply integrated hub into countless additional add-ons. One major difference: While Coupa Software has a market cap of $24.9 billion, Salesforce’s is $206.6 billion.

Strong management

Coupa Software is no longer founder-led, however, CEO Rob Bernshteyn behaves very much like one. He owns 2.3% of outstanding shares and has a 99% approval rating by Coupa employees on Glassdoor — the highest I’ve seen.

Coupa Software is an outstanding future-relevant business with great management and a huge market opportunity. Though I expect to see some volatility in its share price, I think building a small position here and buying more opportunistically will work out very well for long-term investors.

Key Business Risk

With under $500 million in trailing sales, it has only a tiny fraction of the sales of SAP or Oracle (or Salesforce). A premium valuation — it’s trading at around 46 times sales — anticipates very strong growth for years to come. Yet while growth of both revenue and deferred revenue remains very strong, it has decelerated somewhat in fiscal 2021.

But it remains to be seen what the end of the pandemic will bring. It could mean faster sales and a further reacceleration of revenue growth. But if the company sees another slowdown, that could be a significant blow to a stock price that has very nearly doubled in 2021.

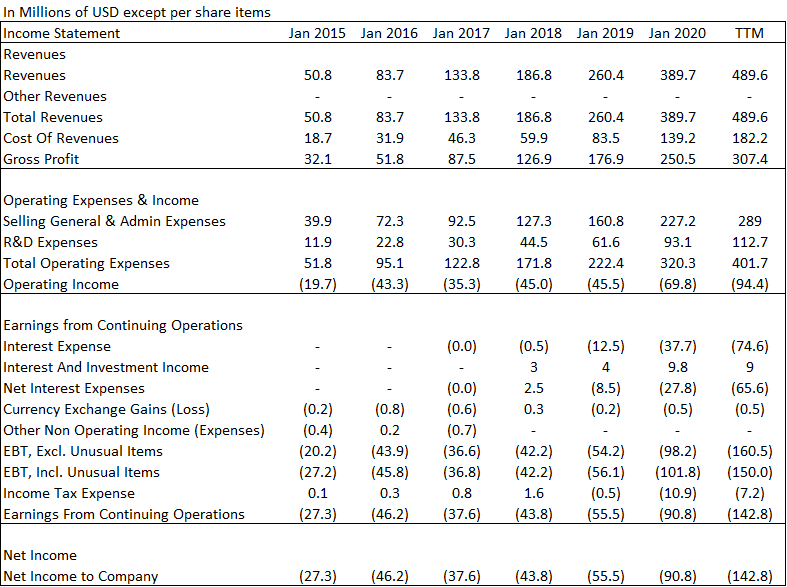

Historical Financials

Not a pretty picture here but the reason why losses have been growing is largely the result of growing SG&A expenses, likely the result of non-cash employee share options.

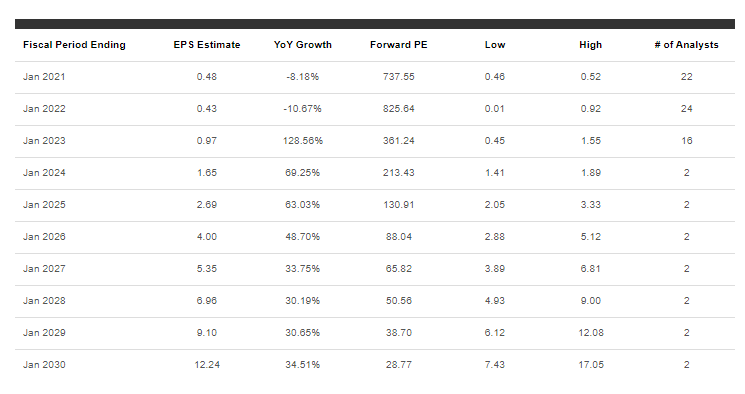

As can be seen from the consensus revenue and EPS below, on a non-GAAP basis, the company is profitable but forward PER is still an insanely large figure.

While it’s certainly not the cheapest stock around, this is a company that has consistently surpassed all expectations, delivered great value, and set itself up to further its lead.

Consensus Estimates

Conclusion

Coupa Software is to business spending management what Salesforce.com is to customer relationship management — except that it is much earlier in its journey. I fully expect it to continue to grow its core procurement platform in more directions, fuelled by a growing roster of loyal customers.

The company is however susceptible to a valuation de-rating if it fails to deliver on the growth front.

However, that might actually be an opportunity to acquire an outstanding company at a cheaper price. I will be looking to potentially acquire more at a price of $300/share.

Based on the TradersGPS platform, Coupa Software is currently undergoing a minor correction and might be an ideal candidate for a short-term Daily Swing Trade (last for about 1-3 weeks)

For those who are interested to find out more about the TradersGPS system, there will be a FREE online training session on the 5th of January 2021 where Collin (founder of The Systematic Trader program) will look to identify momentum stocks to enter.

The Systematic Trader

The Systematic Trader course has been voted as the best investment course by Seedly. Learn how to find the RIGHT stocks to enter at the RIGHT time.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update November 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.