Marco Polo Marine: Taking a Look Beyond its 1HFY2023 Reported Numbers

Marco Polo Marine 1HFY2023 reported numbers might not paint a pretty sight but investors should look beyond that for its strong operating performance

Marco Polo Marine 1HFY2023 reported numbers might not paint a pretty sight but investors should look beyond that for its strong operating performance

3 Undervalued Singapore Small Cap Stocks that you should note: Singapore Stock #1: Manulife US REIT, Singapore Stock #2 China Sunsine

Which is the best free Singapore Stock Screener that is an alternative to using Bloomberg, a platform that most retail investors cannot afford

NIO listing on SGX NIO is today creating history by being the very first company in the world to be listed on 3 stock exchanges, namely US, HK and SG. The SG listing will happen on 20th May 2022, which will allow Singapore investors an easier avenue to partake in this fast-growing EV play. The

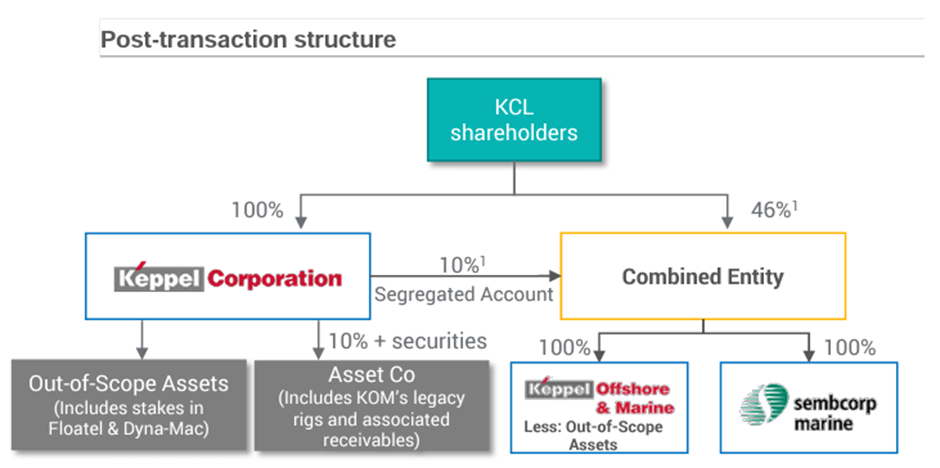

Keppel and Sembcorp Marine signed a definitive agreement for merger Keppel and Sembcorp Marine announced this morning that they have entered into a definitive agreement for the proposed combination of Keppel O&M and Sembcorp Marine to create a new entity that will be focused on offshore renewables, new energy and cleaner O&M solutions. This merger

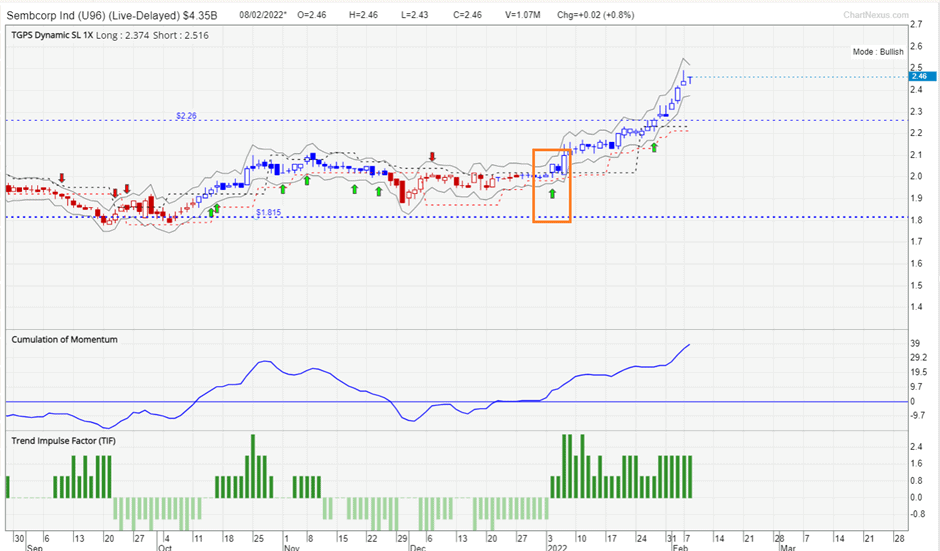

Singapore Blue Chip Stocks to capitalize on rising momentum Singapore stocks have been one of the more resilient performers since the start of 2022, with the Straits Times Index (STI) STI up a commendable 8%, one of the best stock market performers not just in the region, but on a global scale, an achievement that

SGX top gainers over the past 1 month Investors who are interested in SG counters can use the SGX stock screener function to identify stocks that meet certain criteria. In this article, I look to identify which are the SGX top gainers over the past 1 month and to evaluate if that momentum can be

Amid the current market turbulence, which is the best performing Singapore REITs? The table below provides a quick snapshot of the performance of the Singapore REITs, sorted based on its YTD Price performance (Update on 28 June 2021). There are quite a number of REITs that generated positive returns so far on a YTD basis.

Best ETFs in Singapore You might not know but there are many Singapore ETFs that you can use to structure a resilient inflation-proof passive portfolio. Out of the 43 ETFs currently trading on the Singapore Stock Exchange (SGX), we will highlight 4 ETFs that we believe are the best-in-class that an investor can purchase directly

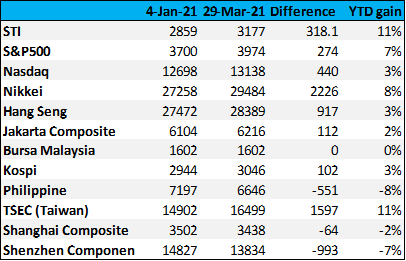

The STI index is one of the best-performing market indexes globally on a YTD basis (pretty surprising, but more on that later), currently up more than 11% since the start of 2021, based on data from Factset. This compares favorably vs. regional peers such as Malaysia (down 3% YTD), Indonesia (down 1%), Philippines (down 8%),

Small-Cap Singapore Dividend Stocks In the pursuit of dividends, many investors fall into the trap of purchasing stocks purely on a dividend yield basis. Many of these “high-yielding” stocks generated negative TOTAL returns (capital appreciation + dividend returns) over the mid to long-term horizon. In this article, we will be exploring 5 Undervalued Small-Cap Singapore

In this article, I identify 5 potentially undervalued stocks in the Singapore stock exchange (Large-cap), based on the counter’s current share price vs. the street consensus. My selection criteria weren’t based on the traditional “value” criteria which seek to identify stocks that fit certain “value” metrics such as low PER, low PBR, high dividend yield,

Best performing Singapore Blue-Chip Stocks The Straits Times Index has been one of the best performing indices of late, with the index currently trading near its all-time high mark of 3,183. On a YTD basis, the STI currently ranks Joint 1 (with Taiwan) as one of the best-performing stock market indices in the region. This

Capitaland Integrated Commercial Trust (CICT): Is the REIT worth buying post-COVID-19? One unique feature about investing is the lack of a “10-year series” which guarantees a sure-win strategy. With so many factors that can influence the market, effort doesn’t always commensurate with returns (If only it does!). Along the way, many have added their own

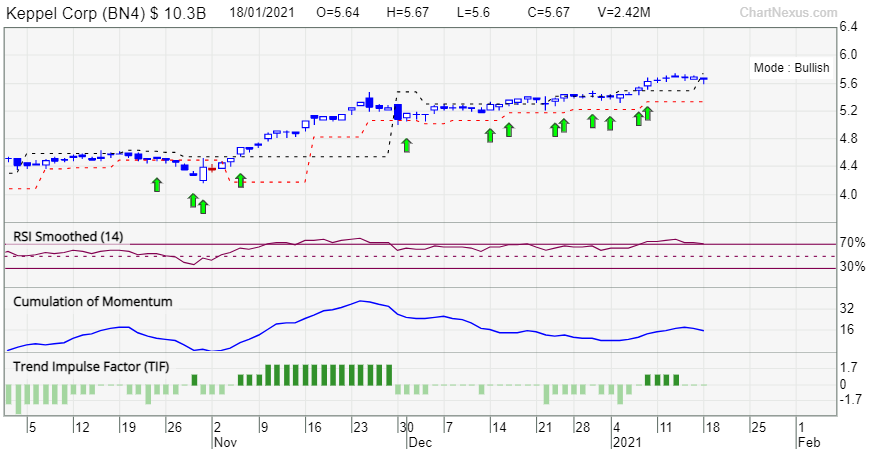

How to identify momentum stocks the easy way At the end of 2020, I wrote an article highlighting 4 Singapore momentum stocks to buy into 2021. All 4 SG stocks have appreciated in value of approx. 3-22% over 3 weeks and it does seem like their current price momentum could result in another leg up

SG Momentum stocks to buy now When one talks about investing or trading in general, the usual norm is to buy low and sell high. While such an investing philosophy has been widely accepted, momentum investing is the art of buying high and selling higher. Buying momentum stocks takes a different path compared to the