Capitaland Integrated Commercial Trust (CICT): Is the REIT worth buying post-COVID-19?

One unique feature about investing is the lack of a “10-year series” which guarantees a sure-win strategy. With so many factors that can influence the market, effort doesn’t always commensurate with returns (If only it does!). Along the way, many have added their own twist to well-known strategies out there.

For me, something I’ve read about investments in the past has resonated deeply – the ability to invest in things we interact with on a daily basis. Be it in the can of coke you’re drinking, your mobile provider to the shopping malls that you visit!

By doing so, you’ll be able to personally monitor your investments and assess the viability of its business model. For me, I found this approach highly compelling which was why I looked into CICT and eventually invested in them. But you might be wondering, what about Covid-19 and the impact of online shopping?

Let me share with you why I’m still confident in their business model!

In this article, I will share with you my views of CICT and the benefits I enjoy from investing in something I utilize daily. Further, I will elaborate more on CapitaStar and my thoughts regarding it.

CapitaLand Integrated Commercial Trust (CICT)

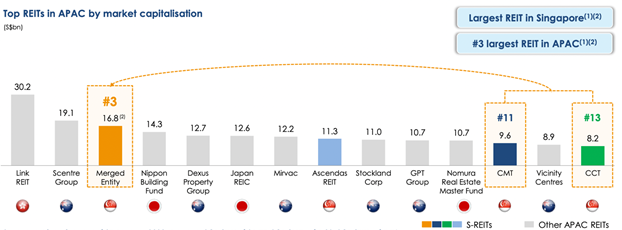

CapitaLand Integrated Commercial Trust (SGX: C31) was formed just last year through a merger between CapitaLand Mall Trust and CapitaLand Commercial Trust. The merged entity has a total of 24 properties, making them the largest REIT in Singapore and 3rd in APAC.

Apart from their office spaces, some notable malls under their portfolio are Plaza Singapura, Bugis+, Bugis Junction, IMM, West Gate, and many more! These malls are a good mix of suburban as well as prime shopping districts in Singapore. As a shareholder, I get to enjoy the malls owned by the REIT and get cashback in the form of dividends!

Further, visiting them allows me to look at factors such as the mall’s footfall and vacancy rates.

With Covid-19 ravaging both the economy and our lives, are REITs still a smart investment? And what have these companies done to mitigate the risks? Thankfully, these malls are easily accessible, and I was able to do my personal research. Here are my views!

Impact of Covid-19 on REITs and CICT

After Singapore’s very first case of Covid-19 in February 2020, a slew of changes was made to our way of life. We’ve seen work from home being activated across sectors as well as the closure of non-essential shops in malls.

Singapore REITs took a direct hit as their underlying business is driven by rentals. Just in 2020 alone, CICT wrote off S$128.4million in rental waivers! This impact can be seen in share prices where CICT shaved off 38.71% in market capitalization value from March to April.

Further, we’re still a long way from pre-covid levels.

Outlook of Commercial Properties

There are countless debates as to whether WFH would be a permanent move with companies downscaling their offices. Personally, I believe that offices are here to stay due to the concerns regarding the WFH arrangement. Here are the reasons why:

- It was reported that employees struggle to draw the line between work and home which causes an unhealthy balance. Employees tend to work longer hours while being less effective at home. Therefore, low productivity isn’t an ideal situation.

- Research by CBRE reported that office rents would fare better in the second half of 2021, resulting in an overall positive rental growth next year. This is welcoming news for CICT as rental income can be expected to increase.

- Throughout the months, we’ve seen the likes of Bytedance, Tencent, and Alibaba setting up their offices in Singapore. They join the long list of companies such as Zoom, Twitter, and many more that will be establishing their presence here. With the influx of investments coming in, many have even brought up the possibility of Singapore being the Silicon Valley of Asia. This will definitely benefit CICT with both office and retail spaces.

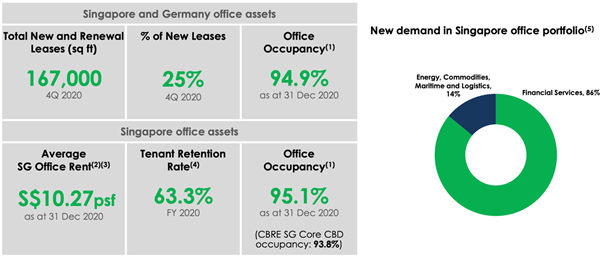

Lastly, CICT’s commercial sector has been rather resilient amid the impact of Covid-19. As of December 2020, the occupancy rate of their commercial spaces is above the industry averages. For its Singapore office, occupancy rate stood at 95.1% with the Singapore’s average of 93.8%.

The outlook of retail malls – Footfall and Threat of E-Commerce

Technology and e-commerce have always been a threat to brick-and-mortar stores. The risk has accelerated due to the circuit breaker imposed where people are forced to make their purchases online. You might be wondering, how are the malls doing these days?

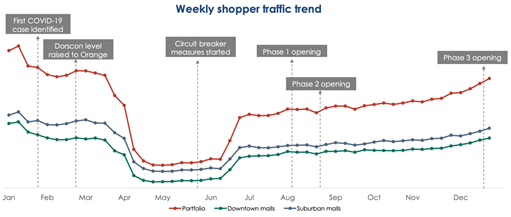

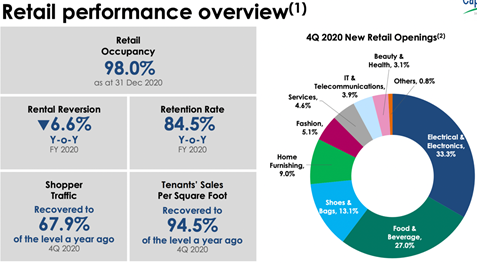

As our economy gradually opens up in phases, malls owned by CICT have seen a gradual increase in footfall. According to their 2020 Q4 data, work still has to be done to recover the traffic seen last year. However, the tenants were able to recover 94.5% of sales that were recorded last year in 2020 Q4! This is definitely an encouraging sign for retail malls.

On the other hand, how are the retail occupancy rates doing? We’ve seen news of department stores like Robinson exiting the industry which is definitely not a good sign. However, as of 31st Dec 2020, the retail occupancy rate stood at an impressive 98%! Again, which is well above Singapore’s average of 90.4%. Are you surprised?

With land scarcity in Singapore, the locations of these malls are an asset and I believe that one man’s junk is another man’s treasure. There is a myriad of companies ready to pounce on the opportunity to set up their stores at a lower cost. Let’s take the Robinson case at Raffles City as an example, it is reported that BHG will be taking up 2 floors of retail space previously occupied by them. On top of that, Uniqlo is opening a 2-storey outlet at Tampines Mall which is own by CICT as well!

But of course, e-commerce is still a threat to these malls, and let me share with you what the management has done to mitigate these risks!

Initiatives by CICT

I believe that managers are a very important component of REITs. What defines the performance of the underlying properties is all down to what the managers do. Therefore, I find it particularly encouraging to see what CICT has done to maneuver through Covid-19. Here are some examples!

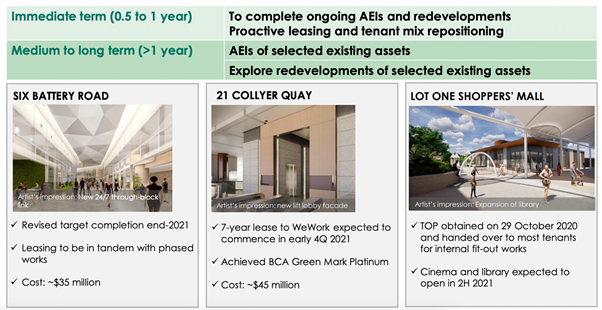

Asset Enhancement Initiatives (AEI)

AEI is part of a REIT’s value creation strategy to help unlock greater potential of its assets. This can be done by repurposing a building through enhancing the functionality or aesthetical feature of properties to match the preferences of consumers.

Over the years, CICT has carried out a list of AEIs to their properties such as rejuvenating malls like IMM, Tampines Mall, and Bukit Panjang Plaza. Currently, they are working to enhance several properties such as upgrading the library and cinema of Lot One Mall. I believe this is the right time to carry out these enhancements as entertainment outlets are restricted in their operations!

Virtual Malls via E-Commerce sites

Over the years, CICT has been pushing for an omnichannel approach for retail stores but faced resistance from its tenants. At that point in time, most of them were slow to adopt technology or lack the digital capability to do so. However, this changed due to Covid-19 as tenants are forced to digitalize their operations. It inadvertently helped in CICT’s push for an omnichannel strategy which birthed several concepts!

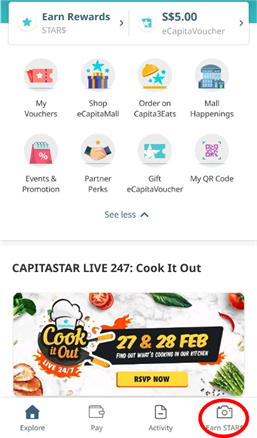

Just mid-last year, CICT launched two digital platforms – eCapitaMall and Capita3Eats. The former focuses on goods and services while the latter is a food ordering platform. Since its launch, they managed to amass over 300 online merchants on their site! The platform amplifies the reach of retailers while giving them a 24/7 digital presence.

Shoppers are able to browse the stores online and make purchases with CICT’s tenants. The goods can be received through home delivery or in-store collection. Furthermore, purchases can be done through their CapitaStar app which allows one to earn and spend loyally points! Imagine being rewarded for purchases! I believe that this is a very effective ecosystem that helps to boost both customer traffic and experience.

Furthermore, CICT partnered with Shopee to enhance its digital presence. In their CapitaLand & Shopee 11.11 initiative, shoppers are able to redeem Shopee Coins and vouchers that can be used in various CICT malls! Just early this month, they’ve extended their partnership to create IMM’s virtual mall on Shopee’s platform.

Sounds good and exciting? Here’s my experience with the application!

How do I open a CapitaStar account?

The basics of the Capitastar

With the CapitaStar application, you’ll be able to do the following:

- Make payments through the application

- Access eCapitaMall and Capita3Eats

- Redeem your CapitaStar points (STAR$)

- Look at events and promotions in the malls you’re visiting

Also, always remember to not throw your receipts away as you’ll require to take a picture of them via the application! These receipts must be at least S$20 in value (In all CICT malls) and S$10 in value when you’re shopping at Jewel!

Also, they have to be scanned into the application no later than the next day of purchase (11.59pm) to be eligible! Every S$1 spend will give you 5 STAR$ and you can convert 5000 STAR$ into a $5 voucher! You can either convert them into vouchers or redeem certain promotions via the application! So how do we start on this?

Downloading the necessary applications

In order to open an account with CapitaStar, you can find the application on the app store. The information that you’ll require are:

- Your phone number

- Any promo code that you might have while signing up

Navigating through the system – Redemption of your vouchers

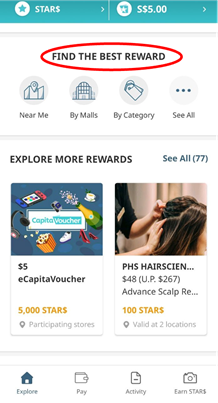

To look at what you can redeem with your STAR$ points, you can scroll down from the application’s main page to the “Find the best reward” section. Here, you can filter the discounts by categories, malls or even promotions that are near your area!

Wrapping up and thoughts on the application

To end off this article, I believe that this is a very good initiative by CapitaLand Integrated Commercial Trust to improve both the shopper’s experience as well as sales of tenants. Seeing how the managers workaround to navigate through Covid-19, this gives me confidence as an investor! Finally, I find this application helpful for my personal finance and savings with rebates from my purchase. Happy shopping!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DBS Vickers – Should you be trading using this brokerage account?

- OCBC BCIP: Why should you Dollar Cost Average into OCBC Blue Chip Investment Plan

- Top 4 Investment Tips For Beginners

- The average salary in Singapore 2021: Can you afford a condo with your income?

- Buy High, Sell High or Buy Low, Sell High? Momentum Investing vs Contrarian Investing: Which Is Better?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.