There are a variety of ways to invest your money. A popular investment methodology popularized by various investing gurus such as Joel Greenblatt, Warren Buffett, Benjamin Graham has been the concept of Value Investing.

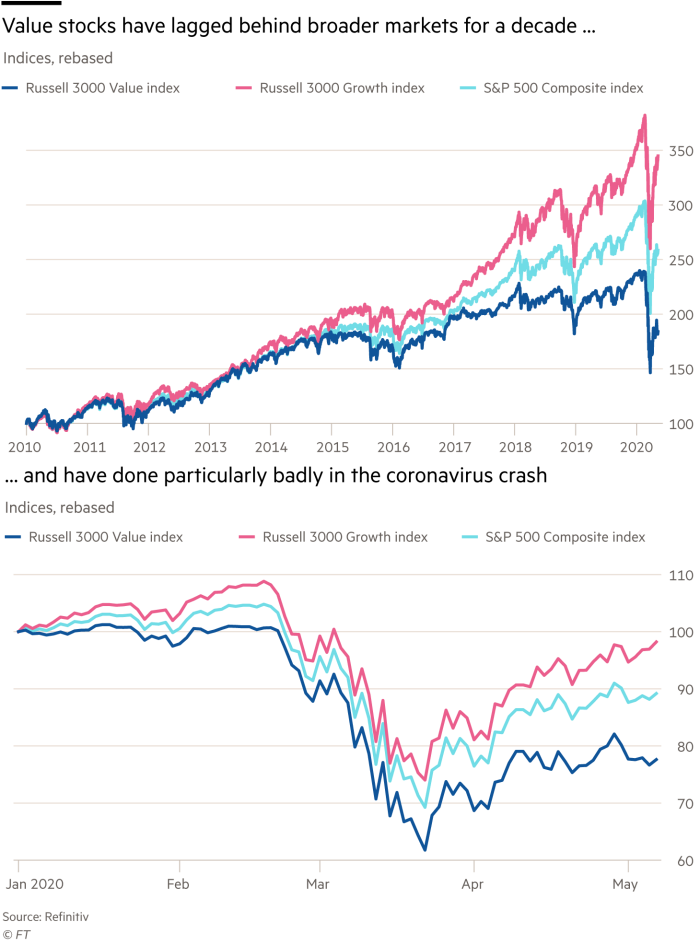

However, value investing has significantly underperformed its growth counterpart over the last decade since GFC, with this segment continues to significantly underperform growth stocks in the recent COVID-19 driven sell down. Are the heydays of value investing a thing of the past?

I will first explore the recent happenings surrounding value investing before providing a solution for Singapore investors who are keen to engage in a little value investing in Singapore, either through Robo Advisors or a DIY-approach. I will also highlight 10 SG value opportunities that met my value screening criteria.

History of value investing

Benjamin Graham is regarded by many to be the father of value investing. Together with David Dodd, they established the concept of margin of safety, which calls for an approach to investing that is focused on purchasing equities at prices less than their intrinsic values.

In terms of stock screening criteria, he advocates purchasing firms that have 1) steady profits, 2) trading at a low price to book value, 3) have low price to earnings (P/E) ratios, and 4) have relatively low debt.

Benjamin Graham probably inspired many investor-wannabe to start their investing journey. One of them was Joel Greenblatt, the popular author of “The Little Book that Beats the Market”. When he went to Wharton Business School in the late 1970s, he stumbled over a Fortune article on stock picking. It was a lightbulb moment for him that the stock market ain’t as efficient as it was made out to be and that prices aren’t necessarily correct.

“Buying cheap stocks is great, but buying good companies cheaply is even better. That’s a potent combination”.

Joel Greenblatt.

Mr. Greenblatt compares value investing akin to purchasing a house. One needs to carefully examine the foundation, construction quality, yields, and potential for price appreciation base on peer comparison as well as the development potential of the neighborhood.

Another one of Graham’s protégé is none other than the legendary Mr. Warren Buffett himself. Till today, every investing move he makes is still closely watched by the market.

However, the faith of many values investing disciples has been sorely tested in the past decade since the Great Financial Crisis. While there might be a different definition of what constitutes value investing and the exact approach that it should be done, few have argued against its awful stretch of underperformance vs. the broader market since GFC.

Surprisingly, value investing has continued to underperform substantially in the latest COVID-19 driven market crash.

Value Investors have hoped that the onset of a bear market will witness the shift of funds flow from the pricey technology stocks that have dominated the market post-2008 to that of their cheaper “value” counterparts.

That did not happen. Instead, value stocks have been hammered more than the broader market. While tech stocks have not been spared the sharp sell-off alongside the broader market in March 2020, their subsequent rebound in April can be said to be “too fast too furious”, with many tech stocks now posting new 52-week highs.

Ben Inker of value-centric investment house GMO describes the experience as “like being slowly but repeatedly bashed in the head”.

“It’s less extreme than in the late 1990s when every day felt like being hit with a bat. But this has been a slow drip of pain over a long time. It’s less memorable, but in aggregate the pain has been fairly similar”.

Ben Inker

Is Value Investing no longer relevant today?

Value Investing proponents continue to argue that their long-term track record remains superior compared to growth investing. One of the first few successful investors was arguably the economist John Maynard Keynes. He managed to beat the UK stock market by an average of 8 percentage points from 1921 to 1946 by “carefully selecting a few investments according to their intrinsic value”.

Since then, many other well-known value investors such as Joel Greenblatt, Seth Klarman, Jeremy Grantham, Warren Buffett, etc have replicated his success.

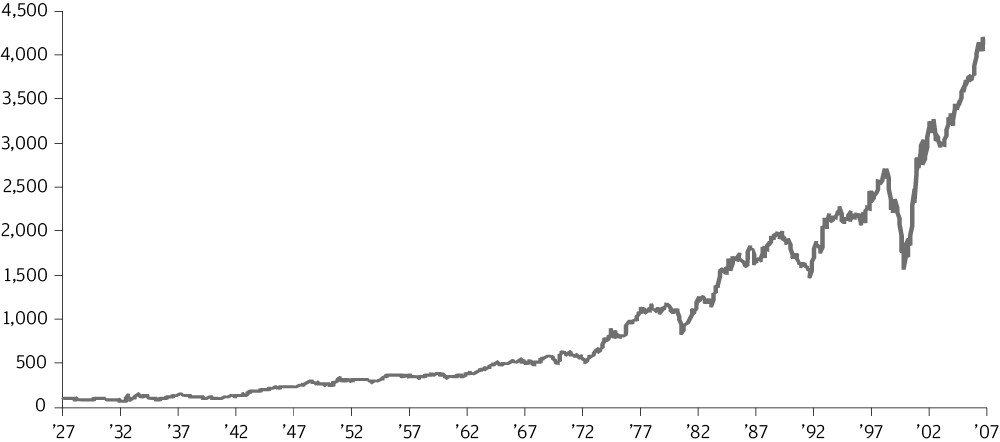

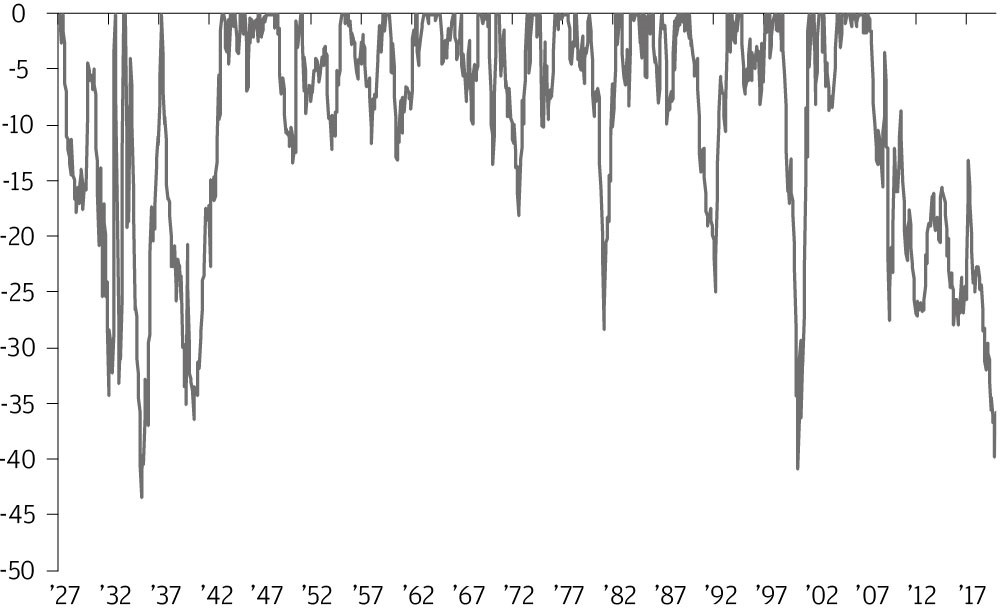

According to JPM, from 1927 to 2007, buying shares that were cheaper (value investing) than the rest of the market led to huge outperformance. It was widely assumed in 2007 that value investing was the BEST approach for long-term investors.

Alas, it was the start of a decade long of Value Underperformance vs. Growth. The underperformance of value relative to growth has now exceeded the dot-com bubble and is approaching the level last seen during the GFC.

Tech crushing Financials

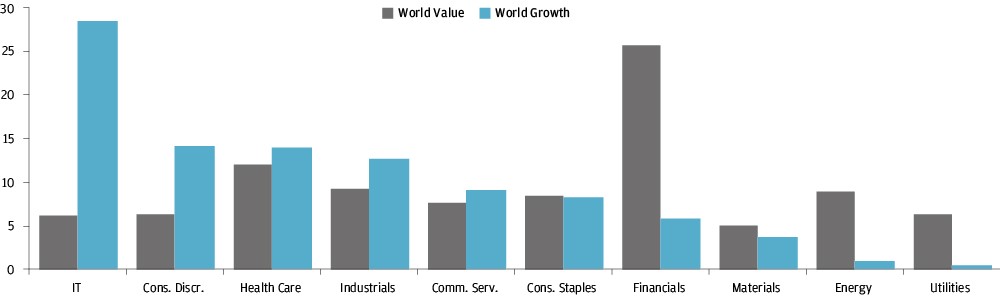

A key reason why the value index has lagged the growth index is due to their composition.

Financials are the largest part of the value index whereas technology stocks make up the largest part of the growth index. So a large part of the underperformance of value stocks since 2007 can be put down to the financial crisis of 2008 and the low-interest-rate environment that has persisted in its aftermath.

In the current COVID-19 driven recession, financials face multiple headwinds despite entering the recession with a healthy balance sheet.

For one, interest rates have been driven to zero and hence net interest margins of banks will be significantly impacted.

The lack of loan growth is not a major concern but the fact that many of the banks’ loans will turn sour over the next 1-2 years as bankruptcies accelerate due to SME failures is a major cause for concern.

Technology stocks, on the other hand, have benefited from significant disruption, allowing them to deliver phenomenal sales and user growth. Big technology stocks are now essentially oligopolies that allows them to earn super-normal profit margins with strong growth prospect.

With many of these tech companies transitioning towards a recurring service business model vs. historical business structure focusing on product sales, the increase in their revenue visibility amid a recessionary macro-environment will continue to serve as a major tailwind for these companies who remain favored by investors who are willing to pay up for disrupters that could deliver significant growth in a low-interest rate and slow growth environment.

The other major component of the value index that has done poorly is the energy sector that has been decimated in the current COVID-19 pandemic as oil demand evaporates with half of the world population on lockdown.

Is price to-book becoming obsolete?

According to GMO’s Inker, traditional value measures such as Price-to-book value are becoming obsolete.

The intellectual property, brands, and often dominant market positioning of many of the new technology companies do not show up on a corporate balance sheet in the same way as hard, tangible assets.

“Accounting has not kept up with how companies use their cash. If a company spends a lot of money building factories it affects the book value. But if you spend that on intellectual property it doesn’t show up the same way”.

Hence, many value investors like GMO are evolving with time. While they are still buying stocks which they believe are undervalued, they are no longer constrained by traditional “valuation” metrics which define a value stock, such as one having a low Price-to-book ratio.

Can Value Investing stage a comeback?

The folks over at AQR believe that Value Investing is not dead in the water and that value stocks are now VERY cheap compared to their growth counterparts on a historical basis.

That we probably know but how cheap is VERY cheap?

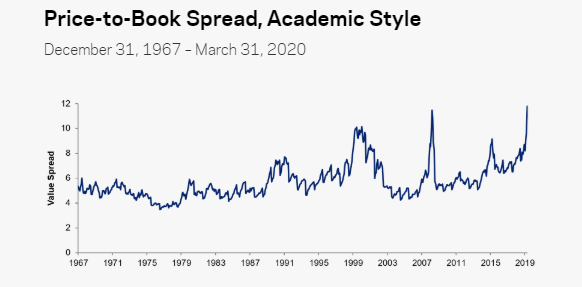

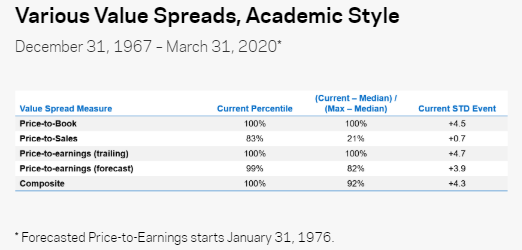

They look at the Price-to-book spread between value and growth stocks. So the expensive stocks are sometimes only <4x as expensive as the cheap stocks, the median is that they are 5.4x more expensive, but today they are almost 12x more expensive. It is now (March 31, 2020) at the 100th percentile vs. the 50+ years of history

However, if PBR is no longer a “relevant” ratio, like what GMO believes, are there other value metrics that might better support the case for value investing turnaround?

The Price-to-Earnings (forecast) metric seems to imply a +4 STD event as well.

The article continues to look at other scenarios based on the value spread, with the conclusion that value is exceptionally cheap today and it gets cheaper the closer their analysis gets to realistic implementations.

He concludes by saying:

“Today is the maximum ever and 23% more above-median than the tech bubble peak. Again, this a sort on intra-industry price-to-sales, not price-to-book, for you price-to-book haters! Value is simply exceptionally cheap any way you slice it and anyway you try to reduce it by excluding whomever you think the culprits may be. It’s record-cheap on what we think are common methods many quants use (like neutralizing the industry bet and using more measures than just price-to-book) and usually by a decent margin”.

Asness, AQR Capital

He goes on to say:

“If value investing was like driving my four kids on a long car ride, we’d be very deep into the ‘are we there yet?’ stage of the ride, and value investors are justifiably in a world of pain. However, the odds are now ‘rather dramatically’ on the side of value”.

Asness, AQR Capital

How to partake in Value Investing for Singapore investors?

Do I think Value Investing is dead? I don’t think so.

Do I think value investing is prime to outperform growth investing any time soon? I also don’t think so, unless the current recession which many compares equivalent to the Great Depression of the 1930s, comes to an abrupt end now. Is that going to happen?

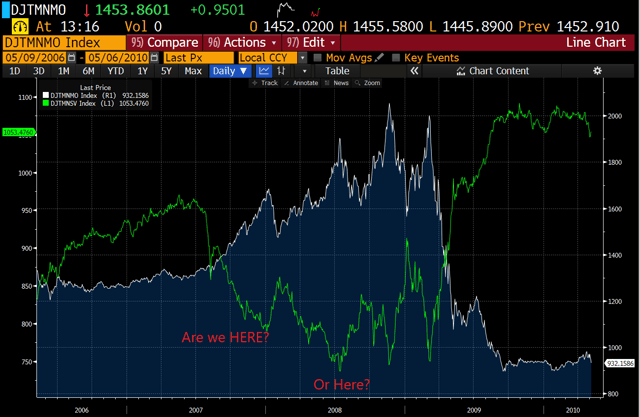

Value stocks tend to perform exceedingly well in the aftermath of a recession, ie early stage of economic growth. Take for example this Bloomberg chart which shows the Value index (in white) vs. Momentum index (Green).

From 2006 to early-2009 which is the period of the GFC, the momentum index has continued to outperform that of the value index. It is only from mid-2009 (early stages of the GFC recovery) onwards that did value counters stage a brief but strong comeback against momentum.

For the value index to outperform the growth index, financials will need to stage a strong comeback. With so much economic uncertainty over the horizon and with interest rates at an all-time low, I find it a challenge to warrant an optimistic outlook of banks.

Warren Buffett certainly is feeling cautious about his beloved US banks. He slashed his Goldman Sachs holdings by more than 80% in 1Q20.

While growth and momentum investing might continue to dominate in the coming months, there is no harm in preparing for a Value reversal, if and when it happens.

For Singapore investors, you can either do it on a hands-free approach by investing with Robo advisors whose investment methodology places great emphasis on value investing such as Endowus and MoneyOwl or you can engage a DIY approach which I will further elaborate.

Value Investing in Singapore through Robo Advisors

In Singapore, there are a couple of Robo-advisors that focus on value investing, largely the result of the investment methodology of the unit trusts which they are vested in.

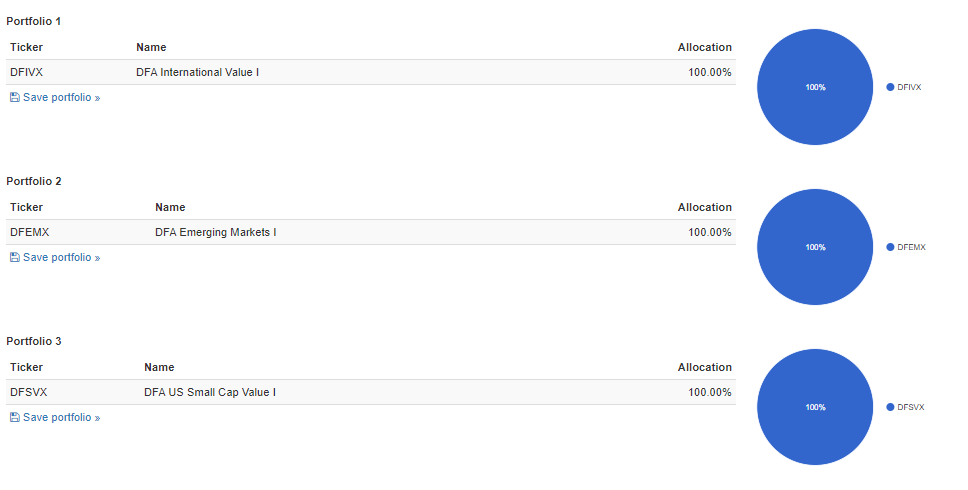

Take, for example, Endowus and MoneyOwl, both of which provide retail investors with access to Dimensional Funds through their platform.

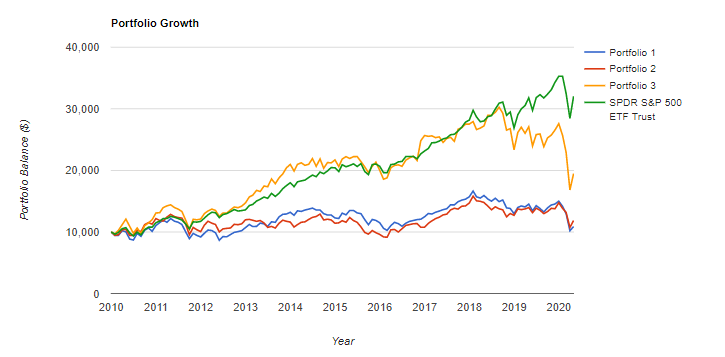

I have written about Dimensional Funds previously. Dimensional Funds engages factors investing, with a focus on value and small-cap names. It is hence not surprising that their fund performance has significantly trailed that of the broader index both over the past decade as well as during COVID-19.

Nonetheless, Dimensional funds are among the most well-regarded practitioners of value investing and if a value reversal is in order, then one should consider using either Endowus or MoneyOwl to partake in the Value Investing revival.

Value investing in Singapore on a DIY basis

Value investing in Singapore on a DIY basis gets a little more complicated but yet also more interesting.

What is a value stock?

First I will need to define what is a value stock. There is no shortage of investor definitions as to what constitutes a value stock. Most investors would agree that a value stock should have a decently low price to earnings (P/E) ratio and/or Price to book (P/B) ratio. Some investors also consider metrics such as low Price to Sales (P/S).

The definition of low can be on an absolute basis, meaning, defining a P/E ratio of less than 10x or a P/B or P/S ratios of less than 1x.

My preference is to look for value relative to a company’s industry. For example, in the current tech world, the average P/E multiple might be hovering at around 40x. On the other hand, the average P/E for the energy segment might be around 15x.

I will consider a tech stock with a P/E multiple of 25x as exhibiting “value characteristic” while an energy stock having that same P/E multiple of 25x will be viewed as extremely overvalued.

Another reason for using value relative to the industry is to avoid having a concentrated portfolio in a particular industry. For example, when oil companies by traditional valuation measures such as their P/B are spectacularly cheap. If we did a valuation screen based on absolute multiples, then we may end up picking only oil companies for our portfolio, not very wise in today’s context.

Value Stocks vs. Value Traps

There are a lot of value stocks that turn out to become value traps. Similar to how a growth stock becomes a value stock.

Some value stocks are cheap for a reason and they often get cheaper. These stocks are known as “value traps”. No matter how cheap they might look, they always seem to surprise further on the downside.

Ultimately, these value traps will unravel to being no longer of “value”. It could be due to a huge asset write-off or elevates their P/B ratio immediately or it could be due to the loss of competitiveness in its product service offerings from new entrants which results in the rapid decline of its top and bottom-line.

One will hence need to distinguish “good value” from the “bad value” to become successful as a value investor.

How do I find Value Stocks in SG?

First, I will use a stock screener like Uncle Stock. It is not the best stock screener out there in my opinion particularly if you are just focusing on US stocks but for this article where the focus is on finding value stocks in Singapore and Asia, this stock screener is among the best out there.

So I use 6 screening criteria. P/S, P/E, and EV/FCFF are relative valuations when compared against industry peers. The idea is to find companies that are relatively undervalued based on these criteria when compared to their industry peers. These ratios have to be at least 15% below the industry average.

I also look at EPS and Revenue growth to ensure that these stocks have been growing decently (revenue CAGR of 2% and EPS CAGR of 5%) over the past 3 years and are not value traps.

Lastly, I look at Singapore stocks that have a market cap of at least USD200m.

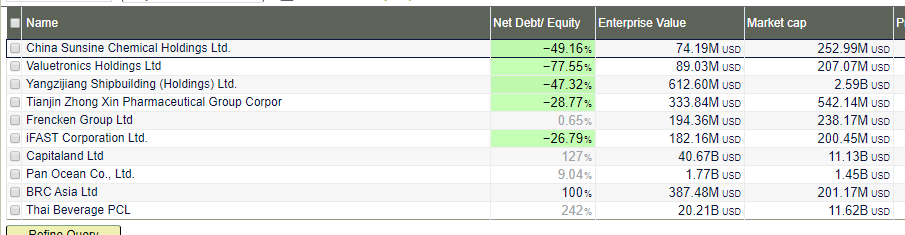

Using these criteria, I found 10 stocks that meet these criteria.

The 10 stocks are China Sunsine, Valuetronics, Yangzijiang, Tianjin Zhong Xin, Frencken Group, iFAST Corporation, CapitaLand, Pan Ocean Co, BRC Asia, and Thai Beverage.

Digging Deeper

Not many “value stocks” within the Singapore universe that are worthy of a closer look. There are probably a lot more counters if you expand your scope outside of Singapore stocks.

Screening for value stocks is the first step. I now need to ascertain whether these stocks are true value stocks or value traps. Unfortunately, this can only be determined by doing additional research stock by stock.

There are three factors which I will next consider:

- Price Performance vs. Index

- Gearing level

- Growth outlook

Price-performance vs. index

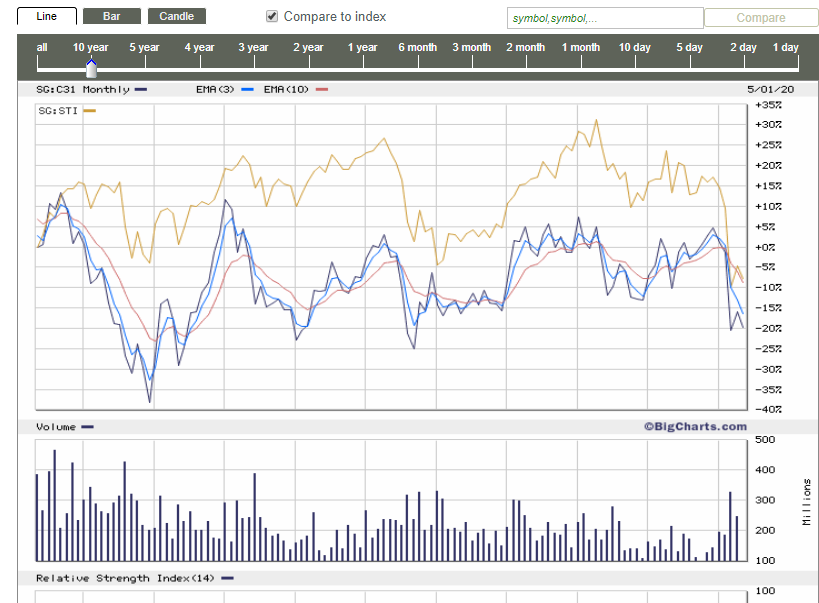

This can help us to find our true value stocks from value traps, cheap stocks that can never appreciate. I can look at the relative performance of the counter vs. the index over a multitude of periods.

This can be done using Uncle Stock price comparison vs. index

I will tend to avoid stocks that show underperformance against the index on most or all of the major time frames. These stocks tend to be value traps.

Look for stocks that are beginning to outperform the index in the nearer time frame (1-month return, 3 months return) which could indicate that the market may be recognizing some value in the counter.

Gearing Level

I want to avoid stocks that have a significant amount of debt level on a case by case basis (hence not included as part of the screening criteria)

This could indicate potential credit risks to the counter.

Out of the 10 stocks which we have identified, most of them have decent net debt to equity ratio, with 5 counters in a strong net cash position. There are 3 stocks with a relatively high level of gearing. They are CapitaLand, BRC Asia, and Thai Beverage.

One will need to evaluate if the high gearing level in these counters is a cause for concern. I believe CapitaLand remains in a financially strong position despite its high gearing level which atypical of property developers. BRC Asia might run into credit-related risks if the construction industry fails to gain traction post-COVID-19. Lastly, the credit risk of Thai Beverage is relatively low considering that the company is back by the richest man in Thailand. However, its SABECO acquisition now seemingly looks like an over-priced mistake.

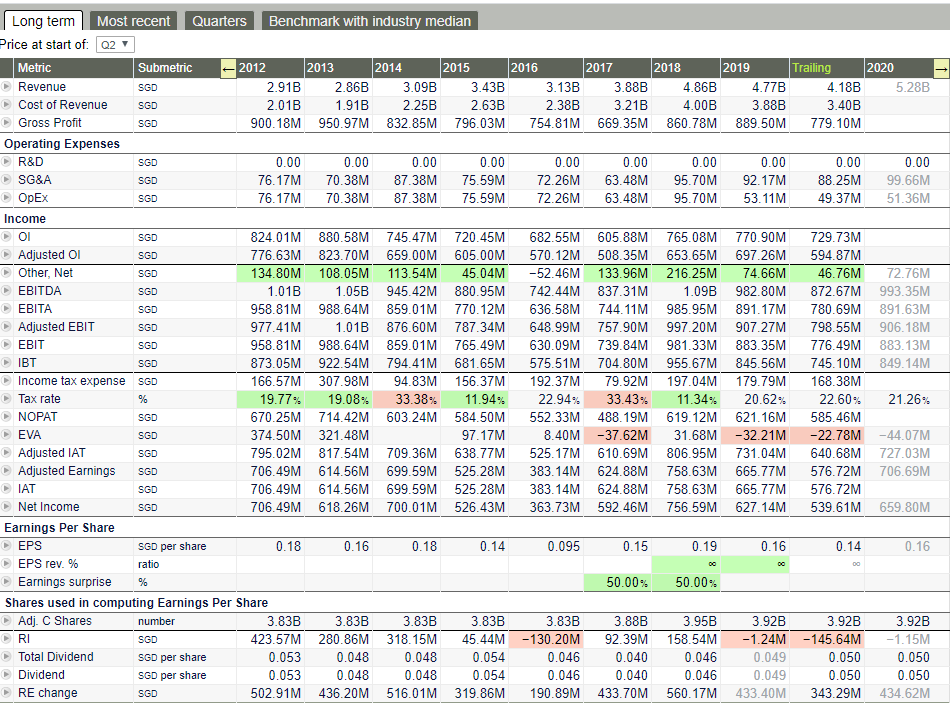

Growth Outlook

Last but not least, I will like to evaluate the forward growth outlook of the company as well. The screener already ensures there has been growth in sales and EPS over the last 3 years.

But what about the company’s future earnings outlook? Are there major speed bumps on the horizon?

This might require more work despite Uncle Stock providing a forward forecast on the counter’s financial statements. However, this is based on its calculated growth assumptions using historical data which might not be relevant.

For example, the above shows the financials of Yangzijiang, a counter that I have covered several times previously. Uncle Stock is forecasting a 2020 net income growth of 5.7% based on past results which might not be relevant.

The easiest solution is to head over to Sginvestors.io to check out what analysts have to say regarding the counter.

Conclusion

These 10 stocks are cheap relative to their industry peers based on traditional value metrics that I employ. More work needs to be done to determine if they are indeed value stocks worthy of an investment.

I have identified some of these stocks in my previous article on undervalued Singapore Dividend Stocks which you might like to check out as well.

I hope that for all the value investors wannabe out there, you now have a better understanding of value investing and its macro outlook. For those looking to DIY, I hope that you will feel more confident in performing the steps in identifying and constructing your portfolio of value stocks.

Value investing, however, requires patience, as you might already know by now. Stocks that are trading significantly below their intrinsic value might not be fully appreciated by the market in the near term but on a long enough horizon, the market will ultimately recognize their value, provided they do not become value traps first.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- WHEN TO BUY STOCKS IN A RECESSION? THE IDEAL TIME TO PICK A BOTTOM

- HOW TO INVEST IN A RECESSION OR BEAR MARKET (2020 EDITION)

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Value Investing in Singapore: 10 SG Value stocks that might make sense”