How to hedge stocks in a volatile market

I have been asked numerous times. Why is the stock market rallying when the global economic situation remains pretty much in ruins? Against the backdrop of the second wave of COVID-19 spread which has resulted in some US states reversing some of their re-opening decisions, should economic normalcy be the base case scenario for 2H20?

That seems to be what the global stock markets are currently implying. While I have been equally caught off-guard by the swift rise in global stock markets, I believe it makes some sense at the current stage to deploy certain hedges in your stock portfolio.

In this article, I will be highlighting the 5 levels of hedging. But before that, a quick look at the disparity between economic reality and the stock market.

The music is still playing

As the popular saying goes: “As long as the music is playing, you’ve got to get up and dance”. This was a comment by Chuck Prince, the ex-CEO of Citigroup, who said back in July 2007: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance”. He was sacked a few months later at the peak of the GFC and never returned to the dance floor.

The current COVID-19 driven pandemic has essentially unleashed a torrent of liquidity by governments all over the world, led by the US Fed. The Fed has provided an immense backstop to the credit market and that has cleared a big overhang for stocks.

The Fed has purchased bonds in speculative-grade companies as well as ETFs, including the SPDR Bloomberg Barclays High Yield Bonds, a fund in which the Fed holds a US$412bn position.

The decision to “interfere” with the credit market raises questions over the probity of such a move into the functioning of free markets and the role of what is supposed to be an independent central bank.

Looking ahead, nothing is stopping the Fed from making the printing press go “brrr” again and directly interfere with the stock market by purchasing equities as a possible means to stem a potential market decline if that happens.

So, with big brother providing that strong support, what can ultimately cause the music to stop playing, and participants hesitant to continue jiggling? What is the implication of the Fed’s balance sheet being at US$7trn currently? (Note that it was just US$870m in Aug 2007). Why can’t it go to US$14trn or whatever number you throw at it? The skies the limit?

Honestly, I have got no real answer to that. Inflation might be a critical catalyst. US consumer prices increased by the most in nearly 8 years in June 2020 as businesses reopened but the underlying trend suggested inflation would remain muted and allow the Federal Reserve to keep injecting money into the ailing economy.

With a record 33m people on unemployment benefits, economists expect inflation is likely to remain benign, at least for now.

Animal Spirits keep rampaging

Bloomberg recently ran an article that highlighted that beneath the surface of the highest-flying stock markets in the world, animal spirits keep rampaging like rarely seen before.

Call Options contracts for Amazon that is having an estimated one-in-ten chance of paying off is seeing record demand. Traders are expecting that the stock has another 50% rise potential in the next three months, after already having risen 60% YTD.

Contracts betting on the online retailer to reach $4,600 by October were among the most-traded calls for that expiry month this week.

That speculative frenzy is a similar story for Tesla. Nearly 40,000 Robinhood accounts added shares of the automaker within four hours on Monday, according to Bloomberg, citing data from Robintrack.net. Currently, roughly 469,000 investors on the app hold shares of the automaker in some form.

Traders are also chasing fresh upside in Chinse equities after the country’s influential state media stoked bullish enthusiasm. Call Skew, a measure of the implied volatility of calls vs. puts has jumped by record for BlackRock Inc’s iShares China Large-Cap ETF or FXI, according to Credit Suisse.

Volatility the order of the day

It is hard to believe that the current stock market rise is going to be a smooth sailing one. Just yesterday, the CSI 300 index closed 4.8% lower, the biggest loss since the market reopened in February after the Chinese government decided to curb trading enthusiasm by targeting one of the Chinese favorite stock of all-time, Kweichow Moutai Co, the maker of baijiu, a form of hard liquor that is very popular among the Chinese.

Beyond the fact that COVID-19 is still rampaging globally, with daily cases hitting a record high yesterday at close to 250k cases and daily deaths witnessing an uplift from the bottom in early June, according to data from Worldometers, the state of global economies remains dreadful.

Here in Sunny Singapore, the central bank (MAS) just highlighted that Singapore’s economic situation is “dire” as global COVID-19 resurgent looms.

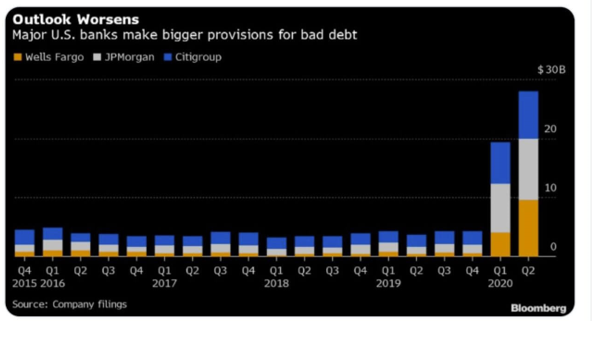

In the US, while big banks’ latest quarterly profits were better than expected due to “black swan” trading gains, it masks the fact that they are making huge provisions. Wells Fargo, JP Morgan, and Citigroup have collectively set aside nearly $28bn in 2Q20 alone to deal with an impending wave of defaults on bad loans. This means that they know a lot of clients aren’t paying and probably won’t ever get back on track.

How to hedge stocks

Amid the current market volatility, I think it pays to be cautious to have a certain level of hedging for your stock portfolio. While it is perfectly fine that you choose to continue to jiggle along with the “music” that the Fed is playing, you might want to consider “giving up” some of those gains from your equity portfolio and hedging your downside risk.

Level 1 of hedging stocks: Going partially into cash

Yes, its that simple. Increasing cash after markets have given fantastic short-term returns is one of the best ways to hedge your stock portfolio. However, one will have to battle the Fear of Missing Out or FOMO as most would coin it.

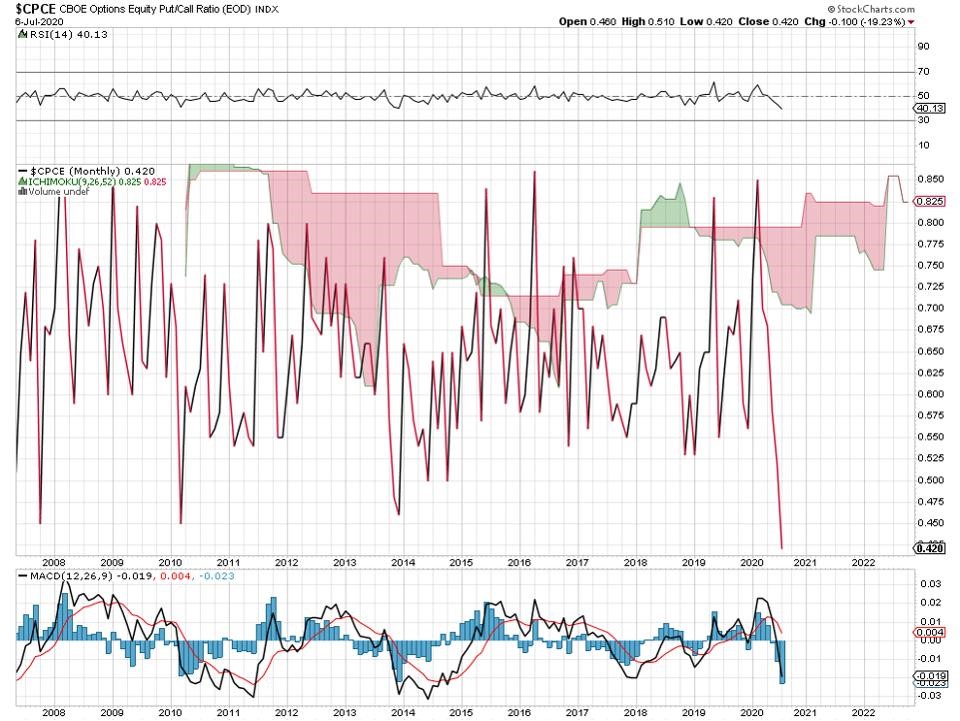

Historically one of the best indicators to use to increase cash has been the Put-Call Ratio and this current ratio “shouts” extreme at the current level.

This index is showing that fewer equity puts and more equity calls have been purchased than at any time shown in the past 12 years. A potential level of frothiness?

Having an allocation to cash will hurt investment performance when the stock market goes up, which most of the time it does. But I believe it is worth giving up some of the upside return to better protect and provide for your needs when times are tough.

With a crystal ball, we’d be able to allocate in and out of cash as needed, but until that crystal ball is invented, we’d rather the permanent allocation to cash.

Level 2 of hedging stocks: Buying Short-term bonds

Holding cash is a great short-term hedge but earns nothing or next to nothing today. One way investors can take the first hedge up a notch is to use that raised cash to buy shorter-term bonds.

As interest rates have fallen, bonds have lost their appeal to a large extent. But they can serve as a modest boost to just holding cash. In general, you want to hold shorter duration bonds with zero default risk as corporate bonds tend to follow equities more closely.

So, this could be a money market fund which unfortunately only yields around 1% at present. For those who are looking at a higher yield here in Singapore, the ABF Singapore Bond Fund might be a potential alternative as well.

This is an ETF that is actively traded on the SGX bourse as well so it should not be too much of a hassle to buy and sell. However, for retail investors, do note the potential commission cost involved in the purchasing of the ETF as well as other expense ratios incurred.

Another alternative is to find a very sound and highly rated company and buy their bonds. That will likely hold up like cash even in a market dislocation. Recall that the Fed is buying corporate bonds, even that of sound companies like Visa and Apple. What could go wrong! That is as good as a risk-free return, in my opinion. The financial positions of these big corporates are in much better shape than the US government itself. The only risk I see is a major devaluation of the US dollar hurting returns for foreign investors.

Level 3 of hedging stocks: Directly shorting the index ETFs

While the previously-presented choices offer some ways of offsetting a decline, directly shorting indices is significantly closer to home for hedging. The idea is that on a downswing, the percentage of profits on the short side should ideally exceed the percentage losses on the long side.

Investors might get curious as to why this is better than just raising cash by selling the stocks that have gone up. In other words, why is this better than Level 1 and 2 of hedging. Short selling gives investors several advantages.

- Shorting removes the necessity of selling shares already owned.

- For income investors, selling your income-generating portfolio of stocks might not be the best way forward as it will reduce your future income potential. As index funds are typically much lower in terms of dividend yield, shorting index funds will solve the dilemma of having downside protection while still maintaining your stock exposure.

- Benefit from potential mean reversion. If your portfolio is mainly in income-generating value stocks, for example, you might want to short an ETF that is largely composed of growth stocks, such as the QQQ ETF for example. By shorting the growth ETF as a hedge, one can protect the portfolio from downside and also catch the two indices catching up to each other.

However, there is always that risk in Point 3 where your value portfolio will continue to lose value while at the same time your hedge on growth stocks also falter which means that you end up losing on both sides of the equation.

Since Index funds are generally quite liquid, there is little risk that you are forced to cover at the wrong time due to a shortage of shares to borrow. This is generally a risk with individual securities.

Besides the cost of the dividend yield of the ETF that might be applicable when you short an ETF, there is also the borrowing costs that your brokerage firm will charge you for lending you the shares to short. This needs to be taken into consideration as well.

Level 4 of hedging stocks: Buying Put Options

So far I have stressed less expensive ways of hedging. Next one can also short via buying puts. Buying equity or index put gives the owner the right, but not the obligation, to sell 100 shares 91 option contract) of underlying stock at a specified price (the strike price) at any time before a specific time (the expiration date).

While American style options (the ones that trade on all US and Canadian exchanges) can be exercised at any point before expiration, they usually are just sold before expiration rather than exercised, as that almost always results in better value.

Buying Put Options is often seen as a more leverage way to hedge as well as one where your maximum risk is defined by the number of premiums you pay for owning the puts.

However, there will be occasions where buying a put option is inherently expensive due to the elevated level of implied volatility, for example, during the March market sell down. One should not be buying Put options during that period as you will be over-paying for your “time premium”.

A potential workaround will be to purchase long-dated Deep-ITM Put Options which have less time value component (mostly intrinsic) and where the time value decay process is slow.

Level 5 of hedging stocks: Buying Inverse ETF and leveraged Inverse ETFs

There has been an explosion in inverse funds since first introduced and they have expanded to over 150, covering asset classes across the board. Popular products here are ProShares Short QQQ (PSQ), Direxion Daily S&P 500 Bear 1X (SPDN), and ProShares Short S&P 500 (SH).

The key disadvantage is the effect of compounding on these funds which causes decay. As these funds are set up to replicate the inverse of daily moves, whenever you hold them overnight you introduce a compounding effect. Compounding can work on both sides. What do I mean?

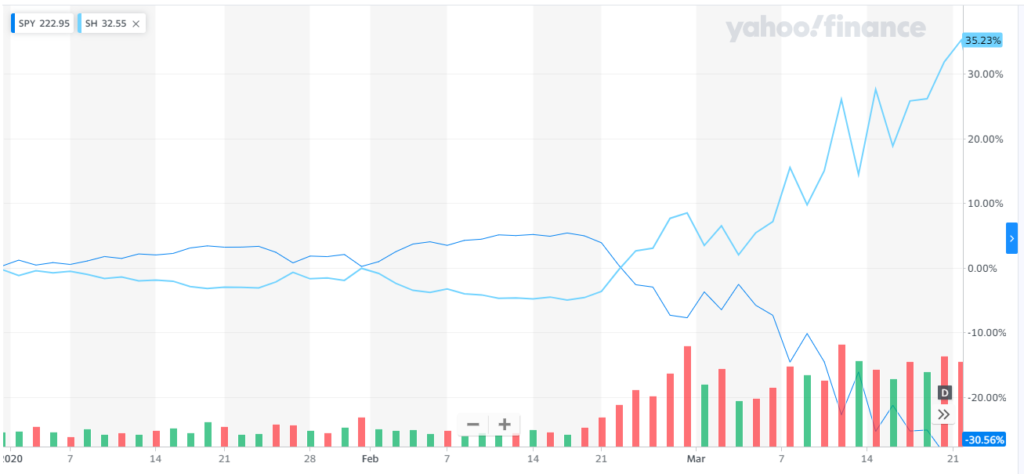

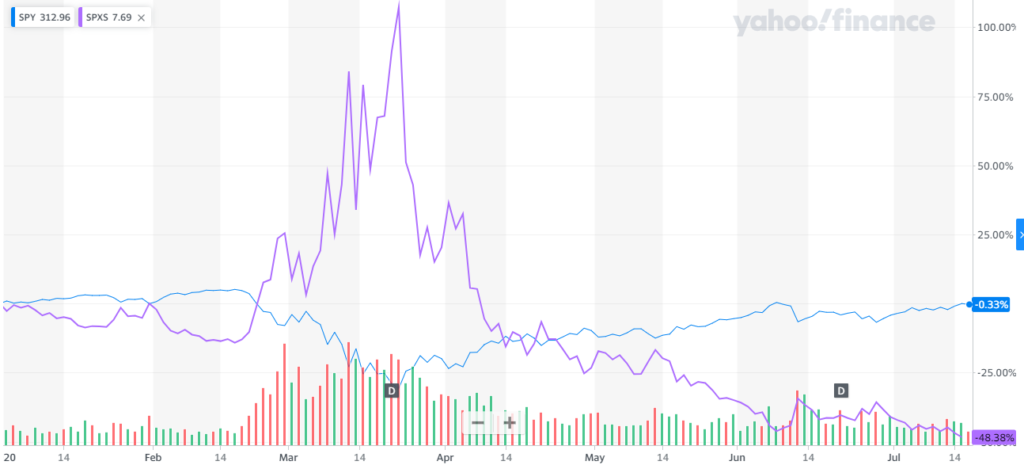

One can see this by observing the performance of going long SH vs. shorting SPY. From Jan 1, 2020, to March 23, 2020, you can see going long SH outperformed going short SPY. That’s compounding at work.

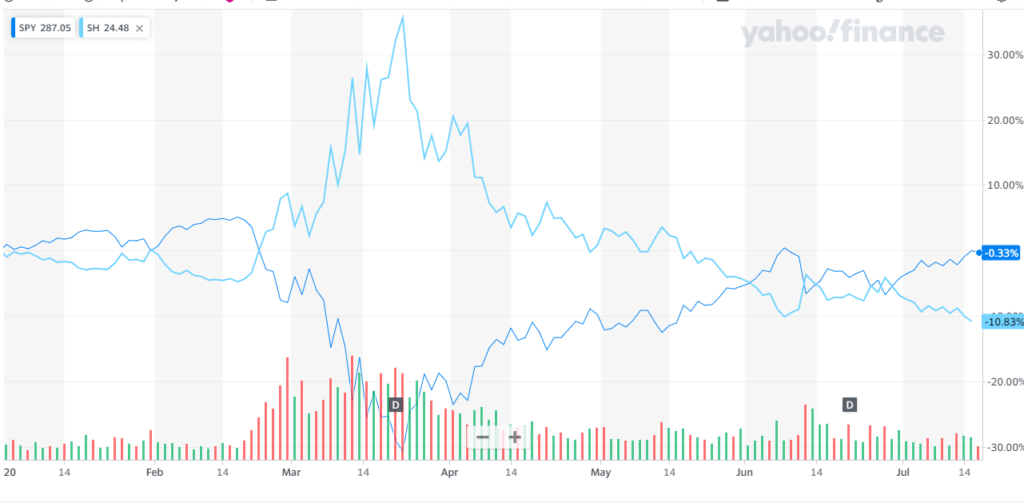

However, year to date, going long SH has underperformed shorting SPY by a decent margin. That’s also compounding at work.

If you are holding an inverse ETF in a strong trending market, you are going to see the effect being compounded either positively or negatively. Inverse funds keep decreasing your short exposure as the markets go higher and keep increasing it as the markets go lower.

This might cause a problem when it comes to instilling your hedging strategy. For example, you might think that that the market going up 20% might cause your inverse ETF to only decline by 20%. But the fact is that the inverse ETF decline is going to be more significant than 20% due to the compounding effect.

Leveraged Inverse ETFs are essentially inverse ETFs on steroids and they are just going to magnify the gains and losses of inverse ETF by 2-3X. If the market collapse in a straight downtrend over a short period (like the one in March), then your leverage inverse ETFs are also going to significantly outperform by more than a factor of 2-3x.

However, a long-drawn bull market will leave your portfolio suffering from the disastrous effect of decay. Not that long in fact. SPY shares were essentially flat between the beginning of the year and June 9, 2020. SPXS lost a whopping 45% in the same time frame.

Conclusion

These are the 5 levels of hedging strategies for your stock portfolio. Level 1-3 are relatively easy to implement. For those looking to purchase Put options on Index ETF as a long-term hedge mechanism, I would recommend doing deep ITM options. While the leverage effect is minimized, these options do not have much time premium component which is subjected to daily decay.

I will not recommend Level 5 as a hedging method unless one’s holding period is relatively short. On the grand scheme of hedging your portfolio on a long-term basis, this is not a good strategy to use.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- STASHAWAY SIMPLE REVIEW + OTHER NO FRILLS CASH SAVINGS [UPDATE MAY 2020]

- ULTIMATE ROBO ADVISORS SINGAPORE GUIDE. KEY FACTS YOU NEED TO KNOW (2020)

- DIY OR ROBO? THE 1.6% OPPORTUNITY COST DILEMMA

- CREATING THE BEST TAX EFFICIENT ETF PORTFOLIO TO INVEST IN?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “How to hedge stocks: 5 levels of hedging”