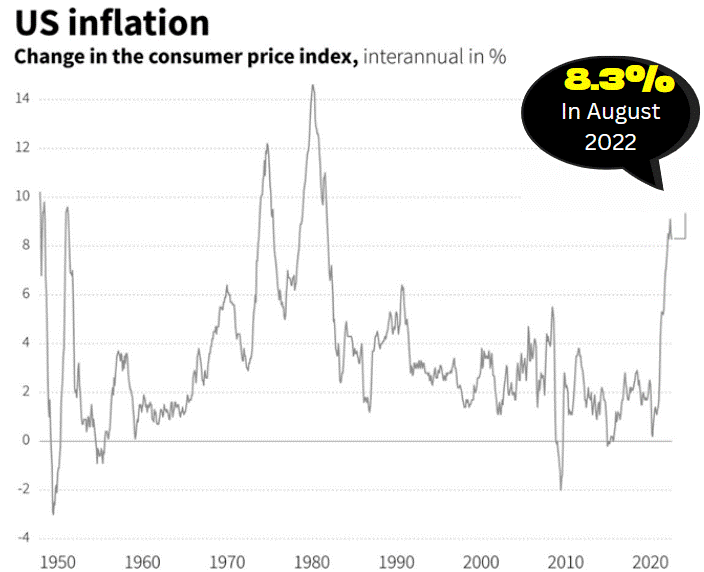

The market has had its most significant drawdown since June 2020, with every sector deep in the red. The key factor driving lower markets was undoubtedly inflation, or how sticky it was. Back in early September, I wrote this article: Has inflation peaked? Don’t bet on that. My thesis was that while inflation showed a … Read more

inflation

Has inflation peaked? Since mid-June, the S&P 500 has been on a “bear market rally”. While proponents from the bull camp such as Tom Lee from Fundstrat who believes that the downtrend is over and the S&P 500 is on track to hit his year-end target of 4,800, other naysayers such as “ almost perma-bear” … Read more

Combat inflation and rising rates today with these 4 ETFs Concerned about inflation and interest rates hikes in 2022? Here are 4 ETFs that could help hedge your portfolio against the adverse effects of both inflation and rising interest rates. Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at … Read more

Market Correction: Is the sky falling again in 2022? The sky is falling “yet again” as the stock market experience its first significant market correction in 2022 with the S&P 500 declining by almost 2% and the Nasdaq tanking 3.3% last night (5th Jan) as meetings from the Fed spooked the market. Minutes from the … Read more

How to beat inflation and protect your investment portfolio “Inflation is transitory”. That is no longer the buzzword used by the Fed, instead, the world’s largest central bank is acknowledging that price increases had exceeded its 2% target “for some time”. Should we still hold the Fed’s words as the gospel truth? Well, not according … Read more

The market pretty much ignored the inflation number which came out last week, with the CPI hitting 5%. Then last night, well-known hedge fund billionaire Paul Tudor Jones gave an interview to CNBC, highlighting that the Fed could give the green light to ALL-IN on inflation products pretty soon. He also hinted that hedge funds … Read more

May 2021 inflation at 5% The latest inflation number was out last night, with the figure of 5% higher than the market’s expectations of 4.7%. While the Fed will like you to believe that this high inflationary figure is transitory, what if it is more persistent? One key point in the 5% number that is … Read more

In a previous article, I wrote about how to hedge against a stock market decline, using 5 levels of hedging. I did not mention gold, which might be more of a useful hedge against a broad-based decline in fiat currencies, particularly the USD as well as the increased probability of inflation rather than a stock … Read more

Not much has been written about Inflation. However, it is one of the Four Key unknowns that affect one’s retirement plan. Granted that inflationary pressure has been low in the past decade. However, having a complacent mindset with a low inflation assumption baked into one’s retirement calculation might be a recipe for disaster. Compound Interest … Read more