Straco’s Flyer suspended due to technical issues

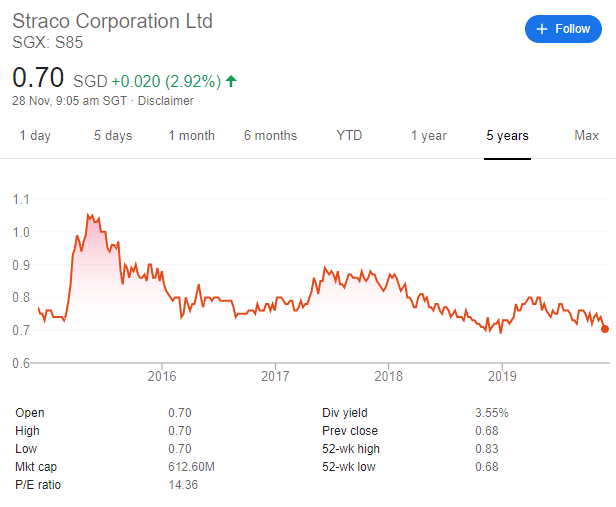

Straco Corp, a share that I own in my portfolio, saw its share’s declined by more than 4% when it was reported that the Singapore Flyer has suspended its operations since Nov 19 after a technical issue involving one of the spoke cables.

A spokesman for the Flyer said that the move was a precautionary measure while the Flyer undergoes inspection, repairs, and rectification works.

It is unclear when the Flyer will reopen to the public.

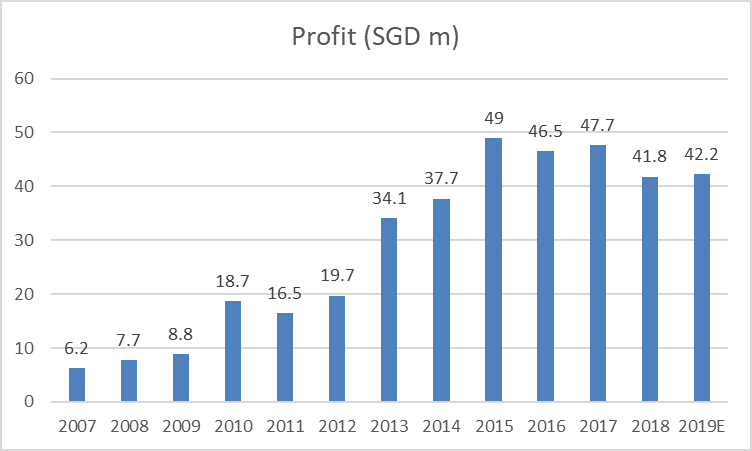

This is not the first time that the Flyer has suffered technical breakdowns. Operations were suspended in January 2018 for two months due to a “technical issue”. This event contributed to a 12.4% declined in FY2018 earnings for the company.

We were previously hopeful that the worst of the Flyer’s issues were behind us. This suspension proved otherwise. However, despite a double whammy of 1) slowing Chinese visitations and now a 2) potential prolong suspension of the Flyer, we took its share price weakness as an opportunity to increase our stake in Straco.

Price weakness an opportunity?

We have previously written an article entitled, Straco: Is It a Good Buy Now?

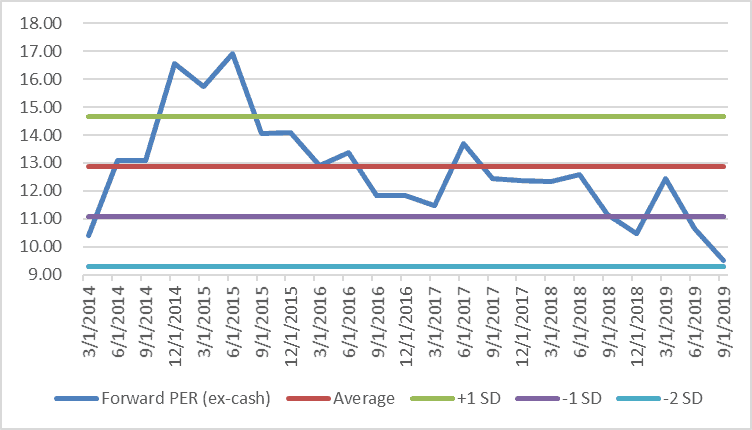

The conclusion then was that the counter was cheap (trading at 10.6x 2019E PER on an ex-cash basis) but it lacks a re-rating factor to bring its valuation multiples back to its average level of 12.9x.

We made a couple of key forecasts then:

- 2019 visitation numbers will decline by 5% YoY

- Stable Revenue/tourist ratio of 24.7x in 2019

- Net margin of 37.7% in 2019

- Net cash increment of SGD$15m in 2019

- 2019E earnings of SGD$44m

Based on 9M19 performance, we look to adjust some of the figures:

- 9M19 visitations (3.911m); 9M18 visitations (4.03m). YoY decline of 2.9%. We are maintaining an FY2019 visitation numbers decline of 5%. This will imply that 4Q19 visitations will only reach 0.81m vs. 0.946m in 4Q18 or 14% YoY decline.

- Total 9M19 revenue: SGD$94.1m which corresponds to a revenue/tourist ratio of 24.1x. We assume that this ratio will now be at 23.5x in 2019. This will imply that our FY2019 revenue is at SGD$111m vs. FY2018 level of SGD$118m

- 9M19 net margin of 38.6%. We assume an FY2019 net margin of 38%.

- Based on the assumptions above, 2019E net profit will amount to SGD$42.2m, a slight decrease from our previous assumption of SGD$44m. Profits could be lower depending on the duration of the Flyer’s suspension.

- Net cash increment of SGD$15m in 2019 to bring total cash hoard as of end-2019 to SGD217m

Based on these new assumptions, Straco Corp, with a market cap of SGD$592m, is now trading at an ex-cash (SGD$400m) forward 2019E PER of 9.5x. This is almost equivalent to -2SD to its past 5 years ex-cash forward PER trading range.

Still a strong cash-generating machine

Despite weakness seen in its China visitation numbers, (visitations in 3Q19 has however been slightly stronger than our previous expectations), the company has been able to generate consistent operating cash. 9M19 operating cash of SGD$52.4m is even stronger than 9M18 operating cash of SGD$49.1m.

Assuming that the company generates FY2019 operating cash of SGD$60m with a CAPEX of SGD$5m, this will bring free cash flow to SGD$55m. Based on a market cap of S$592m, that is a Price/free cash flow of 10.8x which is pretty attractive, in our view.

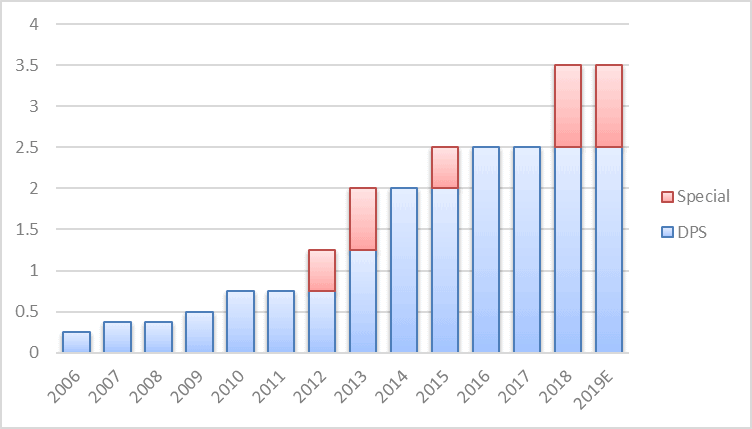

With the company expected to end the year in a strong net cash position of close to SGD$190m, Straco can well afford to maintain its strong dividend payment of 3.5 cents per share for 2019. This translates to total dividend amount of SGD$30m or a pay-out ratio of 72% and well within the comfort zone of its expected free cash flow generation of SGD$55m in 2019.

Straco is one of the very few companies listed in SGX that has not cut its dividend payment since 2006, an extremely credible track record. Over the past 12 years, DPS has increased from 0.25 cents to 3.5 cents, or a CAGR of 24.6%, a fantastic compounded growth rate.

We expect Straco to at least maintain its DPS at 3.5 cents for 2019. The company could surprise or reward shareholders if they are able to win the lawsuit pertaining to the Flyer’s breakdown in 2018 and now 2019) against its insurance company.

Still waiting for a major acquisition

Straco net cash is expected to hit SGD$191m by end-2019, a record level. Its cash pile is currently generating close to 2.4% in interest income yield, a decent figure considering today’s low-interest-rate environment. However, it’s cash can be better deployed in an earnings accretive acquisition.

The company can fully fund a similar SGD$140m acquisition (Flyer cost back in 2014) without having to incur any debt. The Flyer generated SGD$11m in PBT back in 2017. Assuming no interest cost and a corporate tax rate of 17%, such an acquisition would have netted the company a profit of SGD$10m or a 24% YoY profit increment from 2019E level.

Risks are still present

Despite the company’s strong balance and cash generation profile, it is a fact that its operating business is being negatively impacted. Despite operating in the relatively robust tourism industry, Straco’s core China tourism business has been on a decline. The company is looking at active refurbishment to increase its appeal.

Top risks:

- A persistent slowdown in China visitation numbers due to competitive pressure. While no one is expecting Straco to increase ticket prices to their attractions, a ticket price cut will result in significant operating deleverage

- Depending on how long the Flyer is being suspended, operating performance in this segment could take a major hit if the suspension goes beyond two months. In 2018, profits declined by c.SGD$5m as a result of the 2 months suspension. Assuming a similar hit in 2019, 2019E net profit could be at c.SGD38m vs. our SGD$42m forecast. This will imply an ex-cash PER of 10.5x, still at an attractive -1 SD level.

Conclusion

Straco’s share price is currently close to a 5-years low, trading at -2 SD to its forward ex-cash PER multiple. Despite near term hiccups and competitive pressure, there are no signs that Straco’s resilient tourism business is at risk of a structural downturn.

With a strong balance sheet, the company is in a better position compared to many other companies to ride out a potential recession. A recession might be the trigger to provide the company with the opportunity to deploy its cash hoard, which continues to increase at a rate of SGD$15-20m every year.

The company will have fully paid off its debt in 2 years’ time and that will further give a boost to its cash generation profile. Net-interest generation (assuming no acquisitions) will be close to SGD$6.5m alone on our forecast (a combination of interest income and interest cost savings from fully-repaid loans).

Base on the above assessment, which emphasizes on the valuation angle vs. profiling its operational landscape (might be an article for another time), we believe Straco is still a company that warrants an investment at S$0.70/share.

I don’t think the company will cut its DPS of 3.5 cents. At our entry price of S$0.70, that is a 5% yield. However, if the company decides to cut dividends despite a record cash hoard with no acquisition in sight, that will lead me to rethink my investment thesis.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER WRITE-UPS

- THE MAN WHO TRUMPS WARREN BUFFETT BY 200X OVER THE PAST 30 YEARS

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.