Stocks vs Bonds vs ETFs vs Mutual Funds: Which should you invest in?

When I first started my investment journey, the experience was similar to being thrown into uncharted waters. With a myriad of financial instruments available, it was a struggle to find the right product to keep me afloat in the market! This experience is not foreign to many and this article seeks to serve as a handy beginner guide for common investment products – Stocks vs Bonds vs ETFs vs Mutual Funds.

It will cover what they are, the differences, and the product you should invest in.

What are stocks?

Stocks or often known as Equities represent legal ownership of a company. One classic analogy is to view the company as a pizza.

The number of shares or slices you own refers to the proportion of your ownership. Although you won’t be involved in the day-to-day operations of the firm, you get a share of the profits the company makes.

Why would they list shares if their profits are distributed?

There are mainly two ways a company can raise funds – listing of shares or taking up loans. Unlike loans, financing through equities places a lesser financial burden on firms as they do not have to repay the debt.

Where can we purchase these stocks?

Listed companies sell their shares through the respective stock exchanges such as STI or HSI. Think of these exchanges as an auction house where the price varies based on the supply and demand of individual shares. The ever-changing dynamics within the market results in fluctuation in prices.

When more buyers are willing to purchase the stock vs. the number of sellers looking to sell the stock, the price of the stock will rise. The reverse of more sellers vs. buyers translates to a declining share price.

One can purchase these listed shares through a brokerage house.

Additional Reading: Best Stock Brokerage in Singapore

How do we profit from stocks?

As shares are relatively volatile, investors tend to enjoy greater rewards in exchange for the higher risks. There are two main ways you can profit from them:

- Capital Appreciation: Investors can profit when a stock of a listed company they own sees an appreciation in its share price vs. the cost of purchase.

- Dividends Return: The distribution of profits by companies is referred to as dividends. The regular payments paid to shareholders can serve as periodic income. However, do note that not all companies distribute dividends.

Pros and cons of stocks?

As mentioned previously, stocks are riskier due to the volatility of the market. Here are the pros and cons of the financial instrument:

Pros

- Higher Returns: Investing in stocks tend to provide a higher return compared to other investment assets

- Liquidity: Stocks are highly liquid as the stock market has a high volume of transactions in general. Compared to properties that might take time to sell, you can convert your shares into cash instantly if required

- Dividends: Regular payments provide investors with an income that can be used to beat inflation.

Cons

- Consumption of time: Investing in a company requires research and conviction of the company which is time-consuming

- Higher risk: If the company you invest in defaults, you run the risk of losing your entire investment

- Volatility and Emotional Toll: The stock market is highly volatile and prices can swing widely. This can be emotionally draining for investors as your mettle will be tested.

Are stocks ideal for you?

If you have the time to study a company’s finances and the risk appetite, the stock market will be ideal for you! As the market generally increases over time, be prepared to have a longer-term horizon in the stock market.

What are bonds?

Bonds or also known as a fixed income instrument represent a loan made by an investor to the borrower. These are either sold by the government or corporations to raise funds.

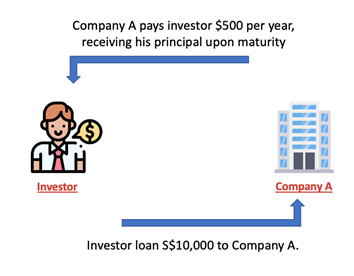

To illustrate, let’s say Company A is looking to take up a $10,000 loan for 5 years. To facilitate this, they issue a bond that pays a 5% interest known as a coupon yearly. As seen in the picture below, the investor will receive a $500 payment per year and his principal at the end of the bond!

Are all bonds the same?

Bonds can vary in terms of maturity ranging from three months government treasury bills to 30-year bonds! Apart from the duration of debt, the riskiness of bonds varies based on the creditworthiness of the company. There are instances that the company defaults and bondholders can’t recover the amount loaned. A local example would be Hyflux.

To understand the risks of bonds, you can refer to credit agencies such as S&P and Moody’s. These agencies rate bonds based on factors such as the creditworthiness of the issuer and the nature of its revenue. For example, S&P rate bonds on a scale of AAA to D. The former carries the lowest risk while the latter refers to the riskiest bonds. To reward investors for taking a higher risk, riskier bonds usually pay a higher interest or coupon rate.

Where can we purchase these bonds?

There are three main types of bonds you can purchase in Singapore:

- Government Bonds: Bonds issued by the Singapore government are known as the Singapore Savings Bond (SSB). If you have a CDP account, you can subscribe to them through an ATM or your internet banking portal

- Listed bonds on the market: There are several retail bonds listed on SGX that you can purchase like any other stocks through a brokerage firm like FSMOne.

- OTC market: The FSMOne platform also allows a retail investor to DIY purchase corporate bonds which are sold on the Over-The-Counter (OTC) markets.

Do note that bonds issued by the government are generally lower in risk and the returns are much lower compared to the ones issued by companies.

An indirect way to purchase bonds might be through a Robo Advisory platform such as Syfe’s Core Portfolio where investor funds are partially allocated to Bond ETFs. For example, Syfe’s Core Balanced Portfolio allocates c.50% of investors’ funds into Bond ETFs.

For new investors who are unfamiliar with ETFs, we have you covered in the next segment.

How do we profit from bonds?

Investors in fixed income instruments profit from the periodic coupon payment made by the borrower.

Pros and cons of bonds?

Compared to volatile equities, bonds are rather boring but provides a stable income. Here are the pros and cons of the financial instrument:

Pros:

- Low Volatility: Bond prices have lesser price fluctuations

- Fixed and Stable Income: Unlike dividends that may vary based on the company’s performance, bondholders receive fixed coupon payments.

Cons:

- Lower Returns: In general, bonds provide a lower return to investors compared to stocks

- Fixed Income: Despite the stability bonds provide in coupons, your returns are fixed throughout the bond’s tenure. Should the broad interest rate increase, you will be getting a lower return compared to the market

- Low Liquidity: Compared to stocks, bonds are generally less liquid.

Are bonds ideal for you?

If you are looking for a low-risk and low-volatility environment to preserve your capital, the bond market would be ideal for you! Instead of leaving cash in your bank, bonds provide returns in the form of coupon payments.

What are Exchange Traded Funds (ETFs)?

ETFs are investment funds used to track a market, index, or sector. By gaining access to the market, investors are charged in the form of an expense ratio. Normally traded on the stock exchange, the fund pools money from all investors to achieve its stated mandate.

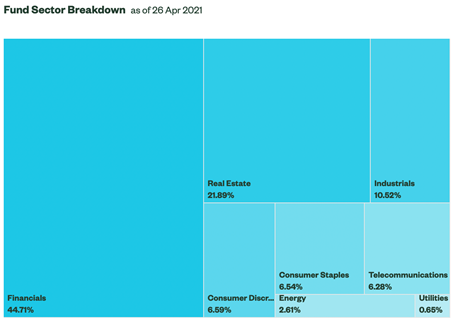

For illustration, the picture below shows the composite of the SPDR STI ETF (SGX: ES3) that tracks the Straits Times Index. Purchasing an ETF is similar to buying a basket of assets without heavy exposure to a particular company. In this case, it provides you with access to the Singapore market. Additional Reading: Best ETFs in Singapore to structure your passive portfolio.

What are the ETFs out there?

There is a wide spectrum of choices for investors in the world of ETFs. The majority of them are passively managed and these are some examples of them:

- Industry ETFs: Tracks particular industries such as the tech sector. An example would be iShares Hang Seng TECH ETF (3067) that tracks Hong Kong-listed stocks

- Bond ETFs: Tracks fixed income instruments issued by government or corporations

- Commodities ETFs: Tracks commodities such as gold or silver

- Currency ETFs: Tracks currencies such as USD or EUR.

Where can we purchase ETFs?

Similar to stocks, ETFs can be found in the respective stock exchanges. The price is dependent on the performance of underlying assets and fluctuates daily. Similar to stocks, one can purchase ETFs through your brokerage firm.

How do we profit from ETFs?

Similar to stocks, there are two main ways investors can profit from ETFs. The diversification of ETFs lowers both the risk and returns of investments

- Capital Appreciation: Investors can profit from any gain in ETF prices

- Dividends Return: The distribution of profits from assets tracked by the index are paid to shareholders.

Pros and cons of ETFs?

One can easily gain exposure to a particular market through ETFs instead of buying individual companies. Here are the pros and cons of the financial instrument:

Pros

- Diversification: Carries lesser risk as investors have limited exposure to a particular company

- Low Fees: Charges lower expense ratio than other managed funds. Compared to other managed funds, ETFs

- Transparency: Holdings are disclosed daily unliked other managed funds.

Cons

- Lack of Liquidity: Investors might face liquidity issues as not all ETFs are traded with high volume daily

- Market Risk: The fund’s value is still highly susceptible to any broad market correction

- Tracking Errors: It refers to the deviation between the ETF and the underlying index it tracks. Do note that some funds have high tracking errors and you can find the numbers in its prospectus.

Are ETFs ideal for you?

If you are looking for a cheaper alternative to dabble into the equity market without having to pick individual companies, ETFs are the ideal investment asset for you! Furthermore, it caters to investors with lower risk appetite through diversification.

What are Mutual Funds?

Mutual funds, or sometimes called Unit Trusts, pool money from investors to track a market, index, or sector. As they are actively managed by a team of managers, these funds usually command a higher fee. Unlike ETFs that are listed and traded on the stock exchange, mutual funds are not listed and are sold through private channels.

What are the Mutual Funds out there?

The wide spectrum of mutual funds are generally classified into three categories:

- Equities: Tracks an index or a smaller subset of the equity market such as growth or value stocks

- Bonds: Tracks fixed income instruments issued by government or corporations

- Hybrid: Mixture of both equities and bonds

Where can we purchase Mutual Funds?

Mutual funds are usually purchased through investment companies or financial institutions. There is however an increasing number of brokerage companies that enable retail investors to purchase mutual funds/unit trusts through their platform.

How do we profit from Mutual Funds?

Like the other mentioned financial instruments, there are two main ways investors can profit.

- Capital Appreciation: Investors can profit from any gain in Net Asset Value (NAV)

- Dividends Return: The distribution of profits from assets tracked by the index are paid to shareholders.

Pros and cons of Mutual Funds?

Like ETFs, investors can gain exposure to a particular market through Mutual Funds. However, they command a higher fee as the funds are actively managed. Here are the pros and cons of the financial instrument:

Pros:

- Professional Management: Funds are managed daily by analysts to carry out tasks such as rebalancing the portfolio

- Diversification: Carries lesser risk as investors have limited exposure to a particular company.

Cons:

- Lower Transparency: As mutual funds are not traded over the stock market, the NAV (price) of them are only updated at the end of the day

- Higher Fees: Actively managed funds are very costly which will have a direct impact on your investment gains. The median annual fees are approx. 1.5%

- Higher Entry Level: Mutual funds generally require a higher minimum investment amount

- Entry fees. The initial purchase fees might be substantial, with one-off fees as high as 5%.

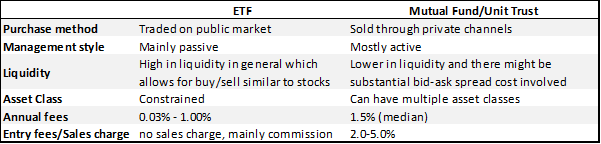

Key Differences between ETFs and Mutual Funds

Are Mutual Funds ideal for you?

If it provides you with ease of mind to have professionals manage your funds actively, mutual funds are ideal for you! Despite a higher cost structure, investors will face lesser risk due to its diversification nature similar to ETFs.

If you believe in active investing and that a good active portfolio manager can generate the necessary “alpha” for you, then mutual funds might be the right asset for you. However, a word of caution, the majority of active fund managers have failed to outperform their relevant passive index benchmark.

Being able to identify an active portfolio manager that consistently outperforms the relevant index is often seen as a tall order.

Conclusion

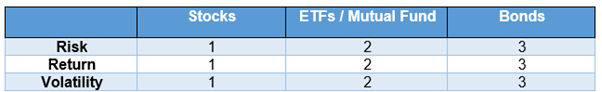

Putting everything together, the table below is how I rank the various financial instruments (With 1 being the highest).

Ultimately, picking the right financial product is highly dependent on one’s investment goals and portfolio!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here on this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER STOCKS WRITE-UP

- Early Retirement Plan – A 9-Steps Ultimate Guide

- A step-by-step guide to figuring out your retirement sum

- Full Retirement Sum (FRS): > S$400k by 2050.

- How much to retire in Singapore?

- The IDEAL Retirement portfolio structure

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.