How much should one have in retirement savings when it is finally the time to leave the rat race? Based on my calculation, a 30-year old will need approx. S$1.5m when he/she retires at the Age of 65. What! Are you kidding me?

Before I delve into my STEP-by-STEP guide towards getting that magic retirement figure and why you should get started on investing ASAP (you will be surprise by how little investment is required if you start early, even if the end goal is 1.5 MILLION DOLLAR), let me share two thought-provoking articles relating to retirement.

Two thought-provoking retirement articles

I recently read two articles from my favorite content creators: 1) Some thoughts on CPF Rants, Bond Tents and New Financial Advisor Money Management by Investmentmoats and 2) Retirement Planning made easy: 3 things to do today to prepare for your future retirement by Dollar and Sense. It got me thinking about how much I actually need for my retirement.

Let me just do a brief summary on both the articles:

First article

In the article, Kyith from Investmentmoats highlighted the grouse of a certain Mr Clifford Theseira that his CPF payout of S$575/month is insufficient to support the livelihood of his wife and himself. He needs to drive Grab to supplement his income but at the age of 72 years old, Mr Theseira is concerned that his health might not be in good condition to continue driving for long.

Well, it seems like he did not give the full picture.

CPF subsequently came out with a rebuttal that he had withdrawn a total of about S$140k since turning 55 years old.

This was followed by more rebuttals from our people “Online Opposition Party”, The Online Citizen as well as SDP.

I shall not go into the details which touch on topics like inflated house prices leaving many Singaporeans asset rich but cash poor.

Kyith’s conclusion is that Singaporeans like Mr Theseira will always grouse about the shifting goal post of the CPF system, not allowing citizens to withdraw all their money at 55 years old.

But what happens if one is allowed to withdraw all their money at age 55 and spend it all. Should the burden of supporting these “retirees” now fall on the shoulder of the government and indirectly tax payers? Food for thought.

Second article

The second article by Dollar and Sense touches on 3 essential activities that one needs to do to prepare for his/her retirement.

- Figure out what retirement looks like to you. What is the lifestyle that you hope to achieve? While one will ideally like to maintain his/her current lifestyle, there may be some big ticket items that no longer be required, items such as loan installments, kids’ expenses etc.

- Understand how much you can get from CPF LIFE. For most Singaporeans, CPF LIFE is their key retirement income source. However, that income is often insufficient. Is it a flaw in our pension system?

- Enhance your retirement pay-outs with retirement plans. Besides banking solely on CPF LIFE, one can choose to invest through stocks, bonds and property or simply purchase retirement plans to supplement your retirement income beyond the CPF LIFE pay-outs.

The article was well-written with examples given as well.

What is a sensible retirement sum needed?

The two articles above got me pondering how much I should have in my retirement account when it is finally time to leave the rat race and really enjoy life.

How do I avoid being in a situation like Mr Theseira (definitely not the “worst-case” scenario in Singapore)? Is my CPF LIFE sum going to be sufficient for me?

Following the rule of thumb (25X or 33X?)

A common rule of thumb will be to multiple your expense required by 25x. So, for example if you forecast you need S$40,000 as annual expenses when you retire, then you should have 25 * S$40,000 = S$1,000,000 in your account when you retire.

For even more safety, maybe you should try 33X for a grand total of S$1.32m before you DREAM about wanting to retire. The numbers above are big and scary and it is something that financial advisors will “claim” that you need to have in order to have a comfortable retirement.

But can we ALL achieve millionaire status when we retire? Seems like a pretty far-fetch dream. And when it seems unattainable, most people give up thinking about it and choose to live on a day-by-day basis.

What we will like to explore in this article is a step-by-step approach to find out what is your realistic retirement savings. One can forecast that he/she needs S$50,000/annum in living expenses by the time he/she hits retirement. Is this figure realistic? How did one get this magic figure? Might it be too low or too high?

Quick insights: While we hate to burst your bubble, our simple calculations show that an average Singaporean does require more than S$1m to retire, in fact that figure is closer to S$1.5m. But saving that amount is actually much more achievable than you would have thought so. Read on to find out why.

Lets start exploring using a step-by-step approach.

#Step 1: Find out how much you really require on an annual basis if you RETIRE today.

Let’s assume that you decide to retire today. How much will you really need for a livelihood that you might find comfortable?

According to data from Singstat, the average monthly household expenditure for a non-working, Age 65 years and over personnel is approx. S$1,154. Let’s assume that this is a figure that works for you, or you might want to adjust accordingly based on the individual items highlighted in the table. More money for travel perhaps?

Let’s round up that figure to S$1,200 and multiply it by 12 to get our annual figure.

S$1,200 x 12 months = S$14,400/annum required for living expenses

Now we know that S$14,400 is the figure that we require each year for our living expenses in TODAY’s dollar. That is ASSUMING you are retiring today. Are you? Most likely not if you are reading this article.

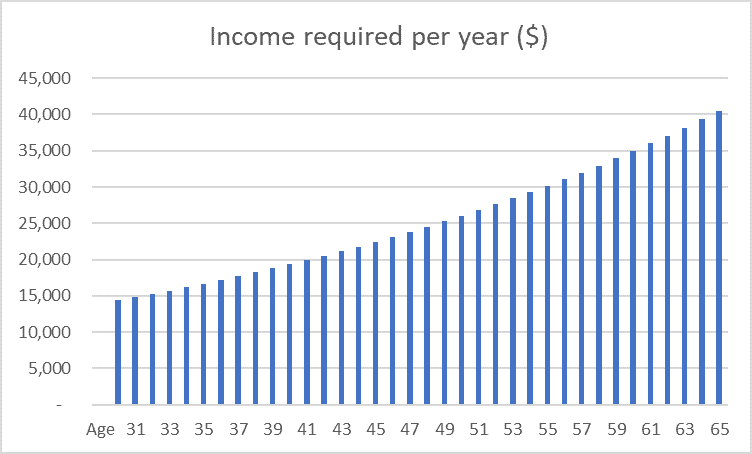

So let’s assume that a 30 year old young Singaporean, named John, who wish to see how much he will really needs when he adjust that S$14,400, accounting for inflation when it comes to his retirement at Age 65.

#Step 2: Adjust the annual figure for inflation

The S$14,400 that he needs for basic living expenses today for retirement will translate to a figure of S$40,520 at a 3% inflationary rate/annum when he hits Age 65. That translates to a monthly figure of S$3,377.

Holey Moley! The MAGIC of inflation.

So S$14,400 in today’s context becomes S$40,520 in 35 years-time. That is how much John will need for retirement expenses, assuming no drastic changes in daily consumption pattern between a retiree in today’s context and one in 35 years’ time? Reasonable? Well let’s just stick with this assumption first.

#Step 3: Find out how much you require for the REST OF YOUR LIFE from Age 65 onwards.

From Step 2, John derived his annual inflation adjusted expense required and it comes out to an “atrocious” S$40,520 (vs. S$14,400 35 years ago). Based on this, how much will he require for the rest of his life? We are coming to the juicy bits…

Let’s assume that John lives to a grand old age of 90, which is slightly higher than the average life-expectancy of a Singaporean today, according to the latest data from 2017. Is this figure going to hit 100 in 35 years’ time? Hmm…. Maybe. But let’s say one can reasonably live to Age 90, that is another 25 years from the retirement Age of 65.

You will then sum up the inflation-adjusted (3% inflation) ANNUAL expense from Age 65 to Age 90. Based on the current example where one requires S$40,520 at age 65, that will translate to a total retirement sum of S$1.56m (Age 65 to Age 90)!!! See I told ya.

Requirement at Age 65 (S$40,520) + requirement at Age 66 (S$41,734) = requirement at Age 67 (S$42,987) +…….. retirement at Age 90 (S$84,839) = S$1.56m

How did requiring S$1,200/month in today’s context translate to requiring a retirement sum of S$1.56m by the time one hits Age 65! Well that seems to be what our numbers are suggesting. But let’s not despair first and move on to Step 4. It will get easier (I HOPE).

#Step 4: Calculate your CPF LIFE payout.

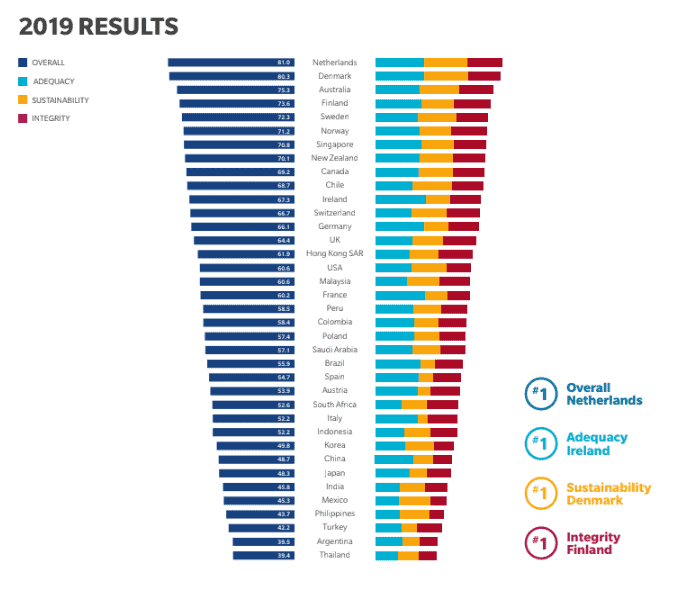

So how do we fund that S$1.56m retirement requirement at Age 65? Let’s bank on Singapore’s pension scheme system, which according to Melbourne Mercer Global Pension Index (MMGPI), is the strongest in Asia and No. 7 in the World. Hmm…. sure got people will disagree…. Let’s leave that argument for another day.

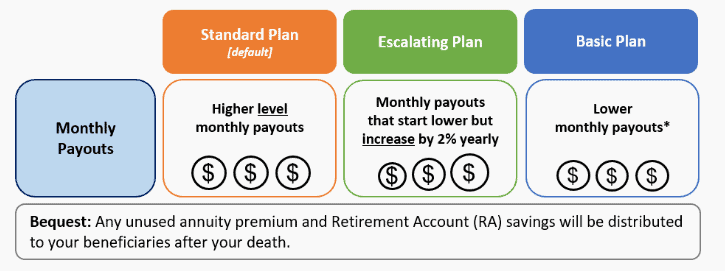

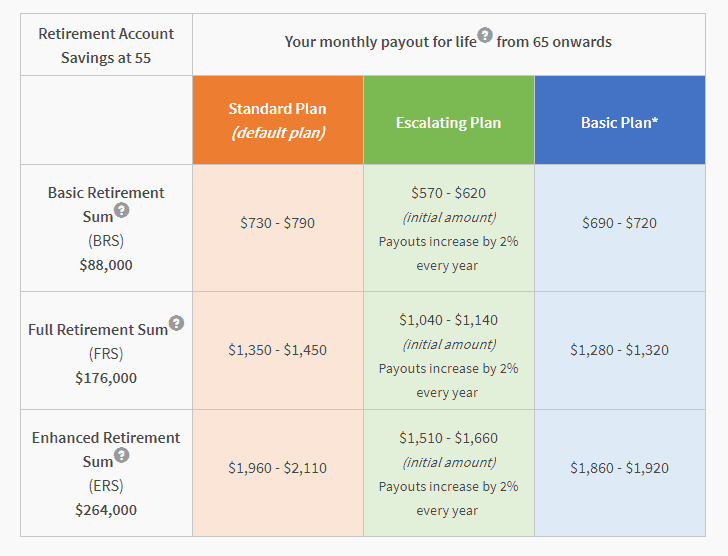

Let’s use the Full Retirement Sum (FRS) of S$176,000 for CPF LIFE in our example. If you are 55 years old in 2019, the full retirement sum that you will need to set aside in your retirement account is S$176,000. When you hit Age 65, you will be entitled to a FIXED monthly pay-out of approx. S$1,400/month (based on STANDARD PLAN).

Side note: For those still unfamiliar with the CPF LIFE, please refer to the CPF LIFE website for more details. For the purpose of this article, we will not be elaborating on the various plans available. Many financial bloggers have written quality content on it so I shall not look to replicate them.

For someone like John, who is Age 30 in 2019, what will the FRS be when he hits Age 55 (in 25 years’ time). Based on a 2.8% inflation-adjusted rate, the FRS amount will be S$351,000. Holey Moley. You can hear all the outcries from Singaporeans again. S$351,000 of my hard-earned money that I cannot take out when I am close to retirement!!!

Oh well, that’s the reality of life. Suck it up, unless PAP is no longer the ruling party?

Based on a FRS amount of S$351,000, the monthly payout will increase from the current S$1,400/month to approx. S$2,800/month or c.S$33,600/annum when one becomes eligible to the pension pay-out at Age 65.

Well, we are getting pretty close to the magic number of S$40,520/annum in living expenses.

At this stage, one might be wondering if the FRS amount of S$351,000 is actually attainable.

Let’s do a quick calculation.

#Step 4 (b): Determine if its possible to hit S$351,000 in FRS in 25 years’ time

So let’s assume that John (started working at Age 30, hence no CPF prior to this) currently generates a gross monthly pay of S$3,500 or S$42,000/annum. His CPF allocation to his Ordinary Account (OA) and Special Account (SA) will be 29% (this % will reduce as one ages) of his gross pay or c.S$12,180/annum.

Let’s assume that this figure generates a return of 3% a year (OA generates 2.5% while SA generates 4% but we assume an average rate of 3% due to greater allocation to OA).

Note: One can achieve a higher return of 4% if he/she transfer all his OA funds to SA. That will ensure a faster compounding. Not saying you should be doing it as the transfer is irreversible and funds in SA cannot be used for home purchases.

Based on 2 key assumptions: 1) Wage growth of 1% annually (reasonable?) and 2) 3% compound return, John who is initially earning S$3,500/month in gross salary will make c.S$4,488/month by the time he hits Age 55 and he/she will have close to S$520,000 in the retirement account. The OA and SA contribution from himself and his employer would have amounted to c.S$343,000 over 25 years while the remaining S$177,000 will be from interest compounded.

So Yes, it is reasonable to expect that an average income-earner can meet the FRS retirement figure of S$351,000 when he/she hits Age 55. BUT…….

This assumes that funds in his/her OA is not being used to purchase a dwelling.

#Step 5: Calculate the short fall after deducting CPF LIFE

So, we know that in our example, John will get S$2,800/month in pay-out or S$33,600/annum when he hits Age 65.

We simply multiply this annual figure of S$33,600 by 25X (Age 90 – Age 65) to derive a total figure of S$840,000 that one can withdraw from CPF LIFE from Age 65 to Age 90. Note that this amount of S$33,600/annum is a FIXED payout which will not account for inflation, a major drawdown of the STANDARD PLAN.

Hence, the SHORT FALL is the difference between our retirement expense requirement of S$1.56m and that of what CPF LIFE is able to provide for life, which is S$840,000:

Short fall = S$1.56m – S$840k = S$720k.

Well, that sux. After slogging for the bulk of my life and I still have got a S$720k hole to fill? Again, that is the reality of life.

#Step 6: Calculate the monthly amount you need to start INVESTING to plug the deficit.

So now we have a better picture of our financial situation. While it might not be a rosy one, it is so much better than shooting in the dark, not knowing how our retirement future might be, or if there is going to be one.

We now know with some certainty that based on these preliminary numbers, we will not be able to retire well, even with very basic monthly living expenses of S$1,200 in today’s context.

What should John do then?

He should start his investment journey ASAP. The fortunate thing is that he has got a long run-way before he hits the Age of 65 where he might be looking to retire.

How much should he be investing?

Before we tackle the issue of HOW MUCH, let’s just briefly talk about HOW he should be investing. His available options are: 1) Purchasing a Retirement Plan such as MoneyOwl’s RetireWise Bundle, 2) Investing through a Regular Savings Plan, 3) Investing through a Robo-advisor, 4) Investing through a DIY approach.

Option 1 will likely entail the greatest amount of capital in our view. Option 2 will likely be the lowest cost if portfolio diversification is not a major consideration. Option 3 might offer one a risk-adjusted diversified portfolio but comes at a higher ALL-IN expense and Option 4 should only be engaged if one is willing to spend the time and effort to learn the nuances of investing.

For the purpose of this article, let’s assume John has a long investment horizon (35-years) and hence able to invest more aggressively (100% stock portfolio allocation) to achieve a long-term inflation-adjusted return of 6% through a RSP approach.

Assuming that he generates 6% annualized return on a long-term basis, all he needs is to fork out S$500/month. By Age 65, his investment will generate a total sum of S$757k which is now sufficient to cover for the short fall.

Can one afford to invest S$500/month as part of his retirement planning? The answer should be a resounding YES. I always strongly advocate the concept of “Paying Yourself First”. S$500 might sound like a significant amount to fork out on a monthly basis for some, particularly for those living from paycheck to paycheck. However, the crux is starting your investment journey early, no matter how small the initial investment amount might be.

It gets even better

The S$720k hole that we illustrated above might be slightly over-inflated as we did not account for the residual funds of c.S$169k that is leftover after subtracting the FRS sum of S$351,000 from the OA and SA balance as of age 55 of S$520,000 that we calculated earlier.

Left to compound annually at a rate of 3% for the next 10 years, alongside annual CPF contribution of between S$8,400 to S$9,200, at Age 65, there will be approx. S$330k in John’s CPF to help defray the S$720k hole.

Required amount = S$720k – S$330k = S$390k

In this circumstance, one will only need to invest approx. S$270/month over the next 35 years to achieve the sum of S$390k. Now that doesn’t sound like a herculean task anymore. Isn’t it.

In our example, we also ignore the fact that the S$757k fund (at Age 65) continues to compound at x%/annum over the course of the next 25 years (until John hits Age 90, which we assumes to be his life expectancy), hence there will likely be leftover funds that can be bequeath to John’s next-of-kin when he passes away.

Therefore, the theoretical required amount might be way lower than S$270/month. (In fact, based on an annualised return of 4%/annum from Age 65 onwards, one will only need approx. S$160k instead of S$390k as highlighted above. This translates to a monthly investment rate of only S$110).

Excluding his CPF, all John needs is an extra S$160,000 at Age 65 (to be left compounded in a 4% asset class. The principle will start to decline from Age 78 onwards) to have a “decent” retirement (based on today’s average context). This is no longer a big daunting figure in the millions!

But being the conservative person we all should be, one should aim for the stars and even if you fail, you can still land on the moon which might not be such a bad result after all.

What if I want to retire earlier than Age 65?

So we will need to plug a S$720k hole if we wish to retire at Age 65, based on a basic living expense requirement of S$1,200/month in today’s term. What if one wishes to retire at Age 55. What will be his/her magic number?

Retiring at Age 55, you will need to plug a hole of S$1.27m!

So, if a 30-years old wishes to retire at Age 55 (25 years horizon), he will need to amass a total sum of S$1.27m over the course of 25 years.

That will mean requiring to invest S$1,800/month over 25 years, with an annualised return of 6% from the market.

The table below provides a quick summary as to how much 1) savings will be required for you to retire, 2) CPF LIFE contributions, the 3) retirement hole that needs to be plugged and 4) monthly investment amount (based on annualised return of 6%), according to the various age profile.

Do note that if John wishes to retire before Age 65, he will not be able to depend on his pension aka CPF LIFE payout which only kicks in at Age 65. He will need to depend on his external retirement savings.

Conclusion

It is critical that we engage in some form of retirement planning early. Most of us tend to delay such a critical planning process, sometimes due to the fact that the numbers presented to us are seemingly unachievable and hence extremely disheartening.

A simple S$1,200/mth living expense in today’s context will translate to a requirement for S$1.56m in retirement savings in 35 years’ time. That sounds like a lot of money but we have shown that if one starts his investment journey early, it only requires an extremely manageable sum of cash outflow every month.

In our example, that is S$500/month over the course of 35 years if we wish to be conservative. Theoretically, one will only need to invest S$110-270/month for 35 years or even less. That sounds a lot more achievable.

With a credible figure in mind, we can all start planning for our retirement. The KEY is to get started ASAP.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER STOCKS WRITE-UP

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

- DIY OR ROBO? THE 1.6% OPPORTUNITY COST DILEMMA

- ULTIMATE GUIDE TO ROBO ADVISORS IN SINGAPORE

- HOW YOU CAN MAXIMIZE TAX BENEFITS THROUGH STRATEGIC SRS CONTRIBUTION AND WITHDRAWAL

- CAN A YOUNG COUPLE EARNING MEDIAN INCOME AFFORD TO SAVE?

- PRE-PAYING YOUR HDB LOAN? THINK AGAIN

- AVERAGE SINGAPOREAN MEDIAN INCOME. WHERE DO YOU STAND?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.