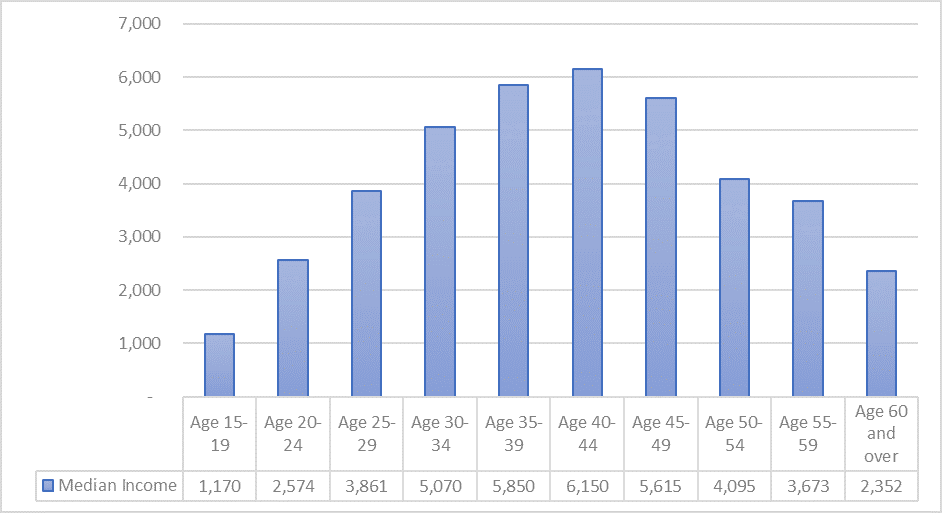

According to the latest 2018 data taken from the Ministry of Manpower, a worker age between 25-29 generates a median income of c.SGD3,861 here in Singapore. This includes his/her own and employer’s CPF contribution. His/Her take home pay will be closer to SGD2,750. We have previously written an article on Average Singaporean Median Income which provides a quick snapshot of the earnings profile of Singaporeans.

Young couple generating median income takes home SGD5,500/month

Let’s assume we meet a young couple with monthly earnings of SGD3,861 per person, or c.SGD7,700 in total. This couple would have a total take home pay of SGD5,500 per month after CPF contribution. We assume that their CPF contribution will be sufficient to cover for their monthly HDB mortgage payments and hence no mortgage costs will be inputted for their household expenses.

Typical HDB household expenses are about SGD4,000/mth

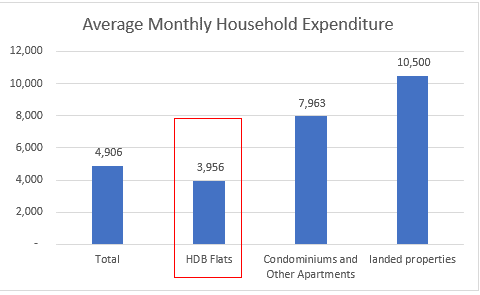

The table below illustrates the typical Average Monthly Household Expenditure by Type of Dwelling, according to data from the Singapore Department of Statistics (Singstats).

The average typical household expenditure is approx.. SGD4,609/month. However, in this example, we assume that this young couple lives in an average 4-room HDB flat with a typical average monthly household expense of SGD3,956, or c.SGD4,000 for simplicity.

This will result in a savings of SGD1,500/month after accounting for household expenses. Just based on this preliminary data, it does seems that a young couple who just enter the workforce with median income earnings can in fact be “paying themselves” SGD1,500 every month.

A young couple’s HDB expenses can be reduced to SGD3,500/month

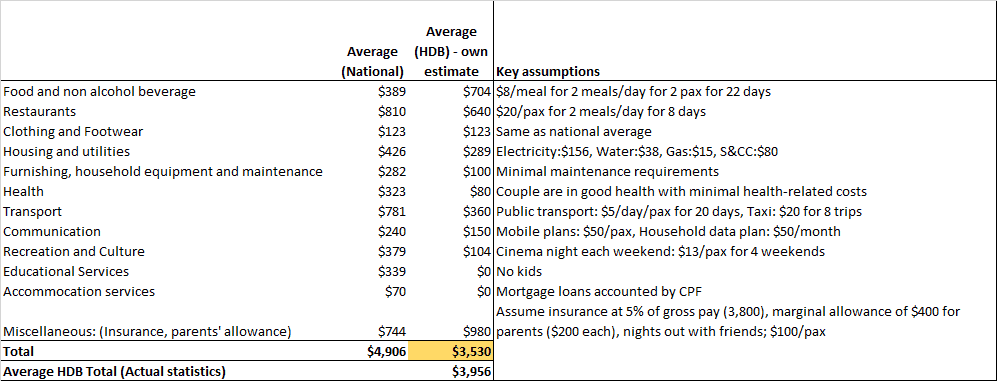

Let’s evaluate the typical household monthly expenditure as provided by Singstats as well as re-create our own household expense budget for a typical young couple residing in a HDB flat. (Note: Singstats does not provide the household expense breakdown for a typical HDB Flat).

Based on our own estimates, a young couple without any kids might have a typical monthly household budget as illustrated by the above table. Surprisingly (or not!) the young couple budget only adds up to c.SGD3,500 vs. the national household average of c.SGD4,900 and HDB household average of c.SGD4,000.

Key variances:

- The national average for Food and Non-alcohol beverage category of SGD389 looks extremely low to us and we believe a comfortable number should actually be in the region of SGD700/mth

- Housing and utility expenses of SGD289/mth is based on a typical 4-room HDB household. We believe this number is significantly lower than the average national figure of SGD426/mth

- We assume minimal household maintenance issues as well as health-related issues

- Our transport budget assumes no car ownership, with budget for 8 trips by taxi

- We assume minimal recreational expenses beyond the weekly trip to the cinema (Are there 4 shows worth catching every month?)

- No kids’ education expenses and no mortgage loans (covered by CPF)

With a take-home pay of c.SGD5,500, the young couple can in fact be saving close to c.SGD2,000/mth with a relatively comfortable life-style.

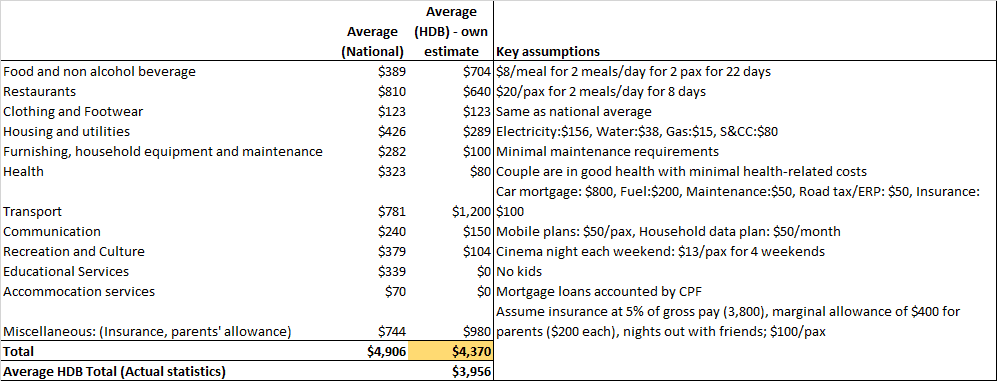

What are the additional expenses with car ownership?

What happens when this young couple actually owns a car? A rough estimate will come out to SGD1,200/mth in terms of car ownership expenses. This will increase total household monthly expenses to c.SGD4,400. The couple monthly savings reduces to SGD1,100. Hence even with the “burden” of a car ownership, there is no excuse that a young couple earning median incomes should not be saving at least SGD1,000 a month for rainy days.

Challenge yourself to save as much as possible, even with a below median income

We believe that a young couple should start their saving plans as early as possible, particularly when kids are not YET in the picture. We know that saving SGD1,000/household could sometime be a challenge, given that we are bombarded by advertisements on a daily basis enticing us to part with our hard-earned money to purchase items which ultimately lands up in our storeroom.

We have shown that a young couple earning a median income could actually be saving as much as SGD2,000/mth. There are various advantages of early savings:

Not held ransom by a job you hate (or not)

Few moments in life are more exhilarating and terrifying than the day you quit your job to pursue your passion or just to engage in full-time parenting or to travel around the world. From my own experience, it’s really was a mixed bag of feelings. On one hand I am finally able to pursue my passion (I don’t really hate my job, FYI) while on the other, the lack of a monthly income security could set me one step further from retirement.

However, i know that it will be extremely reckless on my part if I was to quit without a savings safety net and I believe that six months of living expenses is the absolute minimum amount of savings that needs to sit in your bank before you quit.

For the young couple in this example with a monthly household expense of SGD3,500, their joint bank account should see at least SGD21k in savings before one of them decides to call it quits.

Increase your emergency savings

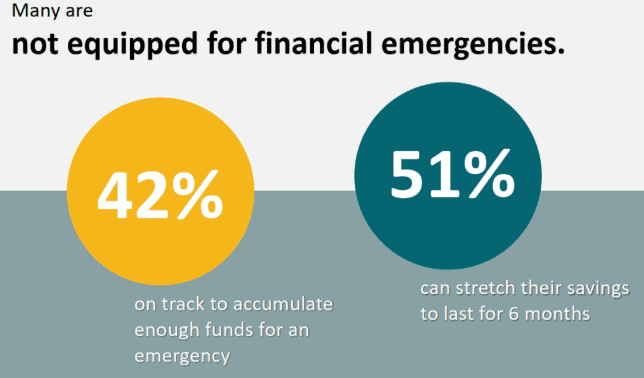

According to a recent study done by OCBC bank, it was highlighted that close to half of those surveyed were unable to stretch their savings to last for six months, with more than half not on track to accumulate enough funds for an emergency.

There is a little confusion in this ratio as a typical emergency fund would have constitute at least 6 months of expenses. So if 51% can stretch their savings to last for 6 months, then it should imply that at least 51% are on track to accumulate enough funds for an emergency instead of the quoted 42%. Nonetheless, I believe there are greater scope for improvement in this arena.

I don’t think the situation of not having sufficient emergency fund is unique to Singapore. I believe that almost every single nation in this world are facing this issue, even seemingly wealthy nations like the US. According to Bankrate’s latest Financial Security Index, 2 in 10 US adults have absolutely no emergency savings. About 60% of surveyed respondents would not be able to cover a USD1,000 emergency expense with their own savings.

By increasing your emergency savings, you will not be caught ransom by an unforeseen accident or a medical emergency, retrenchment, unforeseen household maintenance like a faulty air-conditioning system etc.

It is absolutely critical that one builds up his/her emergency fund by “paying themselves” first (ideally 6 mths) before considering other forms of wealth accumulation such as investing.

Investing to retire early

The less you spend, the more you can save. After setting aside 6 months-worth of emergency funds, you should then look to invest your savings with the aim of early retirement.

Let’s assume that the young couple, both age 27, decides to invest their SGD2,000 savings/mth at a return of 5%/annum. After 30 years at a grand old age of 57, that savings of SGD2,000/mth will translate to total wealth accumulation of close to SGD1.7m. That SGD1.7m in investments, assuming a dividend yield of 3%, will translate to monthly dividend income of c.SGD4,200. That alone can cover close to 2/3 of the couple’s monthly expenses, assuming a 2% inflation rate. Of course, some might argue that it is not realistic to base the young couple’s future household expenses just taking into account inflation rates. If they so decide to have kids, that will raise the overall cost of household expenses.

That is absolutely true, but it also does not take into account income increment that could be channelled towards additional savings. This same strategy can be used for any surplus or surprise, like a bonus. Instead of planning trips or grabbing gadgets, consider directing at least some of it towards firstè debt repayment, second è emergency fund and third è long-term investments.

Live your life to the fullest but still strive to save

Our example shows that even with the “luxury” of owning a car with multiple restaurant outings, a couple generating a median income can still afford to save SGD1,000/mth. While life is short and most millennials are adopting the YOLO (You Only Live Once) mindset, one can always find a good balance to live your life to the fullest and yet avoid the fate of Financial Armageddon.