Can the portfolio sustainably achieve a 1.9% return?

This is an updated post from the original article that was previously written back in Nov 2019. Since then, global interest rates have been slashed with a recent report from Bloomberg highlighting that Singapore could see negative rates creeping in soon. I also provide an update on other no-frills cash savings options.

There has been quite a fair bit of discussion of late pertaining to StashAway Simple offer of a cash management portfolio that allows retail investors the option of investing in money market funds to generate higher returns compared to normal bank deposits.

According to Mr. Michele Ferrario, the co-founder, and CEO of StashAway, the company’s cash management portfolio termed as StashAway Simple, allows one to earn a flat rate of 1.9% with no requirement for any confusing conditions attached to it. No salary credit, no credit card spending, no investment requirements. Nothing whatsoever.

There is really no hoops to jump through in order to earn that 1.9% on your cash. Unless you don’t really get to earn 1.9%.

I applaud StashAway for providing a simplistic manner to allow the man-in-the-street to generate higher returns on their cash. On the surface, it seems like a really simple “no-condition” solution to generate 1.9% returns. However, the devil really lies in the details.

According to StashAway, the projected return is 1.9%, based on an allocation of cash equally into 2 portfolios: 1) 50% to LionGlobal SGD Money Market Fund (MMF) and 2) 50% to LionGlobal SGD Enhanced Liquidity Fund SGD Class I Acc (ELF).

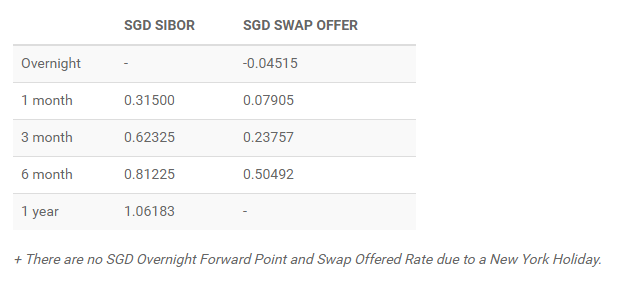

As of 18 Nov 2019, their projections are as follow:

![Stashaway Simple Review + Other No frills Cash Savings [Update May 2020] 1](https://i0.wp.com/newacademyoffinance.com/wp-content/uploads/2019/11/stash-4.png?fit=1024%2C669&ssl=1)

Seems pretty straightforward. StashAway Simple calculates the projected rate based on the weighted yield to maturity of the respectively funds.

[May 2020 Update]: As of today, StashAway is still promoting its Cash Management as generating a projected rate of 1.9%/annum. I am not certain how the Robo Advisor can continue to generate such attractive rates when the benchmark interest rates in Singapore have all decline pretty significantly? The latest 1-month Sibor rates have declined to 0.315%. Back in Nov 2019, the 1-month Sibor rate was 1.77%. Let’s take a closer look at the individual fund details.

LionGlobal SGD Money Market Fund (MMF)

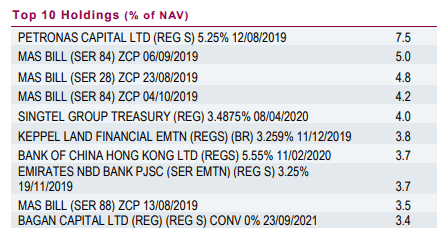

For the MMF, the fund top 10 holdings are mainly government bills or state-backed entities as noted in the table below. These are all investment-grade holdings.

It was highlighted that the weighted yield to maturity is 1.84%. After subtracting the expense ratio of 0.35%, we derived a total net return of approx. 1.5%. The fund managed to achieve a net return of 1.5% over the past 1-year horizon but on a longer-term basis, that returns on a per/annum basis starts to trail.

[May 2020 Update]: The yield to maturity has declined from 1.84% to 1.58% (see table above) as of Mar 2020 with a slight reduction in weighted duration to 0.27 years. This means that the interest will be reset every 0.27 years or roughly around every 3 months. We should expect the 1.58% achieved in end-March 2020 to further decline to potentially below 1% by end-June, assuming the current trend holds.

Over a 10-years horizon, the per annum net return is only 0.9% (likely due to the low-interest-rate environment we had for the past 10 years since GFC). Since inception, the average per annum net return is 1.3%. So should one base the performance of the fund on a longer horizon basis or based on the latest year performance?

If we are looking at an environment where interest rates globally are all expected to trend lower, then the 1.7% achieved over the past one year might not be easily replicated.

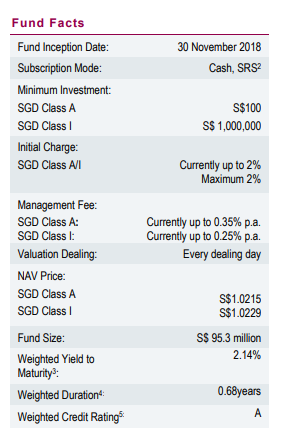

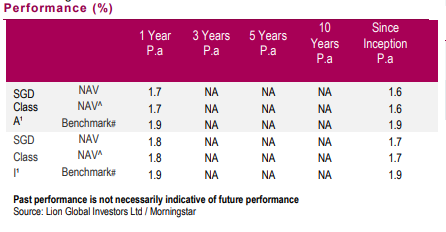

LionGlobal SGD Enhanced Liquidity Fund SGD Class I Acc (ELF)

![Stashaway Simple Review + Other No frills Cash Savings [Update May 2020] 2](https://newacademyoffinance.com/wp-content/uploads/2019/11/stash-7.png)

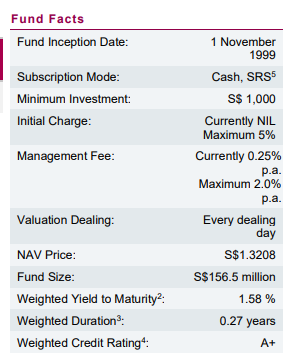

The ELF was only recently incepted, hence there isn’t much historical performance to talk about. This fund has 49% of its allocation in Singapore and 29.6% in China.

![Stashaway Simple Review + Other No frills Cash Savings [Update May 2020] 3](https://i0.wp.com/newacademyoffinance.com/wp-content/uploads/2019/11/stash-2.png?fit=686%2C1024&ssl=1)

Weighted YTM is at 2.45% which is slightly higher compared to what management has quoted as 2.38%. However, the performance of the fund does not seem to demonstrate that its net return will come anywhere close to its YTM.

[May 2020 Update]: The weighted Yield to Maturity of this fund has declined to 2.14%. The yield is slightly more sticky due to the longer weighted duration. However, if you use the information from FSMOne (see chart below) pertaining to the fund’s latest updated performance, you will notice that if we use the 1-month rate of 0.16% and annualized it (0.16% *12 months), the current trend rate will indicate a reversion towards the 1.92% level.

Note that the fund has also been under-performing the Benchmark (3-month MAS Bill) over this short horizon.

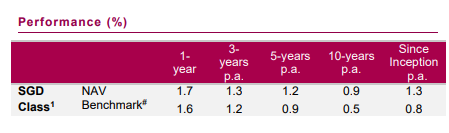

So how much can StashAway Simple actually achieve on a longer horizon basis?

[May 2020 update]: I based the new projection using the latest weighted yield to maturity of the respective funds. It seems like based on the latest reported YTM of the respective funds as of Mar-2020, the realized rate will be closer to 1.66% instead of the advertised 1.9%. As we move into negative rate territory, one should expect this rate to fall even further.

![Stashaway Simple Review + Other No frills Cash Savings [Update May 2020] 4](https://newacademyoffinance.com/wp-content/uploads/2020/05/stashaway-simple-review-Projected-return-May-2020-2.png)

While StashAway Simple tries to keep its cash management portfolio SIMPLE, there are actually quite a number of moving parts that reduce the visibility of what the ultimate returns to the investor might be.

- Performance of MMF and ELF not guaranteed. Based on historical performances of the two funds, the net returns seem to imply a lower projected return vs. 1.9% that StashAway is projecting based on the current YTM of the funds.

- While the cash holding is adjusted on a daily basis, the rebates of 0.125%/annum is only refunded on a quarterly basis, hence it is difficult to track the returns on a day by day basis.

Don’t get me wrong. Being the first Robo-advisor fund in Singapore to offer a cash management portfolio made available for the man-in-the-street is a hugely commendable effort.

In the US, such cash management solutions are more widely available, mainly through Robo-advisors such as Betterment, Personal Capital, Wealthfront, etc. According to NerdWallet, the 6 best US-based cash management accounts yields between 0.82% and 1.85%. (As of March 2020, it is now between 0.01 and 1.00%)

Hence even for StashAway Simple to offer net returns of 1.66%/annum, those returns are not to be sniffed at. However, StashAway needs to present in a clearer manner, those returns are not guaranteed in any manner and probably explain in more detail what could drive this projected rate up or down in the future so that potential investors can make a more informed decision. They should also be more pro-active in updating the projected rates.

I will be extremely surprised if they are still able to generate 1.9% (since no updates were made on their website) amid a decline in both the benchmark interest rates in Singapore as well as the YTM of the respective MMF and ELF they are vested into. Based on the current trend, it might seem imminent that the rate could head below 1% soon?

[Update] i have provided an explanation as to how Stashaway can achieve the reported 1.9% rate in the article: HOW TO GENERATE A “GUARANTEED” RETURN OF C.70% WITH STASHAWAY

Are there better no-frills options?

I will be briefly evaluating some savings options that are no-frills in nature. I will not be including the Standard Chartered Jumpstart account which is likely the best savings account for young adults between the age of 18 and 26, with an interest rate of 2% for the first S$20k. Unfortunately, I don’t fit that criterion anymore.

Citi MaxiGain

I believe that many of us are (or used to be) fans of Citi MaxiGain account until they decide to yet again change the terms and conditions which essentially slashes the interest on what one can generate on our cash from 2.4% to 1.5% 0.75% (see below for update).

I have got to admit that it is a huge disappointment for me. Citi is likely prepared to see quite a fair bit of account closures. Will I be one of them?

I am currently still evaluating the various options. I like that the MaxiGain account remains a good tool for hedging against inflation through Sibor, although inflation is not projected to rise significantly in 2020.

According to MAS monetary policy in Oct 2019, Inflation is still likely to be relatively benign in the year ahead. Inflation fell to an average of 0.8% YoY in July-August 2019, vs. 1.4% in 1H19. MAS core inflation is expected to average at the lower end of the 1-2% range in 2019 and 0.5-1.5% in 2020. Core inflation in YTD 2020 is now negative.

[May 2020 Update]: With 1-month SIBOR now declining to 0.3%, if it remains at the current level, this will imply that the maximum total interest you can get is only 0.75%, calculated as (50% of 1-month SIBOR + bonus interest up to 0.6%). While inflation expectations are currently low, I will not be overly complacent that inflation will not materialize in the near future with all the money printing that is going around, particularly in the US.

CIMB Fast Saver account

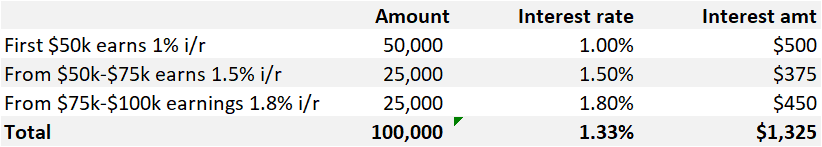

CIMB Fast Saver account is another savings account with no conditions being attached. While its “advertising” campaign shows that one can generate up to 1.8%/annum in interest rates, the effective interest rate for a S$100k account balance is only 1.33%. Starting to look more attractive in a low-interest-rate environment.

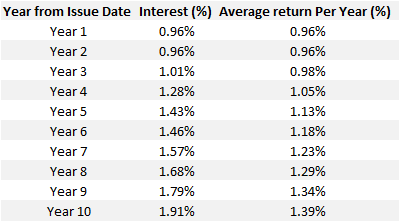

Singapore Savings bond

Singapore Savings Bond (SSB) has lost some love with retail savers of late due to its huge popularity amid a low-interest-rate environment that has driven down its return over a 10-year horizon to just 1.71%/annum 1.39%/annum

The return is only 1.56%/annum 0.98%/annum over the first 3 years. A key advantage of investing in SSB is that there is no penalty for early redemption, unlike fixed deposits.

Once you submit your redemption request, you will get your principal (along with accrued interest) by the second business day of the following month (so yes there is a slight delay so do take note of this point if you really need access to your funds urgently).

Your min amount of S$500 can start generating interest of 1.56%/annum (0.96%/annum) from Day 1. Compare this to CIMB Fast Saver which will accrue at a rate of 1%/annum for the same amount of funds.

ELASTIQ

TIQ, Etiqa’s online insurance space recently came out with a whole life insurance savings plan which they deemed as the first-of-its-kind. The product is called ELASTIQ.

This product allows one to earn interest from Day 1 at a rate of 1.80%/annum (guaranteed) for the first 3 years. However, one of the key requirements is that the funds can only be withdrawn after 90 calendar days, so there is essentially a lock-up period of 3 months. There is also a minimum requirement of S$5k to start off the plan.

Singlife (May 2020 entry)

Singlife, a direct life insurer licensed by the Monetary Authority of Singapore (‘MAS’), is offering up to 2.5% interest rate for the Singlife Account. A saver will need to initially fund $500 to start generating 2.5%/annum interest up to $10,000. Thereafter, you will need to maintain a minimum account balance of $100. Amounts above your first S$10,000 up to S$100,000 will earn 1% p.a. returns instead. Amounts above S$100,000 will not earn any returns.

There is also no lock-in period and funds can be withdraw anytime.

Similar to StashAway, Singlife’s returns are not guaranteed and may change in the future. Again not certain how Singlife is able to offer such high-interest rates (at least for the first S$10k)

So which will I choose?

The choice looks pretty obvious on the surface with Singlife as the winner. Not only does it provide the highest interest rate at 2.5% for the first S$10,000, but there is also no lock-in (unlike Elastiq) and the minimum initial funding criteria of $500 is low compared to Elastiq’s $5k.

There is however a max cap of S$10k and the interest returns are not guaranteed compared to Elastiq. The non-guarantee issue might be a problem as Singlife can choose to reduce the rates significantly in the not so distance future. Of course, you have the choice to withdraw out your capital without incurring penalties.

I believe there is no easy way to ultimately reconcile what is the actual returns that StashAway Simple is actually offering (which could trend significantly lower ahead base on the current MMF and ELF returns disclosure) vs. the guaranteed returns of 1.8% offered by Elastiq, at least for the first 3 years vs. the higher 2.5% non-guaranteed returns of Singlife.

For Elastiq, I will probably enquire if there are any hidden costs associated with full account closure after 90 days. If there are in fact none whatsoever, then it could be a really interesting proposition for future consideration, given that there is also a small death benefit of 106.8% of the account value. For those who want certainty pertaining to the interest rate over the next 3 years as well as having a larger notional saving value, then Elastiq might be the choice.

For those who are willing to risk a potential decline in interest, SingLife seems to be a better option vs. StashAway due to the former’s higher interest rate.

Conclusion

While StashAway Simple’s intention to provide a no-frills savings option is laudable, I believe that the 1.9% projected return is not going to be easily achieved. Based on my calculation using historical data of the performance of both MMF and ELF, the actual returns could be closer to 1.6% at present. This figure will likely trend lower as we head into a negative interest rate territory.

It is, however, a commendable starting point for StashAway Simple to offer this cash management solution for the common folks like myself to have the opportunity to partake in money market funds on a fuss-free basis. I believe that it is a matter of time before more of our local Robo-advisors start offering such money management solutions as well.

The fight for capital will increasingly intensify. I believe the ultimate winner will be the one who provides the greatest transparency and execution when it comes to both money management and investment solutions.

Who might that be? Time will tell.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- VENTURE 6% PRICE DECLINE POST-RESULTS; SATS’ 2QFY20 COULD REMAIN WEAK

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

6 thoughts on “Stashaway Simple Review + Other No frills Cash Savings [Update May 2020]”

Money mkt funds (mmf) have been in S’pore for over 25 years already. In the earlier years you had to pay expensive sales charges of 1% to 1.5% when buying through banks. Later this dropped to 0.5% sales charges when online platforms started in 1999, and soon became zero for mmf’s.

Mmf’s are sensitive to interest rates. S’pore yields track US yields closely. My mmf’s have been yielding 1.7% to 1.9% since 2nd half of 2018 & for most of 2019. They’re starting to drop in the last 2 months as the dovish stance of the Fed is having effect on local yields. (That’s why mortgage rates have come down much to the relief of overleveraged property buyers.)

I only started using mmf’s from 2003 onwards so I don’t know their actual experience in the 1990s. By 2006 when the Fed rate was 5.25% most mmf’s here were yielding 3% to 3.5%. It was a very good deal for me as banks then were reducing savings deposits rate to 0.05% and even FDs were not spared (which subsequently led to aggressive marketing of CDS/CDO “structured deposits” like Minibonds & High Notes paying 4+% to 6%).

Citi used to have a simple money mkt savings account for many decades. In the 2000s it was yielding around 2.5%. Like mmf’s the interest rate changed daily according to the mmf & short term notes market. I think Maxigain evolved from that money mkt savings account.

Currently my mmf’s yields have come down to 1.5% to 1.7%. If the Fed lowers their rate further, the local mmf’s yields will drop further. I use mmf’s for funds earmarked for investments, war chest. They are useful as I can liquidate back to my bank accounts within 3-5 biz days, have Ok yields, no hoops to jump thru, and zero sales charges (although have internal fund mgmt fees). For some brokers like Poems & FSMone they use mmf’s for cash mgmt.

For emergency funds I prefer to use a couple of traditional bank accounts (with SDIC insurance of $75K per bank) even if total interest rates are lower.

Hi ABC,

Thanks for the detailed comments on MMF. So would you recommend StashAway Simple?

Stashaway Simple is OK for spare cash, but there are other mmf’s with slightly better yield.

I wouldn’t recommend it for emergency funds due to mmf’s still considered as investment & no capital guarantee insurance.

For spare cash, I would :-

(1) First max out any possible high-interest savings account.

(2) Then you can consider SSB or Stashaway Simple or DIY mmf’s on Dollardex or Poems (no sales charges & no platform fees).

Mmf’s will have very slight investment risk but in over 16 years of using them locally, I have no problems even during the worse of 2008.

You can always diversify between SSBs, FDs, savings a/c, Stashaway Simple & DIY mmf’s.

ABC thanks for sharing again. Learn alot from you.

can consider using esaver and isavvy, basically you alternate the funds between the 2 accounts for the ‘fresh funds’ bonus every 2 months or depending on the promotion periods while keeping the minimum balance in the other account

https://www.sc.com/sg/save/savings-accounts/esaver/

https://info.maybank2u.com.sg/promotion/deposits-banking/fresh-funds-top-up.aspx

Hi Lcsg,

Will check out those two. Thanks for highlighting.