Starbucks: Long-term recovery play + Short-term momentum opportunity

I believe that everyone is probably familiar with Starbucks, a blue chip US stock that might be the ideal COVID-19 recovery play for your portfolio.

The Starbucks brand is likely the undisputed No.1 coffee chain brand globally. Starbucks is the market leader in the retail coffee market ain’t because they produce the best coffee products in the world.

They are No.1 because they have established a strong brand equity that associates them as a “lifestyle brand” rather than a “coffee seller”. People enjoy going to a Starbucks outlet to “chill-out” with their friends. It has essentially become the 3rd home for most people. The first being your home, the second being the office and the third being a place to relax like Starbucks.

COVID-19 in a way has made this 3rd home a quintessential choice as people desire to get out of the confines of their homes or select Starbucks as their “mobile” office instead.

The company has weathered COVID-19 pretty nicely, with its current share price at an all-time high despite the obvious fact that its business has been “decimated” in 2020. While foot traffic has no doubt decline, the company has been able to raise its price for its products back in Nov 2020 to make up for the sales shortfall.

This can only be achieved due to its strong brand equity.

Brewing Success

Shares of Starbucks climbed almost 5% last Friday. The coffeehouse giant stood out for its position as a provider of one of the most sought-after consumer products, and investors favored the stability and security inherent in this consumer discretionary behemoth stock that has been extremely resilient even during COVID-19.

Investors are increasingly optimistic about the prospects for consumer services companies such as Starbucks. While pandemic-related restrictions on brick-and-mortar restaurant locations have weighed heavily on companies in this sector for the bulk of 2020, things are looking brighter in 2021.

The prospects for Starbucks and its peers look much better in light of possible full re-openings as more people get immunized through vaccines that are now increasingly available.

While consumers might be struggling with still-high unemployment, certain discretionary consumption is strong as consumers divert their intended spending on travel, etc to lifestyle enjoyment.

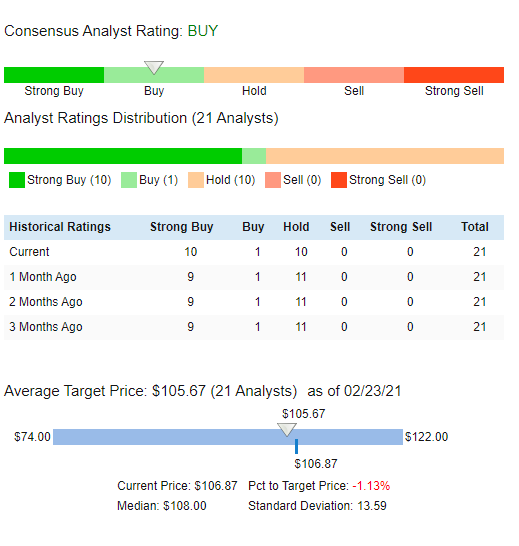

This prompted analysts at Wells Fargo to upgrade the entire consumer services sector earlier this week, with Starbucks as an overweight pick. Meanwhile, analysts at BMO Capital also upgraded Starbucks from market perform to outperform, boosting its share price target to $120/share.

The street is currently having a “positive” view of Starbucks, although most view its current share price as being relatively fair.

The long-term growth outlook remains in-tact

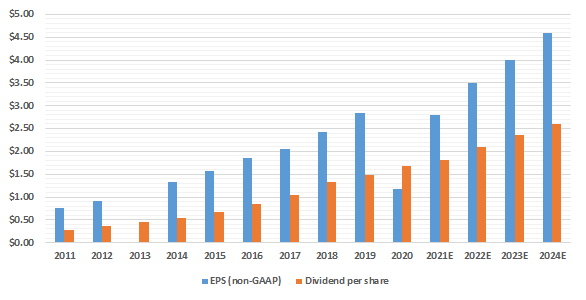

In a long-term forecast, Starbucks believes that the recovery setup through 2021 will extend through 2022, pushing EPS growth (non-GAAP) to over 20% YoY.

The recent disruption of the global pandemic has accelerated certain shifts in consumer behavior, and Starbucks has quickly adapted its business for the short- and long-term implications.

Starbucks highlighted 5 shifts in consumer behavior:

1) The fundamental need to be seen and experience a feeling of connection to others,

2) Seeking out experiences that effortlessly fit their lifestyle,

3) Appreciation of consistent experiences,

4) Desire for high-quality and sustainable products and experiences that support the well-being of people and the planet and,

5) Increasing loyalty to brands with strong values.

For FY21, Starbucks reaffirmed its non-GAAP EPS range of $2.70 to $2.90.

For FY22, the company expects outsized EPS growth of at least 20% as highlighted earlier.

For FY23 and FY24, non-GAAP EPS growth rate will be between 10-12%.

Based on the counter’s current share price just slightly north of $100/share, the counter will be trading at a forward FY21 PER multiple of 35x.

Excluding the 2020 outlier period, Starbucks has historically been trading at an average PER multiple of around 28-30X. Hence this forward 35x FY21 PER multiple might still be seen as a premium. However, with FY21 being seen as a transition year towards a more normalized FY22, Starbucks is trading at a relatively “fair” FY22 PER multiple of 30x.

The growth isn’t over

Starbucks, which started way back in 1971, might be seen as an old school company by many. However, its long-term growth potential remains strong.

There are currently 33,000 Starbucks location worldwide, with management targeting the figure to hit 55,000 across 100 markets by 2030.

China will be the major growth story forward for the company and with the “Starbucks of China”, Luckin Coffee filing for bankruptcy in early 2021, that will mean one less competitor (and a big one) in China.

Starbucks is testing a new store format in China called Starbucks Now an express retail experience with its first store opened in Beijing. It is a digitally enabled layout that will lean on the company’s robust technological capabilities to fulfill orders.

Growth ahead in China should be aided as the Chinese middle-class with rising disposable income grows alongside greater brand awareness in this massive but yet competitive global market.

Short-term momentum building

The long-term story in Starbucks remains robust. But what about its current short-term momentum?

The counter has recently breached its 52-weeks high (and all-time high) level with strong momentum building up.

This is one of the few blue-chip US stocks that could witness stronger momentum building up as momentum traders look to ride the short-term strength in the counter.

The TradersGPS platform, a proprietary momentum trading counter has identified this counter as one with a good short-term opportunity.

Additional Reading: Momentum Investing vs. Contrarian Investing. Which is better?

In fact, Starbucks was the Stock of the Week (1 March 2021) highlighted by Collin Seow which he shared with his students during his weekly webinar session as a potential stock to enter to ride the uptrend over the coming 6-9 months.

Collin will be holding an online sharing session on 2 March 2021 at 7 pm to share with you the rationale behind selecting Starbucks as a short-term momentum play.

During the online sharing session, one will also achieve the following key takeaways:

- Learn an easy-to-follow strategy that returns at least twice the return of major indices

- Gain the knowledge that could free you from emotional trading

- The possibility of getting out of the rat race earlier than you have imagined to be.

In a nutshell, the TradersGPS system is a time-tested platform that allows one to trade in a systematic and “robotic” manner without much emotion while concurrently identifying momentum stocks in the early stages of their upcycle.

The Systematic Trader

A course that teaches you how to use the proprietary trading platform, TradersGPS to identify the RIGHT stock to buy at the RIGHT time.

While the system is by no means a crystal ball with 100% accuracy (in fact the accuracy is only approx. 60%), I have used it consistently to find winners in short-term trading opportunities. There are however “duds” such as PLTR which is a red-hot favorite among retail investors/traders where the system indicated an exit, resulting in a loss of approx. 16%.

It could have been a lot worst. Like I mention, the system is nowhere close to a magical crystal ball but it sets the context in place for one to trade without emotions in place. The goal is to cut your losses short FAST and let your winners ride

For those who are interested to find out more about Collin’s online sharing session on 2 March 2021, you can click on the link below.

Conclusion

Starbucks is one of the stocks in my forever portfolio which I intend to hold for the long term. While Starbucks is already a well-known brand globally, its growth potential remains robust over the next decade and beyond.

COVID-19 has demonstrated this branded coffee chain’s resilience when it comes to raising its product prices to counter against the decline in foot traffic (and that inflationary effect is going to be permanent when foot traffic returns post-COVID-19).

It has also shown the company’s receptiveness to adapt to changes with new initiatives made such as bolstering its mobile order penetration and higher engagement with clients through its rewards program.

There might be a short-term trading opportunity in Starbucks stock as well, with momentum traders eyeing a convincing penetration of its all-time high level to pounce into the counter, potentially driving its share price higher over the coming months.

Some might view drinking “high-priced” coffee sold by Starbucks as virtually “pissing” your wealth away, a topic that I have covered in this article: Is drinking latte really costing you $1m and the chance to retire well?

Nonetheless, we should not deprive ourselves of life simple pleasures, might it be just a Latte a day. While it might not help in keeping our retirement woes away, it is certainly not the major cause of one’s retirement worries.

Whether you hold a short or long-term view when it comes to the ownership of Starbucks, it is one blue-chip US stock that you need to keep an eye out for in 2021.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update November 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.