I tried to calculate the math behind the Retirement Sum Scheme and unfortunately, that did not work out for me. I hope that some expert can enlighten me on that.

But before I dive into the details, below is a quick summary of the Retirement Sum Scheme and its successor, CPF LIFE. For those already familiar with Retirement Sum Scheme and CPF LIFE similarities and differences, you can dive straight to the segment on Calculating the Retirement Sum Scheme payout.

Quick summary on Retirement Sum Scheme and CPF LIFE

The Retirement Sum Scheme or RSS for short was the de-facto pension sum scheme that paid CPF members a monthly income out of their CPF to support a basic standard of living during retirement.

This scheme was replaced by the CPF Lifelong Income for the Elderly or CPF LIFE introduced in 2009. CPF LIFE was introduced to mitigate longevity risks.

A key difference was that the retirement sum scheme provided one a monthly income until funds in his/her Retirement Account (RA) runs out while that of CPF LIFE monthly income is for as long as one lives.

Most of us will be placed under CPF LIFE when we turn 55 but there are still pockets of our community that are under the retirement sum scheme, my parents included which fall under point 2. These groups of people are:

- The first group is those already making withdrawals on their Retirement sum scheme in 2009 before CPF LIFE was introduced. They can have the option to switch if they want to.

- The second group is those who were born before 1958 but had not yet begun withdrawing from their Retirement sum scheme (RSS). They too have the option to switch to CPF LIFE if they so wish to.

- The third group is those who fail to meet the CPF LIFE auto-inclusion criteria which are essentially those with less than SGD$60k in their RA six months before they reach the Payout Eligibility Age (PEA) which is from Age 65. Again this group can also choose to switch to CPF LIFE.

The above is just a quick summary of Retirement sum scheme. There are actually a number of websites that have discussed the topic of Retirement Sum Scheme and CPF LIFE, some including pretty comprehensive coverage of the differences between Retirement Sum Scheme and CPF LIFE such as the folks from Dollar and Sense in their article: CPF LIFE vs. Retirement Sum Scheme: What’s the difference?

Retirement Sum Scheme vs. CPF LIFE

Before we touch on the differences, let’s just highlight the key similarity. Both Retirement Sum Scheme and CPF LIFE requires us to set aside a retirement sum under our RA when we hit 55. As we turn 55, our combined Ordinary Account (OA) and Special Account (SA) balances will be funneled into the newly created RA.

For those who turn 55 in 2019, the Full Retirement Sum (FRS) is SGD$176,000. For those with more than the FRS amount, one can choose to 1) withdraw the access, 2) Leave the access in your OA and SA to earn interest. This can be withdrawn anytime or 3) contribute more to RA up to the Enhanced Retirement Sum (ERS) which is currently at SGD$264,000.

Now let’s move on to the key differences as highlighted in DNS’s article:

The 4 big differences as highlighted are

1. How Payouts are received: Under Retirement Sum Scheme, one will receive monthly payouts from his/her RA balances while under CPF LIFE, a lump sum is deducted from his/her RA and used to fund the CPF LIFE scheme. One will receive monthly payouts from the CPF LIFE scheme.

2. Withdrawal Age: Both withdrawal age commences at Age 65 now. However, this wasn’t the case for the old Retirement Sum scheme prior to 2007 where the withdrawal age was 62 then. Again, no differences now between CPF LIFE and Retirement Sum Scheme.

I always thought that at age 65, one will AUTOMATICALLY receive the monthly payout, either from CPF LIFE or Retirement Sum Scheme but it seems like one will need to submit a form to request for a payout at Age 65. The “automation” will only start at Age 70.

3. Buying a property: On the Retirement Sum Scheme, one is able to purchase property with his/her RA balances up to the Basic Retirement Sum (BRS). On CPF LIFE, because the balances in the RA are contributed to CPF LIFE when one turns Age 65. While one can continue to use the RA to fund a property purchase, this flexibility is gone at Age 65 when the RA fund is contributed into CPF LIFE

4. Interest Returns from CPF: This is one of the key differences that are of interest to me. For the Retirement Sum Scheme, interests generated is paid into the RA. For the CPF LIFE, funds that are contributed to the scheme earns interest that does not go into the RA but into the Lifelong Income Fund, which is meant to continue giving monthly payouts to those who live longer.

The interests generated for the Retirement Sum Scheme is critical to sustain and prolong the monthly payout to Age 90 (previously Age 95 – we will highlight this factor in the later segment). However, for CPF LIFE, this interest does not matter as one is guaranteed monthly fixed payouts (based on standard and basic plan) for life. This brings us to the next point.

5. Lifelong payouts: As briefly mentioned in point 4, on the Retirement Sum Scheme, the monthly payout will last until the RA balances are exhausted. Based on the RA interest rate of 4%, the funds can last to Age 85. However, due to the additional interest earned (For Age 55 and above, first SGD$30K of combined balance will earn 6% interest while next SGD$30k will earn 5% and the remaining will earn 4%), the monthly payment can be stretched to Age 90 (the recent policy change reduced the payout age to 90 instead of 95. This will result in higher payouts).

For CPF LIFE, the monthly payout continues for life.

Calculating the Retirement Sum Scheme payout

I have tried to do the calculations behind the Retirement Sum Scheme payout but came out feeling perplex as to how the calculation pertaining to Point 4 and 5 above, that the higher interest rates of up to 6% (achievable for the first SGD$30k) and 5% (for the next SGD$30k) can be used to prolong the payout all the way to Age 95 from Age 85.

Let’s assume that Andy, who turns 55 today, has SGD$176,000 (FRS) set aside in his RA. Let’s again assume that he falls under the Retirement Sum Scheme even though based on today’s context, he will be automatically enrolled in CPF LIFE.

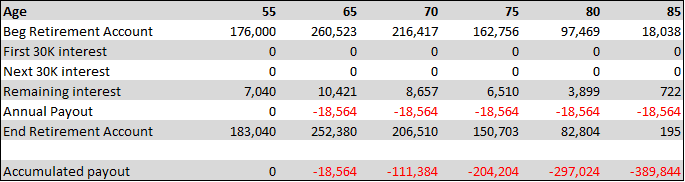

We assume that this SGD$176,000 accrues interest of 4% in his RA. Yes, we don’t factor in the additional interests for the first SGD$60k as yet.

His SGD$176,000 will translate to SGD$260,523 as of the start of Age 65 where his monthly payout begins. What is this monthly payout amount? Let’s term this amount as X first.

Theoretically, at the prevailing interest rate of 4% in his RA, this amount should run out by Age 85. So what is the monthly amount that translates to a zero or near zero account by Age 85? This will be our X.

My calculated amount is SGD$1,547/month which translates to approx. SGD$18,564 per annum.

This is the amount that Andy should get per month under the Retirement Sum Scheme which will see his RA account being depleted by Age 85. The amount of SGD$1,547 is approx. 11% higher than the CPF LIFE payout amount of SGD$1,400 today based on the standard plan for FRS.

So far everything till this point still makes sense.

However, the extension of the monthly payment from Age 85 to Age 95 (prior to the change to Age 90 recently) is where I got lost in translation.

To support an additional 10 years of payment which amounts to a grand total of SGD$185,640 (SGD$18,564 x 10years), one will need the additional compounded interest accrued from the first SGD$60k in the RA to make up for the deficit.

How is that even possible?

Based on my calculation, the extra interest will result in the RA balance of Andy amounting to SGD$68,514 when he turns 85 (when instead it should have been close to SGD$18k without the additional interest as highlighted in the table above).

However, by simple maths, this amount will be reduced to only SGD4,377 when he turns 89 based on an annual cash outflow of SGD$18,564.

So, how are the additional interests “alone” able to sustain payment all the way from Age 85 to Age 95? My calculation shows that this extra Interest of SGD$900/annum (SGD$600 from first SGD$30k generating 2% higher interest and next SGD$300 from next SGD$30k generating 1% higher interest) generates a total compounded (at 4%) return of SGD$93,400 (SGD$36,000 from SGD$900 principal interest over 40 years + SGD57,400 from compounded interest) over the course of 40 years (Age 55 to Age 95) which is halved the amount required based on a c.SGD$185,640 requirement

This is something that many articles have blogged about (talked about additional interests sustaining payment to Age 95) but none have yet to verify or come out with the math behind it.

Does extending the Age payment from 85 to 95 entails a reduction of the monthly payout as well? So instead of paying SGD$1,547/month, one will actually be paid only SGD$1,360/month on my calculation in order to meet the extended payout range to Age 95.

This amount is even lower than the current monthly payout amount under the CPF LIFE Standard scheme of approx. SGD$1,400/month for life. So instead of benefitting from higher theoretical payouts under Retirement Sum Scheme, the actual amount is actually lower compared to CPF LIFE?

I got to say that I am definitely not a CPF expert here and I hope that some CPF experts out there can enlighten me on this query. My initial guess is that the Age 95 figure could be based on a payout starting anywhere between Age 67 and up to Age 70 instead of Age 65 used in our example.

That will then make sense but again this is just my guess as there is insufficient clarity on this matter. This is also not an Apple to Apple comparison as the initial income of SGD$1,547/month was derived based on a starting payment year at Age 65.

New changes in regulation

From next year, CPF members under Retirement Sum Scheme who turn 65 from 1 July 2020 will come under the new payout rules, which spreads payouts to age 90 rather than age 95, following a review by the Ministry of manpower (MOM) and the Central Provident Fund (CPF) board.

The change, made in response to feedback that the current payout duration was too long, means that a proportion of Retirement Sum Scheme members will be getting higher payouts each month. How much higher? Well, based on my calculation, one will get an additional increase of SGD$37/month.

Seriously? Only SGD$37/month. One would have thought that this amount would have been much larger. Assuming a payment of SGD$1,547/month or SGD$18,564/annum, that will equate to an additional (SGD$18,564 x 5 years) = SGD$92,820 to be spread out over the course of 25 years (90 years – 65 years) which is equivalent to an extra SGD$3,712/annum or SGD$309/month!

Even if we assumed the more realistic figure of SGD$1,360/month (instead of SGD$1,547/month), that will translate to SGD$272/month in additional monthly income from the 5 years payment reduction from Age 95 to 90.

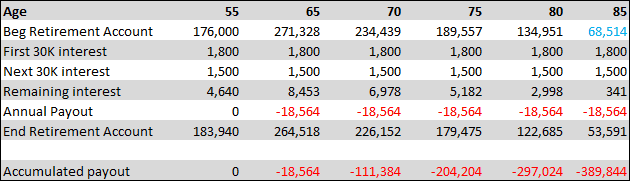

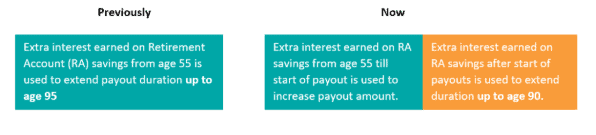

But unfortunately, that is not the case. According to Manpower Minister Ms. Josephine Teo, the “extra interest earned from age 55 until the member starts his payouts (we assume at Age 65) will now be used to increase his payout amount”.

“Extra interest earned after the member starts his payout (meaning from Age 65 in our example) will continue to extend his payout duration (from Age 85 to Age 90)”.

So how did we derive our SGD$37/month additional figure?

We calculate that the extra 1-2% interest generates SGD$900/annum before interest compounding. Taking into account interest compounding (at a rate of 4%/annum), the extra interest of SGD$11,238 will be generated over the course of 10 years from Age 55 to Age 65.

This extra interest of SGD$11,238 will go into increasing the monthly payout over the course of the next 25 years which equates to SGD$450/annum or SGD$37/month. This amount will be slightly higher if one delays his/her payout year beyond Age 65.

MoneyOwl recently also has an article that commented on this point, highlighting that the increase in payout ranges from SGD$20-SGD$50/month.

Is this amount really meaningful or sufficient to offset the risk of us outliving that 90 years threshold? If my above analysis is accurate, then it makes lots of sense for a CPF member currently under Retirement Sum Scheme to convert to CPF LIFE. The “additional” monthly income based on the reduction of duration to Age 90 instead of Age 95 is just not substantial enough vs. the risk of outliving beyond 90.

This is unless one has a low RA balance. Under Retirement Sum Scheme, there is a minimum payment of SGD$250/month whereas there is no such minimum for CPF LIFE.

Conclusion

Once again, I will like to highlight that I am no CPF expert. The above analysis is premised on my basic understanding of how the Retirement Sum Scheme works.

For the majority of us, changes in the Retirement Sum Scheme will not impact us as we will fall under the CPF LIFE scheme.

However, I am penning down these thoughts as it does affect the older generation like my parents who are still debating whether it makes sense for them to convert to CPF LIFE.

CPF has always garnered a lot of attention from Singaporeans as it is usually the bulk if not the only source of retirement income for the mass majority in sunny Singapore.

I believe that there should be greater transparency when it comes to transmitting such information.

For example, telling a CPF member still on Retirement Sum Scheme that based on the new changes, he will be “forfeiting” 5 years of income which could translate to SGD$1,547/month in regular Retirement Sum Scheme income x 12 months x 5 years = SGD$93k and getting only SGD37/month in increased payment x 12 months x 25 years = SGD11k in return just doesn’t sound right mathematically.

Once again, please do your own due diligence and I will also be seeking the help of experts pertaining to this issue and will update this article accordingly. It is NEVER my intention to be a source of “fake news” regarding our well-respected pension system that is among the best in the world, that is if you believe this ranking system.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “The Confusing Math behind Retirement Sum Scheme aka CPF LIFE predecessor”

tl;dr PAP jia lui

Haha, not implying that.

did you convert your parents RSS to CPFL eventually? i am still on the fence. still not sure which is a better proposition.