Reading Financial Statements: An Introduction

Financial statements are usually used by investors who are interested to “dig into the numbers” and assess the fundamentals of a company. You can look at it as report cards that provide you with an insight into a company’s financial health and performance.

Many people get scared off by the prospect of reading financial statements, but it doesn’t take a degree in business to be able to understand a few key figures. The first time you look at one, you may be overwhelmed, but as you grow as an investor, you’ll grow more comfortable with them.

By understanding the numbers in these financial statements, investors can analyze how a company is performing operationally. Is the company growing its sales? How about improving its margins?

Beyond operational growth, one critical component is to also assess the company’s debt levels. You wouldn’t want to invest in a company that is heavily laden with debt, would you?

This article seeks to simplify the reading of financial statements and it will identify key items to look for in your investments. Statements from Sheng Siong Group Limited (SGX: OV8) will be used to illustrate the pointers below.

There are typically three key financial statements in focus – 1) Balance Sheet, 2) Income Statement and 3) Cashflow Statement.

Balance Sheet

Balance sheets allow investors to understand a company’s profitability, liquidity, and solvency levels. It breaks down the assets, liabilities, and equities owned at a particular point in time.

If the right numbers are extracted from the statement, investors can plug the numbers into several ratios to learn more about the firm.

Within each category, they are further segregated into “current” and “non-current”. Here’s a quick explanation of them:

Asset

Assets are cash-generating resources that are categorized into two periods:

- Current Assets – Assets that can be easily converted into cash within 1 year such as receivables or short-term deposits. This can refer to inventories or even receivables that the company may have.

- Non-Current Assets – Assets that cannot be easily converted into cash within 1 year such as land. For supermarkets, it refers to properties or even equipment owned.

Liability

Liabilities are one of two ways that a firm can raise money for its operations. These obligations can be categorized into two periods:

- Current Liability – Short-term obligations that are due within 1 year such as short-term loans and payables. In relation to Sheng Siong, term loans and payables are short-term liabilities for the supermarket.

- Non-Current Liability – Long-term obligations that are due over 1 year such as long-term loans taken by the firm. Longer-term debts are examples of non-current liabilities.

Equity

Equity is another way a firm can raise money by listing shares in the market. This section refers to money raised during a listing as well as profits generated by the firm that is being recycled back. Dividends are profits generated by the firm that is being paid out to shareholders. This will not be accounted for under the Equity segment.

Key items to look out for in a Balance Sheet

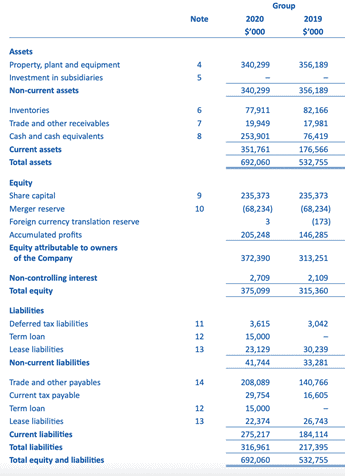

Here’s an example of the Balance Sheet of Sheng Siong:

As mentioned previously, these financial statements can reveal useful information about a company! Here are some of the key ones to focus on.

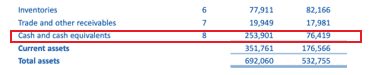

Cash & Cash Equivalents

This is the amount of cash the company (i.e, net income) has on hand. You can quickly check this figure against last year’s figure to see if the number is heading higher. If so, that is a good sign. BTW this can be considered as a cash flow statement of a company.

This means that the company is generating profits and saving more. Cash can ultimately be used for debt repayment, pay dividends to shareholders or grow the company in the form of making acquisitions.

If the company’s cash has declined, find out what might be the reason behind that and it might not always be a bad sign. Sometimes it could be due to timing issues where cash has been used to service payment while its collections have yet to be received.

In the case of Sheng Siong, the company’s cash pile ballooned from $76m to $254m over just 1-year, likely the direct result of COVID-19 which was a major boon for this supermarket operator.

Long Term Debt

In the liabilities segment, you will see the company’s long-term debt. Check to see if this figure is going down from the previous years. That is also a good sign for company’s financial health because it reduces the credit risk associated with the company.

Long-term debt going up is usually a bad sign unless it is associated with a major acquisition that might “pay dividends” down the road.

Look out for companies that increase their debt in the income statements to maintain their dividend payments to shareholders. That is usually a red flag, one which many companies have “indulged” in during the current low-interest-rate environment.

Sheng Siong’s long-term debt of $15m, while an increment vs. 2019 (no debt) is highly manageable based on its huge cash hoard as well as equity base.

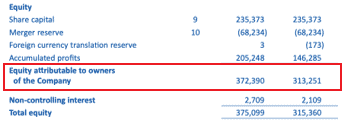

Total Shareholder Equity

This is a figure that tells you how much equity there is in a company. When a company is profitable, its profit goes towards increasing the equity figure. When a company is loss-making, those losses go towards decreasing the equity figure.

In general, a higher shareholder equity figure is better. Do take note if the rise in shareholder equity is a result of operational profitability (which will increase accumulated profits) or due to fundraising (which will increase share capital). You want to see shareholder equity rising because of the former and not the latter.

In the case of Sheng Siong, the rise in shareholder equity is predominantly attributable to higher accumulated profits which is a good sign.

No one figure on a balance sheet will tell you if a company is a good investment or not. A balance sheet is useful for getting an overview of where the company’s financial statements stands now. The above items are just some of the key ones that I tend to pay more attention to.

Income Statement

Income statements break down the revenue, expenses, and the overall profit or loss a company made during the financial period. Through these income statements, investors can gain an insight into the efficiency of management, performance of sectors and compare it with the industry.

This tends to be the most important financial statement among the three, with investors typically more concerned over the growth aspect of the company.

An Income Statement has three main components – Income, Expenses, Net Profits / Losses.

Income / Revenue

This section provides the different sources of income for the company through the sales of products/services. As seen in the statement below, the main source of income for Sheng Siong is supermarket sales.

Expenses

This section provides the different sources of expenses incurred. The main component is typically “Cost of Sales”, which is the DIRECT cost. This is what the company has to spend to develop its product for sale. For Sheng Siong, its Cost of Sale is largely the procurement cost of its groceries to be sold at its supermarket.

- Operating expenses capture the bulk of indirect costs associated with sales such as marketing and advertising spends as well as the everyday costs of running the company. We can see that the largest contribution to expenses for Sheng Siong is the administrative and distribution cost which is mainly payroll costs.

- Non-operating expenses capture the remaining indirect costs that are not directly associated with operations, the key item here being interest and tax expenses.

Net Profits

This refers to the net profit or loss made by the company after revenue is subtracted from all the above expenses highlighted. With this figure, you will also be able to compute the earnings per share (EPS) for the company by dividing the net profit by its outstanding shares.

Key items to look out for in an Income Statement

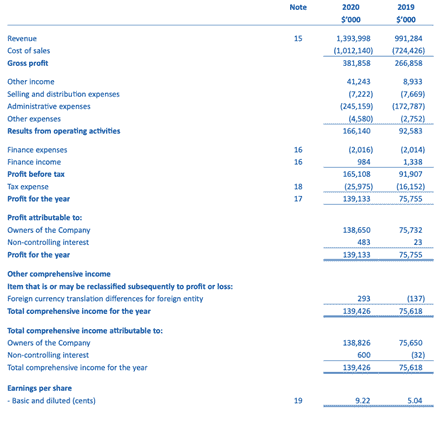

Here’s an example of Sheng Siong’s Income Statement:

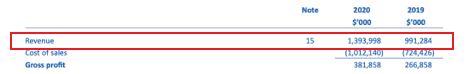

Revenue

Revenue or top-line sales is typically one of the most important metrics to look at in the financial statement. You want to see that a company is continuously growing its revenue aka selling more products/services.

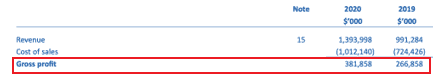

Gross profit

This is another key metric that should be given attention to. We highlighted earlier that rising revenue is good for the company. However, that needs to be accompanied by rising gross profit as well.

A company that demonstrates rising revenue but declining gross profit means that it is now more costly for the company to grow its sales. This is not a good sign. For Sheng Siong, gross profit grew from S$267m in 2019 to S$382m in 2020, in line with the growth of its revenue.

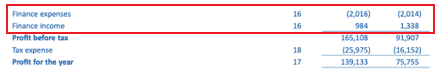

Finance Expense

Finance expense is interest owed to the bank because of the company’s borrowing. We want to see this figure dropping which likely highlights that the company is actively paring down its debt levels.

One way to see if a company might be at risk of a potential “default” in terms of interest payment is to look at this ratio called the interest coverage ratio. This is calculated based on the following:

Interest coverage ratio = Operating profit / interest expense.

The higher the ratio, the better it is for the company. Ideally, we want to be seeing an interest coverage ratio over 3X.

In Sheng Siong’s example, the company generated $166m in operating profit in 2020 while its net interest expense (interest expense – interest income) is $1m, translating to an interest coverage ratio of 166x. No credit issue there.

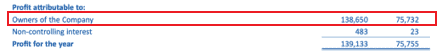

Net income attributable to owners of the company

This is profits generated by the company after subtracting all the expenses associated with running the business (both operationally and non-operationally) with its revenue.

This is a figure that everyone will be looking at and comparing against the prior year’s figure. It shows how profitable the company is and a rising figure vs. the previous year is a good sign.

For Sheng Siong, its net profit grew to S$139m in 2020 from $76m in 2019. That is a welcoming sign.

Cashflow Statement

As the name suggests, cash flow statements show the amount of cash or cash equivalent moving in and out of the firm. These statements allow investors to know how well the company manages its cash levels to fund operations and debt.

People talk a lot about a company being profitable as I have highlighted above on looking at a company’s net profit figure. In reality, you wouldn’t expect young growth companies to be profitable but that does not mean they are bad investments or they are not making money.

The company can be loss-making (negative net profit) but has positive cash flow (meaning more money coming in vs. going out). Positive cash flow is likely more important than simply looking at the net profit level.

When a company is cash-flow positive, they have control over their future. A negative cash flow means either raising money or eventually going bankrupt.

There are three key categories – Operating activities, Investing activities, Financing activities. Lets first take a look at these 3 key categories before going deeper into the calculation of Positive/Negative Free Cashflow.

Operating Activities

This refers to any activity that is related to the company’s provision of goods or services to the market. For Sheng Siong, this refers to the process of sourcing goods to sell in its supermarket. The supermarket was able to generate higher operating cash flow in 2020 vs. 2019, which is in line with its net profit level.

Investing Activities

This refers to any activity related to the company’s investments. Therefore, should a company invest in other entities, returns from this investment will be included in this section. The main source of investing cash flow comes from Property, Plant, and Equipment or PPE purchases.

Financing Activities

This refers to any activities related to the funding of the company. It includes cash transactions that involve debt, equity and dividends issued. Financing costs were higher for Sheng Siong due to a larger distribution of dividends for the year.

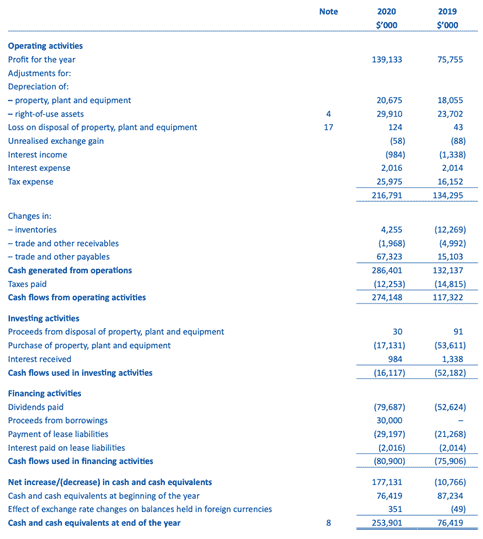

Key items to look out for in a Cashflow Statement

Here’s an example of Sheng Siong’s Cashflow Statement:

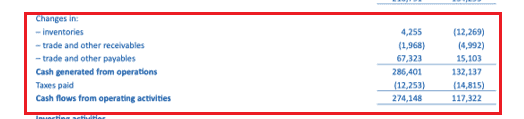

Cash generated from operations

This is typically the key focus when it comes to the cash flow statement. We want to know that the company is not only profitable (positive net profit from the income statement) but is also generating cash from its operations.

Many companies consistently generate positive net profit but also consistently show negative cash generated from operations. This is a major red flag.

For a young growth company, being able to generate positive operating cash is more critical vs. generating net profit as it shows that the company is “self-sustaining” and does not have to depend on other external cash sources to fund its growth.

Purchase of PPE

This is typically capital expenditure to ensure that the company can continue to operate smoothly. For example, in Sheng Siong’s case, that could be periodic repair and refurbishment of its supermarket outlets to ensure that they are in proper condition to serve the masses.

This figure should typically increase IN-LINE with revenue growth. A major red flag would be consistently high PPE expenses when revenue is stagnant or declining.

Free Cash Flow

This is derived from subtracting PPE from Operating cash flow. Ideally, this figure should be positive. Positive free cash flow will mean that the company can afford to pay shareholders dividends.

Free Cash Flow = Operating Cash Flow – Purchase of PPE

Excess cash that is not paid out to shareholders in the form of dividends will serve to increase the company’s cash holdings.

For Sheng Siong, the company generated tons of free cash flow in 2020 (S$274m – $17m) where a substantial portion was returned to shareholders in the form of dividend payments (S$80m) while the remaining amount boosted its overall cash balance. This serves as a good buffer for potential future acquisitions that Sheng Siong might make.

Summary

I have covered the financial statement of a company, using Sheng Siong as an illustration. In addition, I have also highlighted which are the key items that one should be looking at when reading a company’s financial statement.

One can combine a number of these figures from different segment of its financial statement (using income statement figures together with balance sheet statement figures) to derive some key financial ratios which will be useful in assessing the fundamentals of a company.

I will run you through some key financial ratios below:

1.Profitability Ratios – Return on Equity

This ratio measures the efficiency of the management to generate earnings on every dollar the company receives from shareholders. The higher the ROE, it means that the company can generate profits internally without going into the debt market.

To plug in the numbers for Sheng Siong, you’ll get

- Net Income = $139,133,000 (from income statement)

- Shareholders Equity = $372,390,000 (from balance sheet statement)

- ROE = (Net Income / Shareholders Equity) x 100 = 37.36%

The ROE recorded by Sheng Siong in 2020 was a very strong 37.36%! As this figure is above the company’s 5-year average of 28.17%, the supermarket has been very efficient in generating income through shareholders’ contributions.

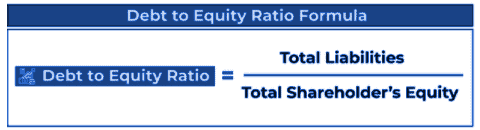

2.Debt to equity ratio

Also known as the debt-to-equity ratio, the D/E Ratio measures two things: first – the degree to which its operations are funded by debt, and second – whether shareholders’ equity (net amount of assets and liabilities) can cover total liabilities.

To plug in the numbers for Sheng Siong, you’ll get

- Total Debt = $30m (from balance sheet statement)

- Total Shareholders’ Equity = $372m (from balance sheet statement)

- Debt to Equity ratio = (TD / TE) = 0.08

A D/E ratio greater than 1 indicates that the company has more debt, while a value below 1 indicates less debt. For Sheng Siong’s case, its debt to equity ratio is extremely low which goes to show there is no credit risk.

A more common alternative to the debt to equity ratio is the net debt to equity ratio, where total debt is subtracted from cash holdings and if there is more cash vs. debt, the company will be seen as NET CASH.

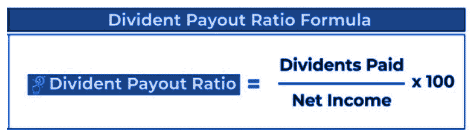

3.Dividend payout ratio

The dividend payout ratio measures the amount of dividends a company pays to its shareholders relative to its net income, thus indicating the proportion of earnings that get distributed as dividends.

The dividend payout ratio is calculated by dividing dividends paid by net income, then multiplying by 100.

Typically this ratio is used to assess if a company’s dividend payment is sustainable. Broadly speaking, a dividend payout ratio of 40% is considered decent, but again, that number may fluctuate depending on the industry and a multitude of other factors.

Do refer to this article: 15 key financial ratios new investors should know before making investments for more financial ratio coverage.

Conclusion

The emphasis on different components of financial statements is highly dependent on the demand of the industry. However, the ability to read them allows investors to gain an insight into the company’s operations! This allows one to maximize their investments by ensuring that the companies are on track with growth expectations.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.