Recently, Dollar and Sense wrote a post called “How you can make your child a CPF millionaire by contributing by contributing S$400 every month until they turn 21”.

It was an interesting article to me as a parent to two young boys. However, it also got me thinking if me and the missus should be sacrificing our retirement to fund our future adult children’s lifestyle. S$400/month for the next 21 years is A LOT of money.

Millionaire kids: Hard or Easy way?

As parents, it is natural that we will like our kids to have a better financial future. The definition of “better financial future” might be subjective from parents to parents. Some would like to leave a legacy or inheritance to their kids so that they can grow up to be happy masters of money rather than a money slave that most people are today.

Others prefer to teach their kids about money from a young age so that they are keenly aware of their financial situation and will grow up to become a financial savvy/independent individual.

Striking a balance between giving your kids a good financial head-start VS. “over-helping” them that they become over-reliant on you even when they become adults is often a challenging act one needs to be wary about.

Personally, I belong to the camp of teaching my kids how to fish (in this case, learning about money) rather than putting the fish directly on their platter (leaving a large legacy/inheritance/savings for them). Teaching my kids about money will ensure that they are well-equipped as much as possible to handle any financial circumstances in the future. A large monetary legacy, on the other hand, could easily be depleted without the right financial habits.

I hope that the right financial education will increase the odds that my kids reach millionaire status one day and remain as one.

If done well, this I believe is my best legacy for them.

5 ways I teach my kids about money

These are the 5 things that I personally do for my kids at the moment, which I believe many have done before me and many will continue to do after me.

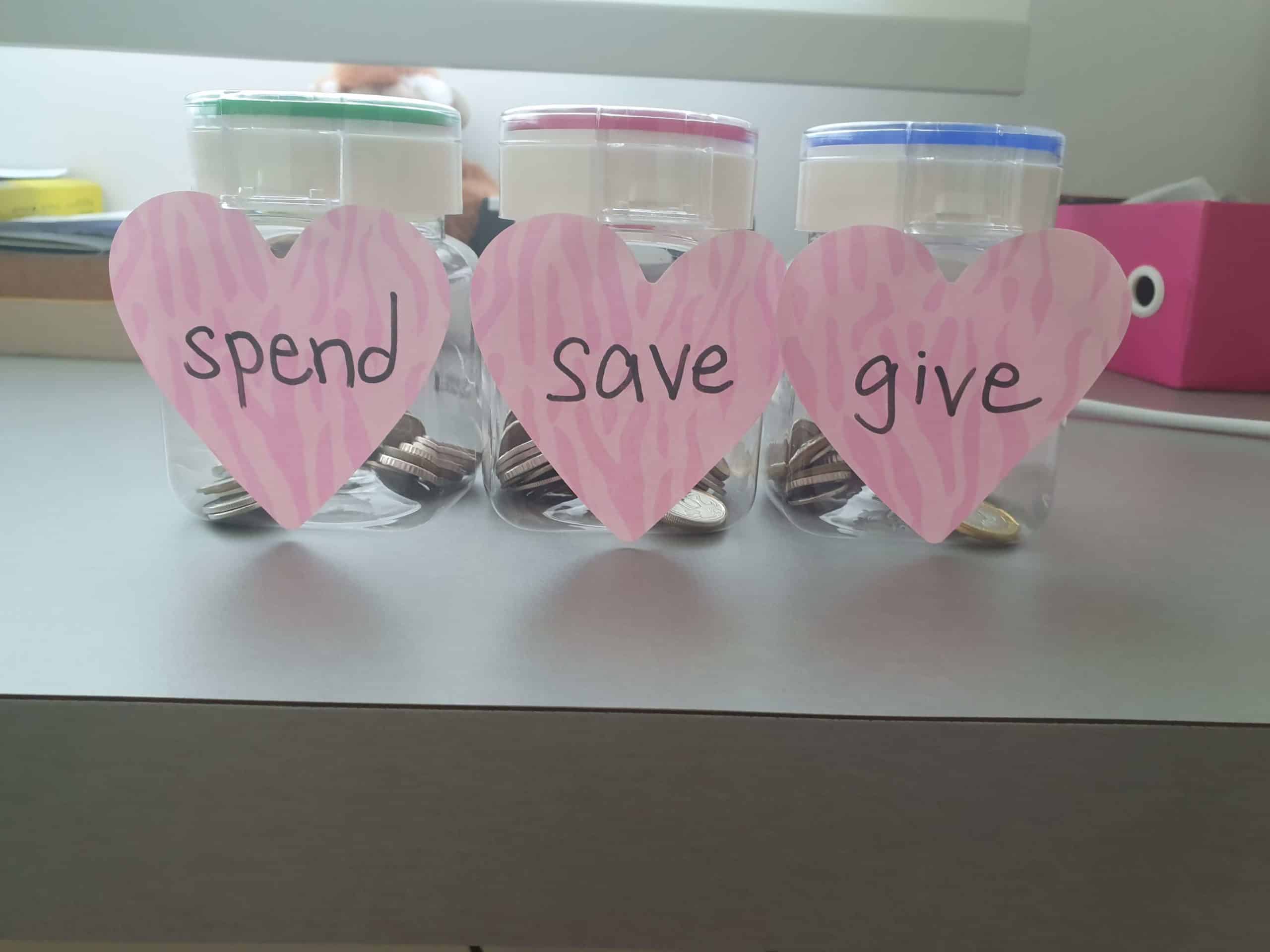

1.Creating separate Jars for Saving, Spending and Giving

My elder boy is currently hitting 4-years old and I recently gave him 3 different Jars/Containers and named them Save, Spend and Give. Previously he just had one piggy bank. This time round, I told him that he can choose to put his savings into any or all of his jars. His Saving Jar is used for accumulating funds for big purchases. The Spending Jar is mainly for small ticket items like tidbits or paying for his TV time and last but not least, the Giving Jar is for donating to the less fortunate.

2.Giving them the chance to earn some money

I give my elder boy the opportunity to earn “his keep” on a daily basis, which includes helping to do household chores such as sweeping the floor and cleaning his own desk. He will also be rewarded for doing a good job in terms of personal care such as putting his own soiled clothes in the laundry basket, bathing and brushing his teeth all by himself and helping to fold his own clothes.

3.Giving them the chance to “utilise” their savings

I will bring my boy down to the supermarket where he is entitled to use the money that has been accumulating in his “spend” Jar to purchase small ticket items like biscuits and sweets, albeit with certain restrictions. I like him to know that after working hard to earn money, he can be rewarded in the little joys of life.

I also make my boy pay for his TV time. There are occasions that he will like to indulge in kids’ programs such as “Paw Patrol”, “PJ Masks” etc. He can use the savings that he has already accumulated in his “spend” jar to pay for his TV time.

4.Having money conversations with them

I believe that kids should be involve in the family’s financial conversation as well. For example, my washing machine recently broke down and I had to do our laundry by hand in the interim before our new washing machine arrives. I told my kid to help “wash” the laundry (which was essentially just to throw his dirty clothes into a bucket of water and pour some washing powder on it).

I told him that if we did not save enough money to buy a new washing, he will need to wash all his clothes by hands everyday. That got him keenly aware of the importance of savings.

5.Teach them to give back

Sometimes earning money ain’t all about spending on one’s own personal needs and wants. Besides teaching my boy not to be wasteful with his food (as there are many unfortunate households who struggle to put food on the table on a daily basis), I also teach him about the importance of giving to the less fortunate.

This is where money in his “Give” Jar comes in. I am actually pretty happy that in most circumstances, my boy will actually choose to put a portion of money earned into his “Give” Jar.

What I plan to do in future when my kids get older.

I plan to introduce the concept of Investing to my elder boy when he gets older. So we expect to add another “Invest” Jar, probably when he gets into Primary school.

I will also like to teach my kids about money concepts through money games. A game night will be a win-win situation to spend quality time with the kids while concurrently indulging in a variety of entertaining financial board games that can teach the kids a wide range of financial literacy skills.

Conclusion

I like to spend as much quality time as possible with my kids in their growing up phase. Besides helping them with their homework, I believe that simple money management skills can also be inculcated at an early age.

This is probably something that our current education system is lacking, focusing mainly on grades with the ultimate goal of achieving a good degree that leads to a stable job. In the age of automation where the notion of job security becomes an illusion, having the right money management strategy ranks higher in importance vs. obtaining a degree, which has become increasingly commoditised (yet more expensive) in my view.

As parents, it is normal to have the mindset of wanting to give the very best to our kids, sometimes at the detriment of our own financial well-being and potentially to theirs as well. I have previously written about the cost of college education and how we can actually help ourselves and our kids to graduate debt-free. Should we be neglecting our own retirement plans so as to help our kids pay for their college fees? Would it be better to have them “work” for all or part of their own college fees? Why college fees should not be an overly expensive affair.

These were some of the topics what we discussed previously that I believe remains very relevant to our current topic as well.

Final thoughts: I hope that what I am doing now will not just help them achieve millionaire status in due course but also a millionaire mindset that is sustainable and can in turn be imparted to the next generation.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER WRITE-UPS

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- VENTURE 6% PRICE DECLINE POST-RESULTS; SATS’ 2QFY20 COULD REMAIN WEAK

- YANGZIJIANG’S SHARE PRICE IS UP 7%. CAN MOMENTUM PERSIST POST-RESULTS ON 7TH?

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.