According to various media sources, Frasers Logistic & Industrial Trust and Frasers Commercial Trust are planning to merge, as consolidation among Singapore’s real estate investment trusts (REITs) gathers pace.

This will be the 4th deal this year if it happens. In January, CapitaLand Ltd strikes an SGD$6bn deal with Temasek Holdings for Ascendas Pte and Singbridge Pte.

The second deal was in April when OUE Commercial Reit agreed to buy OUE Hospitality Trust to create one of Singapore’s 10 biggest Reits.

The third deal came in July when Ascott Residence Trust and Ascendas Hospitality Trust agreed to create the largest hospitality trust in the Asia-Pacific region, with SGD$7.6bn of assets comprising serviced residences and hotels.

Reits poised for further consolidation

The Reit market in Singapore has become rather fragmented, with just 1 back in 2002 flourishing to more than 40 currently.

ESR Reit and Viva Industrial Trust merger to form the city’s fourth-largest industrial property trust last year got the consolidation ball rolling.

Why are Reits consolidating?

A merger will not only improve the profile for some smaller Reits but will also improve portfolio diversification and their cost of capital structure through economies of scale that lower their overall operating costs (removal duplicate costs, lower bank borrowing costs etc)

Very often, these smaller Reits also have a low free float with daily trades of less than SGD$1m in value.

Improving their cost of capital is important as this will allow for greater acquisition options. A low cost of capital allows future acquisitions to be accretive. However, for these smaller Reits, it is hard to achieve, particularly with low trading volume.

For example, if a Reit is trading at 7-8% yield, a deal will have to be structured above that threshold in order to be accretive for unitholders. Such deals are increasingly rare in today’s low-interest-rate environment with cap-rates being compressed.

By merging, the combined Reits will be of a larger scale nature with higher trading liquidity and this tends to improve their overall cost of capital as well.

The chances for the combined Reits to gain inclusion into global equity indices and attract international attention will also be higher. Morgan Stanley Research finds that Reits that are part of the FTSE EPRA/NAREIT Developed Index enjoy a valuation premium of 130 basis points spread over those Reits that are not in the index.

Reits that are trading below their book value will often see the market revaluing it substantially after a merger. Take the case of Ascendas Hospitality Trust which was trading at 0.8x Price/Book before the merger announcement. The merger valued the counter at a slight premium to its book which resulted in a significant price revision for the counter.

So who is next?

So, following Frasers Logistic & Industrial Trust and Frasers Commercial Trust planned merger, who might be next-in-line?

ESR REIT and Sabana REIT

A combination of ESR Reit and Sabana Reit was previously speculated when ESR took control of logistics-focused Sabana Reit in May after acquiring a 9.9% interest in the trust and a 51% stake in its manager.

ESR has become Sabana Reit’s largest unitholder with a 21.4% stake and also indirectly controls 93.8% in the manager.

Activist fund urging for a merger

An activist fund, Quarz Capital Management released an open letter to Sabana Reit on 14 Nov, urging both ESR Reit and Sabana Reit to merge. A merger will solve the issue of overlapping investment mandates between the two trusts, which may have corporate governance implications.

For example, it was highlighted that both Reits primarily invest in the Singapore industrial sector which is limited in size and transaction. Both might tender for the same assets and priority might be given to ESR Reit given that ESR’s stake in ESR Reit has a much larger value than its stake in Sabana Reit.

The activist fund is proposing that ESR Reit merge with Sabana Reit in a cash and unit transaction where 0.92 units of the former and SGD$0.067 cash would be exchanged for one unit of Sabana Reit, giving a value of about SGD$0.545/unit. This is an 18% takeover premium for Sabana Reit.

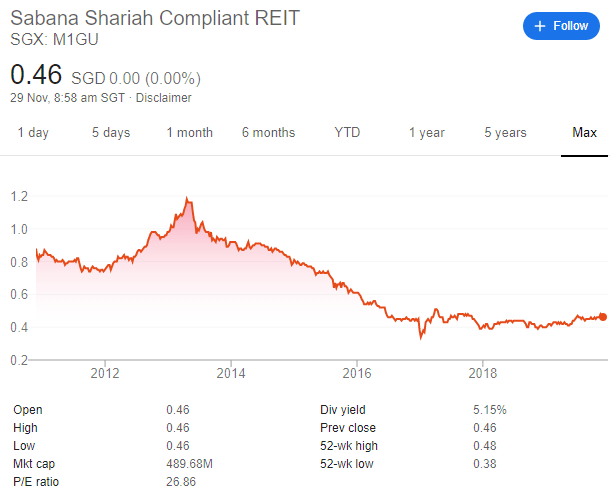

Sabana Reit currently trades at 0.8x P/B while ESR Reit is valued at around 1.15x P/B. The disparity in valuations between the two is reflective of size. A merger, depending on the terms, could see a re-rating of Sabana Reit’s valuation closer to book parity.

Investors can have the choice of either investing in Sabana Reit to enjoy the acquisition premium or buy and hold ESR Reit for the latter to consolidate the industrial Reit sector and consequently enjoy the benefits of scale.

Should one be investing in Sabana Reit now?

We will not be going into details of the fundamentals of Sabana Reit in this article but just to briefly highlight the company’s tumultuous history. The share price was as high as SGD1.20 back in 2013 and a series of “poor” management and acquisitions led to a rapid decline in its share price.

This incurred the wrath of some of its minority shareholders which tried without success to remove the underperforming Reit manager back in 2017.

A new CEO, Donald Han was appointed in 2018. The company sold two properties at more than double their book value with a focus to ramp up occupancy level nearer to the 90% level. Its Occupancy rate is currently at 80.6% (would have been 85.4% if not for the early settlement and termination of the lease at 10 Changi South Street 2).

Has the fundamentals of the company improved under the new leadership of Mr. Han since early 2018? This will likely be another article for another day. (I have got no vested interest in Sabana Reit as at this point of writing).

Conclusion

Reits have to grow to a sufficient size to enjoy economies of scale with higher trading liquidity and potential inclusion into the index. This will help improve their valuations. For smaller Reits that suffer from issues like the high cost of capital, low valuation etc., the easiest path to better performance will be through a consolidation.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER WRITE-UPS

- THE MAN WHO TRUMPS WARREN BUFFETT BY 200X OVER THE PAST 30 YEARS

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.