Inflation: Don’t ignore this silent retirement killer

Not much has been written about Inflation. However, it is one of the Four Key unknowns that affect one’s retirement plan. Granted that inflationary pressure has been low in the

Not much has been written about Inflation. However, it is one of the Four Key unknowns that affect one’s retirement plan. Granted that inflationary pressure has been low in the

We have written in a previous article why a 60:40 equity to bond portfolio composition (Portfolio 1) isn’t the ideal structure for a retirement portfolio using the 4% withdrawal rule.

Creating the ideal 4% withdrawal rule portfolio I believe that some of you would be familiar with the 4% retirement rule. In a simple nutshell, this is the amount of

Recently, Dollar and Sense wrote a post called “How you can make your child a CPF millionaire by contributing by contributing S$400 every month until they turn 21”. It

How much should one have in retirement savings when it is finally the time to leave the rat race? Based on my calculation, a 30-year old will need approx. S$1.5m

Robo or DIY? We have previously written articles pertaining to robo-advisors available here in Singapore as well as the ALL-IN costs of choosing robo-advisors vs. a DIY approach. While the

Quick Intro: I recently attended an event by one of the robo advisors here in Singapore, Endowus, jointly organised by Dollar and Sense (DNS). DNS Co-founder, Mr Timothy Ho hosted

While most Singaporeans would be familiar with the Central Provident Fund (CPF), most might still be unaware of the Supplementary Retirement Scheme (SRS). Check out the Ministry of Finance (MOF)

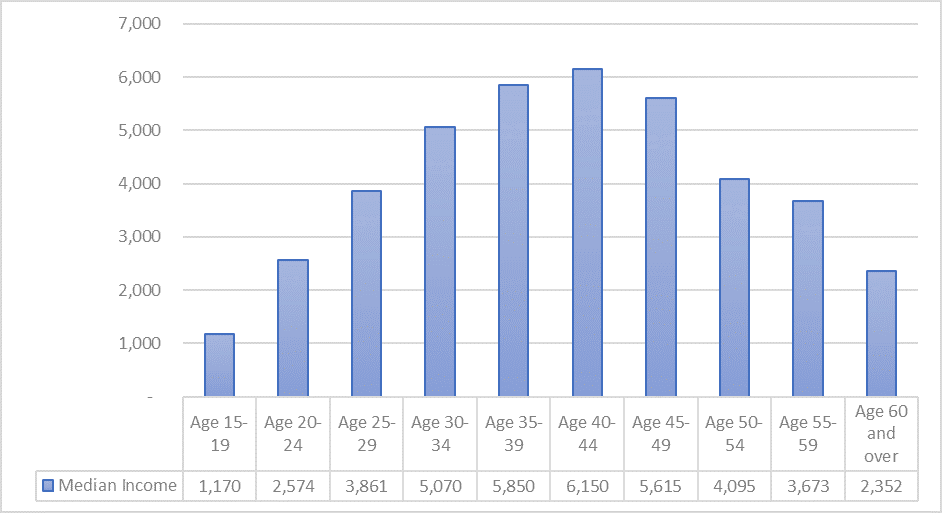

According to the latest 2018 data taken from the Ministry of Manpower, a worker age between 25-29 generates a median income of c.SGD3,861 here in Singapore. This includes his/her own

In Singapore, about 80% of the population resides in HDB, the building block for affordable home ownership, often lauded by the government. Well we are not going into the discussion

Are you generating the median income here in sunny Singapore? But first let’s take a look at how our wealth stacks up vs. the world. Using data from the Credit

In 2019, one of my new year resolutions was to get in shape and lose some fats. I hardly exercised at all in 2018 and felt really guilty about it.