Ultimate Guide to Investing Using SRS Account (2023 Update)

Why investing using SRS is critical to help you save on taxes and make your cash work harder for you. Here are the 10 investments you can make.

Why investing using SRS is critical to help you save on taxes and make your cash work harder for you. Here are the 10 investments you can make.

Net worth by age: What should your net worth be at each stage of your life so as to be able to retire comfortably?

Here are 5 simple steps to saving your first 100k: Step 1: Knowing how much to save. Step 2: Set Savings Goals. Step 3: Start Earning More

How much is required for your child education? For some Singaporean parents, seeing their kids being accepted into a local university is a dream come true, particularly if they themselves

Are retirement expectations too high? Retirement is a pretty touchy topic for most people and here in sunny Singapore, it is no exception. While most of us will like to

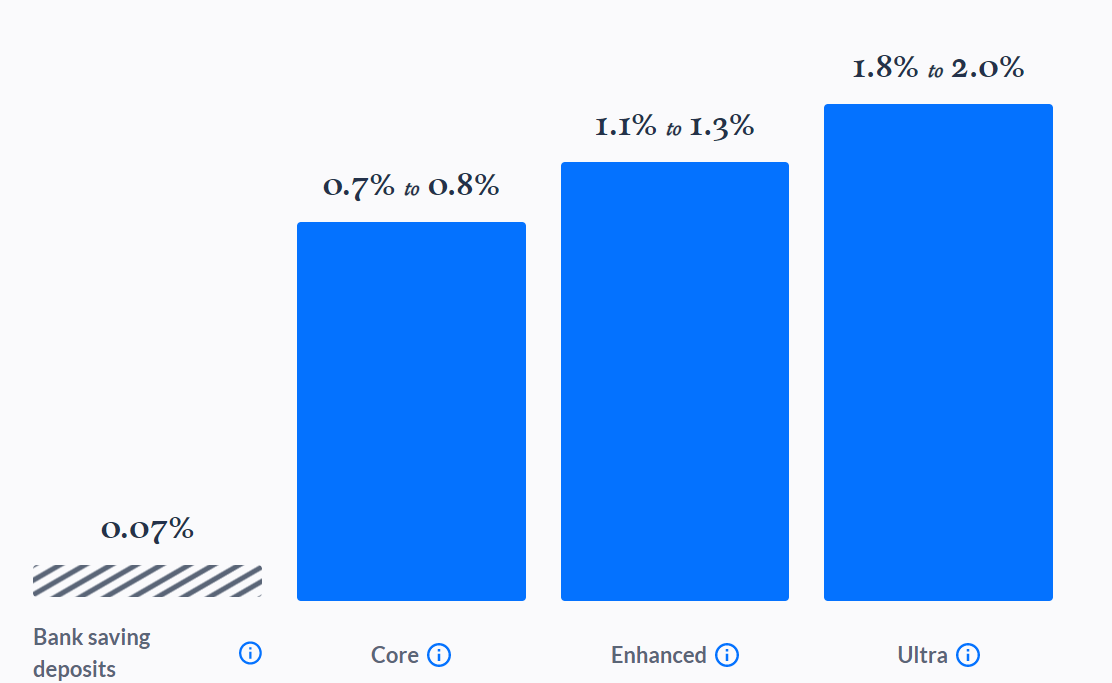

Endowus Cash Smart solutions I have previously written about the various options available for a Singaporean investor to invest in his/her SRS account. Note that funds kept in the SRS

Saving money: Wise or folly? From young, we were taught the virtues of being thrifty and to “save for a rainy day” by our parents. Our parents were taught to

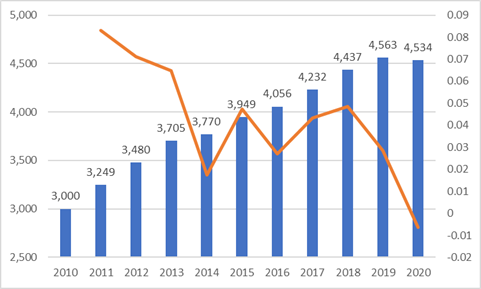

Average Salary in Singapore 2023 The Ministry of Manpower Singapore just formalized the Income statistics of Singaporeans although an earlier tentative report was released back in Dec. The statistics show

Worst market timing: Why that does not matter Some NAOF readers are expressing their concerns over the current state of the stock market. The mismatch between economic “reality” and the

In this article, I will bring you through a step-by-step guide in setting up your early retirement plan. Planning your retirement should not be done when you are in your

FSMOne: Upping the game of “cheap” investing FSMOne Fees for Regular Savings Plans (RSP) in ETFs are likely the most competitive among the local brokerage houses. Investing in US-domiciled ETF

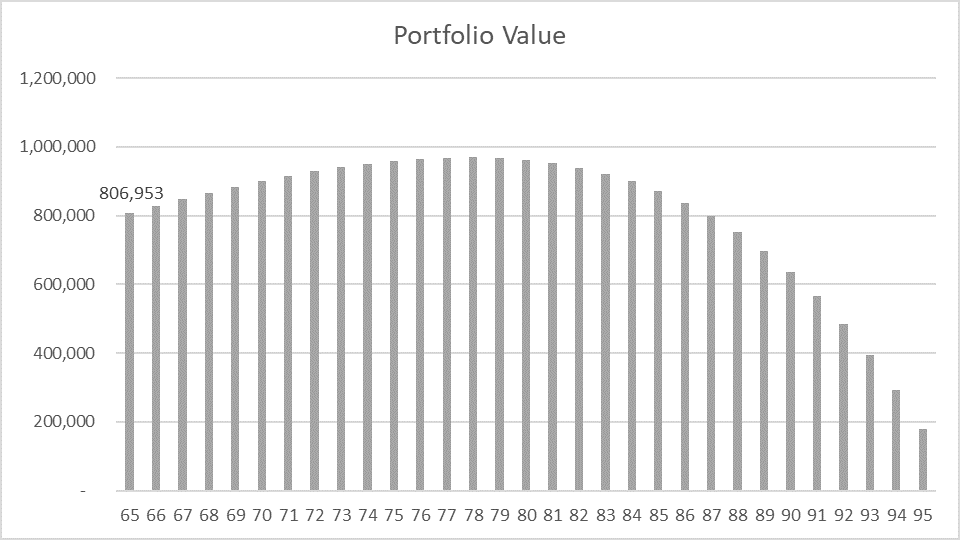

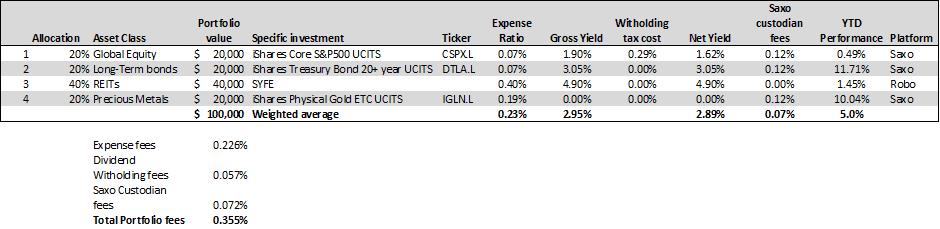

The NAOF-DIY portfolio I have written on numerous occasions that the New Academy of Finance (NAOF) retirement portfolio structure, one that works on the premise of the 4% withdrawal rule,

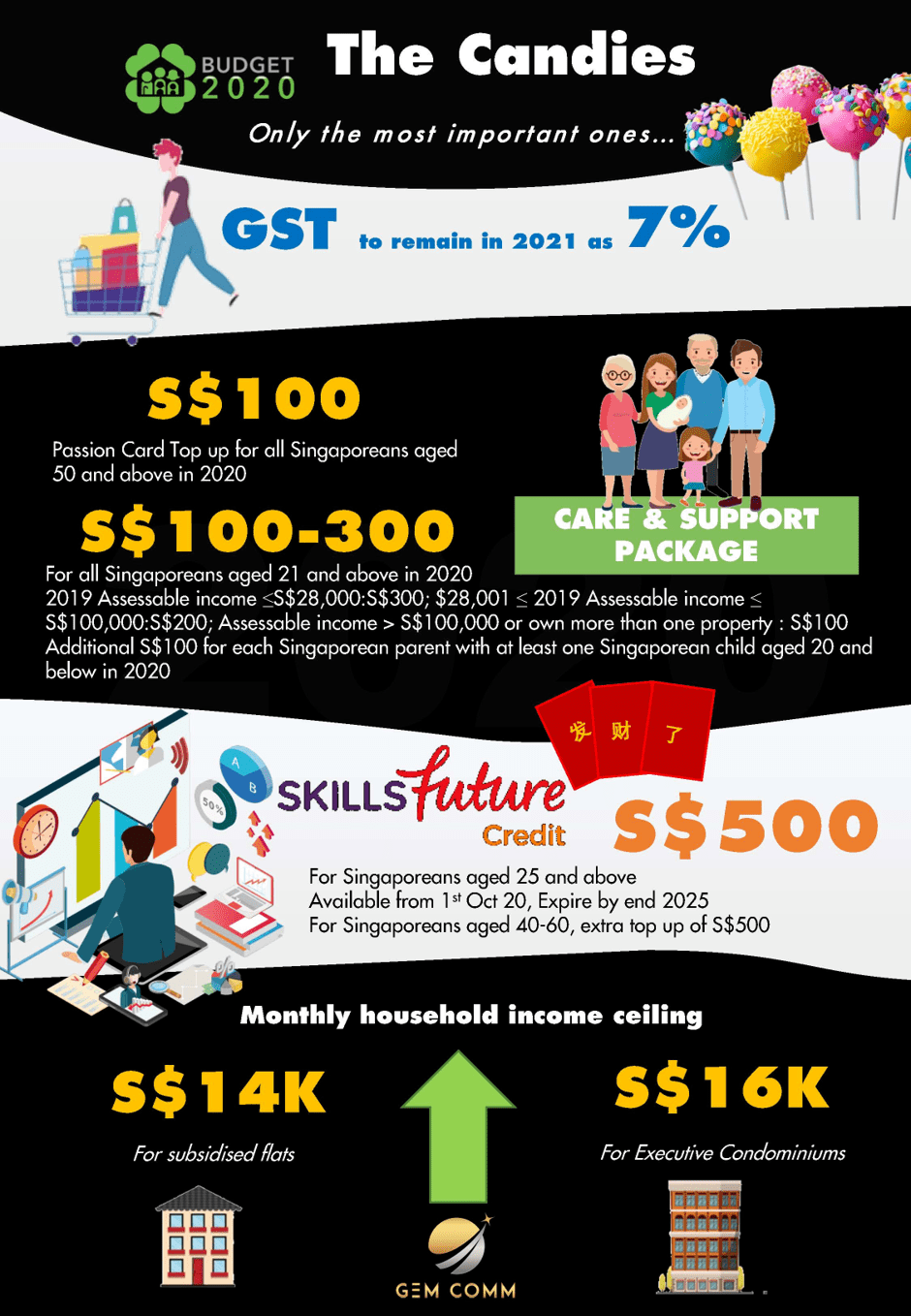

GE 2015 vs 2020 The Government has come up with a generous budget consisting of rebates, bridging loans and cash payouts to help Singaporeans and businesses during these uncertain times.

Sequence of Returns Risk could be your major party pooper Imagine a hard-working individual name John who started saving and investing early and amassed a nest egg of $1m in

Supplementary Retirement Scheme (SRS) Plenty has been written on the Supplementary Retirement Scheme (or SRS for short). This is a voluntary scheme that complements one’s CPF savings for retirement. You

Can we enjoy our Latte and still retire well? If you are like millions of people around the world who spend a $5-6/day, 5 days a week, on a nice