Creating the Best tax Efficient ETF Portfolio to Invest in?

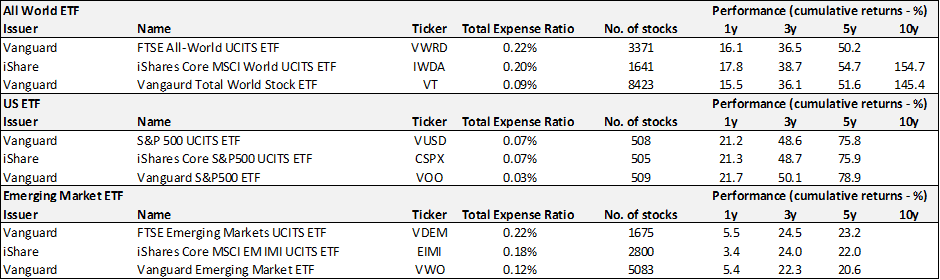

This article looks to identify the best tax efficient ETF portfolio to invest in for Global, US and Emerging Market exposure. For investors who have been engaging a DIY approach

This article looks to identify the best tax efficient ETF portfolio to invest in for Global, US and Emerging Market exposure. For investors who have been engaging a DIY approach

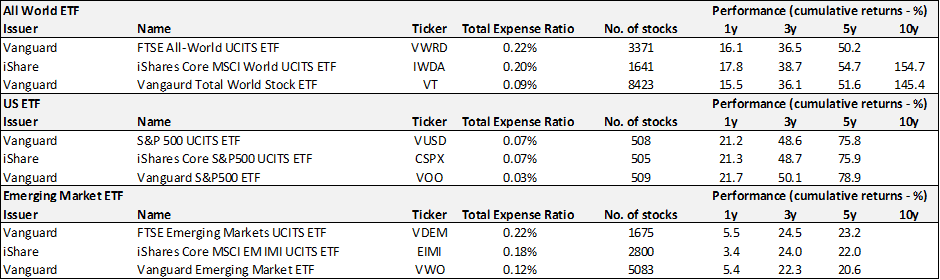

Philip Morris: A SIN stock aiming to do good To some, Philip Morris is considered a “SIN” stock that they will not engage with a 10-foot pole. Well, this is

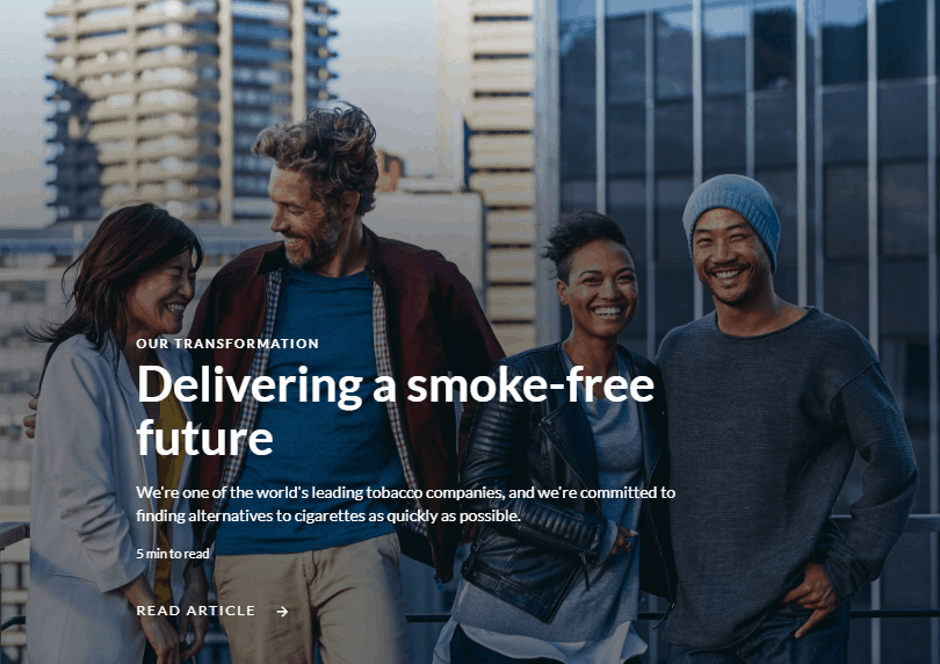

I recently came across an interesting article. This was a Harvard Business Review (HBR) article back in Sep 2019 which identified the Top 20 global companies that have achieved the

I follow this website called TipRanks from time to time when I am running dry of stock ideas. TipRanks is a fintech website that tracks and measures the performance of

We have written in a previous article why a 60:40 equity to bond portfolio composition (Portfolio 1) isn’t the ideal structure for a retirement portfolio using the 4% withdrawal rule.

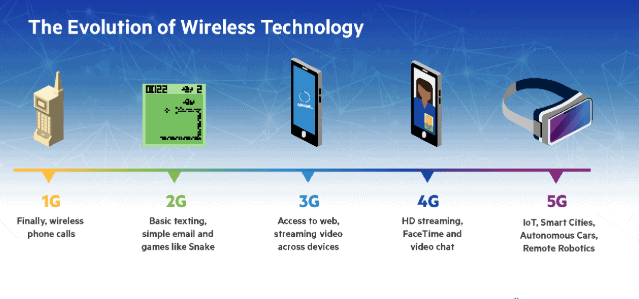

5G evolution is coming. Are you positioned to capitalize? South Korea became the first country in Dec 2018 to offer 5G or what you might term as the fifth-generation mobile

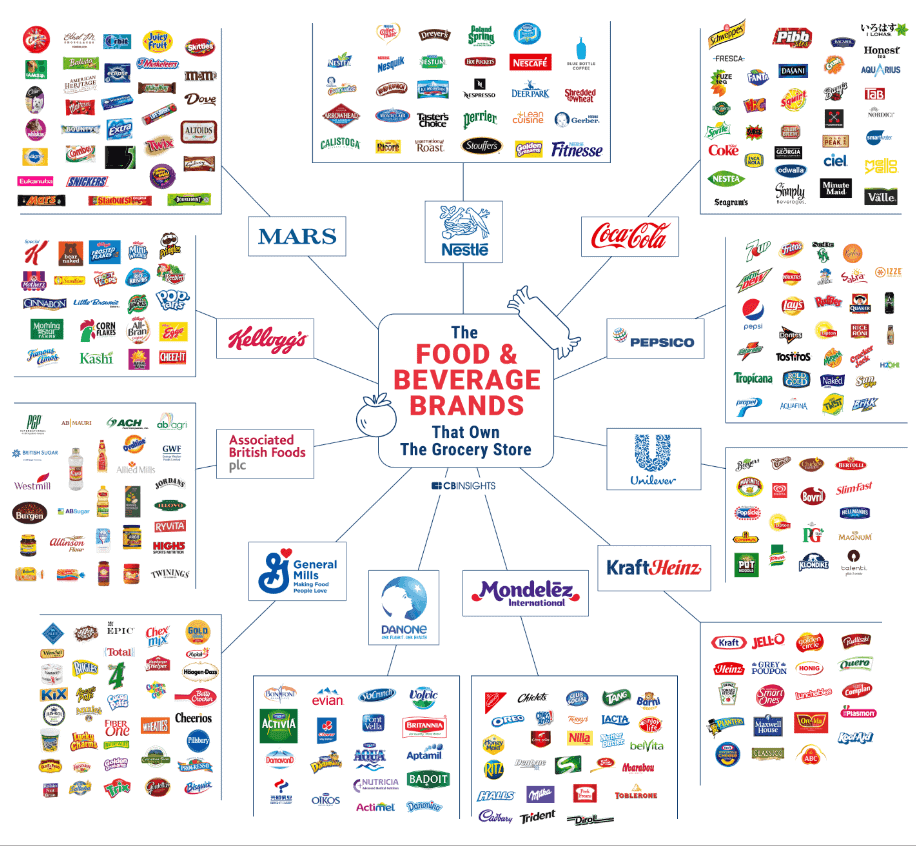

I recently came across this dated study (2017) of “The Food & Beverage Brands That Own The Grocery Store”. While there are plenty of startups pushing forward new food trends,

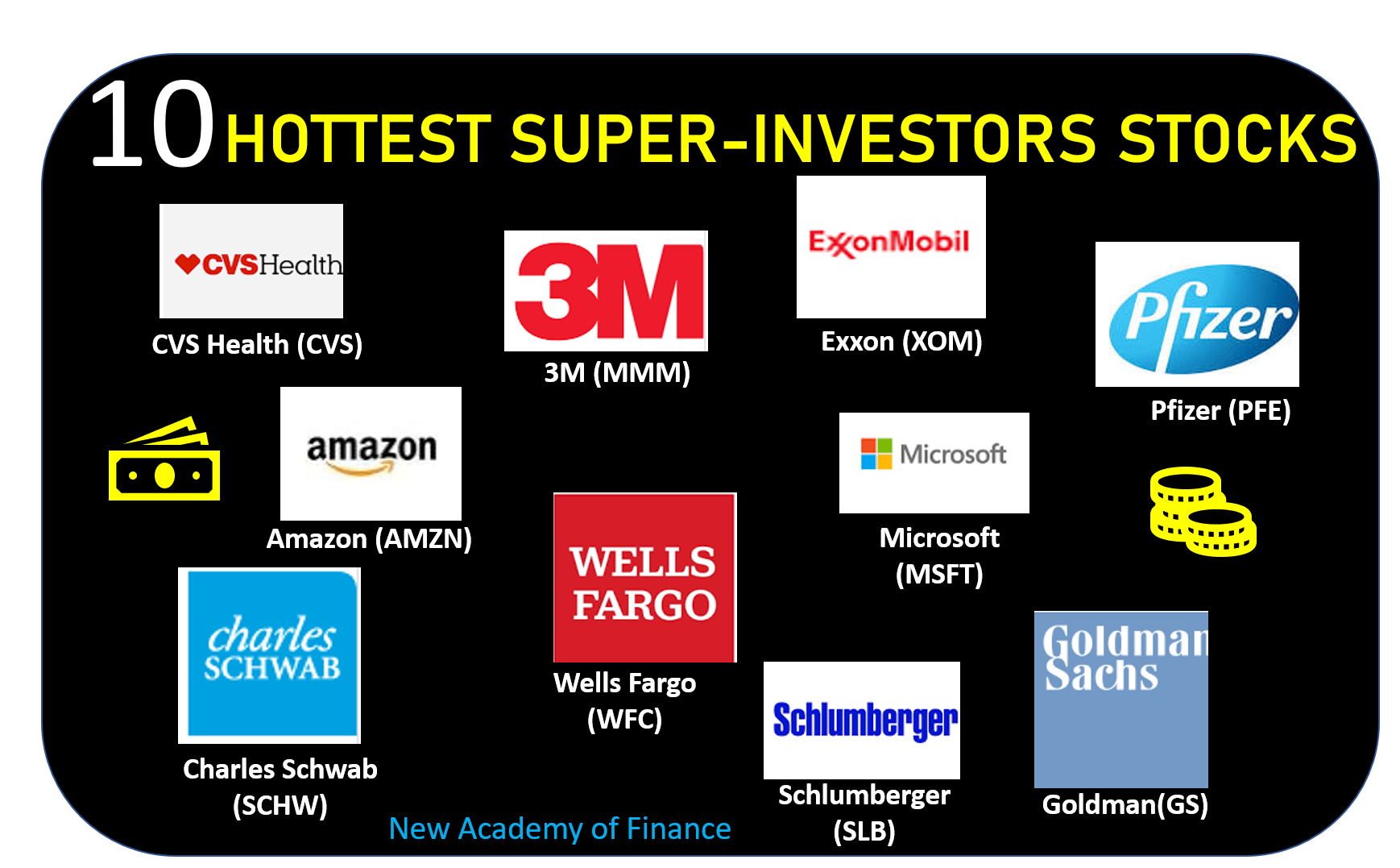

Like any business, the world of investing has its fair share of super stars. These are renowned investors who have achieved sensational results over a long period of time. It’s

A good opportunity or a structural trap? Arista Network’s stock plunged by c.24% after it announced its 3Q19 results. We took the opportunity to enter a small position in the

Recession-proof stocks offer products or services that we simply cannot go without, or that are much more attractive when money is tight, like in a recession. There are however varied

Idexx laboratories: A company trading at 60x PER. Would you buy it? That was the first thought that cross my mind. To be honest, I have got no clue what

Motley Fool has a list of 10 starter stocks which new investors looking to build up a long-term portfolio should seriously consider. You should feel comfortable holding these stocks for

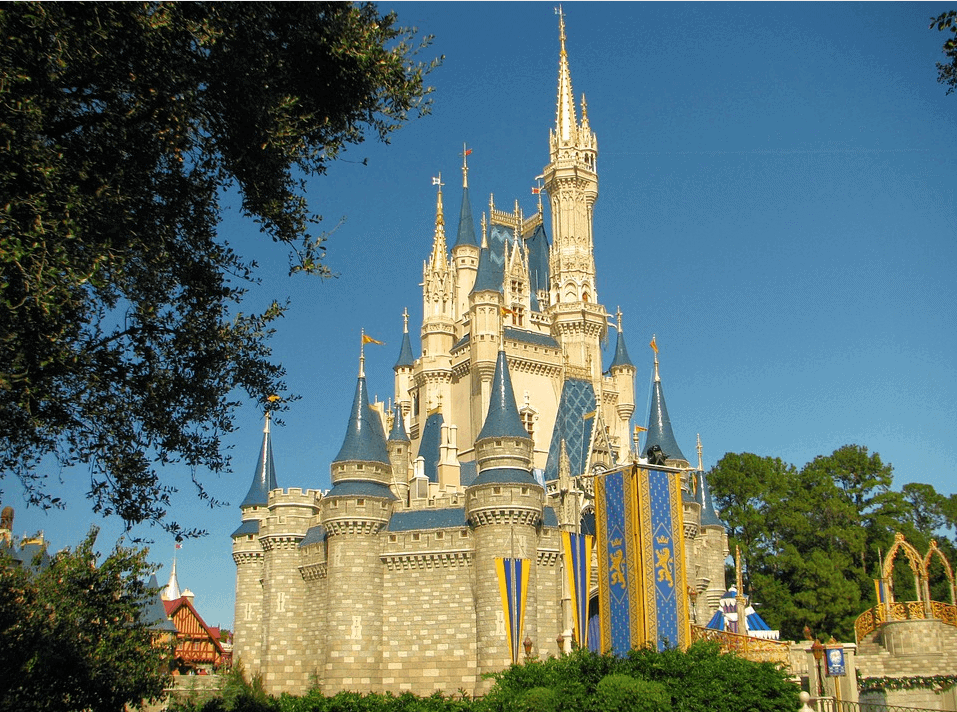

Disney is a household name that is loved by millions of kids and adults alike all over the world. The company is in the business of manufacturing FUN. Yes, Disney

So you want to invest like Warren Buffett? Maybe his current stocks holdings might give you the inspiration. Generations of investors have tried to emulate the “Oracle of Omaha” and