Philip Morris: A SIN stock aiming to do good

To some, Philip Morris is considered a “SIN” stock that they will not engage with a 10-foot pole. Well, this is a cigarette stock that aims to achieve a “smoke-free future”, according to the company’s CEO, Andre Calantzpoulos.

You may be surprised to hear that from the CEO who runs one of the largest tobacco companies in the world. His vision is to have Philip Morris be the largest tobacco company but one that does not sell cigarettes! (more on that later)

Philip Morris’ juicy dividend yield of 5.5% was what caught my attention. However, as a foreign investor (in this case an SG investor), dividend payment by a US company will usually be subjected to a 30% withholding tax. A 5.5% yielding stock will translate to only a 3.9% yielder, not bad but not fantastic.

Well, in the case of Philip Morris, there is NO 30% dividend withholding tax. As an investor, I get ALMOST the full 5.5% dividend yield payment, or to be exact, approx. 99% of that yield.

How is that so?

This is because Philip Morris falls under the special category where it is an 80/20 company. An 80/20 company is a US company where 80% of its gross income for a specified period is generated from active businesses outside the United States.

For those who are not familiar with Philip Morris’ history, it was spin-off from Altria Group back in 2008, with Philip Morris holding the international portfolio while Altria focusing on the US market.

Hence, Philip Morris generates the bulk of its income outside of the US. The company has determined that it qualifies as an 80/20 company for US tax purposes.

As such, Philip Morris has determined that 97% of any dividend it declares in 2018 to a non-US shareholder is exempted from the US withholding tax. The remaining 3% gross dividend is subject to US withholding tax at the 30% statutory rate, in the case of a Singaporean investor.

For example, Philip Morris’s current annual dividend payment is US$4.68/share. For a Singaporean dividend, 97% of this dividend (0.97*$4.68 = $4.54) is withholding tax-free while the remaining 3% ($0.14) is subject to a 30% withholding tax, which means he/she pays a withholding tax amount of $0.04.

So the total dividend received = S$4.64

Total actual dividend received as % of declared = S$4.64/$4.68 = 99%

Merger with Altria has been totally snuffed out

Both Philip Morris and Altria made the spotlight back in late-2019 when the companies confirmed that merger talks between the two companies were ongoing.

That did not sit well with shareholders of Philip Morris as the US market is a highly regulated one. Foreign investors of Philip Morris will also no longer enjoy the 80/20 rule benefit pertaining to dividend payments.

However, in a recent interview with CNBC, Philip Morris CEO said the merger conversation between the global tobacco giant and its domestic counterpart “is finished”. Philip Morris has moved on and the two companies are now focused solely on commercializing the IQOS heat-not-burn tobacco device.

That is good news for Philip Morris, but not so good for Altria, in my view.

Transitioning towards a smoke-free future

When Philip Morris CEO said he wanted to create a smoke-free future, he is referring to his electronic cigarette device that recently got approval to be sold in the US. Its called IQOS, a battery-operated, pen-like device that isn’t a vaping e-cigarette.

It heats tobacco rather than burns it and releases a vapor with the taste of tobacco. The company claims that IQOS has significantly lower levels of harmful chemicals compared to vaping products, with the device aimed at converting adult traditional cigarette-puffing smokers and not one that encourages a higher level of teenage adoption.

IQOS employs a razor-and-blades business model. One where the devices are sold at a low margin to lock in recurring revenue of the higher-margin heated tobacco units termed as Heets.

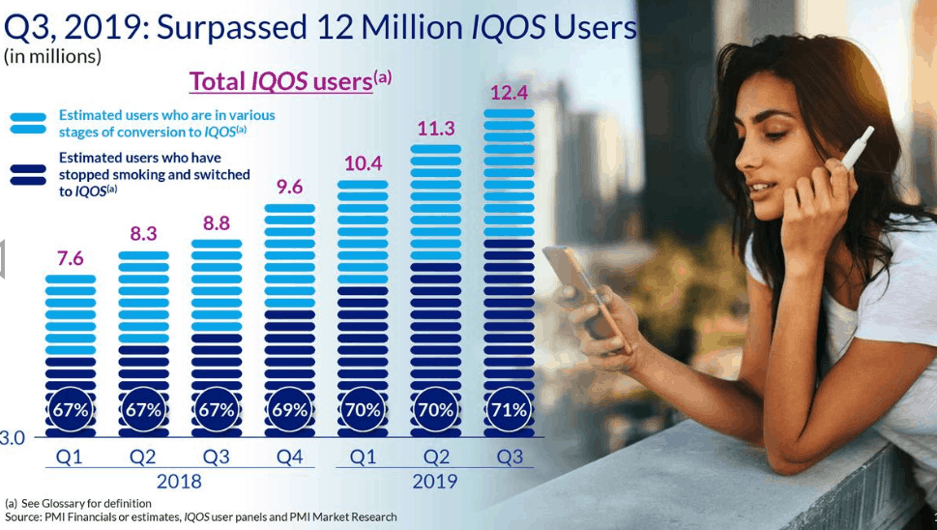

While IQOS is limited for purchase only in Atlanta, Georgia, and Richmond, Virginia in the US, it has been sold in 50 markets outside of the US with more than 12.4 million IQOS users worldwide.

IQOS currently accounts for about 15% of Philip Morris’s net revenue in 2019, with the company’s 2025 goal of deriving 38-42% of its net revenue from smoke-free offerings.

This is not unforeseeable, given that the Reduced-Risk Product (or RRP for short) such as IQOS, only accounts for 4% of global retail value share. Hence there is a massive runway ahead for Philip Morris to continue to execute on its growth strategy.

The company has proactively adapted its business to benefit from the continued rise of cigarette alternatives by reinvesting c.20% of profits into Capex/R&D efforts. This is to ensure that it can maintain a strong position in the nicotine markets of the future.

Key Risks

Governments around the world continue to crack down on tobacco, including bans on marketing, rising taxes and gruesome warning labels on packaging that serve to discourage the usage of cigarettes.

These actions, alongside more smoke-free alternative products becoming available, could put downward pressure on global smoking rates and weaken Philip’s Morris’s brand equity and pricing power.

However, having said that, Philip Morris has done a wonderful job in its R&D efforts, ultimately coming out with its IQOS product which looks like a winner at this current juncture. We believe the growth of its IQOS product is particularly encouraging in Europe and stronger-than-expected growth in this region could well be the key catalyst for the counter in the short-term.

The US is another major market for IQOS, one that is still in its infancy stage. The slow “demise” of vaping products, often seen as a direct competitor to IQOS, could serve to benefit the product in the medium to long-term horizon.

Conclusion

If one is willing to overlook the fact that the company could be in a secular decline “SIN” industry, Philip Morris is a potential high-yield investment for a diversified retirement portfolio.

For Singapore investors, this is one of those rare US counters where you do not need to be concern about withholding tax impact on dividends declared. At 5.5% yield, this is a company that I believe is worthy for consideration in a high-yield portfolio.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

4 thoughts on “Philip Morris: The 5.5% yielder that pays almost ZERO dividend withholding tax”

Hi, great article. Besides Philip Morris, do you know of any other 80/20 companies that are listed on the NYSE? Thanks!

Hi EJL, great question! Unfortunately, I myself am still searching for that list. If i know of any other companies i will update you guys.

Hi EJL,

I just came across this website: https://www.statista.com/chart/11619/the-us-companies-with-the-highest-overseas-earnings/

Potential for these companies to be classified as 80/20. However, most of them do not address the issue of withholding tax on dividends for foreign investors with the exception of PMI.

Likely because they are generally not “dividend” stocks with most only yielding around 1+%, so not very relevant to an investor looking to invest in a high yield US counter.

Many are also in the highly cyclical semiconductor industry

Hi!

Thanks for sharing! Apologies for the late reply, I didn’t know that you replied to me with an update until I just came back to read this article again.

Best Regards,

EJL