Best Stocks for 2021

i will be providing a quick summary of the top picks by Bank of America, which includes the following key segments:

- Best Small-Mid Cap Ideas for 2021

- Media & Cable – Six key themes of growth

- US Semiconductors – Emerging trends in 2021

- Food and Discount Retailers – Entering “Discount Store Decade” Boom

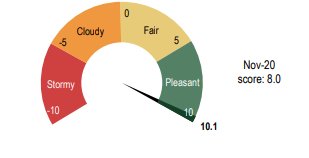

- Renovation Nation – BOA reno barometer soars to 10.1

In each of these key segments, I will also provide the free reports for download.

Best Stocks for 2021: BOA Best Small-Mid Cap Ideas

The focus is on BOA’s buy-rated stocks of at least $1bn in market cap that is also less than $15bn in market cap or falls into one of the major small/mid-cap US benchmarks. The list consists of 31 stocks with an average market cap of $8bn and average implied upside of 19% to their 12-month price objectives.

Recoveries are the best backdrop for stock-picking

BOA suggests that recoveries offer the most alpha opportunity for stock pickers, based on spreads of the best vs. worst-performing small-cap stocks in the four phases of our US Regime Indicator. Valuation dispersion in small caps also remains above average.

Beneficiaries of a Value rotation

Per BOA SMID Cap Year Ahead, they recommend investors tilt toward Value, which typically outperforms both in recoveries (current regime) and the next phase (mid-cycle). Their top ideas have a Value tilt: nearly 80% of the stocks are on the Russell small or mid cap Value benchmarks (vs. half on the Growth benchmarks and one-third on both).

From cyclical recovery/vaccine beneficiaries…

Some of the biggest beneficiaries of the vaccine rollout are consumer stocks, from Foot Locker (FL) –a beneficiary of a rebound in mall traffic plus further stimulus programs to Newell Brands (NWL) – which should benefit from a gradual shift back into offices, schools, etc. In Energy, ChampionX (CHX) should benefit from a recovery in global oil demand.

And in Financials (a top-ranking sector in our small-cap framework), East-West Bancorp (EWBC) offers superior growth and return profile vs. peers but at a discount valuation, with re-rating potential on fading credit risk and a rebounding growth outlook.

…to secular theme beneficiaries in a post-COVID world…

A number of these stocks are well-positioned both in the current backdrop and a post-COVID world. A heightened focus on hygiene/self-care has accelerated the already-strong growth of L Brands’ (LB) Bath & Body Works. In Health Care, Charles River Labs (CRL) is a beneficiary of both COVID (Drug Discovery Services, Toxicology, Biologics Testing) and recovery (Research Models/Svcs., Microbial Solutions), and ongoing personal protective equipment shortages should benefit Owens & Minor (OMI). COVID should also accelerate IT modernization/cybersecurity demand, helping Booz Allen Hamilton (BAH)

…to catalyst-driven names and more

BOA analysts see catalyst-driven opportunities for names from Jazz Pharmaceuticals (JAZZ – new product launches) to NRG (NRG – pivot from independent power producer to retail energy-backed consumer product co.) and more. And as ESG continues to gain traction, stocks focused on environmental services like AECOM (ACM) should benefit.

Best Stocks for 2021: BOA Media & Cable

Six themes for 2021

BOA anticipate six key themes will impact our Media & Cable (M&C) coverage in the year ahead, incl.: (1) accelerating direct-to-consumer (DTC) offerings, (2) normalized, but still robust broadband growth, (3) rising value of sports rights and emerging sports betting opportunities, (4) cont. strength in streaming music, (5) return of live attendance at theaters, events, and theme parks, (6) M&A, increased regulation, and higher corp. taxes.

Video: hindsight is 2020, full-stream ahead

BOA expect major new streaming competition to materialize for large incumbents such as NFLX, with the majority of U.S. streaming growth to be driven by relatively new or rebranded services such as DIS’ Disney+, CMCSA’s Peacock, Warner Media’s HBO Max, VIAC’s Paramount+, DISCA’s discovery+ and more as traditional media companies aggressively pivot to DTC driven business models and ramp up content spend.

Broadband: accelerated by COVID, but runway remains

There will likely be at least some return to normalization in 2021 w/ workers returning to their offices and schools returning to in-class instruction, however, in many cases, there will also be a new normal. Cable operators are major beneficiaries due to their leading position in the last mile with fiber competition limited to roughly 30% of the country at YE2020 and potentially competitive 5G home offerings still in early development.

Sports: DEF wins championships, new playbooks emerge

Sports are one of the only defensible content sources left in a fragmenting media ecosystem, bolstered by the legalization of sports betting. The next cycle of NFL rights will be decided in early 2021, with Sunday package incumbents (FOXA, VIAC, and CMCSA) well-positioned to continue their NFL partnerships into the next decade likely at 1.5-2.0x cost of previous contracts (with new digital rights likely included), while potential DIS participation/ expansion out of Monday Night could be the biggest swing factor.

Music: streaming provides attractive growth

Usage is gradually evolving towards digital and a multitude of secular tailwinds have emerged for the music industry – driving our bullish stance on both music distribution and music labels. In general, BOA is positive on the global music business given its evergreen appeal and attractive exposure to rising streaming consumption trends.

Theaters in Uncharted territory, return of live

BOA anticipate that pent up consumer demand could drive a potential return to normalization of theatrical movie-going (aided by a strong backlog of films) in late 2021/2022, followed by theme parks and large live events (pending vaccine distribution).

Regulation/M&A

Increased regulation, including Title II, and a shift towards higher corporate taxes are likely outcomes from recent US elections. We also expect media M&A to remain in focus as the evolving video/content landscape intensifies focus on an increased scale.

Best Stocks for 2021: BOA US Semiconductor

Drama on and off the floor at CES

The SOX index has surged 7% in just the first two weeks (vs. SPX up 30bps), driven by crucial events that could shake-up semi stock positioning for the year ahead, including 1) CEO change at INTC (impacts AMD, future of US semi manufacturing); 2) Unexpected 54% YoY Capex boost by TSMC (big boost for our top group Semicaps + portends strong ’21 for semis); 3) From “Just-in-Time” to “Just-in-Case” – widespread supply constraints,

esp. in auto chips (limits 1H upside for some cyclical semis); 4) Rise in interest rates and excitement in auto/EV at the annual Consumer Electronics Show (CES) driving up 10%+ YTD returns in selected SMid-cap cap semis (CRUS, IIVI, AMBA, LITE, CREE, ON, MTSI); and 5) Anticipation of new tax/China policies from incoming US administration.

INTC: CEO change only meets half the challenge

BOA like INTC’s appointment of industry veteran Pat Gelsinger to enhance technical depth among the top ranks. The involvement of an activist investor; robust PC market; Q4 positive preannouncement; new 10nm CES product announcements; and promise of 7nm improvements also justify the 16% YTD stock move. However, BOA remain Underperform on the stock since the CEO change is unlikely to reverse market share leakage to AMD; to new non-CPU building blocks including accelerators and DPUs; and to alternative ARM-based internal chip designs from customers such as Apple and Amazon. Any manufacturing fixes (such as outsourcing partially to TSMC) are unlikely to produce results till late 22/20203, or help GM/OM/capex for the next ~2 years, in our view.

TSMC capex boost, chip shortages = Semicap preference

BOA reiterate our strong preference for the industry “arms dealers”, the semicap equipment stocks AMAT, KLAC, LRCX and TER that are solidly positioned to capture the unexpected 50%+ YoY boost in CY21 capex by TSMC; the doubling YoY of capex by GlobalFoundries; and the continued industrywide supply tightness at both leading and

lagging edge nodes. Semicaps also benefit from INTC’s desire to maintain its internal manufacturing, and the trend towards greater onshoring of semi production globally

Auto chip shortages limit 1H upside, l-t trends solid

With auto production expected to sharply rebound in CY21, growing 10%-15% YoY, several vendors highlighted chip shortages, with lead-times extended upwards of 9mo+. Given tight capacity, several vendors acknowledged potential price hikes on customers (incl. NXPI, MCHP), passing through costs. BOA believes industry price hikes could deter customers from potentially over-ordering. L-t, capacity additions and dissipating COVID19 headwinds should ease constraints, with EVs (~2% of mkt) and growing infotainment, safety, and ADAS apps driving auto semi growth well above SAAR for several years.

YTD Tops: SMid-caps and Semicaps off to strong 2021

Its early days, but the first two weeks of the new year are showing a strong investor preference for Semicap and SMidcap semis, with Top 5 YTD returns at: CRUS (20%), AMAT (19.5%), KLAC (17.5%), IIVI (15.9%) and LRCX (15.9%). The bottom 5 include many of last year’s strong outperformers including AMD (-3.8%), NVDA (-1.5%), CDNS (- 1.3%), SWKS (-0.6%) and SNPS (-0.1%), impacted by rising rates that appears to be near-term rotating investor flows out of higher PE, more “secular growth” stocks.

Best Stocks for 2021: BOA Food and Discount Retail

Discounters best positioned for tough comparisons

Food & Discount Retailers were COVID-19 winners in 2020 on the dramatic shift to “at Home” related consumption that drove unprecedented grocery sales as well as strength in household, electronic, outdoor, home exercise & solitary leisure general merchandise. 2021 will be a year of tough comparisons that begins with the cycling of LY’s peak grocery stockpiling in March.

However, the large Discounters (WMT & TGT) & Warehouse Clubs (COST & BJ) have several advantages vs. the grocers, including 1) the y/y shift in sales mix back to general merchandise (from grocery) should be a gross margin tailwind, 2) impressive mobile app engagement, usage of pick-up/delivery & new membership growth should be very “sticky” and could support strong market share gains for WMT, TGT, COST & BJ in 2021, 3) accelerated digital penetration & efficiencies achieved in 2020 support the outlook for Omni-channel profitability, with additional benefits as COVID related expenses roll-off, and 4) the low-price leadership maintained by WMT, TGT, COST & BJ through the highly inflationary grocery environment in 2020 implies fewer sales risk of item deflation and margin pressures at WMT, TGT, COST & BJ vs. the Food Retailers and Dollar Stores as grocery promos continues to normalize.

“Discount Store Decade” moving into “Boom” years

Beyond the expected benefits of gov’t stimulus in 1H21 (see Exhibit 39), data points also suggest a boom environment for Discount Stores should continue, given strong new home sales (which correlate with WMT & TGT’s US sales), continued competitor store closings, impressive digital growth (+100%+ y/y at TGT in Nov./Dec.), alternative profit stream momentum (particularly at WMT), and signs of accelerating demographic drivers

as Millennials (those born between 1981-1994) entering household formation years may now also drive a baby boom beginning in 2021 (see Exhibit 23).

In addition, credit card debt per household has stagnated for more than a decade since peaking in 2008 (Exhibit 30) and the Financial Obligations Ratio (FOR) is extremely depressed vs historical averages, implying a highly unlevered consumer that is positioned to dramatically increase big-ticket & overall spending over the next several years, similar to the post FOR bottoms in 1983 and 1993 that were followed by elevated 3 yr. CAGRs of Total US Retail Sales of 7.5% & 6.5%, respectively (see Exhibit 32)

Stock-up comparisons, minimum wage & migration risks

We expect investors to look through continued near-term strength in Food-at-Home trends due to the virus and focus on the expected negative grocery same-store sales that should begin as the industry cycles COVID-19 stockpiling comparisons in late March.

This should be a major headwind for the Food Retailers (KR, ACI, SFM, & GO) and should also impact the Dollar Stores (DG & DLTR) more than the large Discounters that have broader general merchandise offerings. A federal minimum wage increase to $15 would negatively impact DG & DLTR the most from an expense standpoint as TGT & COST are already at a $15 starting wage and WMT is at $11.

However, the Dollar Stores would likely see stronger low-income customer spending and also have the highest exposure to the States with the most favorable migration trends (see Exhibit 15), while BJ & GO have the highest exposure to States seeing the most outbound migration.

Best Stocks for 2021: BOA Renovation Nation

Home improvement environment remains very strong

The BoA RENO barometer score for December ’20 soared to a score of 10.1 from November’s score of 8.0 (revised), remaining predominantly driven by strong Real-time spending trends. This was the highest-scoring category of the RENO barometer in December, coming in at 19.9, although all four categories improved versus November.

The Economic drivers score of 9.5 and National household financial health measures score of 3.5 mitigated the unfavorable Opinions on housing score of -16.2. Recall that the Opinions on housing score uses inputs from six months prior as a leading sentiment indicator.

Since BOA already knew that sentiment in June (six months ago) was still incredibly weak, this particular component of the RENO barometer was expected to weigh on the overall score, but the strength in the other three components was enough to offset. See Page 2 for a detailed breakdown of the RENO barometer components and Page 7 for scoring methodology.

Raising price objectives on stronger-than-expected data

As November and December spending in home improvement categories has come in stronger than expected, BOA is raising estimates and price objectives for retailers in home improvement categories. For Buy-rated Home Depot (HD), which BOA included in their Top Picks for 2021, they raise their 4Q same-store sales growth (comp) estimate to 19% from 17% (consensus 17%) and raise their price objective to $355 from $350.

For Buy-rated Lowe’s (LOW), which recently held an encouraging investor day event, they raise their 4Q comp estimate to 20% from 18% (consensus 16%) and raise their price objective to $215 from $212. Their 4Q comp forecast for Buy-rated Floor & Décor (FND) goes to 17% from 15% (consensus 14.5%), and they raise their price objective to $110 from $105.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 1Q 2020 TOP HEDGE FUND LETTERS TO SHAREHOLDERS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.