Best performing Singapore Blue-Chip Stocks

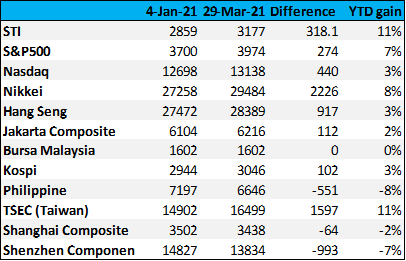

The Straits Times Index has been one of the best performing indices of late, with the index currently trading near its all-time high mark of 3,183. On a YTD basis, the STI currently ranks Joint 1 (with Taiwan) as one of the best-performing stock market indices in the region.

This might come as a surprise to some, given that our local market has been a major laggard over the past decade.

The key reason for this outperformance of late might be the fact that the Straits Times Index (STI) comprises mainly of banks as its main index components and the recent rise in long-term US yields is seen as a boon for bank stocks.

On the other hand, indices that comprise more of technology stocks such as the Nasdaq, Hang Seng, and Shenzhen Component have fared relatively poorly thus far in 2021.

So, which are the Singapore blue-chip stocks that have performed the best in 1Q21, and can their outperformance continue for the rest of the year?

We detail the Top 10 best-performing Singapore Blue-Chip stocks for 1Q21. These stocks are screened based on them having a market cap in excess of SGD$5bn (performance from 1 Jan 2021 – 30 Mar 2021)

Best Performing Singapore Blue-Chip Stock #10: DBS Group

DBS group comes in at #10 with a YTD performance of +13.6%. DBS currently ranks as the largest market cap company in Singapore.

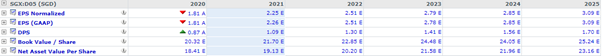

According to Capital IQ estimate, the company is likely to grow its EPS over the coming years, based on a consensus estimate.

The street is generally positive on DBS, with a consensus Outperform rating on the counter, with a street high target price of $33 and a street low target price of $24.

DBS is currently benefiting from the positive sentiments of rising interest rates which tends to favor banks as they are now able to charge higher interest rates for bank borrowings.

While there remain concerns over the strength of the Singapore economy, the current market consensus is towards a strong rebound in economic activity in 2021 and that the recession we had back in 2020 is now a thing of the past, with a recent MAS survey showing that the nation might be growing 5.8% in 2021.

One particular risk would be solvency problems for corporations. Many studies show that as economies start to recover from crisis, solvency problems often become more, not less, serious and this is also likely during the post-COVID-19 recovery.

Best Performing Singapore Blue-Chip Stock #09: Jardine Cycle & Carriage

Jardine Cycle & Carriage or more commonly known as Jardine C&C is the #9 best-performing blue-chip stock in Singapore for YTD 2021, with a YTD return of +15.6%.

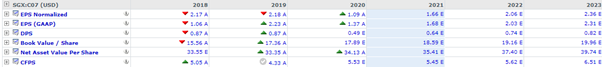

According to Capital IQ estimate, the company’s EPS is expected to rebound very strongly in 2021, after a substantial decline in 2020 as a result of COVID-19. However, 2020 EPS is likely to be below 2018/19 levels.

The company looks to still be in the early stage of a rebound although the recovery in the automobile industry remains a major uncertainty at the moment. The company recently made an unconditional voluntary buyout offer of Bursa Listed Cycle & Carriage Bintang (CCB), a Mercedes-Benz dealer with a network of 12 outlets in Malaysia.

Best Performing Singapore Blue-Chip Stock #08: OCBC

OCBC is the #8 best-performing Singapore blue-chip stock in 2021 thus far, with a return of +17.3%. Similar to DBS, the counter has been a key beneficiary of positive sentiments stemming from rising interest rates.

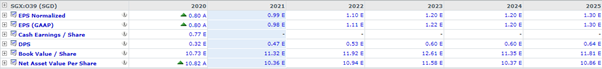

According to Capital IQ, the company could see EPS rising from $0.80 to $0.99 in 2021. Based on its current share price of $11.83, that is a forward PER of approx. 12x.

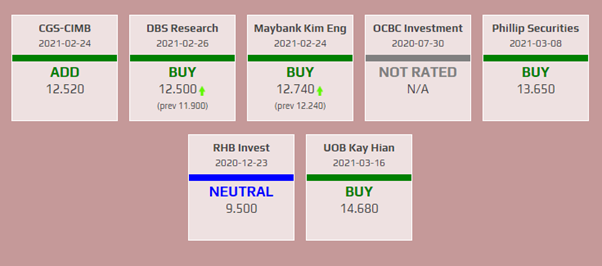

The street remains relatively positive on OCBC, with the average target price around the $12.50 region, implying a c.6% upside from the current level. There might be further upside momentum if OCBC can breach its short-term resistance level of $12/share, after which it could look to test its all-time high level of $13.80 set back in 2018.

Best Performing Singapore Blue-Chip Stock #07: Hong Kong Land Holdings

Hongkong Land Holdings appreciated by +17.7% YTD 2021, making it the 7th best Singapore blue-chip performer in 2021.

The counter is one of those “boring” and “undervalued” property developer counters that have been a laggard for the past decade. 2020 has been a challenging year for Hongkong Land, with the company recently announcing plunging profits due to the direct impact of COVID-19 where its properties now command much lower valuations, resulting in a loss attributable to shareholders of more than $2.6bn for 2020.

Nonetheless, its share price has been on an uptrend since bottoming out in late 2020 and that momentum could continue as the HK property market recovers from the impact of COVID.

There are market rumours that Hongkong Land might be the next privatisation candidate by the Jardine Group, with the latter recently announcing the privatisation of Jardine Strategic.

Best Performing Singapore Blue-Chip Stock #06: Jardine Matheson Holdings

Jardine Matheson Holdings saw its share price appreciating by +18% in 2021, making it’s the 6th best performing Singapore blue-chip counter in 2021.

The company is essentially a holding company, with an 85% interest in Jardine Strategic. Most of its investments are held through Jardine Strategic (Hongkong Land, Dairy Farm, Mandarin Oriental, etc)

The company recently announced that it will be taking Jardine Strategic private by purchasing the remaining 15% stake that it does not already own at an offer price of US$33/share. The company highlighted that it has no intention of raising its offer price, although the offer price has been criticized for being a “lowball” offer.

If the privatization offer is to be successful, this might mean that Jardine Matheson might have gotten a “good deal” through this offer. While shareholders are unlikely to see further “upside” in Jardine Strategic, those with a longer-term horizon might wish to partake in a stake in Jardine Matheson.

Best Performing Singapore Blue-Chip Stock #05: Wilmar Holdings

Wilmar’s share price has appreciated by +18% in 2021, making it the 5th best performing Singapore blue-chip stock in 2021.

Wilmar has been a personal favorite stock and I have blogged about it several times over the past months. While the listing of its China subsidiary no longer counts as a catalyst moving forward, the company remains a potential beneficiary of strong palm oil prices ahead.

The company is also looking to list its 50% owned Indian joint venture, Adani Wilmar, ahead which will allow the company to unlock value for shareholders should it decide to sell down some of its existing stake in the JV post the listing and reward investors with special dividends.

Additional Reading: 4 SG Momentum Stocks to buy into 2021

Best Performing Singapore Blue-Chip Stock #04: CapitaLand Limited

CapitaLand’s share price appreciation of +18.1% YTD made it the 4th best performing Singapore blue-chip stock in 2021.

The bulk of the gain was realized last week when the company announced that it will be undergoing a major restructuring plan to consolidate its fund management and lodging business into a new entity and take its property development business private.

Before that, the company’s share price has been relatively lackluster.

This might just be the news catalyst to help the company break out of a “sideway” market over the past decade, with its share price hovering between $2 and $4/share for the majority of the past 10 years.

The proposal to split itself into two is meant to sharpen the group’s focus on strategic growth and value creation for shareholders.

While the street is generally positive of this move undertaken by CapitaLand, it remains to be seen if such a restructuring can be transitioned smoothly and if the long-term outlook of the newly listed CapitaLand Investment Management (CLIM) is indeed a better one compared to the development-focused CapitaLand.

Best Performing Singapore Blue-Chip Stock #03: Olam International

A surprise candidate in this list, Olam is the 3rd best blue-chip Singapore stock in 2021, appreciating by +18.6% YTD.

The company is likely a beneficiary of rising soft commodity prices globally.

The breach above the key resistance level of $1.62/share is a positive signal for the counter, with the momentum potentially driving the share to the next resistance level of $1.90.

According to the TGPS system, there was a positive entry at $1.67/share. Traders might want to take a closer look at Olam for further price appreciation upside.

Soft commodity prices are expected to remain strong due to a combination of adverse weather affecting crop supply + hoarding of soft commodities + easy money speculation.

Best Performing Singapore Blue-Chip Stock #02: Singapore Airlines

Singapore Airlines is the 2nd best performing Singapore blue-chip stock, appreciating by a “mouth-watering” +30% in 2021 while the travel industry is still pretty much in lockdown mode.

This is something that I cannot reconcile with and admittedly have missed out on the strongest rally seen in its share price over the past decade.

From facing cash flow issues to becoming one of the best performing Singapore-listed stock in recent months, the turnaround in fortunes seen in SIA is indeed spectacular.

Based on its split-adjusted price, the company is now trading at a level last seen back in 2011.

How are its CURRENT fundamentals stronger than back in 2018 to justify the much higher share price that it is trading now?

While the company is now a lower-geared entity after the capitalization, that in itself is no reason why its share price should be at current levels unless the market foresees travel demand to come “roaring” back in the foreseeable future?

Nonetheless, shareholders who have stuck with SIA during the dark days of 2020 have been aptly rewarded thus far. Unfortunately, I wasn’t one of them.

Best Performing Singapore Blue-Chip Stock #01: Jardine Strategic Holdings

The honor of the #1 best performing Singapore blue-chip stock belongs to Jardine Strategic, with a YTD price appreciation of 34.1%.

In total, we have 4 Jardine-related entities in this list, with Jardine Strategic also holding a significant stake in Hong Kong Land.

The announcement by Jardine Matheson to take Jardine Strategic private through the acquisition of its remaining 15% stake likely took the market by surprise. Nonetheless, minority shareholders in Jardine Strategic believed that the offer price of US$33/share is a low-ball one.

However, the deal is structured in such a way that minority shareholders do not have the final say in the privatization deal and Jardine Matheson has publicly announced it has no intention to raise its offer price.

There might, however, still be upside potential for the share price, which is currently trading slightly above US$33/share. Dissenting minority shareholders have taken legal action to have Jardine Strategic’s fair value be appraised in Bermuda and if the Bermuda court appraised that the company’s fair value is greater than US$33/share, then the acquirer will need to pay shareholders the difference between the appraised value and the acquisition price within a month of the court’s decision.

Conclusion

This is the top 10 best-performing Singapore blue-chip stocks in 2021 thus far.

Among the stocks in this list, I favor Wilmar as a counter supported by strong fundamentals for further upside.

My trading list will include Olam and the 2 banks (DBS and OCBC, both of which are looking to breach their key resistant level).

The upside potential of Jardine Strategic, the best performing Singapore blue-chip stock, might be more limited from hereon if there is no revision in the takeover offer made by Matheson.

While SIA’s price momentum has been incredibly strong of late, the key reason for its share price outperformance remains a mystery to me. Are fundamentals of the travel industry so robust ahead that justify SIA’s share price performance to be at “record” levels or is it just “fluff”? This is a stock that I will likely continue to avoid (both on the long and short side) in the near future.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Beginners Guide to CryptoCurrencies and how to get started in 2021?

- The Untold Secret To The Best Time To Invest

- Invest or Save? 5 Compelling Reasons Why You Should Invest Instead Of Save

- How to prepare for a bear market. A simple 3-steps process

- Thematic ETFs partaking in the hottest trends

- Decoding Basic Investing terms: A Beginner’s Guide (Part 2)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.