Best Time to Invest: A surprisingly simple answer.

For decades, aspiring investors have struggled with this question: when is the best time to invest?

Statistics show that people typically start investing in their 30s, but is that really the best age to take the plunge? Or better yet, is there a best age to begin with?

If age is not the defining factor, then what is? Should you jump on the bandwagon during a market upturn, or wait for the perfect opportunity of a dip to enter at a discount? What if you buy right before a crash?

In this article, we will reveal the truth behind these puzzling questions.

The short answer: start investing now.

That means no matter what age you are – 20 or 25; 30 or 40 – or whether the market is down or up; turbulent or steady, the only good time to invest was last year.

Here’s why.

The Script Is Never The Same

In Shakespeare’s comedy As You Like It, the melancholy Jaques spoke this famous line: “All the world’s a stage, And all the men and women merely players.”

If the stock market was a stage, and you were one of the audience watching the play every night, you will be considerably entertained. The script of the market changes every day, upholding its promise to never bore its spectator.

But as one of the players on that stage, you will be frustrated beyond doubt. The irrationality of the market makes it near-impossible to predict its performance today or tomorrow – and that goes for the experts. Trying to find the perfect time to enter will only drive you mad.

“Market timing leads to emotional trading and, all too often, portfolio-crushing mistakes that diminish retirement investment returns,” explained investing legend Professor Burton Malkiel.

Emotional-fuelled trading is known as “animal spirits”, a term coined by famous British economist John Maynard Keynes.

The Perils Of “Animal Spirits”

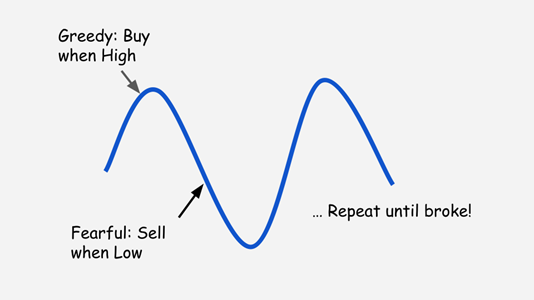

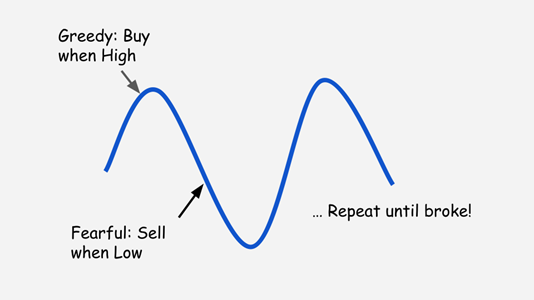

All human beings are, to a certain extent, slaves to our emotions. Particularly when it comes to managing our finances among the volatile market, the worst of our emotions such as greed and fear can take charge over rational planning.

Here is a joke that exemplifies this idea:

What the individual investor thinks she is doing when market timing: make smart maneuvers in and out of the market, avoiding losses before they happen, and swooping in at the bottom to buy the dip.

What she is actually doing: put money in the market when optimism is high, and sell in a frenzy at any sign of pessimism.

This strategy is not only memeable – it is also dangerous.

Market timing can work? An illustration will prove otherwise

At the height of the dot-com bubble (first quarter of 2000), it was recorded that more money flowed into the stock market than ever before. Euphoria drew investors to purchase Internet stocks and funds that managed Internet stocks.

When it all came down crashing, in 2002 and early 2003, the bulk of the investors decided they were finally done with holding the stocks. The mounting fear of an unceasing fall led investors to relent and sell. It was then the money flowed out, right at the bottom of the market, precisely when it should not have come out.

If that case study was not enough to convince you, perhaps a recollection of what happened during the 2008 Global Financial Crisis will.

From the third quarter of 2008 to the beginning of 2009, at the peak of the financial crisis, billions of dollars flowed out of US equities. Investors were panicking and taking out money by the droves. In hindsight, it was evident from the subsequent 10-year bull-market run that that was exactly when they should have been putting money in.

Pattern sounds familiar?

In short, our advice to the average investor is to not try and time your entry into the market. By and large, emotions will get in the way of decision-making, and even with a completely objective and rational mind, it is still difficult to predict market trends in the near future.

But what if I invest right before a dip?

If you have a lingering fear that you will invest right before a market crash, you are not alone. When the stock market is at an all-time high, it is natural for people to wish to protect their “nest eggs” from the possibility of a severe market correction.

That fear of the unknown is what keeps most wannabe investors “grounded”, never entering the market because they are still waiting for the stock market to crash before they start investing.

Additional Reading: 3 reasons why you should not be waiting for the stock market to crash and what you should be doing instead

So what if you only invested at market peaks?

Perhaps this table will give you some reassurance. Below is a compilation of returns from investing at the peak of the market right before a crash

The results speak for themselves. In the short term, there were definitely some lean times, especially in the aftermath of the Great Depression. But after just 10 years, virtually all the investments have seen positive returns. In 20 years, they are making significant gains up to 1288.0%.

This is great news for long-term buy-and-hold investors. While there are no guarantees in the short run, if you have a long enough time horizon and are willing to be patient, you should have minimal fear of investing in the stock market.

Time In The Market Is More Important Than Timing The Market

Obsessing over “what’s going to happen next” in the stock market is not an investment strategy – it is a chore – and a thankless one at that. The truth is, the time you spend on all that speculation and guesswork is better used to take a position in the market and let compounding do the work for you.

When you start investing is not as important as how long you stay invested. And that is a tip to remember in the COVID-19 pandemic, too.

There are three main reasons why this old adage is still widespread advice even today.

Reason 1: The Magic of Compound Interest

There really is no “magic crystal ball” that can help us see the future of the market. But there is a fair share of academic research that shows us that holding a well-diversified portfolio that is rebalanced over time provides the best opportunity for investors to capture the greatest gains in the long term.

In other words, the best way to build wealth is to stay invested. This allows for the surest magic – the magic of compound interest – to take effect.

It is the compounding, exponential growth over time that will help you hit your financial or retirement goals. To rest easy, enter early.

Additional Reading: Let the Power of Compound Interest help you reach millionaire status

Reason 2: Market Timing Rarely Pays Off

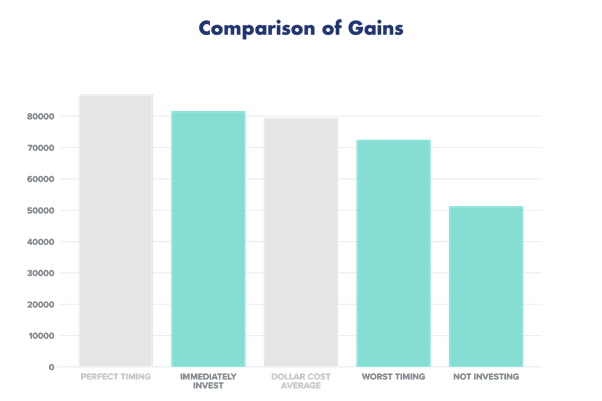

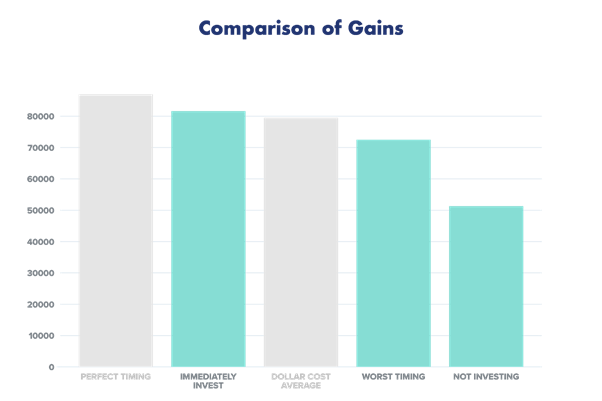

Don’t just take our word for it. Consider this simple comparison between 5 investors, each with different investing styles. The hypothetical investors each received $2000 at the start of every year for 20 years, from 1993 to 2013. Here is what’s left in their accounts by 2013:

The examples are hypothetical and provided for illustrative purposes only. The individual who never bought stocks in the example invested in the lbbotson U.S. 30-day Treasury Bill Index.Past performance is no guarantee of future results. Dividends and interest are assumed to have been reinvested, and the examples do not reflect the effects of taxes, expenses, or fees.

Taking a closer look at the results, it is clear that the investor who invested the $2,000 in the market at the earliest possible moment (IMMEDIATELY INVEST) was the ultimate winner.

Note: There is no record of consistent perfect timing for 20 years. The first investor’s gains are purely hypothetical.

Ironically, it is also the easiest strategy (apart from not investing). Trying to time the market awkwardly rarely pays off. You get it right sometimes, but there are bound to be mistakes and slip-ups that will weigh down on your overall returns.

Another point of interest is that the investor who bought in at the absolute worst timings of each year, for 20 years straight, ended up with a 50% greater return than the person who only dabbled in cash investments (NOT INVESTING).

The conclusion of this study is this:

Investing immediately > dollar-cost averaging > market timing > not investing

(So if you are insistent on timing your entrances, go ahead. Just remember to actually put your money in and not procrastinate – you can still make decent gains in the long term. Even bad market timing beats inertia.)

Reason 3: Risk of missing out on crucial gains

When you are trying to time the market, you may do two things:

1. Wait for the best moment to buy

2. Sell when market volatility is too high

In both cases, your money is out of the market. This is dangerous, as you run the risk of missing out on the best-performing cycles if the stock market surges upwards.

The Bank of America did a recent study which confirmed this theory. They examined the gains of a $1,000 investment in the S&P 500 from 1989 to 2018.

- Scenario 1: The investor implements a buy and hold strategy.

- Scenario 2: The investor pulls their money out of the market and misses the 10 best performing months.

- Scenario 3: The investor pulls their money out of the market and misses the 20 best performing months.

The results demonstrate the risk of market timing:

- The buy-and-hold investor reaped a 1,631% return on investment.

- The investor who missed the 10 best performing months finished with a 596% return on investment.

- The investor who missed the 20 best performing months got a 233 % return on investment.

In a nutshell, it may be riskier to not invest than to invest at a bad time.

Consider Dollar-Cost Averaging as an Alternative

The water is fine, but wade in slowly.

If you lack the means, or stomach, to invest your lump sum all at once, consider investing smaller amounts periodically. This idea, known as dollar-cost averaging, is one of the best strategies to help you remain calm and stay invested during periods of volatility.

Remember this example? The investor who employed the strategy of dollar-cost averaging divided her annual $2,000 allotment into 12 portions, which she invested at the beginning of each month.

But how, exactly, do you start dollar-cost averaging into the market? A common strategy is to pair this with exchange-traded funds (ETFs).

Start with setting up automatic monthly contributions into an ETF through your online brokerage account. This way, you would enjoy the benefits of both dollar-cost averaging and diversification, all through a hands-off approach designed for building long-term wealth.

You may already be doing so through a Regular Savings Plan such as the DBS/POSB Invest Saver or OCBC Blue Chip Investment Plan (BCIP).

Additional Reading: Why you should Dollar Cost Average into OCBC Blue Chip Investment Plan

Another cheap option we recommend is FSMOne’s ETF-based Regular Savings Plan, which allows investors to contribute as little as $50 each month. FSMOne does not require a principal investment amount and only charges 0.08% (min. S$1) per transaction.

Additional Reading: FSMOne. The cheapest Regular Savings Plan for ETFs

FSMOne

Invest cheaply into a broad range of ETFs through a Dollar Cost Average approach using FSMOne intuitive platform

However, do note that dollar-cost averaging is but a compromise to lump-sum investing.

See in the 5-investor example, the investor who used dollar-cost-averaging (DCA) actually fared worse in the long run than the investor who simply bought all the shares as soon as possible. But why?

Research suggests that in a typical 12-month period, the market has risen 74% of the time. So investing sooner gives you a higher chance of buying at lower prices, thus enjoying greater returns at the end.

In brief, if you have the funds and risk temperament to invest all at once, there is a strong case for doing so. You get a greater chance of earning higher returns than someone who diligently dollar-cost averages into her investments.

Additional Reading: A better alternative to Dollar Cost Averaging

Conclusion

Many of us procrastinate when it comes to starting our investing journey because it is a path fraught with uncertainties.

However, the truth is that investing need not be difficult. The first step (and often the most difficult one) is to get started. Once you gain the initial traction, the rest of the steps will follow accordingly.

I have highlighted in this article why the best time to investing is NOW. Make 2021 the year you start your investing journey, one which is a continuous life-long learning journey.

NAOF Investing Series

This is a quick starter guide to get one started on their Investing journey ASAP. Learn why you should start investing today and how to go about doing it – the easy way.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Best commodity asset of the decade and why Bitcoin might prosper in 2020

- How to prepare for a bear market. A simple 3-steps process

- Thematic ETFs partaking in the hottest trends

- Top 5 analysts of the decade and their current favorite stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.