Recession-proof stocks offer products or services that we simply cannot go without, or that are much more attractive when money is tight, like in a recession.

There are however varied opinions as to whether a recession is imminent. The man who predicted the dot-com crash of 2000 and the housing crisis of 2007, Nobel-Prize winning economist Robert Shiller believes that the odds of a 2020 recession are less than 50%.

Jeffrey Gundlach, the outspoken CEO and founder of DoubleLine Capital LP which has assets under management of USD$140bn, believes that there is a 75% chance of a recession before the 2020 presidential election.

If you are looking to protect your portfolio against the possible risk of a global recession, consider these 4 recession proof US stocks to get ahead of the risk. These 4 stocks also exhibit 2 common traits which we believe play a huge part in the stocks’ outperformance over the past decade.

- Rising sales trend

- Improving operating/net margins profile

McDonald’s (MCD)

If there is one thing that people are not going to give up during a recession, that is their burger. In fact, most will swap the occasional visit to a traditional restaurant with that of a fast-food restaurant instead. You will see that McDonald did not suffer much during the Great Recession.

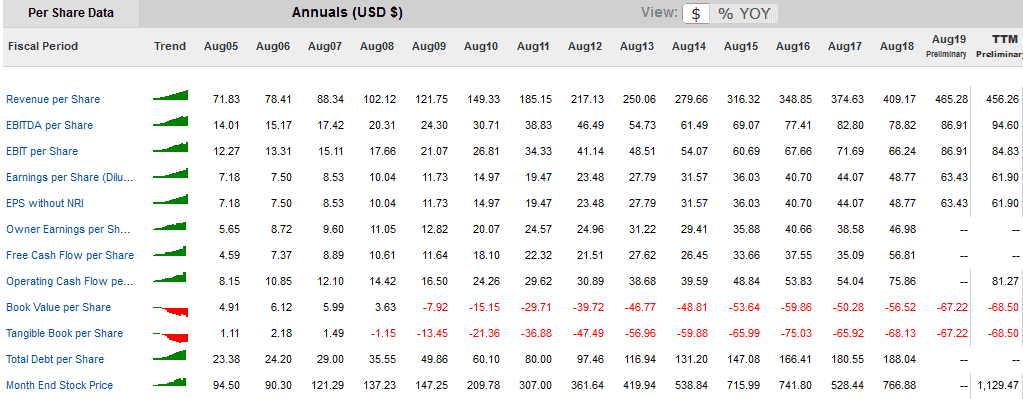

Back in 2008 at the peak of the recession, McDonald’s revenue/share grew by 9.2%. In the following year, sales were flat but rebounded strongly in 2010 to register a close to 10% sales growth.

Let’s fast forward to 2019.

Sales are gaining momentum in the US as the company continues to roll out its “Experience of the Future” stores which fully digitalise its locations, leading to increased visits and higher average checks.

Operating margins have also been steadily increasing, from 29.8% back in 2009 to 42% at present. That is an impressive 10.2% ppt improvement over the duration of just 10 years.

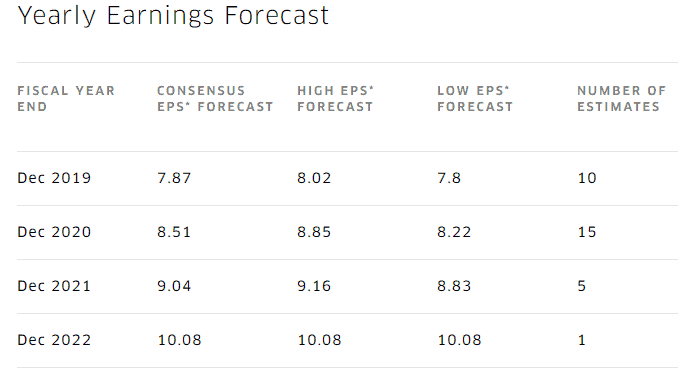

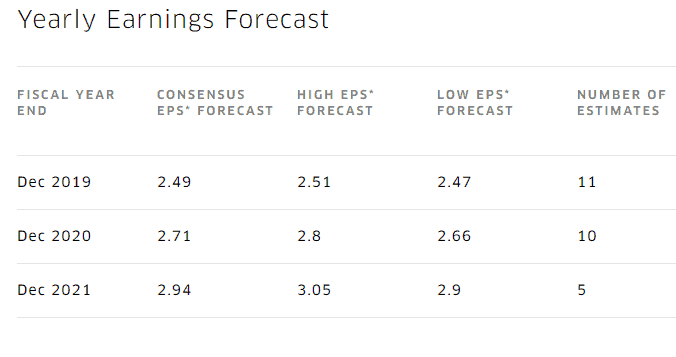

The company is expected to register 8-9% annualised growth over the next few years and is currently trading at a forward PER of 25x.

Add to the fact that the company has a low volatility and it is hard to argue against the fact that this is a Buffett-style stock and one that is likely to be recessionary-proof. We have previously featured McDonald in our Buffett series of stocks with a conclusion that this is a stock that fits well-within Buffett’s selection criteria, but not “buyable” at the current price. Check out our article to see what our ideal entry price is for McDonald.

The stock corrected by 11% from its recent peak due to lacklustre quarterly earnings which fell short of analysts’ expectations, the first time in 2 years. Nonetheless, this is a counter that will continue to perform in the long-term and it will be wise to include this recession-proof counter in your portfolio but only at the right price.

Autozone (AZO)

When times are tough, people look at a variety of ways to save money. This is particularly the case in the automotive business. When times are good, mechanics have a field day. When times are bad, people engage a DIY approach.

That was why Autozone was one of the best performing stocks of the 2007-2009 bear market. Its stock price registered double-digit annualised gains during 2007-2009 when most stocks were being pummeled. It business went through the roof (as evident from both revenue and earnings growth) during the recessionary period while other industries cratered.

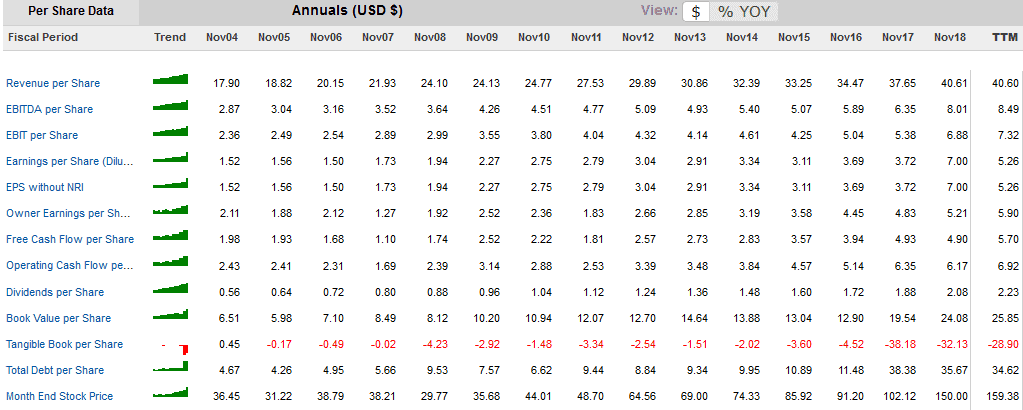

The company has been growing its revenue and earnings every single year since 2005 which is an extremely commendable feat.

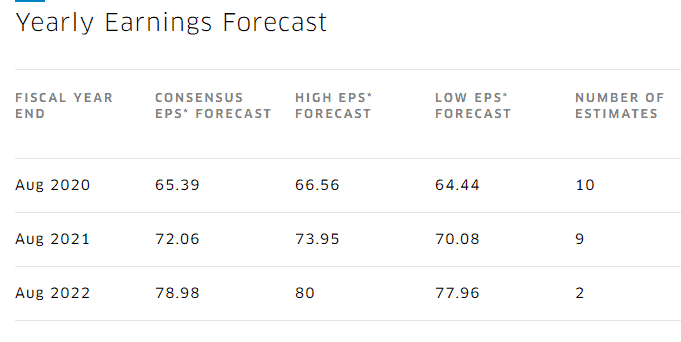

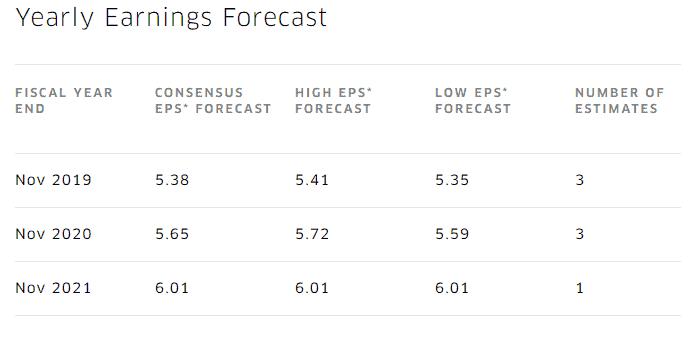

According to consensus forecast, this trend is expected to continue for FY2020 where the street is forecasting EPS of USD65.39/share. This is expected to increase by approx. 10%/annum over the next 2 years to hit USD79/share in FY2022.

From a net margin standpoint, Autozone’s net margin has improved from 9.6% in 2009 to 13.6% in 2019, a commendable 4 ppt improvement.

At its current price of USD1,129/share, this translates to a forward PER of approx. 17x. Not exactly cheap based on historical standards (average PER of around 15-16x).

But do look out for any price weakness as this is definitely a stock you will want to consider owning, given the strength of its operating performance, in both good and bad times.

Among the 4 stocks, this is the counter that is the “cheapest” based on PER vs. its associated growth profile. I will be looking to do a Buffett series analysis on Autozone to see what the ideal entry price level might be.

McCormick (MKC)

McCormick is one of the world’s leading providers of spices, seasonings and flavourings. This is one stock that will perform well during a recession. Why is that so?

People tend to eat out less often when times are hard, opting to cook at home instead. If you do not want your food to turn out bland and tasteless, then it will be wise to choose products from companies like McCormick.

The company has done a fantastic job, not just in growing sales but in cost management as well, as demonstrated by a steady improvement in operating margins (from 13% in 2008 to 18% in 2018).

However, the stock of McCormick is not cheap, trading at a forward PER of close to 30x with annualised earnings growth of approx. 5-6% over the next couple of years. Again, this will be one of the counters that I will be closely monitoring for any form of price weakness as a potential entry point, but not at the current level.

Church & Dwight (CHD)

Probably the least well-known in the list, CHD is the owner of consumer brands such Arm & Hammer (laundry detergent), OxiClean (bleach) etc. It is an extremely resilient stock, with the counter actually gaining 4% back in the recessionary year of 2008.

The company is in the business of developing, manufacturing and marketing household, personal care and specialty products.

The company has an impressive sales record, recording sales/share growth every year since 2005. More impressively, the company has managed to improve its adjusted net margins profile almost every year since 2005 with the exception of 2015 (down 0.46 ppt).

Trading at a PER of approx. 31x with annualised earnings growth of 8-9% over the coming 2 years, this recessionary proof counter cannot be considered cheap but is one that I will also be closely monitoring in my watchlist.

Conclusion

These recession proof stocks have done fantastically well in both good and bad times, as evident from their growing sales and margins profile. Consequently, many of them have re-rated significantly, with their PER multiples rising from c.15x to c.30x (in some of our examples).

As recession-proof as they might be, it will be wise to only engage a position at the right price. We will be doing more in-depth analysis on some of these stocks in future, starting with Autozone.

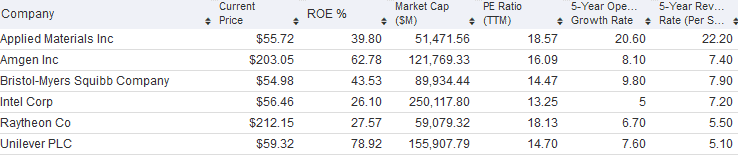

To end of this list of recessionary proof stocks in my watchlist, the six mega stocks highlighted below, screened according to:

- ROE > 20%,

- 10-20x PER,

- 5% annualised revenue growth over past 5 years and

- 5% annualised operating margins growth over past 5 years.

could be worth your consideration as well but I will leave that analysis for another day.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- BUFFETT SERIES: IDEXX LABORATORIES

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- BUFFETT SERIES: DISNEY

- 46 STOCKS IN BUFFETT PORTFOLIO

- BUFFETT SERIES: MCDONALD

- STRACO: IS IT A GOOD BUY NOW?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.