[Update 24 Sep 2020] In likely the final update prior to its listing in mid-October, Wilmar released a statement today before the market opens to state that it has finalized its YKA’s IPO pricing, with the counter to be listed at RMB25.70/share or equivalent to a valuation of US$2.06bn for the 10% stake. The company also highlighted that this translates to a valuation multiple of 31x based on the 2019 net recurring revenue of YKA.

This means that the total value of YKA will be at USD20.6bn or SGD28.6bn (based on USD 1:1.37) which is slightly more than what Wilmar’s current market cap is (SGD27.7bn). The market is essentially accruing ZERO value to its remaining business. In addition, there is a propensity for YKA to further re-rate higher, given that its peers are trading at 41x, according to this link provided by Wilmar’s management in the statement.

If so, then Wilmar’s current valuation looks rather undemanding. Is there really zero value to its remaining business?

[Update September 2020] In the latest update, Wilmar released a statement on the 16 September 2020 that the company’s subsidiary YKA has received final registration approval for listing on the SZSE ChiNext Board from the China Securities Regulatory Commission (“CSRC”). Based on the usual IPO timeline, it is expected that the listing will take place by mid-October 2020, subject to market conditions. With the approval of CSRC, the company has completed Stage 5 of the listing process (with Stage 6 being the formal listing of the stock). Do refer below for more information.

Although management once again highlighted that there is no certainty that the Proposed Listing will proceed as it is still subject to prevailing market conditions, the listing of YKA is likely certain to happen in October unless we see a major collapse in the China stock market.

The street has raised its target price of the company with the imminent listing of YKA. Do see below for the target prices assigned by the various brokerage houses.

[Update August 2020] This is a quick update on the status of Wilmar China IPO listing. Wilmar announced on the 6 August 2020 that SZSE ChiNext Board Listing Committee (the “Committee”) has met with YKA and deliberated on the Proposed Listing today. Following the meeting, the Committee has confirmed that YKA meets the listing and disclosure requirements. Following the Committee’s decision, YKA will be making a submission to the China Securities Regulatory Commission (“CSRC”) for final registration approval for listing on the SZSE ChiNext Board.

Although the company stated that this announcement is still not guaranteed of a listing, which is subject to final registration approval by CSRC and prevailing market conditions, it is highly likely, in my view, that the listing will now go through given the current bullish market sentiment and the fact that it’s Yihai listing is the largest among the list of companies to be IPOed.

How much will its China listing be worth?

Wilmar saw a bump in its share price today when an article from agricensus noted that the company has obtained an initial green light for the public listing of its agricultural business division in China after mulling the process for two years. Other Chinese publications such as this and this have quoted the news as well.

The company’s Shanghai registered agribusiness subsidiary Yihai Kerry Co. Ltd (YKA) has been approved for an initial public offering with a valuation of CNY13.87bn (USD1.96bn) on China’s Shenzhen Stock Exchange.

Although the IPO is still awaiting final approval from the exchange’s IPO committee, this is the first time that Chinese regulators have given the green light for the IPO via a Chinese exchange since its first attempt back in 2017.

Yihai Kerry, which is often referred directly to as Wilmar in the industry, is one of the largest importers and processors of grains, oilseeds and vegetable oils in the world.

According to the IPO prospectus, Yihai Kerry’s revenue reached nearly CNY171bn (US$24.2bn) in 2019 and achieved a profit of CNY5.6bn (USD790m) that year. The company is one of the top soybean crushers in China, importing about 15-17m mt annually and accounting for roughly 16-18% of China’s total soybean imports every year.

Note: Following a query by the SGX regarding its price action, Wilmar has stated in an announcement that YKA has submitted an updated prospectus to the China Securities Regulatory Commission in relation to its application for the Proposed Listing. The company highlighted that the proposed listing is still in progress and there is no assurance that the listing will proceed.

Valuation could be at the high end of analyst forecast

Assuming that YKA is in-fact listed with a value of USD$1.96bn, the company could be looking at a total valuation of USD$19.6bn (roughly 30x trailing PER, according to CIMB) for the whole YKA, given that it is only listing 10% of the total Pro-forma share capital. My own calculation indicates a trailing PER of 25x based on USD$790m in 2019 profits.

According to a CIMB report dated 13 May, the analyst forecast that YKA could be valued at between a trailing PER of 23x and 30x, which translates to a market capitalization of between USD$14.6bn to USD$19bn for YKA.

The analyst values its remaining business (ex-YKA) at 12x to 16x to arrive at a valuation of USD$7.4bn to USD$9.9bn.

Combining those two parts, CIMB estimate Wilmar’s market cap to be around USD$18.8bn to USD$28.9bn (or S$4.13 to S$6.34/share). As of the current writing, Wilmar’s share price has since appreciated in excess of S$4.10. However, based on a top-end valuation of S$6.34/share, there is still an approximate 33% upside from the current share price level.

Other analysts are similarly positive on Wilmar, with RHB having the highest target price prior to this news at S$4.83/share. The brokerage house is forecasting its China business to be valued at 23x PER based on a blended 2019-20 forecast. The brokerage marginally raised its TP to S$4.87/share in late-June

DBS has one of the lowest TP of S$4.00/share for the counter and value YKA at 19x FY20PER. Its initial valuation of Wilmar was at S$2/share based on 19x. Using the expected 30x PER, that will translate to a per-share value of S$3.16. Adding the other non-YKA component of S$1.90/share and the re-valuated fair price could be closer to S$5.06/share. The Brokerage firm on 1 July raised its target price to S$4.60

Similarly, UOB has a prior TP of S$4/share, valuing its China business at 23x 2020F PER and its remaining business at a more conservative 11x PER. Based on their sensitivity analysis, with YKA listed at 29x, their fair value of Wilmar will increase to S$4.90/share. The Brokerage house raised its TP to S$4.80/share in mid-June

[September 2020 Update]: Most of the brokerage houses have updated their target price of Wilmar.

CIMB target price: S$5.53

DBS target price: S$5.28

Maybank target price: $5.24

OCBC target price: $5.40

RHB target price: $5.45

UOB target price: $5.35

The road to a final listing

Currently, Wilmar is still in the second stage of the listing process. The below details the 6 stage process. [Update August 2020] Following the latest announcement, the company is now in Stage 5 of the 6 Stage Process.

Stage 1: The issuer submits the registration materials.

Stage 2: Accept the application. The Shenzhen Stock Exchange shall make a decision on whether to accept the application within 5 working days after receiving the listing application documents. If the application documents do not meet the requirements of the Exchange, they shall be corrected within 30 working days.

Stage 3: Audit inquiry. Within 20 working days from the acceptance of the Shenzhen Stock Exchange, the first round of examination and inquiry shall be submitted. If it needs to be inquired again, it shall be sent out within 10 working days after receiving the reply.

Stage 4: Review by the Listing Committee. The participating committee members formed a deliberation opinion through collegial discussions. Based on the review opinions of the Listing Committee, the Shenzhen Stock Exchange will issue an issuer’s audit opinion that meets the issuance conditions, listing conditions and information disclosure requirements, or makes a decision to terminate the issuance of the listing audit. The whole process shall not take more than 3 months from the date of acceptance of the listing application documents.

Stage 5: Registration by the China Securities Regulatory Commission. If the audit is passed, the Shenzhen Stock Exchange shall submit the audit opinion and relevant application documents to the China Securities Regulatory Commission. The China Securities Regulatory Commission shall make a decision on whether to register or not to register the issuer’s registration application within 20 working days.

Stage 6: Issuing and listing. The decision of the China Securities Regulatory Commission to register is effective for one year from the date of making, and the issuer can independently choose the time point of an issue within the validity period of the decision

Some background on Wilmar

Wilmar International is a processor of agricultural commodities and raw materials.

The company’s business activities include oil palm cultivation, edible oils refining, oilseed crushing, sugar milling and refining, oleochemicals, biodiesel, specialty fats, and fertilizer manufacturing and flour and rice milling.

It operates across the entire value chain of agriculture commodity processing business from origination and processing, branding, merchandising, and distribution of agricultural commodities and products to end customers. Wilmar’s agricultural product finds application in the food manufacturing industry and by preferred customers.

Corporate Strategy

The company intends to develop an integrated business model that holds the entire value chain of the agricultural commodity, including merchandising, cultivation, processing, and manufacturing of a wide range of branded agricultural products. it also focuses on improving its downstream businesses.

Wilmar focuses on strengthening its business through strategic collaborations, investments, and operational streamlining. Its strategy focuses on leveraging its existing distribution network to provide a wide range of competitive solutions catered to the needs of its consumers. As part of its growth strategy, it expanded its footprint in new and existing markets and enhanced product offerings.

The company plans to strengthen its distribution networks, brand building research and development and introduce new products to expand its market presence globally. Wilmar focuses on seeking opportunities to expand its fleet with cost-effective vessels to support the needs of its logistics operations. The company focuses on markets where it has a competitive advantage and a significant presence to ensure sustainable and achievable growth.

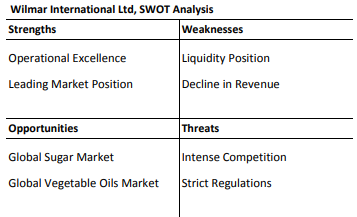

SWOT Analysis

Wilmar International Limited (Wilmar) is an agribusiness company, carry out oil palm cultivation, sugar, specialty fats, oleochemicals, oilseed crushing, edible oil refining, and biodiesel manufacturing and grain processing.

Leading market position, operational excellence, R&D, and profitability are the company’s main strengths, whereas low liquidity position and decline in revenue remain major areas of concern. The global sugar market, global vegetable oils market, and strategic initiatives are likely to offer growth opportunities to the company.

However, strict regulation, intense competition, and foreign exchange risks could affect its business operations.

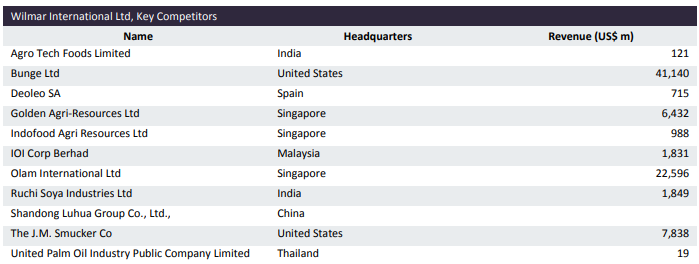

Key competitors

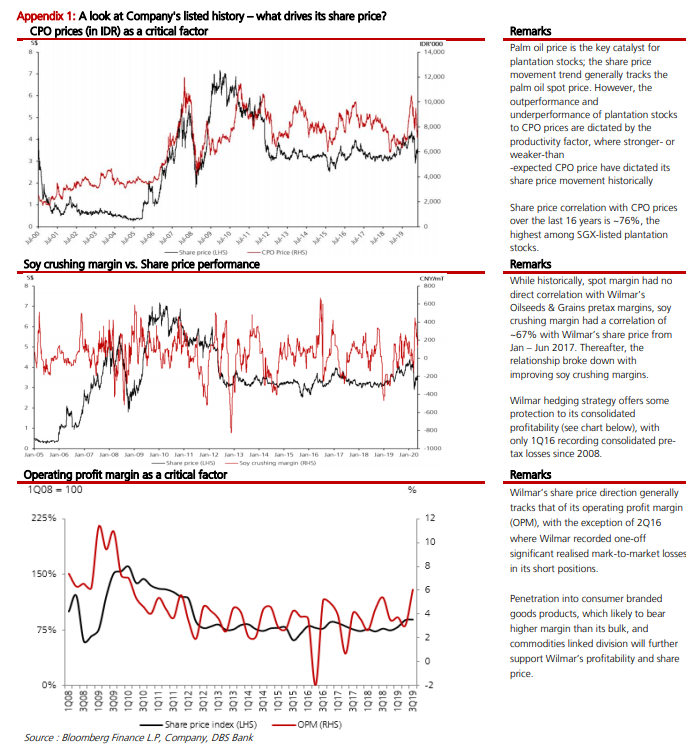

What drives its share price?

DBS has done an analysis of the correlation between certain factors and its share price.

The conclusion is that share price correlation with CPO prices over the last 16 years is c.76%, the highest among SGX-listed plantation stocks. CPO prices have been volatile of late and there are concerns that a potential second wave of COVID-19 transmission could taper demand for palm oil globally.

According to this article, global palm oil usage is set to fall for the first time due to COVID-19.

Nonetheless, Wilmar’s management has highlighted that its 2Q20 performance will remain strong as Wilmar is a producer of essential products, both food and non-food which should recover alongside economic activity. The crushing margin is also likely to remain strong in 2Q20, according to DBS.

The brokerage house believes the changing of segment reporting will reveal Wilmar’s strength and presence in China and other regions, especially consumer branded goods which were historically hidden away in the oilseeds and grains and tropical oil segment.

Technical Analysis of Wilmar

For disclosure purposes, I have a stake in Wilmar which I entered when the counter rebounded from the recent price low due to COVID-19 and there was a BUY entry at around the S$3.83 level based on the proprietary trading system that I am using.

![Wilmar China IPO: listing imminent? [Update September 2020] 1](https://i0.wp.com/newacademyoffinance.com/wp-content/uploads/2020/06/wilmar-China-IPO-technical-entry.png?fit=1024%2C509&ssl=1)

Given that the China IPO is still on the board and I see that serving as a strong fundamental catalyst for the stock, I decided to enter a small position when the signal gave a positive entry sign back in Mid-May.

Looking ahead

The listing of YKA still requires the final approval from the IPO committee. The final confirmation could finally put an end to the long-awaited IPO of its China business, one that has been 2-years late.

While the commodity business is not typically my cup of tea, I do see Wilmar as relatively undervalued, trading in the low-teens earnings multiple while having a strong forward catalyst.

The street will likely be looking to revalue the counter substantially higher if it is confirmed that YKA will in fact be listed at close to 30x PER multiple, given that most of the houses are valuing the listing at around 23x.

Do note the news report has not been verified by Wilmar and hence there could substantial variability in the valuation of YKA as well.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- HYPHENS PHARMA: IS THIS PHARMA COMPANY UNDERVALUED?

- SEMBCORP INDUSTRIES: WHAT MIGHT BE ITS FAIR VALUE?

- SEMBCORP INDUSTRIES AND MARINE DEMERGER: WHAT YOU NEED TO KNOW AND WHAT TO DO

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 2]

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 1]

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.