With only a few days left to the end of 2020, it might be useful to take some time off and reflect on this question: Where to invest in 2021? In this article, we will provide 7 investing themes for 2021 as well as their related stocks.

An unforgettable 2020

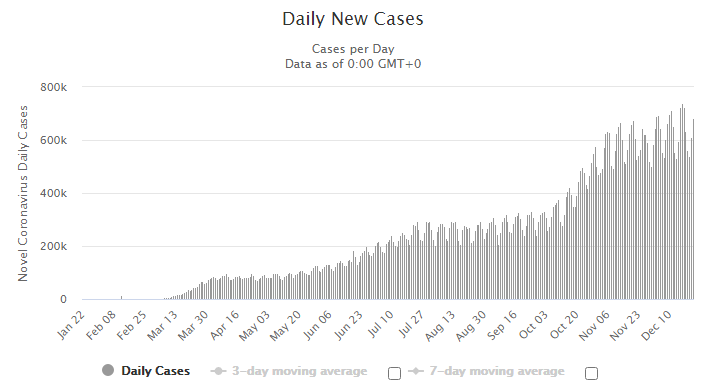

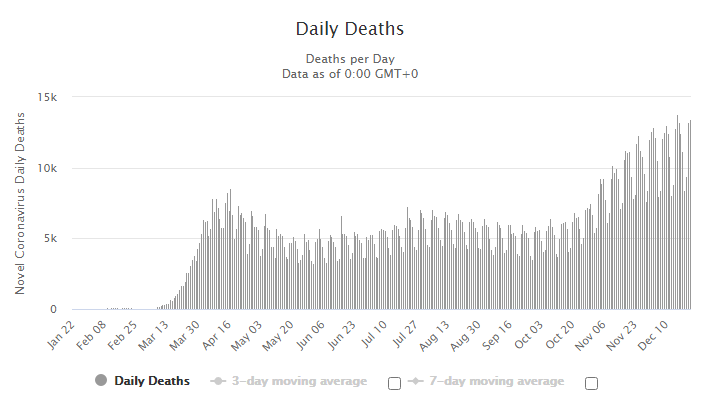

2020 has undoubtedly been an extremely eventful and volatile year if I might say the least. The year began with numerous reports of a deadly virus originating from Wuhan, China (which is now widely termed as COVID-19). After 1-year, we have yet to eradicate the virus and 2020 is likely to end with record daily global COVID-19 cases, with the US leading the pack.

Sadly, as of 24 Dec 2020, according to statistics provided by Worldometers, more than 1.7m lives had been lost around the world to the virus, with the US again alone accounting for 334,000 (and counting) at present.

As quickly as the global stock market went into a full-blown “bear territory”, the recovery was equally swift, likely the results of an unprecedented amount of money being printed by central governments all over the world to support the global economy at risk of plunging into the worst ever recession since the Great Depression of 1929.

That recovery caught even the most astute investor by surprise, many now believe the recovery to be led by easy money in the hands of millennials who for the very first time, are pouring billions into the market at an unprecedented rate.

Next, we have the fall of a nasty presidential election campaign, with the current Commander in Chief (soon to be ex) not willing to concede defeat and is currently still “throwing his weight around” as seen from this attempt to block the COVID-19 stimulus bill previously as well as making uneven demand that has left lawmakers baffled as to what exactly is the outgoing President’s plan.

Throw in the deaths of basketball icon Kobe Bryant and soccer legend Diego Maradona and 2020 will likely be remembered as one of the worst years ever for the masses who are still reeling from the negative implications of COVID-19 at present.

However, just by looking at the stock market, one would never have imagined that global economies are currently still struggling with recessions, with unemployment rates spiking to record levels in 2020.

Growth stocks, in particular, have seen fantastic returns, many of which have seen their businesses benefit incredibly due to the pandemic. Value stocks continue to lag their growth counterpart with modest gains in 2020, many of which remain inexpensive as investors continue to shun valuation in pursuit of companies that demonstrate impressive sales/earnings growth.

Additional Reading: How to find growth stocks to invest in

Stocks as an asset class could continue to benefit in 2021 as cash park in low interest yielding fixed income and government bonds start flowing into riskier assets in the chase for higher yield and return, especially with news of surprisingly strong efficacy for COVID-19 vaccines from Pfizer/BioNTech and Moderna and the likelihood for a healthier global economy as the pandemic recedes.

With that being said, here are 7 themes and their stocks that might prosper in 2021 and could be considered candidates for your portfolio.

Where to invest in 2021?

Investing themes for 2021 #1: Shot in the arm

After 1-year of social distancing, business lockdowns, air travel limitations, the rollout of multiple effective COVID-19 vaccines will set the stage for a return to normalcy as we move through 2021, with the economic outlook more favorable vs. a disastrous 2020.

With pent-up demand and a better jobs picture bolstering the consumer, beaten-down travel and leisure stocks like Royal Caribbean (RCL), air carrier Southwest Airlines (LUV) stand to benefit, as should battered retailers with staying power like Foot Locker (FL).

Investors should not be piling into the most beaten-down stocks (due to COVID-19) without sparing a thought for the possibility that the current vaccine solutions might not be effective after all which will further prolong the pandemic.

Many retail stocks such as those highlighted above will see the next round of sell-down and those without a strong balance sheet to last them through another year of weak demand could “be no more” as we have already witnessed several well-known brands falling victim to the pandemic, closing shop after decades of operating history.

Look out for beaten-down retail stocks that have been flexible in adjusting their operational model to better survive a prolonged COVID-19 crisis.

Investing themes for 2021 #2: Keep the printing press going

We can’t ignore the staggering effort by the federal government in concert with the Fed to back-stop the economy earlier in the year, which drove a record $2trn bump within US deposit accounts over 1H20. The stimulus is just going to keep coming.

Much of this increase found its way onto the balance sheets of the nation’s largest banks like JP Morgan (JPM), Bank of America (BAC), etc. Now sitting flush with reserves against losses, which bolsters earnings power going forward, bank stocks offer some upside potential in 2021. They could be more flexible in extending credits to consumers as they gain access to more liquidity, thus boosting discretionary spending.

The downside effect of a perpetual printing press is the ultimate devaluation of the US dollar, which looks to be taking shape at present.

Besides looking at beaten-down bank stocks, it might be sensible to also hedge the devaluation of fiat currency and a highly inflationary scenario through traditional mediums such as gold/silver assets (GLD ETF) or non-traditional ones such as Bitcoins, which is becoming increasingly popular of late.

Additional Reading: Bitcoin Prediction. 5 reasons why its rise this time around might be sustainable.

Investing themes for 2021 #3: Stay home, stay safe

Pandemic-related shutdowns around the world caused significant changes in the way people work. Businesses, to work outside of the office for fear that they will be less productive, were forced to many leery of policies that allow folks adapt on a time frame of weeks or months instead of years or decades.

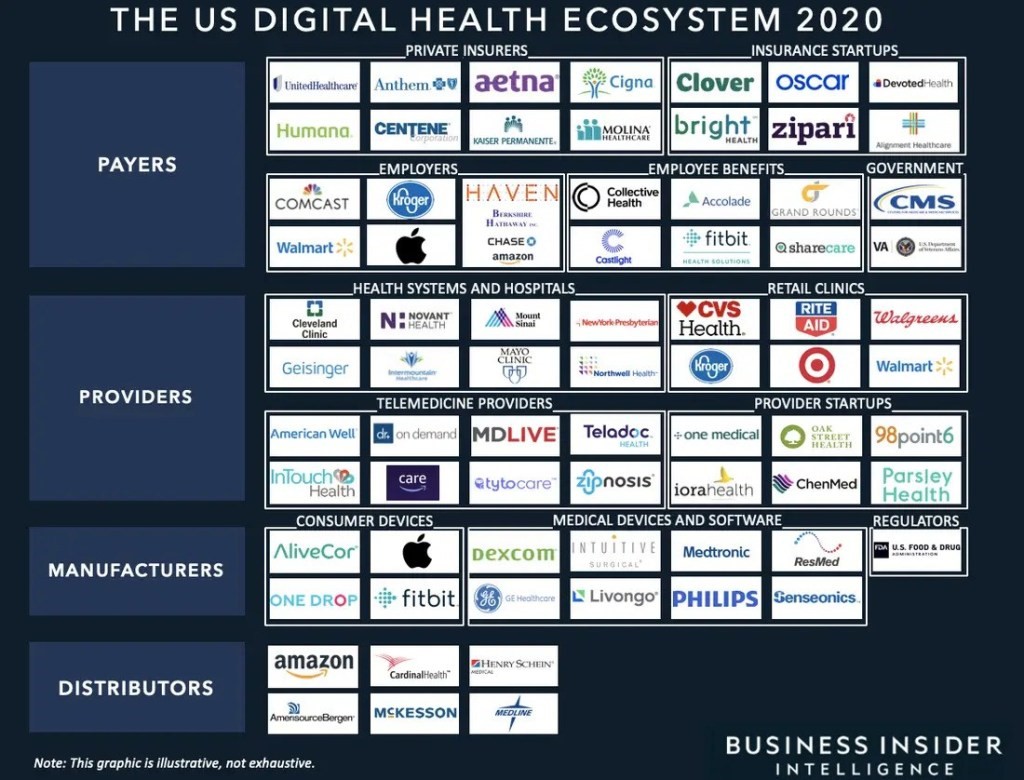

Zoom Video Communications (ZM) is one of the more famous benefactors of the pandemic thanks to record demand for its video conferencing software. Other popular stay home stocks that will likely continue to thrive way after the pandemic has ended are stocks like DocuSign (DOCU) and Teladoc (TDOC).

These stocks are expensive, no doubt about that, but they are not just temporary beneficiaries of the current pandemic scenario that has forced millions to stay-at-home. They will continue to benefit from a structural shift in the way consumers seek access to traditional products/services such as documentation and seeking medical advice.

Additional Reading: Top 8 Technology trends accelerating due to COVID

Tech firms weren’t the only sector to benefit from a Work-from-home (WFH) economy. Big-box retailer Target (TGT) and Costco (COST) saw record online shopping numbers and benefitted handsomely from several years of work reshaping the business, including an ability to ship from a local store and easy-access small-format stores.

Home Depot (HD) is another beneficiary of the stay home trend, with homeowners tinkering with more home renovation projects with the “additional time” at home. Where better than to order from HD which has made it so convenient to order online and collect from in-person from the outlets, thus ensuring optimal efficiency for both consumers and the company.

Last but not least, staying at home all the time has the unwanted consequences of “binge-watching” on streaming content. Netflix (NFLX) is undoubtedly the king in this aspect but is facing increasing competition from the likes of Disney+ and HBO etc. A better way to play it is through a hardware provider like Roku (ROKU) that benefits from the shift of demand from traditional subscription TV to streaming, regardless of who wins the uber-competitive streaming war.

Investing themes for 2021 #4: 5G is the future

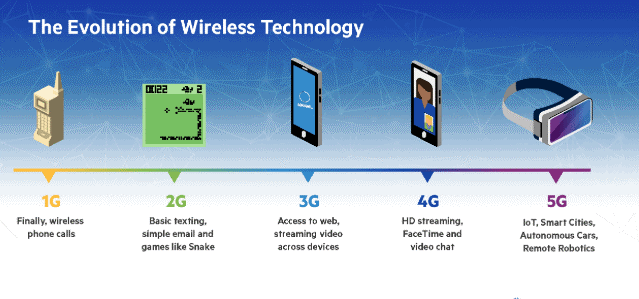

Yes, there have been lots of hype surrounding the arrival of 5G and it is finally here.

After years of development and investment, major telecom companies, such as AT&T (T) and Verizon (VZ), have been launching their ultra-fast networks on a city-by-city basis. New 5G-capable phones, often with Qualcomm (QCOM) communications chips, including the latest batch of Apple’s (AAPL) iPhones and devices powered by Alphabet’s (GOOG) Android operating system, should result in large portions of the population upgrading to take advantage of the technology.

I think 5G is remarkable for its speed and connections, which should allow consumers to get better service more often and should help content kings like Viacom (VIAC) and Walt Disney (DIS) reach wider audiences.

Fast connectivity powered by 5G components relies on “the Cloud” to store and process massive amounts of data. Cisco Systems (CSCO) designs network switching equipment for traffic management, Micron (MU) creates fast solid-state storage devices, Seagate (STX) is a long-time leader in hard-disk design for large amounts of storage not needed frequently and Intel’s (INTC) processors provide gobs of server computing power.

Additional Reading: 4 Blue Chip Stocks to play the 5G evolution

With 5G connections offering ultra-fast service in many areas, we think that content owners and businesses will continue to rely on the 5G+Cloud pairing to form the foundation of computing through at least the end of this decade.

Investing themes for 2021 #5: Show me my dividends

Dividend stocks have underperformed their growth counterparts over the past few years, particularly in 2020. However, the appeal of dividend stocks in 2021 should improve as capital flows out of the safety of low-yielding government bonds.

In December, the yield on the 10-Year U.S. Treasury stood at less than 1.0%, and we expect the low-interest-rate environment to continue through at least 2021, making dividend-payers very attractive especially for folks that need to generate income with their investment portfolios.

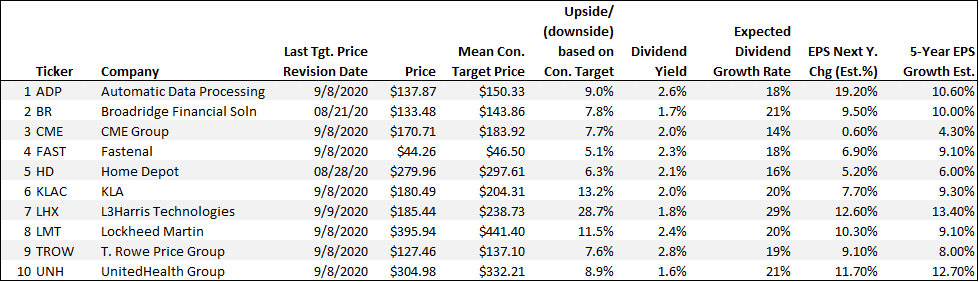

One should however not be singularly focused on yield as the total return (capital appreciation + yield) should be the key objective. Therefore, look out for dividend-paying stocks that have a strong track record of growing their dividends (not just being high yielding).

Dividend aristocrats are stocks that have continuously grown their dividend payments by at least 25 years. Stocks like Archer Daniels Midland (ADM), Medtronic (MDT), Cardinal Health (CAH), Target (TGT), Lowe’s (LOW), etc, are interesting dividend payers that one can consider.

I have written a very comprehensive Guide to Dividend Investing for those interested to start your investing journey with dividend stocks. I have also shown how I created my own NAOF dividend grower list as seen from the table below.

Investing themes for 2021 #6: Welcome the gamblers

The last 2 themes in this list are more controversial. Starting with US online gambling.

When the coronavirus caused nationwide lockdowns in March, state governments absorbed a tough financial blow, watching countless tax streams evaporate. Lawmakers’ hunger for new income sources has opened the door for up-and-coming vice industries, like online sports gambling, to fill the void the virus has created in states’ budgets.

More and more states are launching online betting businesses as the legal infrastructure and public opinion have turned in favor of such services. Next year, major markets such as Michigan will join numerous others as online sports betting becomes legal.

Popular online sport betting companies such as DraftKings (DKNG) and Penn National Gaming (PENN) will stand to benefit from this thematic trend which should continue to gain momentum in 2021.

While these are companies that are taking bets and building the apps that consumers are using, another less well-known company, GAN Limited (GAN) is building the background infrastructure that online gambling is built on.

Its software services include player identity validation, payment services, regulatory reporting, and even some game content. And with the recently announced acquisition of Coolbet, it’ll enter the sports betting market worldwide.

This industry saw U.S. betting increase from $1.85 billion in August to $2.19 billion in September and is on its way to $3 billion in monthly bets. If the industry keeps growing at this rate, it could rival the revenue of physical casinos, and that would be a truly disruptive development in gambling.

Investing themes for 2021 #7: Lasting High?

The last investing theme and the most controversial one in this list is the cannabis industry.

Investors who previously bet on this industry back in 2018/19 saw sentiments collapsing by early 2019 with the share prices of many cannabis stocks correcting by > 50% from peak to trough.

Is the current positive sentiments hype? Just like the bitcoin mania back then as well?

For one, there are more states now that are legalizing the use of recreational cannabis. States such as Arizona, Montana, New Jersey, and South Dakota have been recently added to the list.

US Cannabis sales also hit record levels over the Thanksgiving weekend, promoting industry predictions the combination of COVID-19 anxiety and a trend towards legalization has triggered a permanent uplift in demand.

By keeping people at home, limiting their entertainment options, and adding to their stress, the pandemic has helped to drive demand for cannabis for much of the year.

At present 35 states allow medical marijuana use, some with restrictions, and 15 states plus the District of Columbia have legalized its recreational use.

Although a federal approval looks to be years in the making, the current trend supporting recreational weed will be seen as positive for some of the biggest cannabis stocks in the industry such as Canopy Growth (CGC), GW Pharmaceuticals (GPWH).

Many of these stocks have seen a rebound in their share price of late.

An interesting stock is Planet 13 (PLTH) which is based in Nevada. It has only one store outlet, in Las Vegas but essentially that store is like the “Disneyland for weed”. Disney will probably not want to be associated with Planet 13 though.

Conclusion

As the calendar turns to 2021 and one ponders on where to invest in 2021, I have shown that there are still plenty of investing ideas that could generate significant total return potential in the coming year and beyond

The secret to success in investing is not simply to select good stocks but to not get scared out of them.

I have provided 7 investing themes for 2021 as well as their associated stocks which might be a good place to start your research.

The first 5 investing themes are generally well-accepted while the last 2 investing themes, as I have fore-warned, are more controversial. However, there are initial signs that the current dire situation of states’ coffers are pushing more states to legalize these industries and generate taxes from them vs. ignoring that these “underground” industries exist, with millions and possibly billions of tax opportunities lost.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- Top 20 Best Growth Stocks to buy [2020]

- Thematic ETFs partaking in the hottest trends

- 6 Top Investment trends (2020): Finding safe havens in a pandemic-driven market

- Top 8 technology trends accelerating due to COVID and the stocks to benefit from it

- 5 outperforming stocks that crush the S&P500 in 1Q20

- Best performing ETFs which consistently outperform the S&P500 over the past decade

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.