Value Investing + Options = weird combi?

If you fall into the “value investing” category, you will probably consider yourself somewhat of a “conservative” investor, one who is patient and will only pull the trigger if the share price of a stock falls to a certain level that meets your criteria.

An options trader, on the other hand, is characterized as “aggressive”, one that engages in leverage, and that “tool” can well turn out to be a double-edged sword.

Most value investors would not consider options and options trading as part of their investing strategy. The words “options” and “value-investing” shouldn’t even be used in the same sentence. However, let me show you how options, when applied in a proper manner, is a tremendous “tool-kit” for a value investor.

Did you know that Warren Buffett, whom many recognized as one of the best value investing practitioners alive, is a huge player in the options market?

A value investor dilemma

Scenario 1: If only I can get in at that price….

I believe all value investors would have faced this dilemma before. You found a company that looks decent on the surface and after your investigation, it ticks the majority of the boxes when it comes to evaluating the company based on quality and growth factors.

Quality factors might include evaluating the company’s profitability and balance sheet metrics to find high-quality companies. For example, finding companies with high Return on Invested Capital, high gross/net margins, high-interest coverage ratio, and low debt/equity ratios.

On the other hand, growth factors will evaluate the company’s historical earnings growth rate as well as forward estimates for key operational items such as EBITDA, Sales, and Earnings growth.

In summary, a high-quality company that ain’t a value trap, meaning that the company also exhibits growth characteristics.

However, the only problem is, the company in question is not cheap. It is sitting at or above its fair value. In other words, a fantastic business that you would be happy to own, just not at the current price and the current margin of safety you will be getting if you bought it today.

Let’s use a real-life example. Church and Dwight (CHD) for example is a leading producer of baking soda in the world. Around a dozen of its products are sold under the Arm & Hammer brand umbrella, such as baking soda, toothpaste, cat litter, and carpet cleaner.

These are household consumer staple items that remain in demand, with or without COVID. Not surprisingly, the company’s price performance has been strong YTD, rising by 33% compared to SPY ETF 6% increment.

CHD scores highly in the Quality and Growth category. With a strong portfolio of consumer household products that are well-known in the market, there is no doubt that the company is a quality business. When it comes to historical sales growth, CHD has been crushing the competition, with its past 3 years average sales growth of 9% compared to the industry’s 3%.

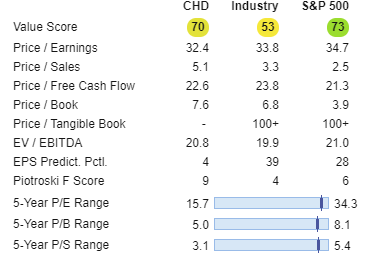

CHD checks the Quality and Growth boxes. However, when it comes to value, it ranks relatively low, with the company currently trading at the upper end of its 5-year PER range of between 16x and 34x. Its Current forward PER ratio is 31x.

There are other criteria such as evaluating its EV/EBITDA, P/B, and P/S where its financial metrics show valuation multiples on the high end of its 5-year average trading range.

Before I explain how an option can help you out in this situation, lets first check out Scenario 2

Scenario 2: Is this company turning out to become a value trap?

Now suppose you purchased a stock after it checks all your boxes of being a “value stock”. However, the price did not appreciate and a macro event like COVID-19 has put pressure on its operating profile with little earnings visibility ahead.

The price of the down is trailing down and you see no clear catalyst for the company to recover from its malaise. However, the good thing is that the company pays an attractive dividend of 4%/annum and you are thus paid to wait for your original thesis to play out.

Is there an “option” to further juice up the dividend potential of the company even further?

This is where options can also help you out in this particular scenario.

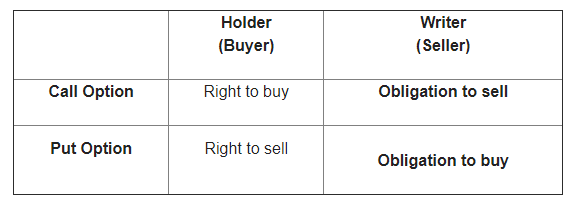

Before I elaborate on how options can be deployed effectively and safely in Scenario 1 and 2, let’s take a step back and go over the basics of what exactly are options and how the two key types of options, Call and Put options can be deployed.

What are options?

Options contracts are simply legal-binding agreements that allow the BUYER of the contract to “lock-in” a price in advance. For that, the Buyer will have to pay a premium. On the other hand, the SELLER of the contract (think of the person like an insurance company) will receive the premium, but by doing so, he/she will need to fulfill his/her obligations in the scenario where the buyer of the contract “exercises” his right.

This concept is best explained using an example as detailed below:

Apple (AAPL) is now trading at $115/share

Peter buys a single Put Options contract of AAPL at a “strike price” of $100/share that expires on 18 Dec 2020.

This means that Peter (option buyer) has purchased the right to SELL 100 shares of AAPL at $100/share on or before the market close on the expiration date 18 Dec 2020. For this option, Peter had to pay a premium of $4.10/share of S$410 in total (1 option contract = 100 shares).

On the other end of the contract is the option seller, David. David is the one who has the obligation to buy Peer’s 100 shares of AAPL if the price drops to or below $100. If AAPL price drops to $80/share before 18 Dec 2020 and Peter exercises his right to sell AAPL at $100/share, the losses for David will be rather substantial at $2k ($100-$80 *100 = $2,000, excluding premium received). David however does get to keep the $410 premium from Peter in exchange for taking on this risk.

Scenario 1: Using Cash-Secured Puts

Going back to Scenario 1, a value investor will have the dilemma of deciding whether to purchase high quality, high growth company that is trading more than its fair value (low on value criteria) or wait out for it to drop below the stock’s fair price before purchasing.

Most value investors would just wait until the price came down to the level that they like before the purchase the shares.

But what if you are in a situation where you can get paid to wait for the price to drop? Even if the price doesn’t drop, you are still entitled to be paid.

You can do this with the option strategy of SELLING a “cash-secured put”. Let’s use the AAPL example again.

- The price of AAPL is at $115/share

- You want to own a high quality and high growth company like AAPL but you don’t want to pay $115/share.

- You believe that AAPL’s fair value is in the region of $100/share and you are comfortable buying the company at that price.

- You have at least $10,000 in your brokerage account to buy the 100 shares of AAPL at $100/share, hence “cash-secured”

In this scenario, you are David, the Put Option Seller and you would sell a put option of AAPL at the strike price of $100/share, thus receiving a premium of $410 in total. Assuming you have $10,000 in your brokerage account, immediately you now have $10,410 upon executing this “sale”.

Between today and the options expiration date, there are 3 months to go. Your Annualized ROI on this trade if it works out for you (more on that later) will be:

Annualized ROI = 410/10,000/3*12 = 16.4%

So what can happen between now and 18 Dec when the options expire.

Situation 1: AAPL price goes higher. Put Option expires worthless. Annualised ROI = 16.4%

Situation 2: AAPL stays flat at $115/share. Put Option expires worthless. Annualised ROI = 16.4%

Situation 3: AAPL price goes down but remains above $100/share. Put Option expires worthless. Annualised ROI = 16.4%

Situation 4: AAPL price goes down below $100/share. You are now obligated to purchase the shares at $100/share, regardless of how low AAPL price might be. Your breakeven price is $100-$4.10 (premium received) = $95.90/share.

Your key risk is in Situation 4 where the price drops below $100/share and you now have the obligation to buy those 100 shares. But you are not worried about that because that’s the price you are happy to buy AAPL for.

As can be seen from Situation 1-3, if the price does not drop to $100/share or below (upon expiration) and stays the same or increase, your option will expire worthless on 18 December and you get to keep the full $410 in premium, thus netting you an annualized ROI of 16.4% over the 3 months duration.

Once the Put Option expires worthless, you can continue to Sell Put Option on AAPL at your targeted entry price of $100/share. Depending on where AAPL’s share price might be on 18 December, the annualized ROI could be lower or higher than the previous 16.4% generated.

Scenario 2: Covered Call

So how about Scenario 2? You own the shares of the company as it ticks all the boxes of being a value stock. More importantly, it is a strong dividend-paying stock.

However, you have got a target price in mind that you will like to exit the counter.

Let’s take for example the stock Philip Morris (PM)

- You own 100 shares of PM with a buy price of $70/share

- The current price of PM is at $82/share but your fair value estimate is around $90/share, which you will be happy to sell your shares at if the price appreciated to that level

- PM currently spots a dividend yield of 6%

Instead of simply waiting for the price to move up, you can instead choose to sell a “Covered Call”. This is “covered” because you own 100 shares of PM. In the event you do not own at least 100 shares of PM, then it becomes a “naked” call which significantly elevates the risk profile of the trade.

Hence, we are only comfortable with dealing with a covered call scenario.

So in this example, your cost of owning 100 shares of PM is $7,000. You decide to sell a call option at a strike price of $90/share, expiring on 18 June 2021 (277 days to expiration). For selling that call option, you will receive $305 in premium.

Based on a holding horizon of 277 days, this trade could generate an annualized ROI of 6%. Adding on to PM’s existing yield of 6%, the total income potential is 12%. That is how we can further “juice up” the counter’s dividend potential or what we termed as putting its “dividends on steroids”.

So let’s see what happens in a few key situations:

Situation 1: PM trends lower than its current price of $82/share on expiration. Covered Call expires worthless, annualized ROI from trade = 6%

Situation 2: PM remains at $82/share on expiration. Covered Call expires worthless, annualized ROI from trade = 6%

Situation 3: PM appreciates from the current level but below $90/share on expiration. Covered Call expires worthless, annualized ROI from trade = 6%

Situation 4: PM appreciates above $90/share. Your ownership of 100 shares got “called away” and you have to sell it for $90/share, regardless of how high PM price have appreciated.

In situation 4, your total return in this example = $90-$70 (capital gain) + 6% dividend yield (assume receive full dividend payment before shares are sold) + 4% covered call income (not annualized) = 39%.

A covered call strategy for a value investor is an extremely low-risk strategy. If the price remains weak, the income generated from the covered call writing can be used to partially offset the paper loss. The only “real risk” is not partaking in the upside of the counter if PM, in this example, appreciates significantly beyond $90/share.

A benefit of the covered call is that it plays into the idea that an investor should have an exit strategy for any position entered. And why not collect a premium along the way?

Sounds too good to be true? What is the downside risk?

Selling a “cash-secured” put make sense for a value investor who wishes to not “overpay” for a stock and only enter at his/her required “fair price”.

The maximum loss is the cash you invested assuming one is doing on a “cash-secured” basis. The risk is similar to that of purchasing a stock directly. However, note that each option contract is equivalent to 100 shares, which means that to sell 1 put option contract on a stock with a strike price of $100/share, that entails a capital outlay of $10,000 which will be rather significant for small-time investors.

Investors without $10,000 in his/her brokerage account will be able to execute the trade on a “margin” basis, typically requiring just 25%, ie $2,500 in this example. However, there is now the risk of potentially “over-leveraging” or “over-selling” on one’s capital.

For the dividend investors out there, there is a “huge downside” to selling put options. Selling put options is not equivalent to owning the stock and that means that your “cash-secured” put is not entitled to any dividends paid by the company as you are theoretically not a shareholder of the company until the option is exercised at the strike price, forcing you to take ownership of the shares.

For covered call selling, there is no downside risk associated purely with the execution of such a trade. As previously highlighted, the income generated can be used to offset paper losses if the price of the shares you own continues to decline and the only major “loss” is the inability to partake in the price appreciation above the price level in which you sold the call at.

Conclusion

Options can be simple or as complicated as you want. There are advanced levels of options strategies that option folks termed as the likes of condors and butterflies etc.

However, options trading need not be complicated for them to be profitable. For a value investor, the use of options can be seen as a potential tool for you to deploy in low-risk scenarios as I have mentioned above.

Put Selling can allow a value investor to “Get Paid” while waiting for the price to hit his/her fair value.

Covered Call Selling, on the other hand, can allow a value investor to be “disciplined” in getting out of his position when it trades significantly above its fair value.

For those who are interested to find out more about how you can trade options effectively and how you can generate a consistent stream of passive income every month, do join me in this FREE 2 hours Options Training Session where I will share with you more about the flexibility of using options and how they can be a useful tool in your trading arsenal.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- 8Best Stock Brokerage in Singapore [Update July 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “Value Investing using options: Why value investors should also be option traders”

One of the best explanations I’ve found for a newbie reader. Thanks and keep it up. 🙂