In this article, I identify 5 potentially undervalued stocks in the Singapore stock exchange (Large-cap), based on the counter’s current share price vs. the street consensus.

My selection criteria weren’t based on the traditional “value” criteria which seek to identify stocks that fit certain “value” metrics such as low PER, low PBR, high dividend yield, low net debt/equity ratios, etc.

Instead, it is based on the stock’s current share price vs. the median target price which the street has set for the counter. These stocks are generally large-cap counters that one should be comfortable holding on to for the long run. Note that these “undervalued” Singapore stocks might not be suitable portfolio candidates if one’s holding horizon is too short.

There are a few selection criteria for this list:

- Market cap > SGD$5bn

- Number of analyst coverage > 5 pax

- Difference between the street’s median TP and current share price > 12%

With that said, here is the list of the Top 5 potentially undervalued stocks in Singapore for consideration to buy now if you have got a long horizon (> 1 year) in mind. The list is from the lowest price differential (least undervalued) to the highest price differential (most undervalued)

Undervalued Stocks in Singapore #5: Singapore Telecom

Singapore Telecom, more commonly known as SingTel, was once the largest market cap company on the Singapore exchange. The company currently sports a market cap of SGD$33bn.

The median TP by the street for this counter is currently pegged at SGD$2.85 vs. its current share price of SGD$2.50, which represents an upside potential of 14%, ranking the company as the 5th most undervalued stock in Singapore based on our criteria.

Singtel has been a major underperformer over the past decade, with its share price hardly appreciating over the last 14-15 years.

The only “positivity” that shareholders get to enjoy is its relatively high dividend yield (4+%) based on its current share market price.

The street is becoming more positive on the counter of late as a result of its gradual transition towards the digital economy, after its partnership with Grab successfully secured a digital banking license from MAS in Dec 2020.

A successful rollout of its digital license plan in 1H21 might be the key event to catalyze its share price performance over the next 1-2 years.

Most investors are currently still vested in SingTel mainly for its dividend payment. While the upside potential of this undervalued stock from capital appreciation over the coming 12 months might not be substantial, this is one blue-chip company that will likely withstand the “test of time”, particularly being a “government-linked” entity.

Undervalued Stocks in Singapore #4: Dairy Farm International

Dairy Farm International ranks as the 4th most undervalued stock in this list. The company spots a market cap of SGD$7.9bn and definitely is one of the best recommended blue-chip stocks on the Singapore exchange.

Its current price is USD$4.36 (equivalent to SGD$5.80 based on the exchange rate of 1USD : 1.33SGD) while the street has a median target price of USD$5.02 on the counter, representing an upside potential of 15.2% from the current share price level.

As can be seen from the chart above, from a technical angle, the counter has found a short-term bottomed at the USD$3.60 level and has been in an uptrend mode since then.

The counter is looking to break the minor resistant level at USD$4.50, after which it might look to challenge the last high at USD$4.75.

From a valuation angle, UOB Kay Hian recently initiated coverage on the counter with a USD$5.19 target price, with the brokerage house finding its 5% yield particularly attractive. The brokerage house likes the counter’s position as the largest retailer in Asia ex-Japan, with its strong market presence in China, Hong Kong, Taiwan, India, and ASEAN giving it exposure to both developed and emerging markets.

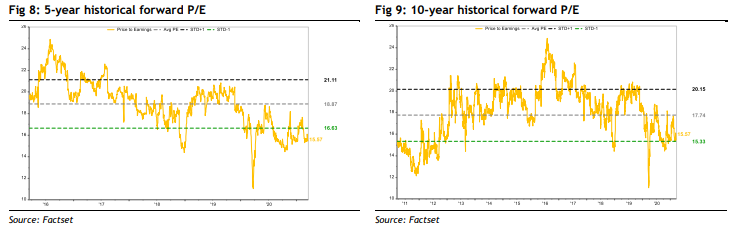

CIMB believes that Dairy Farm is a medium term recovery play, with its share price still trading below its long term average mean PER of 25.9x vs. current 1-year forward PER of 21.5x

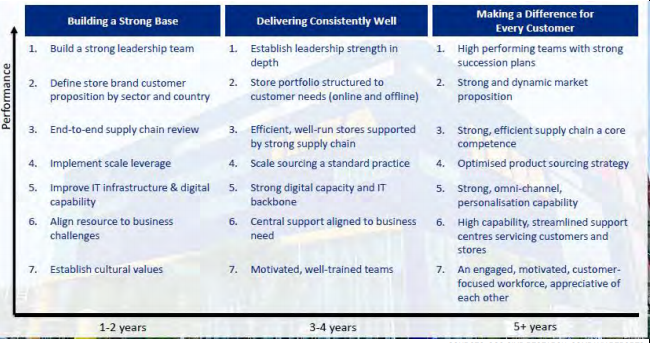

Dairy Farm is currently embarking on Phase 2 of its multi-year transformational plan and this might be a stock for a long-term shareholder who remains a believer in the strategy of engaging both a brick-and-mortar retail presence as well as online e-commerce

This is one stock that is not hugely traded by the market. However, its 5% yield makes it a compelling undervalued stock in Singapore to consider for those looking at an income angle.

The stock gave a positive BUY signal at USD$4.43 using the Traders GPS system, which is a proprietary trading system developed by Collin Seow. For those interested in using systematic software to trade, I highly recommend you to check out his course which I have done a comprehensive review.

The Systematic Traders Program

An investing course that is voted as the Best Investing Course by Seedly reviews, the Systematic Traders Program uses the proprietary platform, TradersGPS which tells you WHAT stock to buy, WHEN to buy and HOW much to buy.

Undervalued Stocks in Singapore #3: City Developments

City Developments is one of the largest property developer in Singapore with a market cap of SGD$7.2bn. Note that, they are not a property investment management company as many used to think previously. The stock has a median target price of SGD$9.12 on the stock vs its current share price level of SGD$7.89, representing a 15.6% upside.

There has been a lot of “buzz” since CapitaLand announced a restructuring plan recently to split off its real estate development units and fund management business. City Developments has since mentioned that it is not ruling out the possibility of a restructuring as well to enhance the value proposition to shareholders.

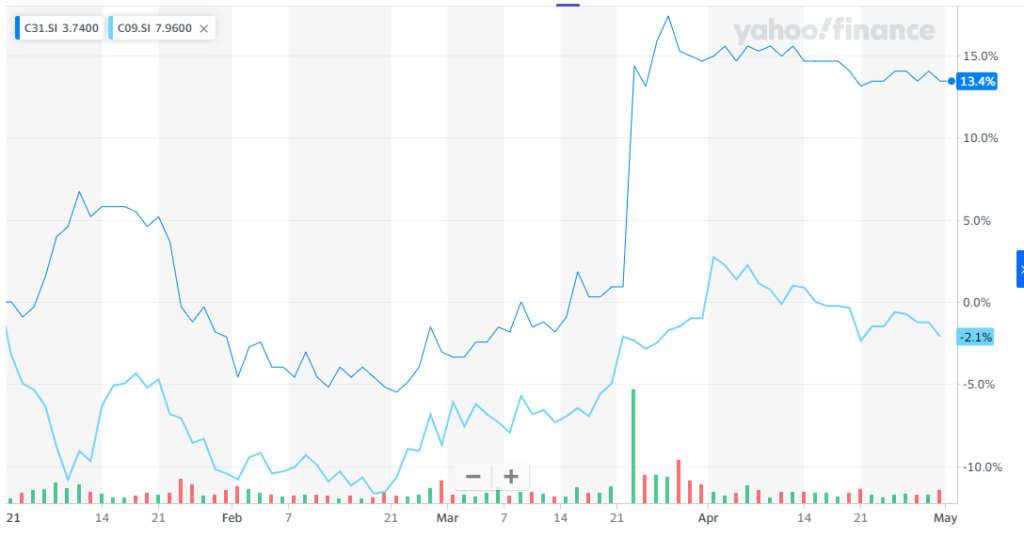

Since the restructuring announcement, CapitaLand saw a substantial outperformance vs. City Development, with the former’s share price trading at +13.4% YTD vs. City Dev’s -2.1% decline over the same horizon. Both stocks tend to trade pretty much in lock-step historically.

The street mostly has a Buy rating on City Development, likely believing that the company will also announce a restructuring on the back of CapitaLand’s announcement. This will serve as a short-term catalyst for the stock.

Among the analysts covering the stock, Phillip Securities is the most bullish on the counter, with a target price of $10.68 although coverage on the counter has been lacking from the brokerage house since August 2020. A more recent coverage on the counter would be by DBS Research, which has a $10.50 TP on the counter.

Although the COVID-19 pandemic has impacted most of City Dev’s business segments especially the hospitality sector, its current share price has priced in most of the downside risks. Currently trading at 0.7x P/NAV, close to -1.5 SD of its 5-year mean, DBS believes valuations are too cheap to ignore as City Dev is well-positioned to leverage on the recovery post-COVID.

The key risk identified by DBS remains policy overhang, with the government possibly introducing further cooling measures to tamper the property price appreciation trend seen in both private properties and HDB of late.

That said, while developers’ share prices may dip (if a policy tightening measure is introduced), it is likely to be a knee-jerk reaction according to DBS. This is given that most developers under their coverage (i) have substantially sold inventory that was sitting on their books, and (ii) are projected to deliver strong earnings recovery led by the recovering commercial and hospitality segments.

Undervalued Stocks in Singapore #2: Wilmar

I have written about Wilmar on several occasions, first in this article highlighting its YKA IPO potential followed by another article that seeks to bring to my readers’ attention the overwhelming demand for its YKA’s IPO shares and how that might reflect the significant undervaluation of the counter.

Wilmar currently spots a market cap of SGD$33bn and is one of the largest blue chip stock in Singapore and remains an undervalued one in my eyes. The street seems to concur, with its median TP set at SGD$6.24 vs. its current share price of SGD$5.22, representing close to a 20% upside from the current level.

While the “listing” catalyst play is over, Wilmar remains one of the undervalued stocks in Singapore due to its exposure to the red hot commodity sector at present.

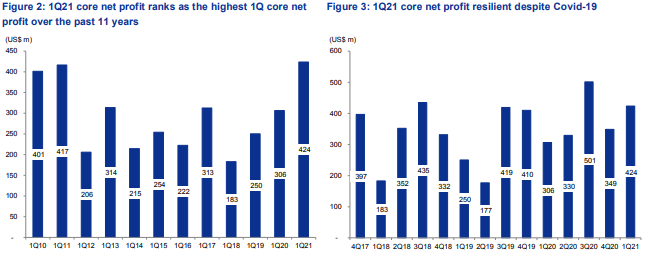

The company announced a doubling in its net profit for 1Q21, with its net profit level of US$450.2m substantially more than the US$224.1m in the previous year.

“Whilst the pace of economic recovery around the world from the pandemic is uneven, we are cautiously optimistic that we will perform satisfactorily for the rest of the year,”

Wilmar

There has been surprising weakness seen in its share price despite a strong 1Q21 results, which generated the highest core earnings over the past 11 years.

Nonetheless, the street remains generally positive on the stock and believes that the counter is substantially undervalued based on its market cap vs. its listed subsidiary YKA.

This is one undervalued stock in Singapore that you should own if you wish to have exposure to the commodity sector, one which has been a beneficiary of rising inflationary expectations globally.

As can be seen from the chart below, the Commodity Index, tracked by Thomson Reuters, have seen a strong performance as of March 2021, significantly outperforming that of the S&P500 index. From soft commodities such as wheat, corn etc to hard commodities such as copper and aluminum, commodity prices have “quietly” inched to record levels in 2021.

The commodity sector (both soft and hard) should be one area which investors should be paying attention to and have a small exposure in their portfolio amid rising inflationary expectations.

Undervalued Stocks in Singapore #1: Thai Beverage

Thai Beverage is the most undervalued stock in this list. The company has a market cap of SGD$18bn and is one of the largest consumer discretionary stocks listed in Singapore. The street is generally very positive on the stock, with the median TP given at SGD$0.89 vs. the current share price level of SGD$0.715, which represents an upside potential of c.25%.

On a technical basis, the counter has undergone a minor correction and is currently sitting at a key support level at SGD$0.70/share. For longer-term investors, this might be an opportunity to average into a counter which yields around 2.6% at the current price.

The reason for the recent correction was due to disappointment over the delayed listing of its USD $2bn Singapore IPO of its regional beer assets.

Despite the disappointment over the proposed listing of its beer business which would help the company monetize part of its beerco stake, the street maintain a positive outlook on the counter as a post-COVID-19 recovery play.

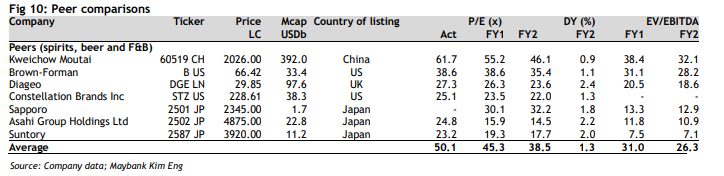

According to Maybank, Thai beverage is trading at 15x FY21 PER, which is at -1 SD below its 5-year mean, and a 65% discount to its global peer average of 45x forward PER.

The table below shows some of its comparable listed peers, based on data from Maybank.

Investors looking to purchase Thai Beverage at present will need to ride out the short-term uncertainty associated with the rising number of COVID-19 cases in Thailand and Vietnam, the 2 key markets in which the company has huge exposure in.

Based on both technical and valuation considerations, it might be an opportune time to invest into an undervalued stock like Thai Beverage at the moment.

Conclusion

These are my Top 5 undervalued stocks in Singapore to buy now, ones I believe are worthy candidates for a long-term portfolio. They are NOT selected based on traditional fundamental ratios. Neither are they selected based on the fact that they are trading at a 52-weeks low (might be value traps).

These stocks are selected based on the differences between the street’s median TP set for the counters vs. their current share prices.

Concurrently, many of them sport a dividend yield of at least 2.5% and above. Investors are hence paid to wait for these companies to revert to their fair value once the post-COVID-19 recovery takes shape.

For those who are interested in purchasing these stocks, you can check out my comprehensive guide on the Best Brokerage in Singapore for SG stocks and other international stock purchases.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- LION-PHILLIP S-REIT ETF: SHOULD YOU BE BUYING THIS REIT ETF?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- THE IDEAL RETIREMENT PORTFOLIO STRUCTURE

- WHAT IS A REGULAR SAVINGS PLAN?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.