Table of Contents

Are you generating the median income here in sunny Singapore? But first let’s take a look at how our wealth stacks up vs. the world.

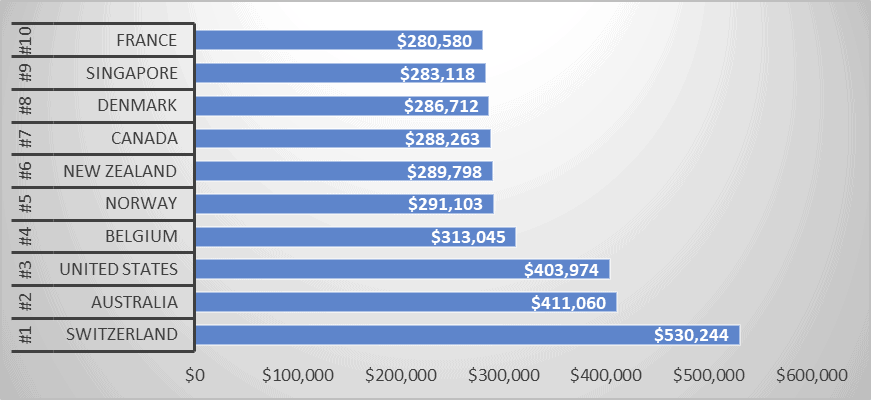

Using data from the Credit Suisse Global Wealth Report 2018, Switzerland ranks top as the nation with the largest average wealth per adult. Australia and USA take second and third spot respectively. However, some argue that this simple metric does not factor in the gap between the richest and poorest in a nation, or what we term as income inequality.

Median wealth a better representation than average wealth

Taking the US for example, while it ranks highly in terms of average wealth per adult at No.3 globally, that ranking drops to No.18 when we use median wealth instead. The US is among the wealthiest nation that has the lowest ratio of median to mean at 15.3%. No wonder there are so many disgruntled US citizens that have turned into Trump supporters! The income disparity is HUGE!

Singapore ranks No. 9 based on average wealth and No. 10 based on median wealth, a respectable performance coming from a tiny nation that is still often mistaken as a province of China! Come on, have you watch Crazy Rich Asians!

However, even then, the disparity between Singaporeans’ average wealth of USD283k and its median wealth of USD92k remains large.

Additional Reading: The Average Salary in Singapore

Let’s take a look at Singaporeans’ income generation

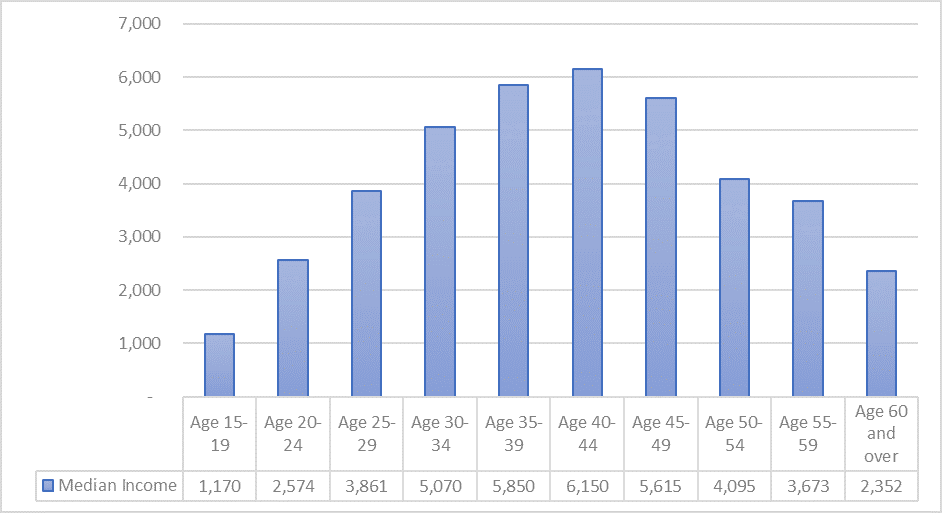

In Singapore, the median gross monthly income from work (including employer CPF) amounts to approx. SGD4,437. On an annualized basis, that equates to SGD53,244 a year.

Which age group has got the “boasting rights” for the highest income generation? Well according to the data from the Ministry of Manpower Singapore, the age group that has the highest median income belongs to the Age 40-44 group of working personnel with a median income generation of SGD6,150.

In fact, the income distribution range follows the bell-curve shape rather closely, with income potential peaking at Age 40-44 and starts trailing downwards significantly from Age 50 onwards.

What is the median income for those Age 35-49?

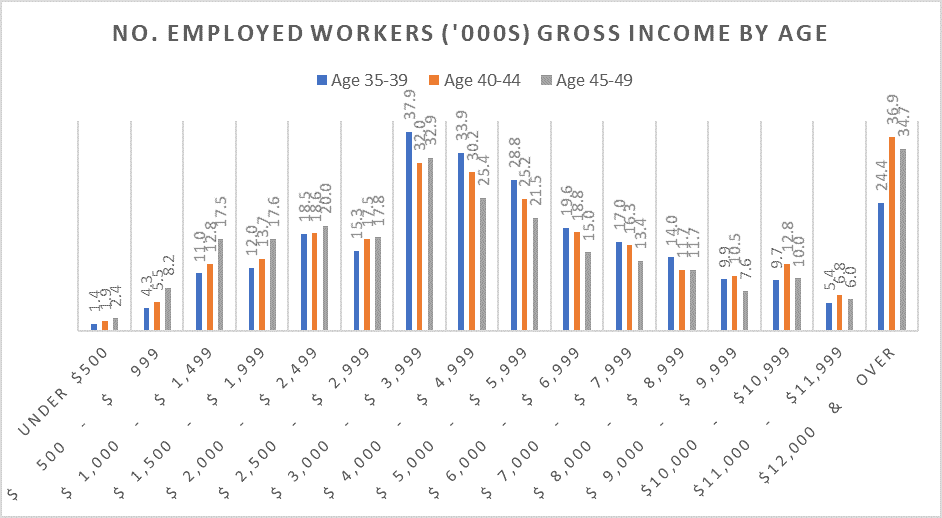

Let’s drill down another level and analyse the common monthly income trend for workers between the Age 35-49 range. The bulk of workers in this age range are actually generating income between the SGD3,000-3,999 range.

How then do we account for the median income of SGD6,150 for Age 40-44? Well, interestingly, as seen from the chart above, there is a surprisingly large amount of personnel generating the “outlier” amount of SGD12,000 and over. This highlights a certain level of “income inequality”. The total personnel in the Age 40-44 range generating a gross monthly income of SGD12,000 and over amounts to a hefty 36,900 pax or 14% of the working population in this age category.

Dual household income becomes a necessity

When I look at the median income levels by age in the chart above, I get a little depressed because it is hard to get ahead with that income figure unless both men and women work, particularly when you are living in sunny Singapore which boasts the notorious title of being the most expensive city to live in for 2019, alongside Hong Kong and Paris for the top spot.

This is the 5th consecutive year where Singapore reigns as the World’s most expensive city. A key reason why we are ranked so “highly” is due to the extremely elevated cost of car ownership here in Singapore where a piece of paper which “certifies” your eligibility to own a car currently cost in excess of SGD30k (FYI: this piece of paper almost hit SGD100k a few years ago).

Median income of SGD4,437 translates to take-home pay of c.SGD3,100

But can either the men or women who make median incomes afford not to work if they so decide to start a family? Hard to say given that childcare cost is atrociously high, not just in Singapore but in most part of the developed world. It is always easy to procreate (don’t mind my language) …. but a mountain of a challenge to raise a kid WELL. A Singaporean that generates a medium income of SGD4,437 typically brings back a take-home pay of c.SGD3,100 (after deducting personal and Employer CPF contribution). That is insufficient to support a typical HDB household expense of c.SGD3,900.

I hope that every single reader on New Academy of Finance increases their incomes and their net worth above the median level over time. This site can be just one of the avenues where you get inspirations to better your financial well-being. There are many other financial blogs out there, some of which are very successful and are willing to openly share their stories and insights to help others to achieve financial success. Do learn from them.

Save as much as possible

While I do not count myself as a high-flyer in terms of income generation, I do try to save as much as possible in-lieu of rainy days. It will not be possible for me to take a 6-months hiatus from work to develop this website if not for the savings that I have painstakingly amassed.

You can take a look at my previous post: 4 Money Habits that change my Life to get some ideas on how you can better manage your savings and money.

If you are happy with your current financial situation, then by all means, carry on. But if you are not, it is time to get motivated and start taking action.