Stock Compounders with buying opportunities

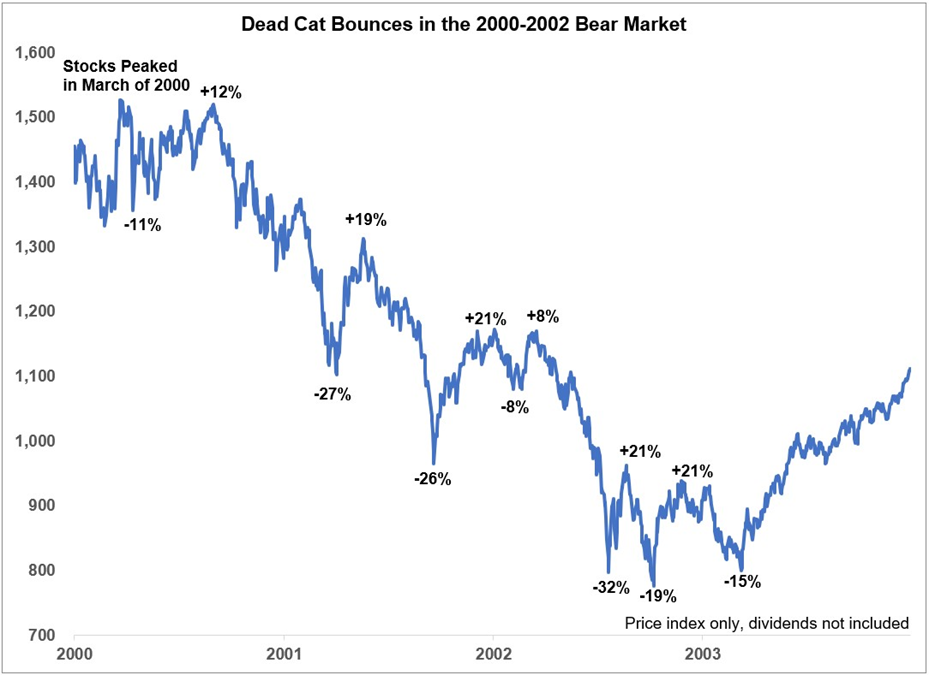

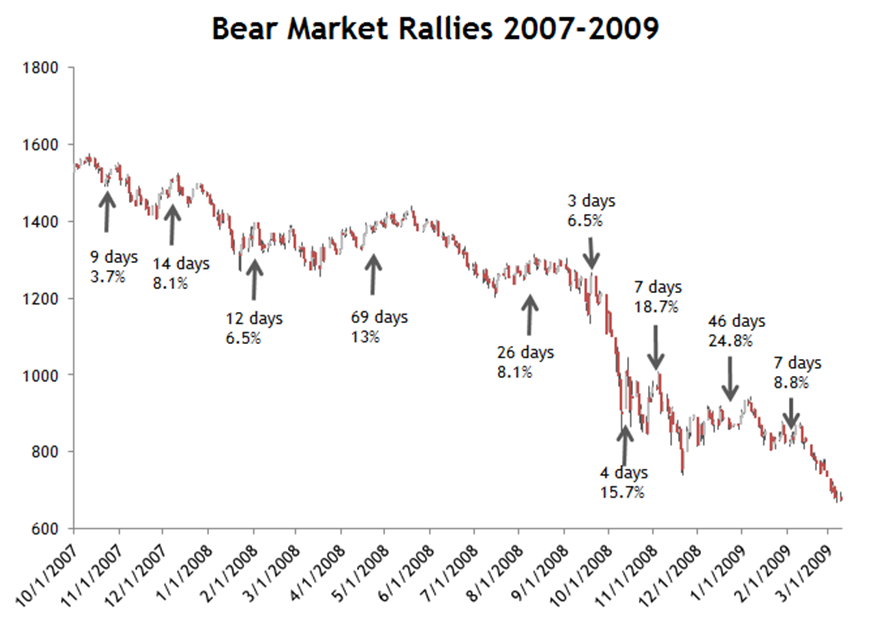

Bear markets are never fun; bulls lose money in their holdings while it is difficult to short the market effectively due to the ferocity of bear market rallies.

As such, during such times when the market goes into a severe decline, I usually just take the time to review my holdings to make sure I am invested in my highest conviction ideas. Additionally, I will also take the time to further my knowledge of the markets.

Recently, I have come across a special breed of stock compounders. As its name suggests, these stocks have compounded returns at a great clip for shareholders. This unique breed of stock compounders is termed “Uber Cannibals”.

“Uber Cannibals”

Coined “Uber Cannibals” by famed investor Mohnish Pabarai, these companies are cash-rich, have good growth in revenue and earnings in their respective fields, are undervalued, and most importantly, these companies have demonstrated that they would consistently buy back shares to return capital to shareholders indirectly.

The formula is simple: Grow earnings consistently and use the cash generated to buy back and cancel shares when they are trading for less than their intrinsic value.

This provides immense value for shareholders as can be seen in the case below for Autozone, a company that consistently demonstrated such traits over the past 7-8 years. Consequently, the market rewarded its shareholders by boosting its share price by 400+% during this period.

Buying back and canceling shares boosts the earnings per share of the company as well as the value of your ownership of the company.

In this article, I will look at 2 such companies that have consistently bought back their shares. The current drawdown in their share prices as a result of the bear “rearing its ugly head” might be a fantastic opportunity to buy these Uber Cannibals on the cheap.

Stock Compounders #1: Domino’s Pizza (DPZ):

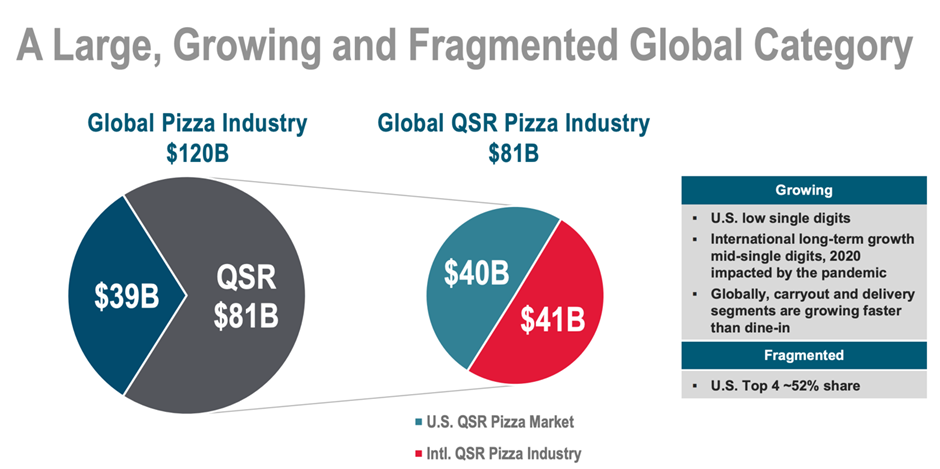

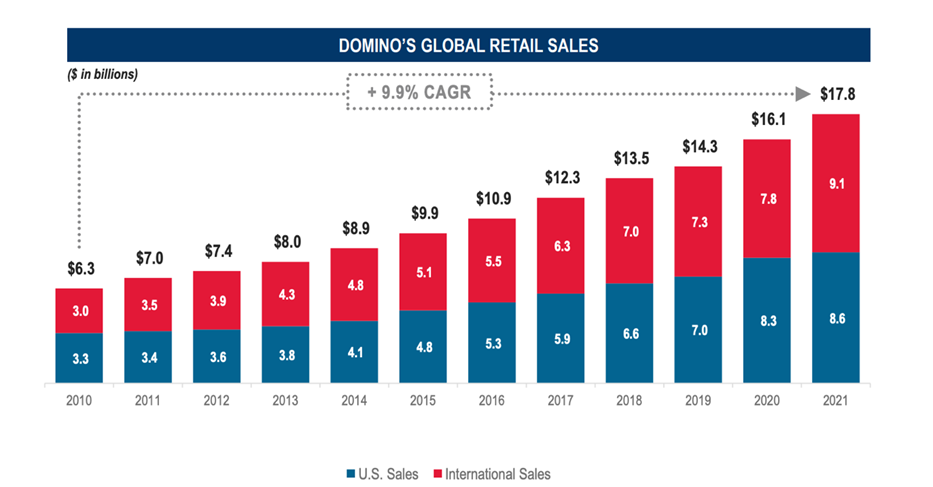

Domino’s is the largest pizza company in the world (Yes, bigger than Pizza Hut based on global retail sales). Currently, it has 20% of the global market share in QSR (Quick Serve Restaurants; Fast-food) pizza and has 19,000 global stores in over 90+ markets around the world.

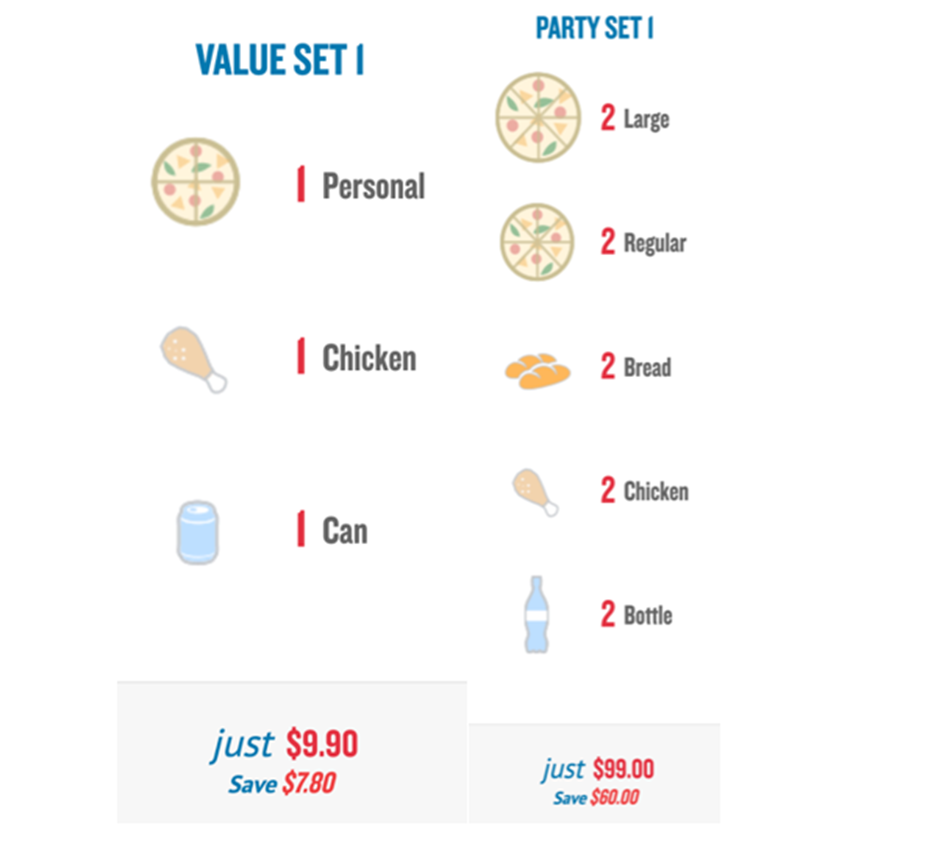

Domino’s is famous for providing great value in its offerings of pizzas and bar snacks through its coupon deals, value meals, promotions, and online-exclusive deals.

They also have special set meals catered for an individual and a group of people.

Having been a frequent customer of Domino’s since my poly days, I can personally attest to the quality of their food. I’m especially fond of their Classic Pepperoni Pizza.

Domino’s is also famous for its relentless dedication to improving its technology to keep itself ahead of its competitors. The company is always trying to innovate and develop new solutions to facilitate the most efficient and fast pizza ordering process for its customers.

To that end, over the years, the company has been the pioneer in many contemporary technologies seen in the fast-food delivery sector: insulated bags that keep food hot during delivery, live order tracking, online ordering, and an AI voice-ordering bot.

Recently, the company has also introduced Driverless Delivery and E-bikes to optimize its delivery process. All these features have contributed to increased cost efficiencies, revenues, and profits, as well as maintaining a seamless and convenient ordering experience for Domino’s.

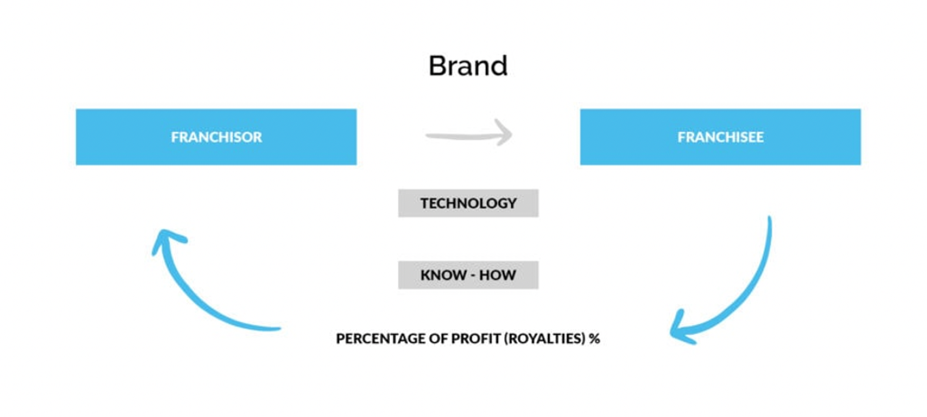

Domino’s also operates a business franchise model in which it allows individuals/groups (franchisees) to own and operate their own Domino’s stores. Domino’s provides the technology and know-how while the franchisee pays Domino’s fees (royalties).

Domino’s generates revenues and earnings by charging royalties and fees to franchisees. Royalties are ongoing percent-of-sales for use of Domino’s brand marks.

The company also generates revenues and earnings by selling food, equipment, and supplies to franchisees in US and Canada through their supply chain operations. Internationally, geographical rights to Domino’s Pizza brand are granted to master franchisees. They are then charged with developing their geographical area.

Domino’s business model can be sheltered from inflationary pressures as Domino’s can look to pass off rising input costs (food items) to consumers by increasing the prices of their food items.

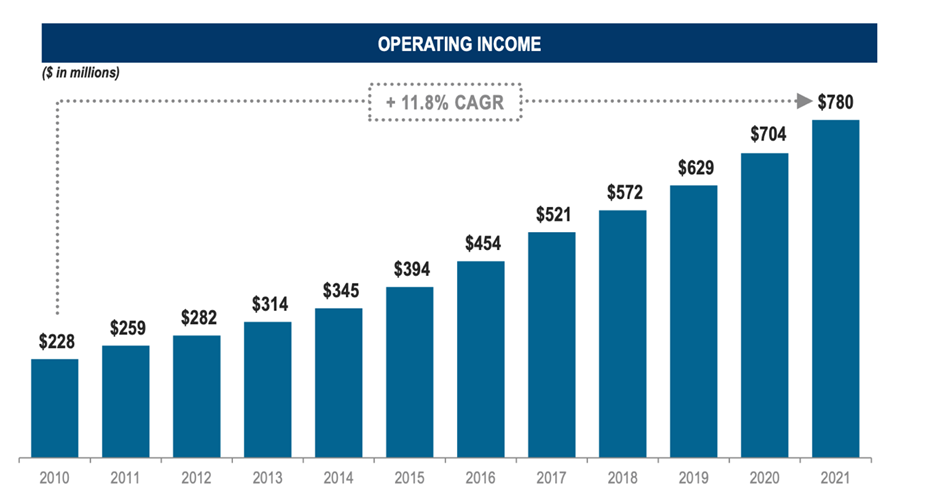

They can also increase their royalty take rate from franchisees. It is an excellent business model that has been generating increasing revenues, growth in operating income, and earnings over the years.

The business also generates significant consistent cash flows from its consistent franchise royalty payment and supply chain revenue stream with moderate capital expenditures.

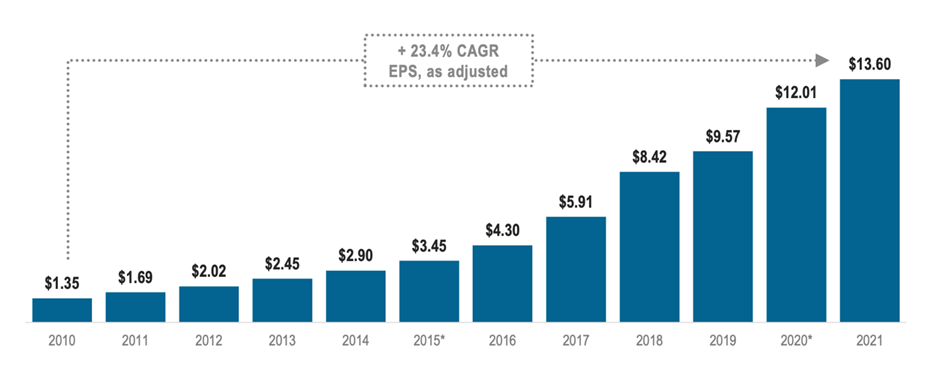

These cash flows have been returned to shareholders via a combination of increasing dividends as well as consistent share buybacks. An astonishing 36% of shares have been bought back and canceled in the past 10 years!

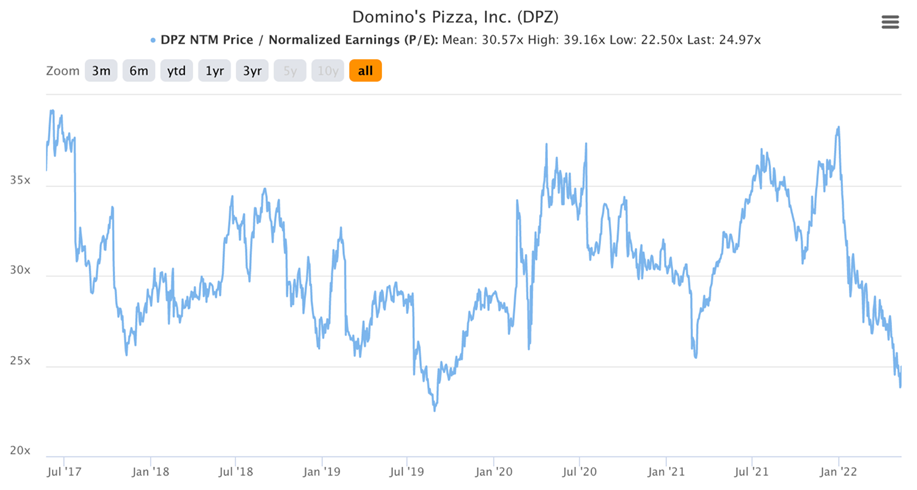

Domino’s current forward P/E is 24.97 which is the lowest in the past 5 years barring a blip in August 2019 (the stock was unfairly sold off due to Chipotle’s E. coli scandal.

Given the current starting valuation, strong fundamentals, and management’s philosophy of consistent share buybacks, I would look to start a position in Domino’s here and I would look to DCA into the company if it continues to sell-off.

Stock Compounders #2: Texas Instruments (TXN):

Texas Instruments is a company that makes microchips, integrated circuits, and other types of electronic semiconductors. You might be familiar with the company’s popular product: the TI-86 Graphing Calculator which is designed and manufactured by the company.

Having been around the scene for decades, the company’s current business model is focused on providing affordable, diverse, and long-lived semi-conductors that will be relevant for decades before they need to be replaced.

This focus on long-lived chips means that the company has a wide addressable market, does not need to spend as much on R&D unlike its rivals (Intel, AMD, Nvidia), and allows the company to establish long-lasting customer relations.

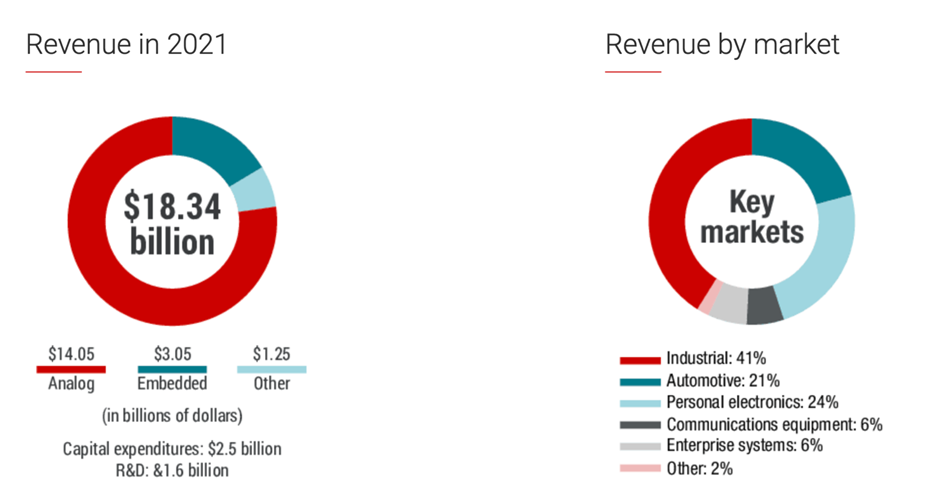

Texas Instruments has 3 primary reporting segments: Analog, Embedded Processing, and Others.

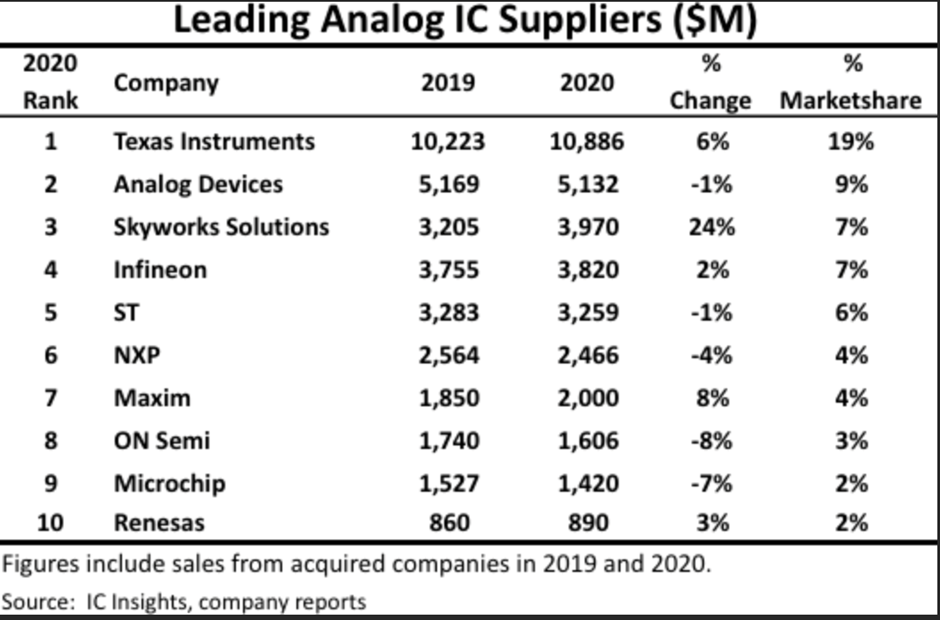

The analog segment makes up the bulk of the company’s revenue. These relate to sensors, amplifiers, regulators, controllers, converters, etc. If an electronic item has a chip that does one small task which interacts with the physical world and nothing else, it is generally an analog sensor/chip. Texas Instruments is the number 1 leading Analog supplier in the world.

Embedded processing makes up ~17% of revenue and is for more advanced chips that are considered “the brain” of electronic equipment. Often accompanied by custom-made software, these chips can be found in simple low-cost devices (microcontrollers) to specialized and complex devices (controlling servos and motors).

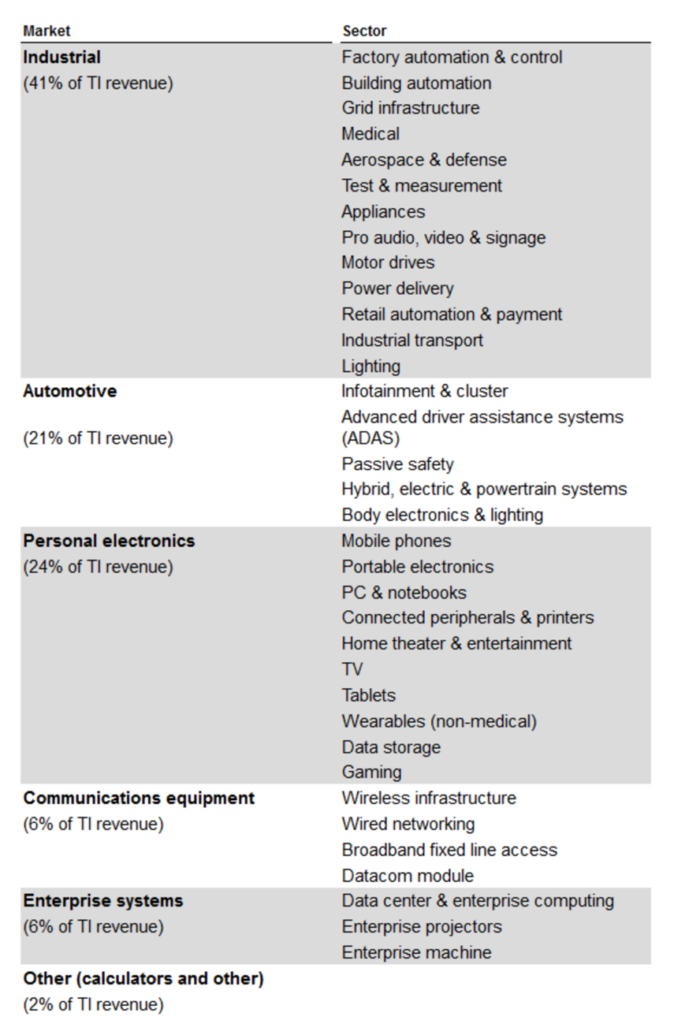

These chips are required to make a whole host of electronic devices that span across man industries from industrial usage (Medical, Aerospace & Defense, Building automation) to Automotive (Body electronics & lighting, Infotainment & Cluster) to Personal electronics (Mobile Phones, PC & notebooks). Texas Instruments has a widely diversified market for its products and services:

While this diversification (key necessities using TXN’s products) does mitigate the severe boom and bust cycles commonly seen in the semiconductor industry, the company is by no means immune from a recession.

Nonetheless, the fact that TXN has been able to grow both revenue and earnings on a YoY basis in its latest 1Q22 results, when many of its peers are negatively impacted by rising costs and consequently lower margins and earnings, is testament to the fact that this blue-chip company is one that has pricing power.

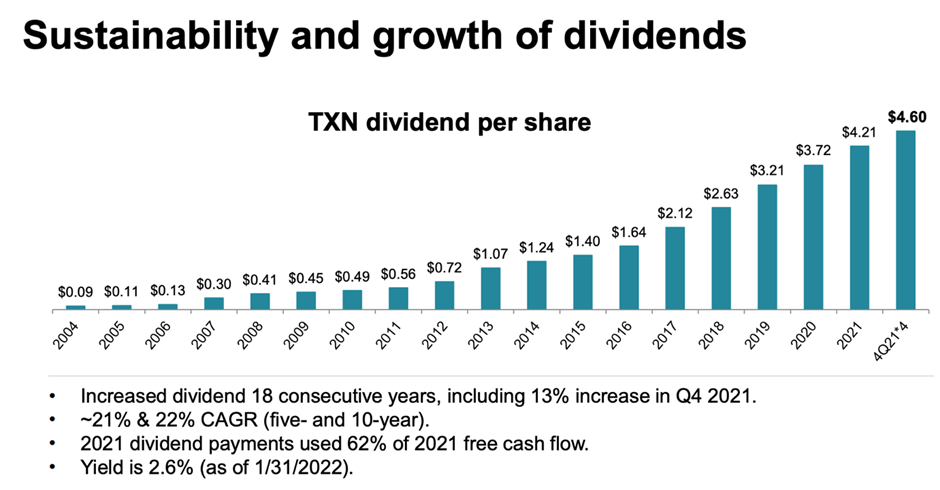

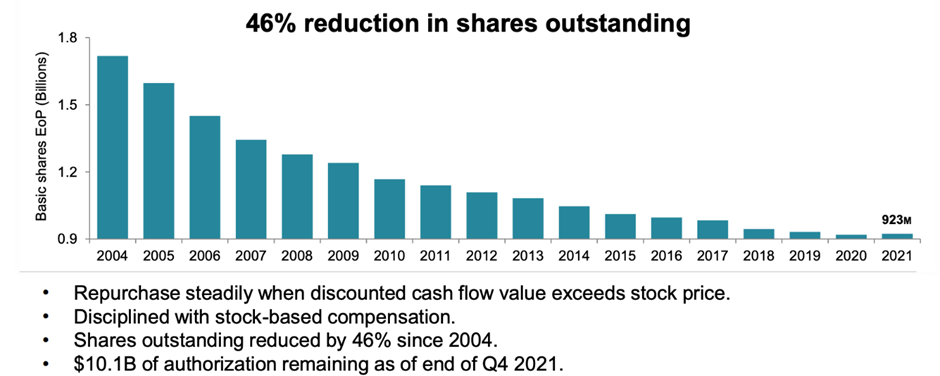

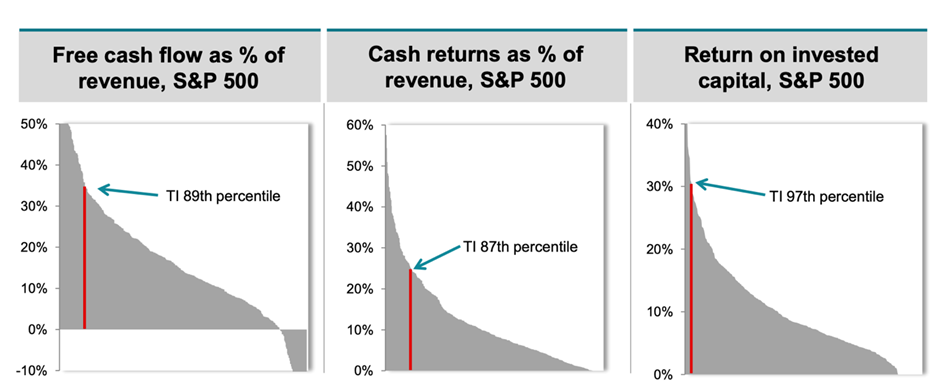

Texas Instruments’ management has stated that excess free cash flow (after reinvesting into the business) would be distributed back to shareholders in the form of increasing dividends and share buybacks. Indeed, dividends have grown at an astounding 22% / year for the past 10 years while 46% of shares outstanding have been reduced since 2004.

TXN is an amazing business at producing free cash flow and returning cash to its shareholders. It has returned 70% of free cash flow in 2021.

TXN trades at a forward P/E ratio of 19.45 while yielding 2.71%. It is trading below its average valuation of the past 5 years.

The company has an inflation hedge as it can pass on rising costs to its consumers owing to its leading position in both the analog and embedded processing market.

Although not recession-proof, given its solid balance sheet and management’s commitment to growing dividends and buying back shares, TXN looks attractive for a starter position at these prices.

This is one high quality stock that is worth starting a position at the current level and DCA into the company should the stock continue to sell off.

In addition, from a short-term trading angle, this is a counter that is also on my radar. I use the TradersGPS platform to find stocks that it witnessing rising momentum. While TXN has not been spared the bear market sell-off seen in the US equity market over the past 1-2 months, its decline has been much milder.

While a BUY signal has yet to be “fully” triggered, this is definitely a stock that has the potential to break it last high level of approx. US$200/share if a stock market rebound happens.

For those who are interested to find out more about the TGPS software, you might want to check out this free preview session conducted by Mr Collin Seow, the founder of this proprietary software, with a community of more than 5,000 existing students actively using his TGPS to identify stocks with rising momentum to buy. There is also a comprehensive review article on his software which can be accessed through this link.

Conclusion:

In this article, I have shared a special category of companies that have compounded great returns for shareholders. Known as Uber Cannibals due to their relentless share buybacks during periods of undervaluation, these companies provide immense value for shareholders by growing earnings per share while reducing shares outstanding. Simple math dictates that the remaining shares would command high prices.

Additionally, I took a look at 2 companies that fit this bill: Domino’s Pizza (DPZ) and Texas Instruments (TXN). While this might not be the absolute bottom in prices for both companies, they do present compelling opportunities at current prices.

As always, this article represents my personal opinion on Domino’s Pizza and Texas Instruments and should not be viewed as a recommendation to BUY/SELL these counters.

Do always conduct your due diligence and note your risk profile before deciding to trade the abovementioned securities. If you enjoy my writings and would like to participate in a financial community of like-minded individuals discussing personal finance and investing, you can join my discord at: https://discord.gg/Vhmjky4XEe

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- How to double dividend yield using this simple strategy

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Strong Dividend Growth Stocks Increasing Dividends by up to 19% in 2020

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- A list of “Best” Dividend Growth Stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.