Singapore Trading Festival 2021

The Singapore Trading Festival 2021 is an event jointly organized by Singapore Exchange (SGX) and InvestingNote.

This event consists of 2 parts:

- A full-day virtual summit to hear trading experts share their new trading strategies in navigating the current volatile markets. This will be held on the 27th Feb 2021

- A 5-day trading event where you can pit your skills against fellow traders in a simulated challenge (no real money involved) and stand a chance to win exciting cash prizes of up to S$5,000 worth of cash prices.

Virtual Summit Event

This virtual event will be held on the 27th Feb 2021 where SGX has invited 24 regionally-acclaimed speakers to engage participants in a wide variety of topics which include:

How to time a market exit and entry in a volatile environment,

How to use warrants for multiplied potential returns,

How to improve your stock picks with factor investing and many more.

There will also be a fireside chat with featured speaker, Jack Schwager, the author of the Best-Selling Market Wizard Series. In his new book “Unknown Market Wizards”, Mr. Schwager talks about how independent traders rival, if not surpass the performance of the best professional managers. He will share with participants during the fireside chat the success stories of these profitable independent traders.

The second featured speaker in this virtual summit event is Mr. Mike Bellafiore, who is the co-founder of SMB Capital & SMB Training. In his keynote address, he will be unveiling to participants of the event the secrets of elite traders, how and why traders at his proprietary trading firm he built, SMB Capital have become elite traders. What they are doing consistently that you are not? Learn from Mr. Bellafiore as he shares what separates elite traders from those NOT YET as good as they can be.

The full-day virtual event schedule is detailed below:

For those who are interested in registering for the summit, you can sign up over here.

Simulated Trading Challenge

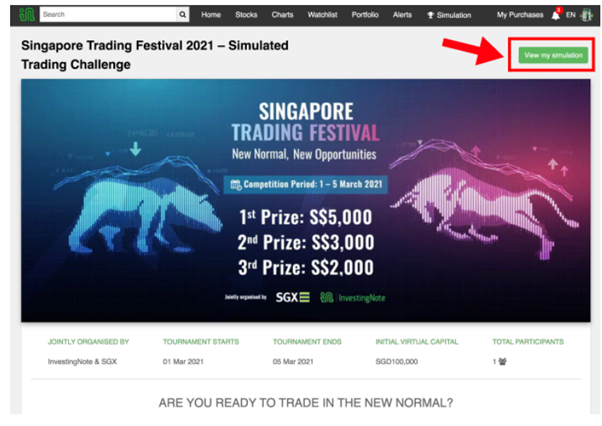

The second part of the Singapore Trading Festival 2021 is the 5-day trading event, from 1-5 March (Monday to Friday) 2021.

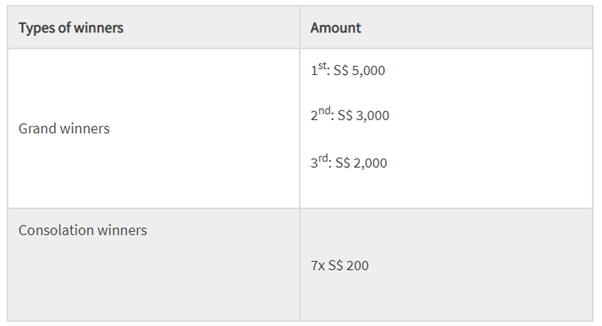

This is where traders can put their skills against each other and stand a chance to win up to S$5,000 worth of cash prices.

Winners will be selected based on the simulated investment portfolio with the most capital gains at the end of the competition (5:30om, 5 March 2021) and the announcement will be made not later than 12 March 2021.

Only realized profits will be taken into account at the end of the competition. In the case of open positions not closed out by the end of the competition, the intrinsic close will be used to calculate the gain/loss.

Key competition details

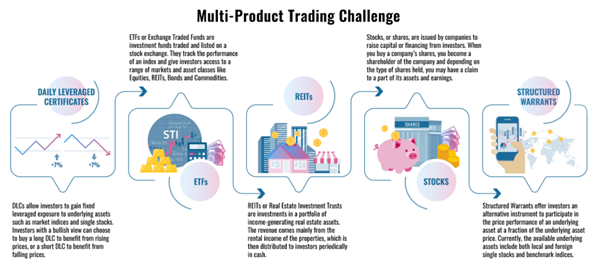

Participants will start with S$100,000 in virtual money and this amount can be used to trade in the following products:

- Common stocks including REITs

- Exchange-Traded Funds (ETFs),

- Daily Leverage Certificates (DLCs) and

- Structured Warrants listed on the SGX.

Each participant is required to make a minimum of 5 long positions for 5 different stocks OR securities within the campaign period to be eligible for the prices.

No short selling is allowed although participants can take a “short sell” position through daily leverage certificates (more on that later).

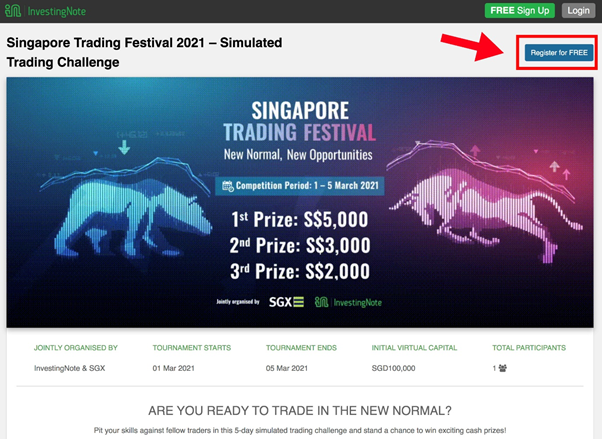

How to register for the challenge

The following information is taken from InvestingNote blog on how to register for this challenge.

Step 1: Visit this link

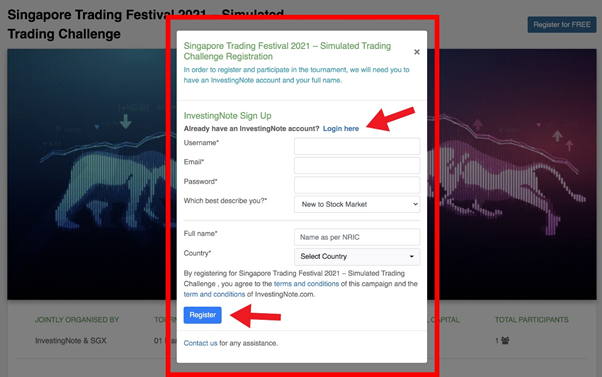

Step 2: Click the “Register for FREE button

Step 3: Follow the instructions and key in your full name as per NRIC and select the country you’re from. If you don’t have an existing InvestingNote account, please sign up for one. If you already have an account, simply login.

Step 4: Congratulations! You’re successfully in the competition!

How to start trading and be on the leaderboard for this tournament

Step 1: As the tournament begins on 1 March 2021, at 9 AM sharp, go to our website: www.investingnote.com and login with the username or account type that you registered for the tournament with.

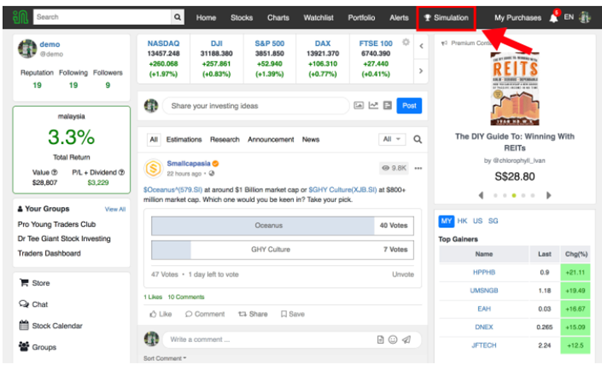

Step 2: Click the “Simulation” button at the top right to access the competition, or use this link:

Step 3: Click the “View My Simulation” button to access your virtual portfolio

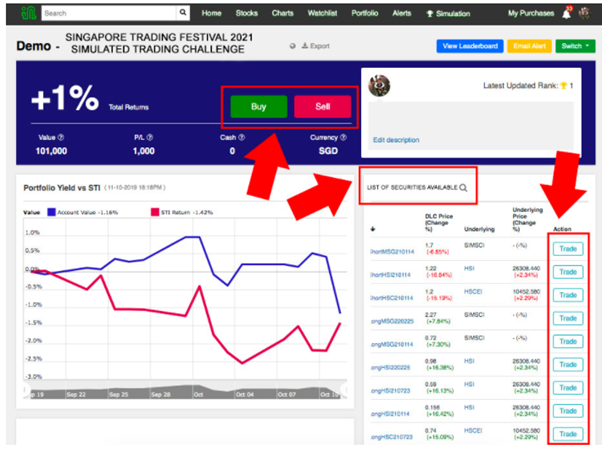

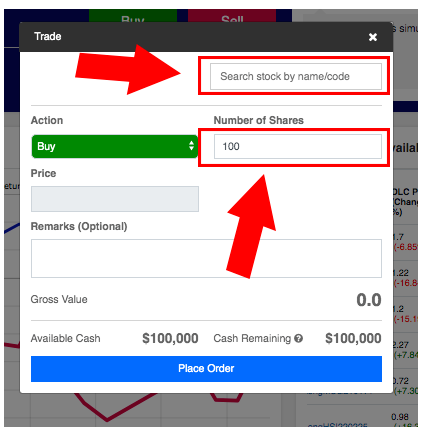

Step 4: View your virtual portfolio’s dashboard, and click the “buy” button at the top or the “trade” button on the right to start trading. Search for the list of securities available to trade on the right panel.

Step 5: Place an order by keying in the desired stock/warrant/DLC and the amount.

Step 6: Let your profits roll and make other trades by repeating step 2!

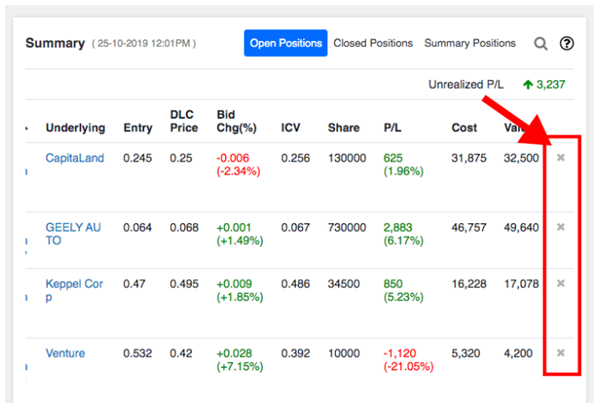

Step 7: Closing your trade: simply go to your summary positions and click the “x” icons.

How to gain an edge in this simulated trading tournament

In all honesty, a typical investor who buys a blue-chip stock or REIT is unlikely to witness massive gains over a 5-day trading horizon unless they are an excellent scalper who goes in and out of a trade within minutes and does that multiple times a day SUCCESSFULLY.

I cannot comment on the “superiority” of such a trading strategy, given that I am not a day-trader (nor do I aspire to be one) and the accumulated trade commissions (which will be accounted for in this challenge) will have an impact on such a strategy.

Instead of selecting blue-chip stocks or REITs to purchase, one can instead trade in higher volatility “penny counters” where the price movement will be more extreme.

Again, while we are talking about “pseudo” money over here, any success achieved by trading in these penny counters should not be “taken for granted” that one does indeed have the “knack” to become an excellent stock picker.

When it comes to using real money, emotions will become a big element in our stock-picking process and that could skew the conclusion dramatically.

To have a realistic chance of winning this tournament, my personal view is that one will need to engage in daily leverage certificates and structured warrants. These are leveraged products that provide investors with the additional “oomph” to generate higher returns on blue-chip counters.

These products should be seen as a double-edged sword. It provides both outsize returns and losses.

Before diving headfirst into these products, it is always ideal to have some basic knowledge and understanding of how these derivative products work.

Daily Leverage Certificates

Daily Leveraged Certificates or DLCs are a form of structured financial instruments issued by banks and traded on the securities market. DLCs offer investors fixed leverage of 3 – 7X of the daily performance of the underlying index, be it a rising or falling market.

The basic principle is simple – if the FTSE Straits Times Index (STI) moves by 1% from its closing price of the previous trading day, the value of the 3x STI DLC will move by 3%.

DLCs seek to achieve short-term investment results that correspond to the daily magnified performance of the underlying benchmarks and need to be actively monitored.

One key point to note is that DLCs have a finite lifespan and they cease to exist on the expiry date. On expiry, the final exercised value of the DLC is calculated and automatically paid to investors. This is a leveraged product that is simpler to use and understand as compared to options, the latter involving factors such as implied volatility and time decay, etc that a trader should also be aware of.

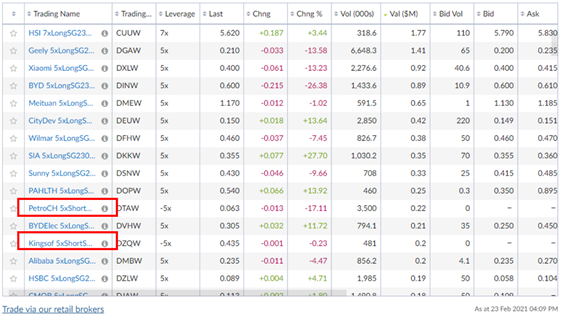

I previously highlighted that DLCs might be a way to play the “short” side of the market. This feature is particularly useful in the event a strong correction in the market is to occur. As we are not allowed to “short sell” in this competition, DLCs provide an alternative option for us to go short the market/individual stocks.

The above is a screenshot taken from the SGX website. Notice that the highlighted counters are “short” positions. If one is bearish on PetroChina and believes the stock will go down, then one can BUY this particular DLC to have a -5X leverage exposure on PetroChina.

So if PetroChina declined by 1% (what you want) for the day, your position in this DLC which you are long in will go up by 5%. The inverse is true.

As can be seen, many of the DLCs generate double-digit daily % movement in their prices. Hence, if you are right in your directional outlook of the counter, the returns will be “super-charged” in a way. However, note that there is a “compounding” effect when trading in DLCs over 1 day.

This compounding effect provides the additional tailwind when you are correct in your directional stance but work against you when you are wrong. For example, over 5 days, the underlying counter tracked by the DLC increased by 1% every day for a total gain of 5%. Your DLC which is 5X leverage should generate you a return of 5% * 5X which is 25%. However, due to the compounding effect, that return is likely more than 25%.

The inverse is also true when you are wrong on the direction.

Using DLCs will allow a trader to get that leverage effect even on blue-chip stocks such as Meituan, Wilmar, Sunny Optical, etc which will likely not appreciate as much as a volatile penny counter when one purchases stocks.

However, do note again that DLCs are leveraged structured products that enhance your gain but also could result in substantial losses. To trade DLCs using real money, an investor needs to be Specified Investment Product (SIP) qualified. This information needs to be declared through your broker.

Structured warrants

Structured warrants are another type of derivative product that gives investors that leverage component when it comes to trading.

These are products issued by 3rd party financial institutions such as banks which gives structured warrant holders the right but not the obligation to buy (for call warrants) or sell (for put warrants) an underlying asset at a predetermined price either on the expiry date or before expiration.

These products are similar to options in that they have a

1. contract horizon,

2. Exercise price,

3. Prices being affected by the volatility of the underlying assets,

4 have Time Value and

5. To a smaller extent being impacted by interest rate movements and dividends paid by the underlying counter.

Structured warrants are not to be confused with company warrants, the latter being an instrument that is issued by a listed company to raise funds for the company and give the holder the right to subscribe for or buy shares in the company.

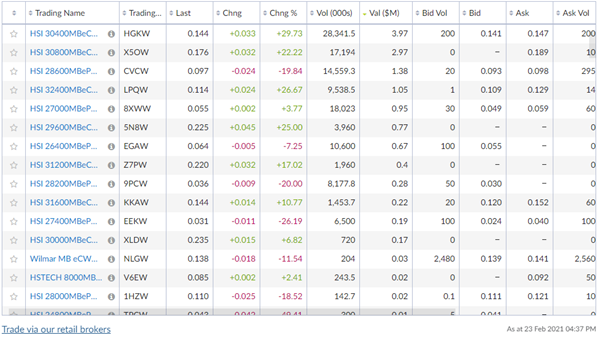

As can be seen from the screenshot again taken from the SGX website, a structured warrant provides outsized returns and losses for investors.

Let’s briefly go through the Trading Name of a structured warrant.

For example, this is a structured warrant that is created with the underlying instrument being Wilmar stock: ie this structured warrant tracks the price movement of Wilmar stock

Wilmar MB eCW211018

MB represents the 3rd party issuing bank, in this case, Macquarie.

CW stands for Call warrants (you buy if you are positive on the underlying counter). If this is a structured Put Warrant (you buy if you are negative on the underlying counter), it will show PW instead.

The numbers 211018 represent the expiration of this structured warrant contract, with its expiry falling on 18 October 2021. On this date, if not exercised, the value of this structured warrant will be ZERO.

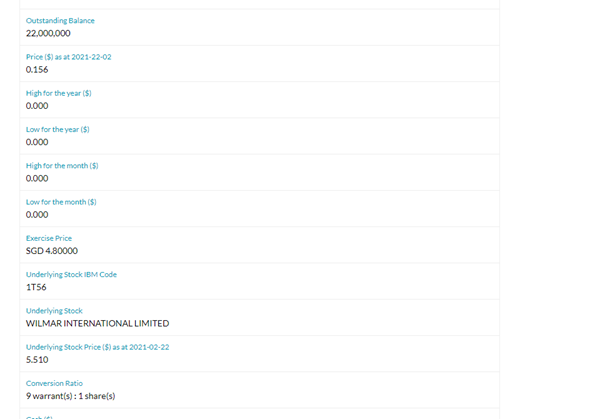

One can get more information by clicking on the tab “view warrant & agent information” which will show you additional critical information of the structured warrant such as the exercise price and the conversion ratio.

In this particular example, if Wilmar’s price closes below S$4.80 (exercise price) on the expiration date, there will be ZERO intrinsic value for this structured warrant.

Currently, this structured warrant is trading at S$0.138. Based on the conversion ratio, an investor will need to pay $0.138*9 warrants = $1.242 + $4.80 (exercise price) = S$6.04 to own 1 share of Wilmar. This is more than the current traded price of Wilmar (currently at S$5.42. The difference is due to the time value present in the structured warrants. Traders are willing to pay this premium for that leverage effect.

Bottom line: Like DLCs, structured warrants are also a leveraged way to play the movement in an underlying asset. That asset could be a specific stock or the equity index such as the HSI. However, do take note of the risk when trading structured warrants using real money. There is nothing awfully wrong with these products. It is usually human greed and lack of product knowledge that results in massive losses for the man-in-the-street trading these structured products.

Conclusion

To get an edge in the simulated trading competition, one will need to know how to trade using these leverage products.

One should however not assume that success in paper trading will translate to one being successful in day trading, the latter involving emotional aspect as a consequence of real money involved that might not be present when paper trading.

The Singapore Trading Festival 2021 is nonetheless an excellent initiative taken by both SGX and InvestingNote to increase the awareness of the SG stock market and the myriad of trading products made available on the SGX.

Once again, do jot down the important dates (27th Feb 2021 – Virtual Summit) and (1-5th March 2021 – Simulated trading competition) for this event. Those who are interested can sign up for the event over here.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- LION-PHILLIP S-REIT ETF: SHOULD YOU BE BUYING THIS REIT ETF?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- THE IDEAL RETIREMENT PORTFOLIO STRUCTURE

- WHAT IS A REGULAR SAVINGS PLAN?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.