Are you overpaying for health insurance?

Lately, I have been doing a little reading up on health insurance in Singapore. The interest was ignited by online personal finance articles pertaining to health insurance cost in the US.

From my analysis, the typical health insurance cost a 41-year old typical Singaporean would pay is approx. SGD1,700/annum while the average 41-year old American will pay USD4,740/annum.

Read on for more details.

US health insurance cost getting out of hand?

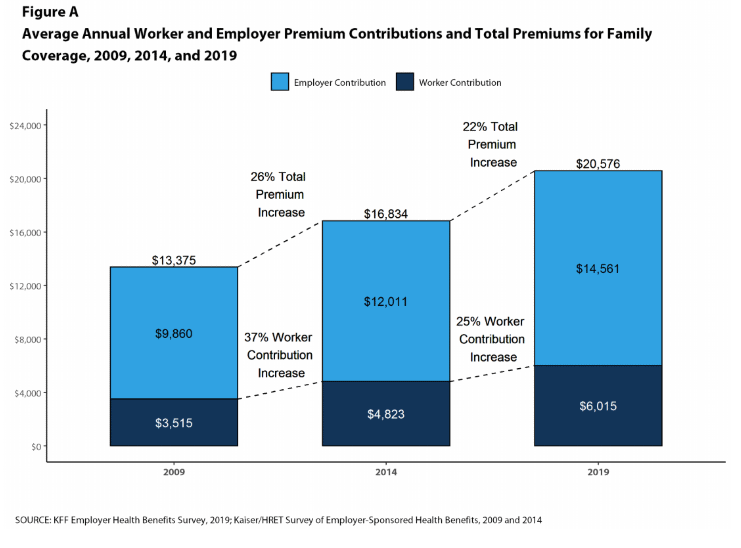

According to Financial Samurai in his article: The Average Cost of Family Health Insurance is Now Outrageously High, he cited the data from Kaiser Family Foundation survey that the average cost of family health insurance offered by companies is now at c.USD$20,576/annum or USD$1,715/month!

The average premium for single workers was USD$7,188/annum or USD$600/month. That is a whole lot of money to be paying for health insurance.

According to CreditDonkey.com, the average US person pays USD$464 for individual coverage and USD$1,266 for family coverage on a monthly basis.

Granted that employers generally pay the bulk of these health insurance expenses (71%-83%). However, for entrepreneurs or those in the gig economy, health insurance will always be an extremely costly burden to bear.

It is estimated by Financial Samurai that based on his own insurance premium of USD28,320/annum (if he adds a second child), the family will need to earn pre-tax return of USD$37,760/annum.

Based on a 4% return or withdrawal rate assumption, they will need to accumulate or allocate USD$944,000 in investments/savings to cover their healthcare premiums alone if they continue to stay unemployed (or continue to enjoy early-retirement life)!

No wonder he has the opinion that US citizens need at least USD$2 million to retire early with kids.

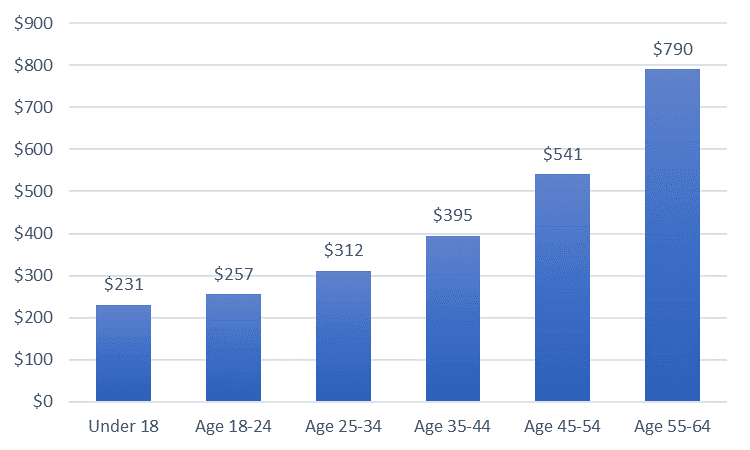

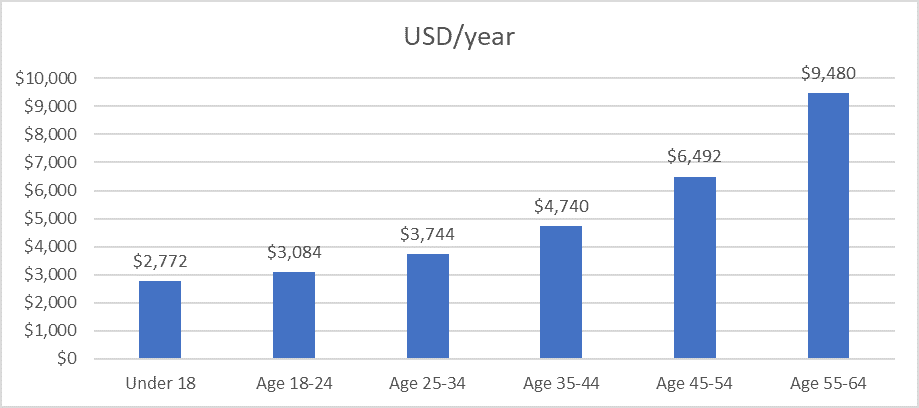

For better comparison sake, the chart below shows the average monthly premiums for US individual plans by age group, according to data from ehealthinsurance:

For an individual Age 35-44, the insurance cost will amount to USD$395/month or USD$4,740 on an annual basis. For Singaporeans Age 41-50 (we will illustrate the cost below), the premiums for Integrated Shield Plans for Private Hospitals (excluding riders) typically cost SGD$1,100/annum.

Even excluding the impact of exchange rate, Singaporeans health insurance premiums are still almost 300% lower than your typical US insurance premiums! More on that in the later segment.

Singapore health insurance cost

While Singapore is “notorious” for being an extremely expensive nation to live with, holding the title of the world’s most expensive city for the fifth year running, according to a report by The Economist Intelligence unit, our health insurance cost is nowhere near the elevated-level seen in the US, although it is noted that employers typically do not contribute to our personal health insurance expense.

Instead, companies typically go down the route of group employee insurance, which typically covers hospitalization and surgery (H&S), outpatient GP and even personal GP.

Before I dive into some of the health insurance options that are available here in Singapore, it is useful to just provide a brief summary of our health insurance systems.

Medisave

Every Singaporean would have some money in their Medisave account. When Singaporeans contribute to their CPF aka pension fund, a portion of it (8%-10.5% of one’s gross salary) will be channeled towards their Medisave account.

Funds in the Medisave account can be used to defray some of your healthcare-related expenses. However, there are typically withdrawal limits, which means that in majority cases, the Medisave funds can only be used to cover a small amount of one’s medical expenses, particularly if the notional amount is large (eg, a serious surgery or a long-term hospitalisation).

Hence you will need to supplement Medisave with other health insurance policies.

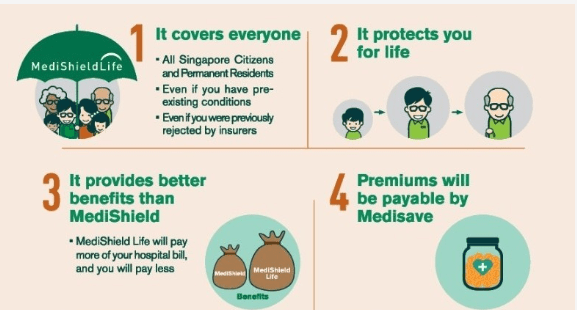

Before you call up your insurance agent to talk about your health insurance plan (I am sure he/she will be joyous to take this call), do note that every Singaporean and Permanent Resident (PR) is covered with basic health insurance called Medishield Life.

Medishield Life

Medishield Life is a basic health insurance plan, administered by the CPF board which helps to pay for large hospital bills and selected costly outpatient treatments such as dialysis and chemotherapy for cancer.

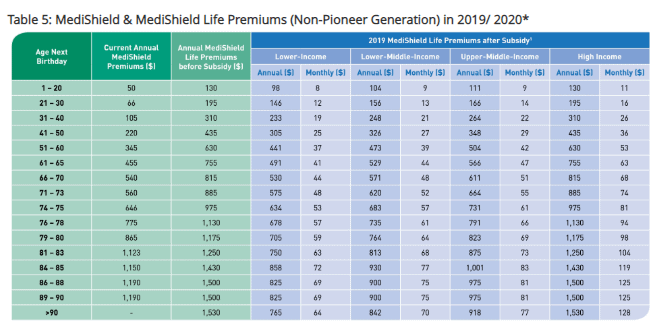

The table below illustrate the premiums payable for Medishield Life. For someone say age, 41 who is in the low-income bracket, he/she will only need to pay S$25/month for Medishield Life coverage. Even if he/she falls in the high-income bracket with no subsidy, that cost only increases to S$36/month.

Compare this to the USD$395/month average health insurance bill that a US citizen, Age 35-44, will have to fork out!

However, given the low premiums, Medishield Life benefits are typically pretty basic. Don’t expect to be staying in a 5-star hospital! Payouts are typically pegged to prices for Class B2 and C wards in public hospitals.

You can choose to stay in Class B1 or A ward or in a private hospital. You can still benefit from Medishield Life, but the balance would have to be topped up by cash or through a private insurance coverage aka integrated Shield Plans or IP for short.

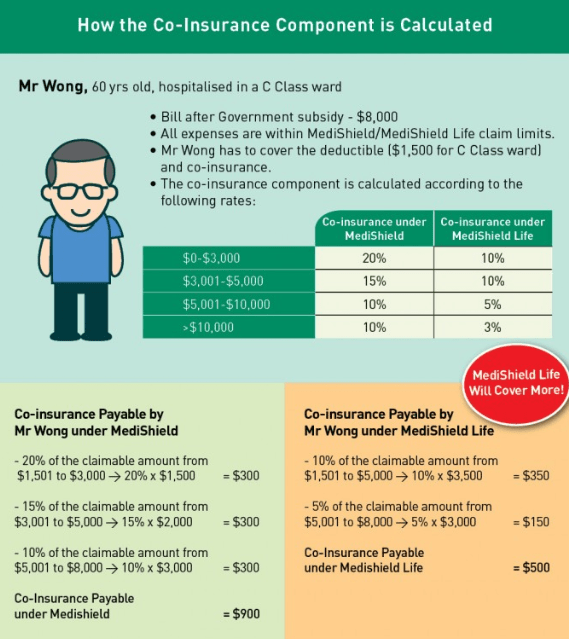

Before we touch on IP, do note that there is also a deductible amount of S$1,500 (Class C)-S$2,000 (Class B2 and above)/annum before your Medishield Life coverage kicks in.

For example, if your total hospital bill (staying in Class C) comes up to S$8,000 and let’s assume you can use your Medisave to offset S$1,000 of that cost. You will still need to fork out S$500 IN CASH as per the deductible requirements. This deductible amount is only paid once in any year you are hospitalised

There is also the co-insurance portion of between 3%-10% on the remaining amount of S$6,500 which you have to pay in cash before Medishield Life kicks in to cover the rest of the hospitalisation bill.

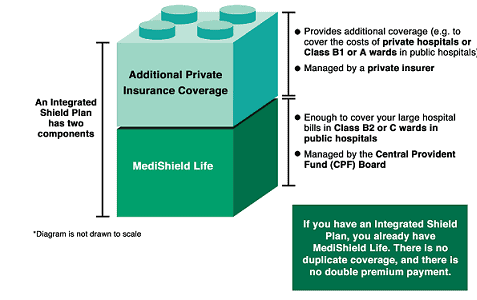

Integrated Shield Plans (IP)

Medishield Life covers the basic health insurance. If you don’t mind staying in Class B2 or C ward in a public hospital, your monthly health insurance payment is typically very affordable.

However, let’s say you will like to stay in Class B1 or Class A or private hospital, that’s when you should be purchasing an IP which combines Medishield Life with additional coverage provided by private insurers.

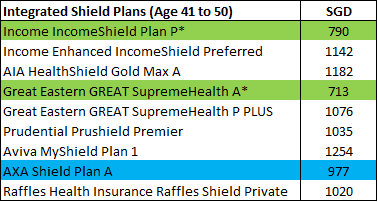

There are 7 IPs in Singapore providing such insurance coverage. For more detailed information, one can refer to the private integrated shield plan comparison compiled by the Ministry of Health. Based on a quick pricing summary (using age 41-50 as benchmark) as seen from the table below, AXA Shield Plan A is the cheapest based on Insurance premium for new policies.

*No Longer being offered to new members

For those who are still on Income IncomeShield Plan P and Great Eastern GREAT SupremeHealth A, both of these plans which are no longer offered to new members, it makes sense to continue renewing your plans due to the lower associated costs. However, do note that your coverage will no longer be as comprehensive.

For example, there are various caps to Day Surgical Procedures for IncomeShield Plan P vs. Income Enhanced IncomeShield Preferred which generally has no cap.

However, one should consider beyond just the premium prices but also other factors such as 1) Any caps on inpatient and day surgery, 2) Pre and Post hospitalisation benefit, 3) Outpatient treatment benefit, 4) Critical illness and Prothesis benefit, 5) Emergency and 6) Overseas medical treatment as well as 7) Policy year claim limit.

Do refer to the link for more details.

Do note that a portion of the IP premiums can be paid with your Medisave:

- S$300 if you are 40 years old or younger on your next birthday

- S$600 if you are 41-70 years old on your next birthday

- S$900 if you are 71 years or older on your next birthday

So how much does a typical Singaporean pay for his/her health insurance premiums (Private hospitals)?

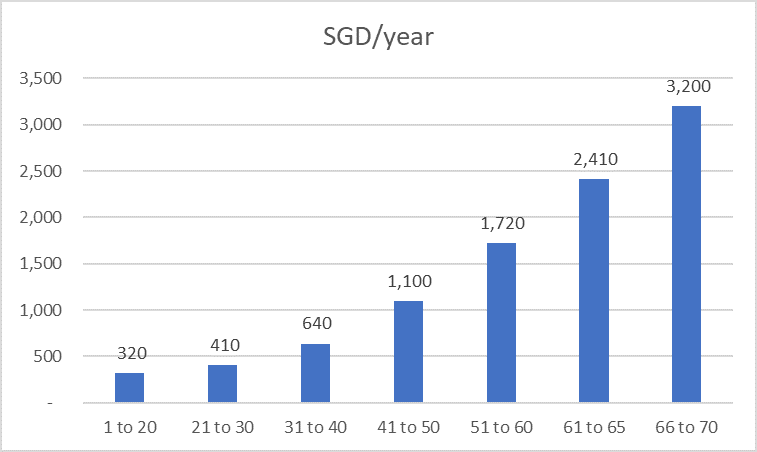

The chart below summarises the typical insurance annual premium cost for a Singaporean that decides to purchase an IP for private hospitals (new plans only).

For younger folks below age 40, that figure ranges around S$320-S$640, age 41-50 approx. S$1,100, age 51-60 approx. S$1,720, age 61-65 approx. S$2410 and for retirees age 65 and above, that figure shoots up to approx. S$3,200 on average.

Compare these figures to those in the US and it seems like health insurance premiums are generally still affordable, despite Singapore’s notoriously high cost of living.

Having said that, for a retiree age 65, after Medisave deduction, he/she still would have to fork out annual premiums of c.S$2,600 (before deduction of S$3,200) which translate to c.S$52,000 of savings in ones CPF retirement account, assuming it accrues interest at a 5% rate.

This might not be a sustainable amount for most retirees who will be progressively drawing down on their retirement account savings.

A solution could be to downgrade to a Class B1 option where premiums of approx. S$1,400/annum are much more affordable vs. S$3,200/annum before Medisave deduction.

Policy riders

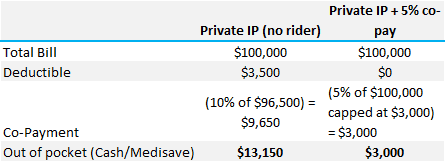

Recall that before the insurance payment kicks in, there is a 1. deductible portion as well as 2. Co-insurance portion. This combined amount can be pretty hefty if your hospitalisation bill is large. For example, the deductible amount is S$3,500 for Class A and private hospital. Co-insurance portion is 10% of the remaining bill.

If your hospital bill amounts to S$100,000, your cash/Medisave payments could total up to S$3,500 + 10%*S$96,500 = S$13,150. That is a pretty sizable out-of-pocket expense that one will have to pay.

The solution would be to purchase IP Riders such that the full amount of S$13,150 will be borne by the IP company. Well it used to be that way until the government decides to introduce the Co-Pay rider scheme.

Co-Pay rider

From 1 April 2019, all new IP riders will need to include a minimum of 5% co-payment on bills relating to hospitalisation, outpatient treatments or day surgery.

There will however be a co-payment cap of S$3,000. That essentially means your hospitalisation bill is cap at S$60,000 (5%*S$60,000 = S$3,000). You will not have to worry for bills in excess of S$60,000 if you purchase a co-pay rider. This S$3,000 can be partially offset by your Medisave funds.

For existing riders purchased between 8 Mar 2018 and 31 Mar 2019, your riders will turn into co-payment upon renewal from 1 Apr 2021 or you can transit to the co-payment scheme if you wish to do so earlier.

For full riders purchased before 8 Mar 2018, there is technically NO change to your plan. Insurers in Singapore are required to honour commercial contracts that they already have with existing policyholders.

Do note that there is however a high likelihood that the premiums you pay for your full rider coverage will increase, since the policyholders most likely to claim on their hospital bills are unlikely to switch to a co-pay rider.

If and when you notice that your full rider premiums are rising significantly, that is when you should be looking to switch to a co-pay rider.

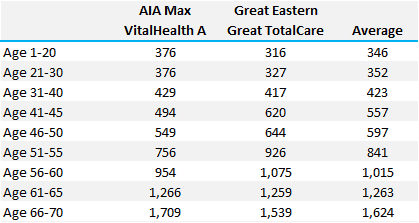

Co-pay rider premiums

The table below illustrates both AIA Max VitalHealth A and Great Eastern GREAT TotalCare, the 2 riders on 5% co-pay system.

Total health insurance premiums

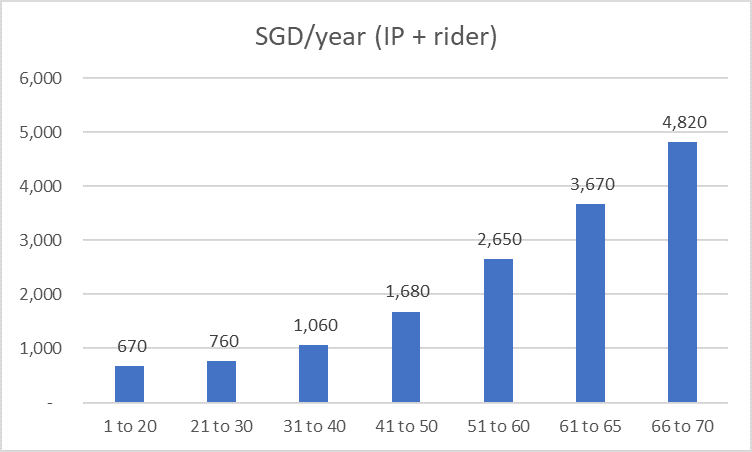

Using the average of these two co-pay riders, we add the cost of riders to the IP premiums for the various age group:

Essentially, an individual age 41 for example will pay a total of approx. SGD$1,680/annum in premiums (IP + co-pay rider) with a total out-of-pocket max outlay of SGD$3,000 (5% co-insurance portion).

If you are paying significantly more in premiums relative to the average of your age band, do take a closer look at where the variances might be. If your full rider premium is significantly higher than a typical co-pay one, as illustrated in the table above, then consider switching to a co-pay rider, particularly if you are a generally healthy individual.

Alternatively, you might want to switch to a new insurer with lower premiums. However do note that any pre-existing conditions may not be covered by your new insurer when you switch.

Again, compare that to a 41-year old American who needs to pay on average USD4,740/annum in premiums, with a total out-of-pocket max of USD3,200 (based on financial samurai’s PPO Platinum plan).

Even with the inclusion of the rider component and similar cap in terms of out-of-pocket outlay, the cost of Singapore health insurance is still 200% lower than that of the US!

Nonetheless, Singaporeans should always be looking at ways to lower their overall healthcare-related cost. We will be looking to engage on this topic in another article.