I recently wrote 2 articles on the semiconductor industry (see links below). I will like to follow up with a 3rd article that seeks to look at the valuation of different semiconductor stocks. Semiconductor stocks can be broadly categorized into 5 segments: 1) Design, 2) Foundry, 3) IDMs, 4) OSATs and 5) Equipment Manufacturers.

Global semiconductor supply chain: Where are the opportunities?

5 Small-Cap Semiconductor stocks that have crushed the market in 2021

Which of these segments command the greatest valuation premium in terms of Price/Earnings ratio? Let’s take an in-depth look at each segment.

Semiconductor Industry Stocks

Design Companies (Fabless)

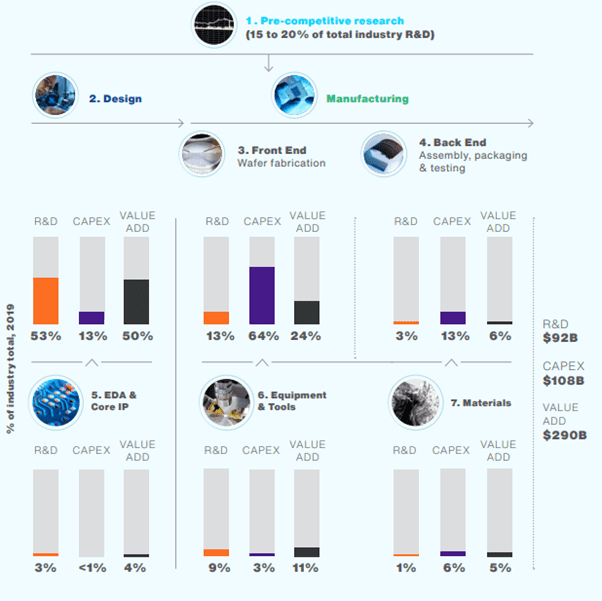

Design companies are also your fabless companies, with the core business purpose being to design chips to be used for different purposes (ie mobile phones, consumer electronics, auto, etc). These companies focus heavily on R&D, with the intent of developing new chips that stand out ahead of the competition.

They do not fabricate their chips but will instead partner with foundries to manufacture chips based on their design.

Design companies provide the greatest “value add” to the entire supply chain. This means that for every dollar that a company such as Apple pays for the purchase of the chips used in its mobile phones, design companies get paid the most.

For example, if it cost Apple $100 for the chips to be used in its phone, approx. $50 of that cost goes to design companies.

Since the value adds of design companies are the greatest, these companies typically also trade at a premium.

Some of the largest chip design companies are Broadcom, Qualcomm, AMD, Nvidia, and Marvel

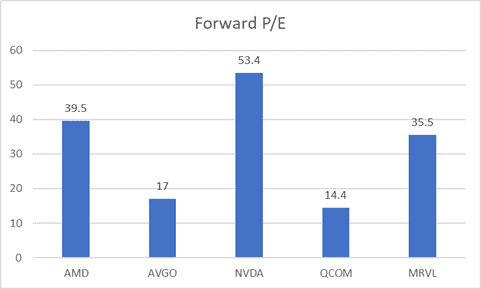

The chart below illustrates the forward P/E of these five chip design companies

The company that is trading at the highest forward P/E ratio is Nvidia at 53x while QCOM is trading at the lowest at 14x P/E.

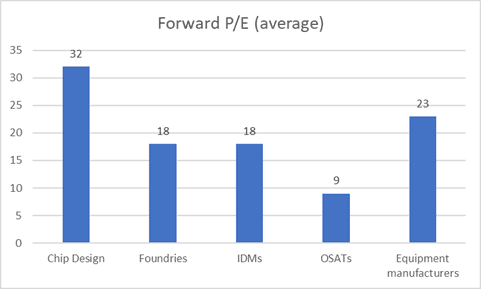

This segment has an average forward P/E ratio of approx. 32x based on the above 5 key chip design companies.

Foundries

Foundries are companies that fabricate/manufacture the chips which have been outsourced to them by the chip design companies.

The largest and most well-known foundries in the world are TSMC, Samsung, UMC, Globalfoundries and SMIC.

These companies spend heavily on Capex to build high-end fabrication plants that often cost billions of dollars to construct, a huge portion of the cost associated with the purchase of high-end machines necessary for the chip fabrication process.

Due to its high barrier of entry in terms of production cost of setting up these expensive fabrication plants, most of the chip fabrication (particularly logic chips) are dominated by the foundries highlighted above, with TSMC accounting for the lion’s share.

In terms of value add, foundries contribute approx. 24%.

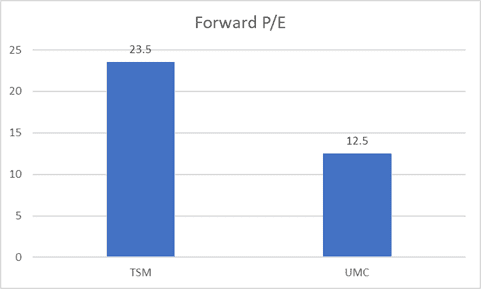

We based the forward P/E of foundries using just TSMC and UMC as a reference point.

TSMC is trading at a substantial premium with a forward P/E ratio of close o 24x, almost double that of UMC’s forward P/E multiple.

On average, this segment has an average forward P/E multiple of 18x, significantly lower than that of the chip design’s companies average forward P/E multiples of 31x.

Integrated Device Manufacturers (IDMs)

IDMs, also known as integrated device manufacturers, are companies that are capable of both design works as well as manufacturing their chips, ie having their fabrication plants.

IDMs used to be the dominant structure when it comes to chip production 30 years ago, with these players accounting for > 90% of the market share for IC production. However, that market share has now dwindled substantially, with pure design companies accounting for a larger slice of the pie.

IDMs, the largest being Intel Corporation, have struggled to balance their limited capital resources between spending on R&D to design high-end chips that appeal to their customers, while concurrently spending on Capex to develop high-end fabrication plants capable of manufacturing the most efficient chips.

Increasingly, more of their customers, the most prominent one often being Apple, are also bringing the chip design process in-house and outsourcing the chip fabrication to more efficient players such as TSMC.

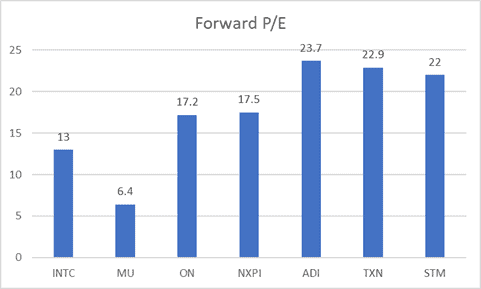

Some of the best-known IDMs are the likes of Intel, Micron, Texas Instrument, Analog Devices and ON Semiconductor.

These companies have an average forward P/E ratio of approx. 17.5x which is generally in line with that of our foundries highlighted earlier. The most well-known IDMs in this list is INTC and it is trading at a forward P/E ratio of just 13x, which illustrates the fact that the market does not seem to accrue a premium for its IDM structure.

OSATs

OSATs are companies that deal with back-end manufacturing once the front-end manufacturing done by the foundries is completed.

Back-end manufacturing typically involves assembly, testing and subsequently packaging of the final chip products to be shipped off to the customers.

Unlike foundries which tend to be a highly concentrated industry with a handful of companies dominating the entire market, the OSAT market is very fragmented with hundreds and thousands of companies providing testing and assembling services.

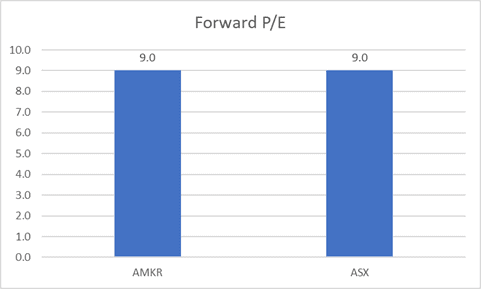

The current market leaders in this segment are ASE and Amkor which are the 2 largest OSAT companies by revenue.

Both companies are currently trading at a forward P/E multiple of 9x which is the lowest valuation among the segments that we have highlighted so far.

This is not surprising considering that the value-added component that these players bring onto the table is also the lowest.

Equipment Manufacturers

Last but not least, are the equipment manufacturers who are extremely critical in the entire chip production process. Without the supply of their highly sophisticated machinery, foundries will not be able to fabricate chips efficiently. Their machinery is also needed for the back-end manufacturing process.

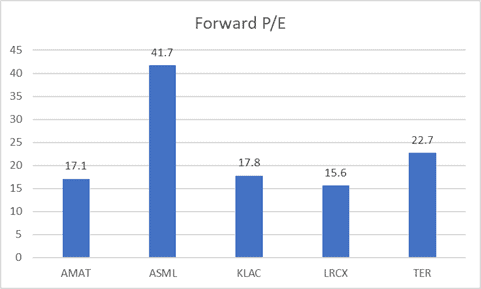

There are several well-known semiconductor equipment manufacturers, with the largest currently being ASML, AMAT, Tokyo Electron, Lam Research, KLA Corporation, etc.

The company with the highest valuation in this list is ASML, which has strong dominance in a critical chip fabrication process: lithography. That is why it often trades at a significant premium to its peers.

The cheapest in terms of forward P/E is Lam Research, which is trading at just 16x forward P/E. This segment has an average forward P/E multiple of 23x, the second-highest overall behind chip design companies.

When valuing semiconductor companies, one should be mindful not to “lump” them all in the same broad semiconductor industry but to identify these companies’ core areas of expertise and value them accordingly.

What happens when we incorporate growth into their P/E multiples?

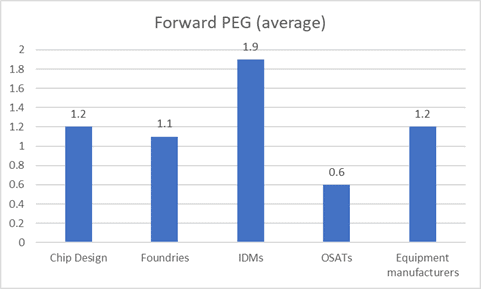

A key financial metric popularized by legendary investor, Peter Lynch, seeks to incorporate the growth factor into the P/E ratios to determine if these P/E ratios are justified.

For example, a semiconductor company might be trading at an elevated P/E ratio of 40x, which makes them look “expensive” but if that company is expected to grow its earnings by 80%, then its 40x P/E is justified since its Price Earnings Growth ratio or PEG ratio for short is only 0.5x (40/80).

Compared to another semiconductor company that is trading at a cheaper P/E multiple of 20x but is only expected to grow its earnings by 20%, then this company will have a PEG ratio of 1.0x (20/20), which now makes it more “expensive” (PEG ratio of 1.0x) when compared to the first company (PEG ratio of 0.5x), after incorporating the growth element into the equation.

The graph below incorporates the growth element into the average P/E ratio of the 5 segments. For example, chip design companies have the highest average forward P/E multiples of 32x (as seen in the earlier graph) and might seem expensive compared to IDMs with a lower multiple of 18x, but because chip design companies are forecasted to grow much faster than IDMs, their average PEG multiple of 1.2x is lower than that of IDMs at 1.9x, making these companies “cheaper” when evaluated using the PEG metric.

OSATs are currently the cheapest when evaluated using the PEG multiple, trading at just 0.6x PEG. Chip design companies, foundries and equipment manufacturers are all trading at similar PEG multiples (1.1-1.2x) at this juncture.

Conclusion

The semiconductor space is a highly complex one with hundreds of processes required to produce a chip that has become a quintessential element of many consumer products that we use daily.

While the structural outlook for the semiconductor industry looks bright, with growing themes such as IoT, 5G, AI, metaverse, etc propelling demand for high-tech chips ahead, one has got to be mindful that this industry is still a highly cyclical one, and that cycle might turn negative in a blink of an eye.

While I don’t expect the cycle to turn negative over the coming year (2022), the risk of an industry downturn might become more evident in 2023 when fabrication supplies start entering the market, prompting chip customers to massively cut back on their “hoarding” behavior.

If demand from growth themes highlighted above is insufficient to absorb the supply “glut” by then, then the next downcycle could become a painful one for many of these semi players.

The most “insulated” ones, in my view, are your chip design companies as they add the greatest “value add” in the entire supply chain and typically can pass-on additional costs to their customers.

However, if chip design companies are not diversified enough and hence possess a high element of customer concentration risks, that could turn disastrous if their key customers, such as Apple, decide to bring the chip design process in-house. We have seen that negatively impacting design companies such as QCOM.

A potential headwind for design companies is also the elevated valuation that most of these companies are commanding at the moment.

What are the semiconductor companies that you are interested in? Do type in the comment section.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only