Sembcorp Industries Stock: Buy, Sell or Hold?

On 7 December, Sembcorp Industries announced profit guidance which seems to become the norm. In the past, the key focus was on Sembcorp Marine, with impairments made to its Energy division being “swept under the rug”.

I previously mentioned in this article: Should one by buying Sembcorp at this level? that Sembcorp Industries’ impairments and write-offs are happening way too frequently.

“This is based on Sembcorp industries’ reported net profit for its Energy Division. While some might argue that it is a better representation to exclude “one-off” items such as impairments and write-offs, the counter-argument can be that such one-offs are occurring too frequently that they should be viewed as “normalized”.

In the latest set of profit guidance (the company did not provide any updates on its 3Q20 results) for its 2H2020 results, Sembcorp Industries highlighted that there will be impairments of approx. S$89m in its 2H2020 financial statements arising from its periodic assessment of the recoverable amounts based on expected future cash flows of its assets.

Amid the latest earnings guidance, is Sembcorp Industries stock still undervalued? Let us first take a look at its latest set of earnings guidance.

Impairments in 2H2020

UKPR

The bulk of its S$89m impairment charges is related to its UK Power Reserve assets (UKPR) which Sembcorp Industries provided charges of S$60m. The official reason for this impairment is “revised strategy for the business” where the company’s focus for the business is now on driving value from its existing portfolio, primarily in the grid services market.

Does the company mean that there was no intention to “drive value” when the business was acquired in the very first place?

This is not the first time that the company is making impairment charges for UKPR. Recall that UKPR was acquired by Sembcorp Industries back in mid-2018 for a total consideration of S$385m.

From the get-go, there were issues with the acquisition, with the UK power capacity market being suspended.

In 2019, the company decided to do a massive S$158m impairment of its UKPR assets, citing a challenging business environment where supply has increased while demand has dropped. This is 41% of its acquisition cost.

Now, after one full year, Sembcorp Industries is making yet another impairment charge on UKPR to the amount of S$60m. This will bring the total value of its impairment charges over a short duration of just 2+ years since the acquisition was made to S$218m which is 57% of the original cost of acquisition.

Will there be further impairments to be made for UKPR down the road?

Utility assets on Jurong Island

A further S$21m impairment for utility assets on Jurong Island was made, comprising a wastewater treatment plant and a woodchip boiler facility in Singapore. Sembcorp industries cited that sales volumes are expected to be adversely affected by the decision of a major customer to exit its Singapore manufacturing site operations on Jurong Island by the end-2020.

The wastewater treatment plant in Nanjing

Lastly, a comparatively small amount of S$8m impairments will be made to its wastewater treatment plant in Nanjing as the service agreement associated with this plant was terminated, with the customer stopping production at its facilities.

Total impairments made in 2019/2020

Combined with impairments and write-down charges of S$191m made in 1H2020, the total amount of “exceptional” charges in 2020 will amount to S$280m.

Again, recall that back in FY2019, Sembcorp Industries made a combined impairment charge of $245m (although these were also offset by divestment gains).

Total impairment charges made across both years amounted to S$525m vs. its Energy division equity base of approx. S$3.7bn as of end-2019.

Sembcorp industries highlighted that as a result of these exceptional items, the Group expects to incur losses for FY2020. Shareholders will likely be on the lookout for its FY2020 results set to be announced on 23 Feb 2021.

Results likely to be boosted by India, but one-off in nature

According to UOB in its November update of the company, Sembcorp Industries’ India business unit SEIL recently reported very strong results for the 6 months ending 30 Sep 2020, with net profit expanding by 24x YoY to Rs3.bn. However, this was due to a change in revenue-recognition laws and thus is a one-off event.

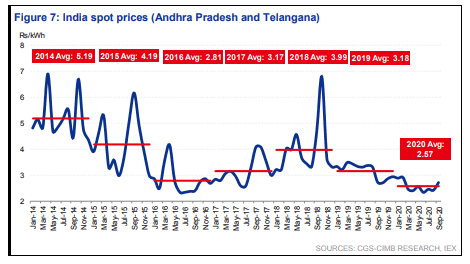

According to CIMB, Spot electricity tariff prices in India remains weak, hovering at around Rs2.57 per unit for the majority of 2020. Solar tariffs are at an all-time low. The only thing going well in India is probably Sembcorp industries’ wind assets.

There were also market rumors that the company is looking to sell its stake in India’s thermal power business back in July 2020, although there were no follow-ups since then. This is probably in the best interest of shareholders since the strategic vision of the company is to go green, with more focus on its solar and wind portfolio.

My conclusion when I wrote this article on Sembcorp industries back in September was that market is already pricing in an earnings recovery in 2021 and there will need to be other forms of positive surprises to catalyze its share price beyond the approx. 0.5x P/B level which the counter was trading then.

I was wrong. Sembcorp Industries’ share price “flew” from S$1.18 at that juncture to the current level of S$1.74, a good 47% price appreciation.

Did its core fundamentals improve drastically post its marine demerger? Doesn’t seem to be the case base on the latest set of negative profit guidance announcement.

Should we then expect a strong earnings performance in 2021? That is likely not going to be the case if key markets such as India, UK, and Singapore continue to perform poorly.

Have already re-rated back to c.0.7x P/B (close to 10-year average)

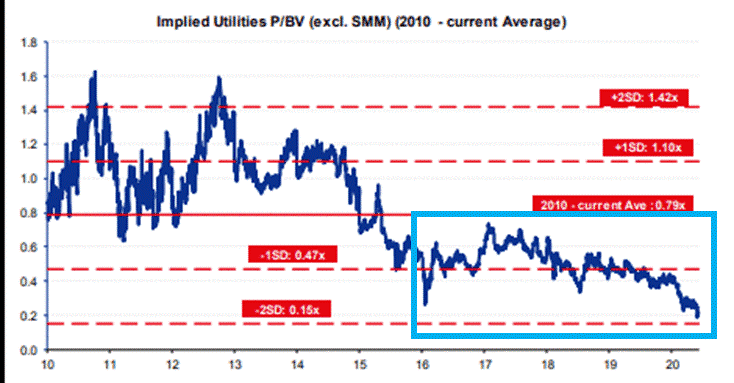

According to CIMB, Sembcorp Industries has been trading at a P/B multiple of 0.79x since 2010 (this multiple exclude Sembcorp Industries). However, in more recent years which has been fraught with the O&G industry uncertainty as well as a deteriorating operating profile in its Singapore Energy market, that multiple has compressed to roughly 0.47x (based on -1 SD over a 10-years horizon) over the past 5-years.

Since its demerger with Sembcorp Marine, Sembcorp Industries has already re-rated from a trough P/B multiple of 0.15x to the level of 0.46x just after the demerger.

It is currently trading at 0.69x P/B which is pretty close to its 10-years average of 0.79x (potentially another 10-15% share price upside to hit that PBR multiple)

Well, the street is already giving it a strong valuation re-rating, with UOB and CIMB both pegging its TP based on 1x P/B.

Again, my key question is that are we being too positive on Sembcorp Industries’ earnings turnaround in 2021, post its demerger with Sembcorp Marine.

I can understand if the counter traded back to its 10-year average of 0.79x PBR if there are strong indications that earnings will rebound strongly in 2021 (to at least the S$300-350m profit region). However, the consistent negative profit guidance made by the company doesn’t seem to justify that such a goal is achievable, especially when we are still facing major uncertainty surrounding COVID-19 as we head into 2021.

It is also highly improbably that it trades to the peak of 1.3-1.4x PBR last witnessed back in 2011-13 which was likely boosted by positive sentiments and earnings performance from Marine.

Not an attractive play with catalysts lacking

I have highlighted many times that the demerger between Sembcorp Industries and Sembcorp Marine will be positive for the former.

Not only will Sembcorp Industries shed the earnings drag, but the company will also benefit from being the largest pure-play utility company in SGX which is an attractive “proposition” for funds who are looking to invest in pure-play utility companies in the region (without exposure to the Oil and gas industry).

We can see that the street has already re-rated the company substantially just base on this fact (that it is now a standalone regional utility player).

However, Sembcorp Industries’ core utility fundamentals remain weak and I don’t see much scope for improvement in 2021, even excluding all the one-off negative impact made in 2020.

Will the impairment charges continue in 2021? I would say there is a greater than even chance if the current vaccine solutions do not fully “get-rid” of COVID-19 by end-2021.

Having said that, I do admit I was wrong in stating a “neutral” stance (I won’t be in a hurry to sell Sembcorp Industries share if I already have them but neither will I be in a hurry to load the truck) on Sembcorp Industries back in September, largely the result of positive sentiments at play which drives the company’s valuation higher.

However, I am still standing my ground based on the fact that I have yet to see any significant improvement in its core fundamentals to justify being more positive on the counter.

Hence, at its current share price of S$1.74 (as of this writing), I will not be looking to purchase the counter, given the lack of any further re-rating catalysts.

A preferred alternative to Sembcorp Industries

My preferred play remains Keppel which still has yet to announce its “restructuring” plans which the market will likely be waiting in anticipation (and with some frustration) for a potential divestment and subsequent merger of its O&M business division with Sembcorp Marine.

There is no reason why Keppel should not take that route for the best interest of shareholders (as seen from the Sembcorp industries/Sembcorp marine example) unless they truly believe that a turnaround in the O&M industry is imminent.

Back in early October, I highlighted Keppel as one of my undervalued plays in this article: 5 undervalued stocks in Singapore to buy now.

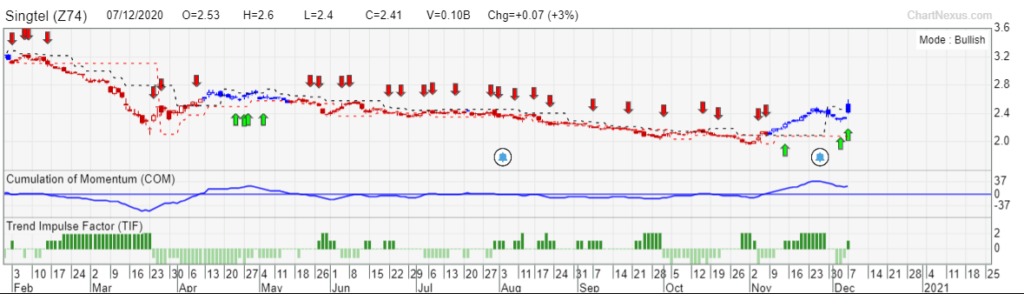

There was a strong positive BUY signal at a price level of S$4.66 based on the proprietary trading system called Traders GPS developed by Collin Seow. While Keppel currently looks to be consolidating, a break above the last recent high of $5.45/share will be seen as a positive signal for greater upside.

The Systematic Trader Program

An investing course that is voted as the Best Investing Course by Seedly reviews, the Systematic Traders Program uses the proprietary platform, TradersGPS which tells you WHAT stock to buy, WHEN to buy and HOW much to buy.

For those who are interested in finding out more about this system, you can check out the free lesson to be held today on 8 December 2020 where Collin will reveal the best stocks to buy and sell NOW.

Using the system, I have identified that Singtel might be an interesting trade and will look to do more research on it.

Do note that the content in this article is for educational purposes. To execute your own due diligence and make your purchase decision independently.

Conclusion

I missed out on the Sembcorp Industries stock rally back in September 2020. I was wrong in my price “forecast” but am holding true to my belief that while sentiments on Sembcorp industries have been positive, it is not supported by an improvement in its core fundamentals, as seen from the latest set of negative earnings guidance for 2H20.

I will hence not be in a hurry to purchase Sembcorp industries stock at its current share price level.

Instead, Keppel will be my preferred energy play at the moment, with a potential catalyst stemming from its restructuring conclusion.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- LION-PHILLIP S-REIT ETF: SHOULD YOU BE BUYING THIS REIT ETF?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- THE IDEAL RETIREMENT PORTFOLIO STRUCTURE

- WHAT IS A REGULAR SAVINGS PLAN?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.