Sembcorp Industries now trade ex-entitlement

Sembcorp Industries price “collapsed” by c.40% today (as of this writing) as the shares went ex-entitlement. Shareholders of Sembcorp Industries shares as of 8 September will be entitled to receive 4.911 shares of Sembcorp Marine for 1 Sembcorp Marine shares that they own. This “entitlement” will no longer be valid as of 9 September, resulting in the correction of Sembcorp Industries price.

Ex-entitlement price

Sembcorp Industries was last-trading at S$1.91 when it was still “cum-entitlement”. This was in the ballpark figure of what I calculated as the fair value of the share (S$1.88) in this article: Sembcorp Industries. What might be its fair value?

The share price of Sembcorp Marine is currently trading at S$0.175 (as of this writing). Assuming that this price holds come Friday (where Sembcorp Industries’ shareholders will receive their entitled 1 Sembcorp Industries: 4.911 Sembcorp Marine shares), their Sembcorp Marine stake will be worth (S$0.175*4.911 = S$0.86) for 1 Sembcorp Industries shares.

This means that the “theoretical” ex-entitlement Sembcorp Industries price based on the above assumption is roughly S$1.91 – S$0.86 = S$1.05

Sembcorp Industries’ shares are currently trading at S$1.18 which means that its price has “magically” pop by 12% “overnight” when there is no new information today (ex-entitlement) vs. yesterday (cum-entitlement)

So the market is either under-pricing Sembcorp Industries shares yesterday or over-pricing it today. Alternatively, some investors only wish to have an exposure to Sembcorp Industries, hence they are selecting to purchase now after ex-entitlement.

Another possible reason is that the expectation for Sembcorp Marine’s price on Friday (when Sembcorp Industries’ shareholders receive the shares) will be drastically below that of the current level of S$0.175.

Assuming that the cum-entitlement price of S$1.91 is the actual fair value of Sembcorp Industries at this stage, this will mean that 4.911 Sembcorp Marine shares should only be worth S$1.91 – S$1.18 = S$0.73 or (S$0.73/4.911 shares = S$0.149/share)

If the price of Sembcorp Marine drops to S$0.149 on Friday, then this 12% “pop” in Sembcorp Industries price will be “neutralized”, assuming that Sembcorp Industries price remains at the current level of S$1.18.

Hence it might still be too early for Sembcorp Industries’ shareholders to rejoice from this 12% price appreciation unless they can “short sell” Sembcorp Marine price now to lock in the profit.

What might be Sembcorp Industries’ fair value?

At the current price of S$1.18/share, Sembcorp Industries boast a market cap of S$2.1bn. Based on its last Shareholder Equity of S$4.61bn (excluding Marine’s NAV), the company is trading at a Price/book value of 0.46x.

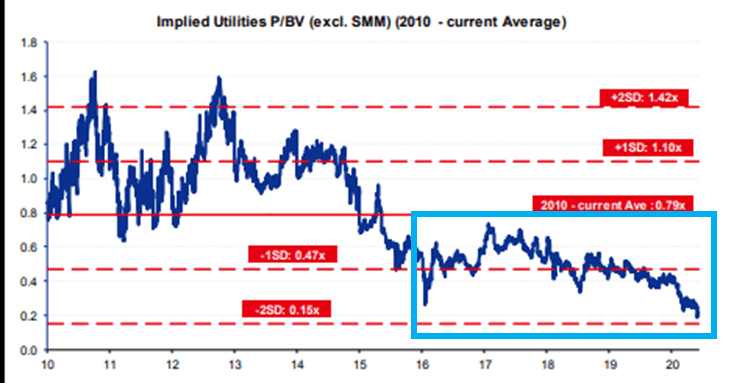

According to CIMB, Sembcorp Industries has been trading at a P/B multiple of 0.79x since 2010 (this multiple exclude Sembcorp Industries). However, in more recent years which has been fraught with the O&G industry uncertainty as well as a deteriorating operating profile in its Singapore Energy market, that multiple has compressed to roughly 0.47x (based on -1 SD over a 10-years horizon) over the past 5-years.

So Sembcorp Industries trading at the current level is roughly “in-line” with its past 5-years historical valuation based on P/B.

Note that the business has already “re-rated” from a trough P/B multiple of 0.15x (-2 SD) to the current level of 0.46x approximately.

The key question then is should there be a further re-rating to justify a higher P/B multiple, perhaps back to the 0.79x which is the average P/B multiple over a 10-years horizon?

If the company re-rates back to 0.79x P/B, the “fair value” of the company will then equate to S$2.00.

Is that overly optimistic, especially in today’s context where the operational profile of its Energy division is less rosy as compared to 5-10 years ago.

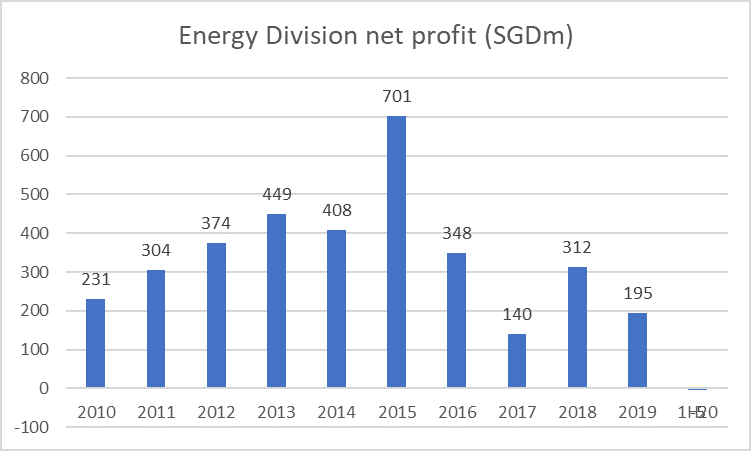

Let’s take a quick look at the Sembcorp Industries Energy division performance over the past 10 years.

This is based on Sembcorp industries’ reported net profit for its Energy Division. While some might argue that it is a better representation to exclude “one-off” items such as impairments and write-offs, the counter-argument can be that such one-offs are occurring too frequently that they should be viewed as “normalized”.

Profit peaked in 2015 at around S$701m. In the previous 5-years (2010-2014), the average net profit was at S$350m. In the next 4-years (2016-2019), the average reported net profit was at S$250m. 2020 reported net profit is expected to come in way below this average number due to substantial impairments/write-offs being done for this division, as already seen in the 5m losses incurred for 1H20.

Using purely these figures, one can argue that for the counter to re-rate to the average P/B multiple of 0.79x, the reported profit level should at least come close to the S$350m mark. 2010-2014 high P/B multiple excesses of 1x is likely due to positive sentiments in the O&G segment flowing through as the world recovers from the GFC.

That might be challenging in the current macro environment where we are facing the worst recession in a global context.

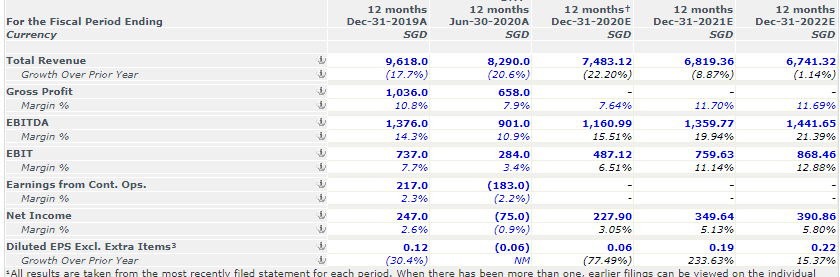

However, the street has much rosier expectations of Sembcorp Industries’ performance, expecting its earnings to rebound strongly to c.S$350m by 2021. If that is to happen, then it is not unreasonable to expect that the company’s multiple can expand to roughly 0.79x or at least closer to the 0.65-0.7x level which will indicate a fair value of around S$1.70/share.

Can this S$350m profitability be achievable in 2021?

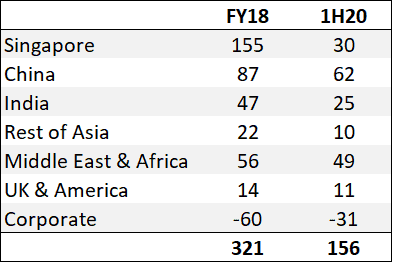

Breaking down its Energy Division profit by geographical zone

Taking reference from its FY18 Energy Division’s profit which generated S$321m of profits that year, we can compare where its current profit might fall short or be in excess.

The current outperformers are 1. China and 2. Middle East & Africa while the key laggard is Singapore.

I don’t expect its Singapore business to recover in a major way anytime soon while there are still concerns over the operating performance in India where tariff rates have been on a decline due to a large drop in electricity demand. As not all of Sembcorp Industries capacity is fixed (in terms of pricing and base level demand), it could turn loss-making again if demand and tariff pricing drops drastically ahead.

Investors got to be mindful that Sembcorp Industries Energy’s operation is not as stable as what they might believe for a utility company due to its substantial exposure to emerging countries where initial capacity might not be on a fixed tariff basis or where base demand load is still low.

Conclusion

At the end of the day, it is not unforeseeable for Sembcorp Industries’ earnings to be over S$300m in 2021. However, the market is already expecting the company to generate this amount of earnings based on the street’s estimate.

For the company to justify a re-rating beyond the current 0.46x P/B, I sense that the company’s earnings growth in 2021 will need to surprise positively coupled with the catalyst of a potential monetization of its India business (India asset to be valued at 1x P/B). However, this is not likely to be done soon based on the current economic climate of the power industry in India.

Hence, for now, I believe the current price of Sembcorp Industries is rather fair, contrary to the market’s belief that it is significantly undervalued.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- IS TIME RUNNING OUT FOR KEPPEL AND SEMBCORP MARINE AS OIL COLLAPSES BELOW ZERO?

- SEMBCORP INDUSTRIES 4Q19 BETTER THAN EXPECTED. SHENG SIONG MARGINALLY DISAPPOINTS

- SEMBCORP MARINE 4Q19 LOSSES EXCEEDED EXPECTATIONS. WHAT YOU SHOULD KNOW

- SEMBCORP INDUSTRIES: PROFIT WARNING A PRELUDE TO MORE PAIN IN 2020?

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Should one be buying Sembcorp Industries at this level?”