Sembcorp Industries 1H20 results

In this article, I provide my view on Sembcorp Industries’ latest 1H20 performance followed by some commentary pertaining to its demerger exercise with Sembcorp Marine.

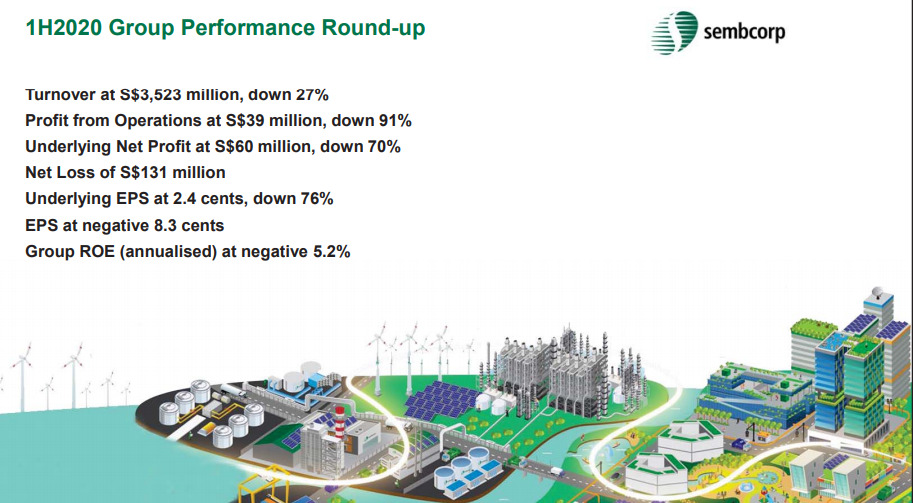

Sembcorp Industries announced after market hours on Friday that the Group has posted a net loss of S$131m and warns of worse to come. Sembcorp Industries posting such a substantial net loss might have been a surprise to some. While its marine division, Sembcorp Marine had earlier on 15 July announced a massive loss of S$192m for 1H20, the expectations are for Sembcorp Industries’ Energy division to offset those losses and still post a marginal profit for 1H20.

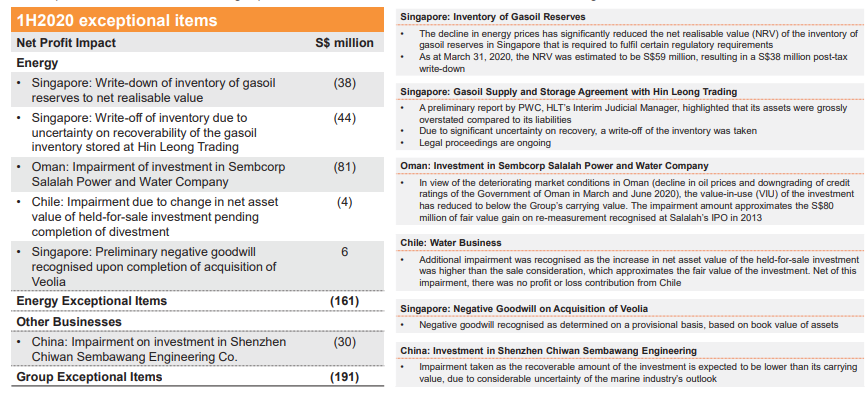

Instead, Sembcorp Industries’ Energy division recorded a net loss of S$5m in 1H20 vs. S$177m in profits for 1H19. This was due to substantial extraordinary losses incurred for 1H20, amounting to S$161m for this division. Without this supposed “one-off exceptional items”, the adjusted normalized net profit for this division would have been S$156m in 1H20 vs. S$184m in adjusted normalized net profit for 1H19.

Such a result would have be considered decent taking into account the state of the current global economy.

The problem is that such extraordinary losses are happening on a frequent basis that it makes one wonder if they should in fact be considered “one-off” in nature. Would it be more appropriate to account for these losses as part and parcel of Sembcorp Industries’ challenging operating outlook? Substantial “one-offs” were made in 2019 and 2017 as well, amounting to S$148m and S$121m respectively.

Is Sembcorp Industries a Value Trap?

It then calls into question if Sembcorp Industries’ Energy assets might actually be over-valued and this raises the possibility of further asset write-downs ahead. Valuing the counter on a Price to book basis might seem cheap on the surface but if the assets are indeed overvalued based on its future operating outlook, then buying this “value” stock using the PBR metric might turn out to become a value-trap at the end of the day. Not saying it is one. Just food for thought.

The current results made it quite clear that it is not a bed of roses on the Energy front. We all know that its Marine business remains in a slump but expectations were riding high for its Energy division to remain as the pillar of support for the Group. The reported net loss of S$5m in 1H20 with various provisions made to its Energy entities shows that a lot more work needs to be done for Sembcorp Industries to become the stable utility entity that the market expects it to be post the de-merger with Sembcorp Marine, assuming that transaction comes to fruition.

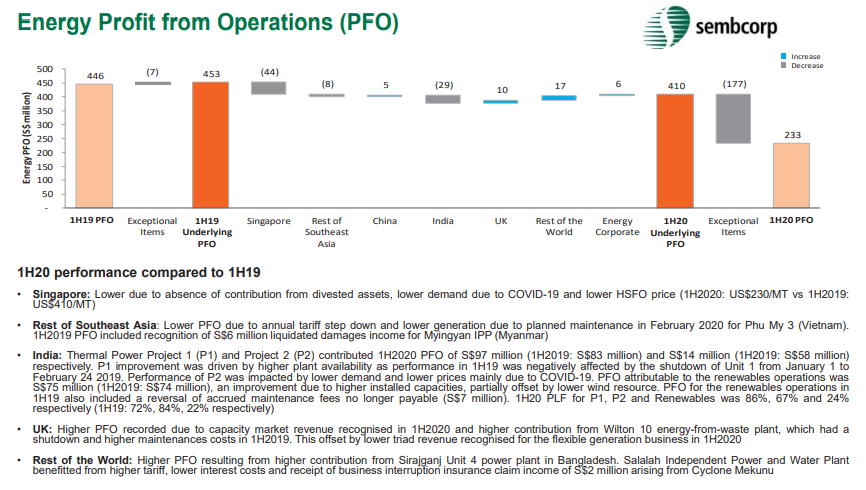

The table below provides a summary of the Operation performance of its Energy Division in 1H20 vs. 1H19.

Key detractors in 1H20 vs 1H19 are its Singapore and India operations. It’s Singapore performance could remain under pressure in the near-term due to weak HSFO prices which are indirectly tied to oil and natural gas prices. India could become the problem kid yet again in 2020 due to lower electricity tariff prices in India. This will affect its Project 2 plant which does not have a substantial portion of its capacity locked up in long-term PPA, resulting in huge variability in revenue and earnings generation.

China remains the only geographical entity that has been very stable and consistent in terms of its earnings contribution to the Energy division.

Sembcorp Industries: why is price still so weak after the demerger announcement?

The Street remains very positive of the de-merger deal between Sembcorp Industries and Sembcorp Marine. I have highlighted my personal views in the two articles below:

SEMBCORP INDUSTRIES AND MARINE DEMERGER: WHAT YOU NEED TO KNOW AND WHAT TO DO

SEMBCORP INDUSTRIES: WHAT MIGHT BE ITS FAIR VALUE?

I have also caution retail investors being “overly positive” on Sembcorp Industries just because they are getting “free shares” in Sembcorp Marine. There is no free lunch and in fact, Sembcorp Industries might actually be overpaying for maintaining its % ownership of Sembcorp Marine (pre-demerger). You can read more about my thoughts on the article above.

Smart money dumping

What is interesting is that the “smart money”, represented by the institutional investors are dumping their Sembcorp Industries shares to the retail investors. Not implying that retail investors are dumb.

Based on SGX fund flow data, since the announcement of the demerger on 8 June, institutional investors have been dumping shares of Sembcorp Industries every week, with the total sales amounting to c.S$45m. Retail investors are of course happily buying Sembcorp Industries shares. Not going to say too much into that, you can probably come to your own conclusion.

During this same period, Keppel Corp has been consistently on the Top 10 Buys of Institutional funds (4 out of 5 weeks).

Status co not a viable long-term solution

The results of Sembcorp Industries and Sembcorp Marine’s 1H20 performance made it clear that keeping status co ain’t going to be the long term solution that is in the best interest of both shareholders, particularly Sembcorp Industries.

The demerger make sense for Sembcorp Industries, but the terms of the deal might not be so.

Overall, I believe that it is in the best interest of all stakeholders which include Temasek to have the deal be done, which will facilitate the subsequent merger of Sembcorp Marine with Keppel’s O&M business. Sembcorp Marine’s existing shareholders might be receiving the short-end of the stick but clearly, as I mentioned, a status co outcome will not solve the long-term problem of an industry potentially in secular decline. It is amazing that no one talks about jack-up rigs and Semi-submersibles anymore. Now it is all about gas and renewable solutions.

Keppel’s results on 30 July will be an interesting one to watch. There are concerns that Temasek might pull the deal pertaining to it taking 51% ownership of Keppel if the upcoming results highlight potential concerns over the profitability nature of Keppel.

To be honest, I wonder if Temasek is actually “clueless” about what is happening within Keppel and needs to wait for its 1H20 results for further evaluation.

Nonetheless, my base case assumption is that the Keppel and Temasek deal will go through at the end of the day unless a major spanner is thrown pertaining to the longstanding Brazilian corruption case, which many believe its already water under the bridge for Keppel.

Conclusion

Sembcorp Industries 1H20 results ain’t a pretty one, peppered with various provisions and impairments made to its Energy division which the street did not expect. It could well be a kitchen sinking exercise but having said that the company’s track record of engaging in kitchen sinking exercises is one too many.

The early results announcement by Sembcorp Marine and Sembcorp Industries is likely a result of bringing forward the EGM for the resolutions to be approved pertaining to its demerger. I am positive that a demerger needs to happen at one stage or another for Sembcorp Group but am not certain that the terms of the deal are great for either entity, in this case.

The successful demerger of Sembcorp Group will pave the way for the subsequent merger between Sembcorp Marine and Keppel’s O&M in my view, one that is critical for the survival of Singapore’s shipbuilding/rig building industry. The Chinese and Korean yards all have received state support in a bid to survive this critical period, with many undergoing consolidations to streamline their operations. I don’t see how our local yards can remain as separate entities and yet be competitive on a global stage. Demand for their products has virtually collapsed and there is no light at the end of the tunnel currently.

Can Sembcorp Marine continue to bleed millions of dollars every year (2020 net losses will likely well be in excess of S$200m) and still remain as a viable operating entity amid a ZERO new orders environment? Keppel’s O&M division is also facing problems with potential order cancellations. It seems inevitable to me that Temasek will have to step in, sooner rather than later.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- IS TIME RUNNING OUT FOR KEPPEL AND SEMBCORP MARINE AS OIL COLLAPSES BELOW ZERO?

- SEMBCORP INDUSTRIES 4Q19 BETTER THAN EXPECTED. SHENG SIONG MARGINALLY DISAPPOINTS

- SEMBCORP MARINE 4Q19 LOSSES EXCEEDED EXPECTATIONS. WHAT YOU SHOULD KNOW

- SEMBCORP INDUSTRIES: PROFIT WARNING A PRELUDE TO MORE PAIN IN 2020?

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.