I have previously highlighted some software companies for my readers who might be interested in finding cloud-based companies with good revenue growth to invest in. Those who are interested can check out the two articles below, where I highlighted the SaaS stocks with gross profit margins in excess of 70% and looking to grow their annual recurring revenue by at least 20%

Additional Reading: Top 20 SaaS stocks. Which are those with strong gross margins and revenue growth? (Part 1)

Additional Reading: Top 20 SaaS stocks. Which are those with strong gross margins and revenue growth? (Part 2)

For those unfamiliar with SaaS stocks, these companies mainly sell software services to customers as an ongoing subscription instead of charging them a one-time sales/service fee. For example, if you are a small online business owner and you set up your “virtual” shop using Shopify’s online platform, then you have used a software-as-a-service (SaaS).

Investors love SaaS stocks because of their high-profit margin and also for the fact that a huge chunk of their revenue is recurring in nature.

As a result, SaaS stocks, despite many of them being hugely loss-making entities, are trading at mega-valuation. The reasons why investors are willing to “pay up” is due to their sexy revenue growth story on how these companies intend to grow their revenue rapidly through market share gain and subsequently locking in their customers with recurring subscription payments.

In this article, I will like to highlight the Top 50 SaaS stocks by market cap and how I look to find “hidden gems” using a value angle through the Rule of 40, with a slight twist.

What is the Rule of 40?

The Rule of 40 is a valuation indicator to see if a loss-making SaaS company is worthy of one’s investment. Let me briefly walk you through the calculation.

Of late, the Rule of 40 – the idea that a software company’s combined revenue growth rate and profit margin should be greater than 40% has gained traction as a metric to evaluate the success of a loss-making software company.

Investors are using the Rule of 40 as a criterion for assessing the trade-offs involved in managing growth and profitability. If a company is growing its revenue strongly, then that strong growth can help to compensate for the lack of profits in the form of lower margins.

If the company is now growing its top-line at pace, then it will need to generate higher profit margins to compensate for that slower growth.

Rule of 40 = Revenue growth + Profit Margin

Revenue growth is pretty straightforward. It is how much the company is growing its sales on a YoY basis.

The profit margin is where there might be some ambiguity. Different analysts have disagreed about the profitability metric to use – gross margins, EBITDA margins, EBIT margins, net margins, etc. The majority chooses EBITDA margin when calculating the Rule of 40.

Calculating the Rule of 40

As highlighted earlier, there are only two inputs for the Rule of 40 formula. Simply add the 1-year forward revenue growth rate plus the expected (or trailing) EBITDA margin of the company.

Say a loss-making Company ABC that is expected to grow its YoY revenue by 30% in 2021 vs. 2020. Company ABC currently has an EBITDA margin of 20%. Hence the Rule of 40 will state that this company has a Rule of 40 ratios of 30% + 20% = 50% and thus meets the minimum benchmark of at least 40%.

Despite its loss-making nature, Company ABC might still be considered attractive based on meeting the Rule of 40 criterion. In fact, it can be considered a healthy saas business to invest in.

However, meeting the Rule of 40 is just one criterion demonstrating that a loss-making company can justify its business appeal by balancing revenue growth and profitability. It does not imply that there is indeed VALUE in investing in Company ABC at this juncture.

Typically, one uses a valuation metric like Price/Sales to determine if there is indeed value in a loss-making but fast-growing SaaS entity. The faster a company’s growth rate is, the higher can its Price/Sales ratio be justified.

Price/Sales has somewhat become the de-facto valuation metric for loss-making SaaS companies. However, can one combine this valuation metric with the Rule of 40 to derive a better judgment if a SaaS company is indeed a VALUE buy now?

Rule of 40 with a twist

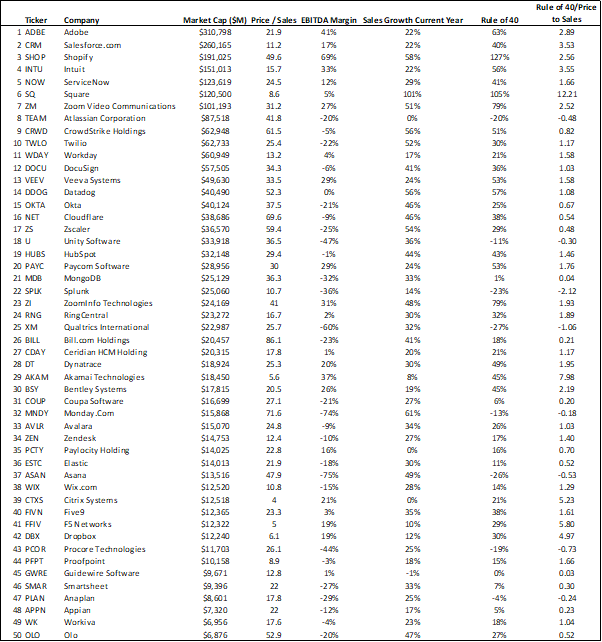

The table below illustrates the biggest 50 public SaaS companies by market cap, with the data sourced from this website.

The largest market cap SaaS counter in this list is Adobe (ADBE) with a market cap of $310bn while the smallest SaaS counter by market cap is Olo (OLO) at $6.9bn.

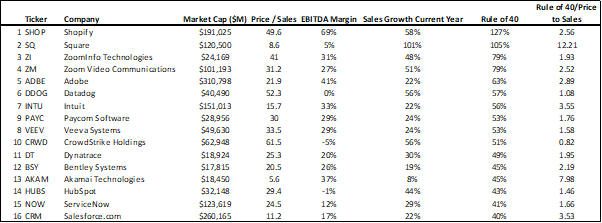

Which of these SaaS companies met the Rule of 40 criterion?

Only 16 of the Top 50 largest SaaS companies met the Rule of 40 criterion as seen from the table below. Shopify ranks No. 1 in terms of the highest ratio, followed by Square, Zoominfo, Zoom and Adobe rounding up the Top 5 in this list.

However, does Shopify, being the top SaaS company using the Rule of 40, means that the company is a BUY at any price? How does its valuation compare with the other SaaS companies based on a Price/Sales basis and can its high Rule of 40 standing justify its Price/Sales ratio?

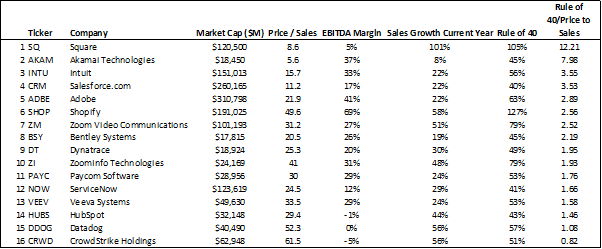

This is where I divide the Rule of 40 ratio of the SaaS companies by its Price/Sales ratio to determine if a SaaS company that meets the basic Rule of 40 criterion, is indeed cheap.

The table below shows the new ranking, with Square being the Top SaaS company using this valuation metric.

Shopify drops to No. 6 on this list despite it having the highest Rule of 40 ratio. This is because it also has a very large Price/Sales ratio of 49.6x which could mean that the counter is more “richly valued” vs. Square (now ranks No. 1) which has a lower Rule of 40 ratio figure (105%) but also a much lower Price/Sales multiple of 8.6x.

Consequently, Square has a Rule of 40 / Price to Sale multiple of 12.2x vs. Shopify at only 2.56x (the larger the multiple, the greater “value” there is in the counter).

Using this Rule of 40 ratio with a twist, we can see that many of the big blue-chip SaaS companies that no longer seem to have “much more upside” is rank fairly high in this list. Take for example Salesforce, which just reported a blockbuster quarterly result recently, is ranked No. 4 in this list, with Adobe, the largest SaaS company in the world, ranking No. 5.

Salesforce has a Rule of 40 ratio of 40% (22%+ sales growth and 17%+ EBITDA margin) while Adobe has a Rule of 40 ratio of 63%. The higher Rule of 40 ratio for Adobe in itself should translate to a higher Price/Sales multiple for Adobe vs. Salesforce which is indeed the case, with Adobe sporting a Price/Sales multiple of 21.9x vs. Salesforce 11.2x.

Is Adobe still a better buy than Salesforce even at a much higher Price/Sales multiple? The Rule of 40 with a twist seems to indicate that Salesforce with free cash flow might be the value counter when compared against Adobe.

Conclusion

The Rule of 40 is a quick and easy criterion to evaluate if a loss-making SaaS company can balance both its revenue growth and profit margin. If it is growing it’s top-line rapidly, then the company can afford to be generating lower EBITDA margins despite having higher customer acquisition cost. If its top-line growth is tapering, the company needs to compensate for that cash flow with a higher EBITDA margin.

No company in the world can generate high growth rates indefinitely. Once top-line growth slows, the company will need to transit to become a more profitable company.

It is interesting to note that some of the largest blue-chip SaaS companies such as Salesforce and Adobe can still generate strong sales growth despite their large-cap nature. These are companies that continue to rank well from both a growth and valuation standpoint, as can be seen using the Rule of 40 with a twist valuation metric.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only