Net Worth Updates – 2019

Net worth updates September, 2019 – $1.196m (+0.4%)

Hi all. Welcome to New Academy of Finance first portfolio and net worth report!

This is where we look to provide transparency in terms of our financial well-being. To be honest, its a little scary disclosing to the world what my household net-worth is like. I tend to be a pretty private person.

But since I have decided to embark on a new financial journey with the birth of this blog, me and the missus decide to challenge ourselves to provide as much financial information as possible as a means of accountability and HOPEFULLY inspiration to others.

September will be the very last month which I will be getting an income from my previous job, hence I am prepared for our Net Worth to take a hit over the coming months.

Ideally, we will like our net worth to be buffered by stronger investment performance. Due to the nature of my previous job (I am an equity analyst), I am not able to participate actively in the capital market as a result of compliance-related issues.

Hence most of the stocks currently in my/missus portfolio are legacy counters. There will be major changes over the coming months as I look to increasingly deploy more capital into the market.

Having said that, I remain extremely cautious of where the current global equity market stands.

September Stock Portfolio update

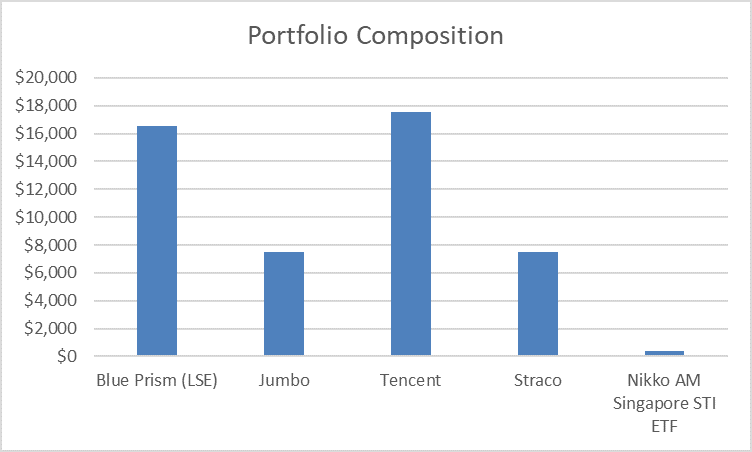

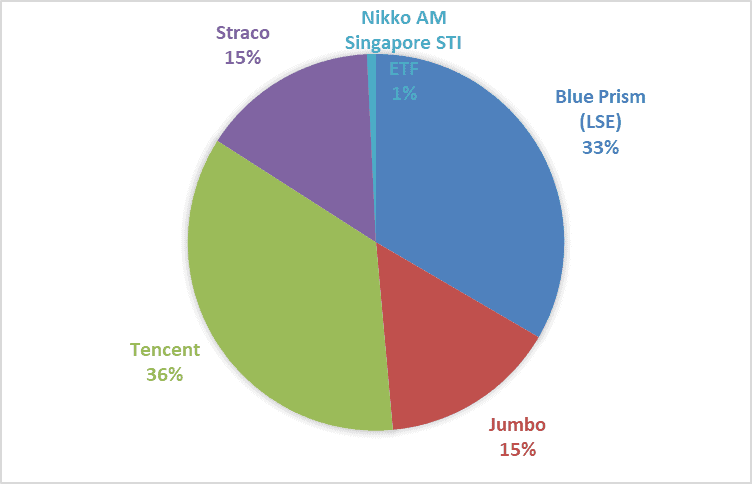

Without further ado, let’s dive into our current stock portfolio. This portfolio exclude stakes in 1) our pension or CPF holdings and 2) cash in our foreign brokerage account. Hence the discrepancy vs. what we disclose in our net worth.

We currently have a small investment portfolio consisting of a handful of individual stocks, with the largest being Tencent Holdings. This will remain a core stock in our portfolio and I will look to incrementally add to our stakes in it.

We also have a small stake in Straco which I will look to add on my position if it hits SGD0.70/share. I have previously written a short write-up on the stock.

Notice that we have got an extremely tiny stake in the form of passive investment, allocated to the Nikko Singapore STI ETF, currently encompassing only 1% of our total portfolio value.

This is set to change. Over the course of the coming months, I will look to increasingly deploy more funds into passive-style investing. Ultimately, that ratio will probably be in the area of 60% passive / 40% active once I am done with our portfolio restructuring.

Sam Dogen from the uber popular financial website: Financial Samurai, recently wrote a post on: The recommended split between passive and active investing. Do take a look at it to see if you concur with his views. I do think it makes lots of sense.

With that, I wrap up my September Stock Portfolio update. Nothing exciting going on as of yet but I promise that there will be more portfolio actions over the coming months.

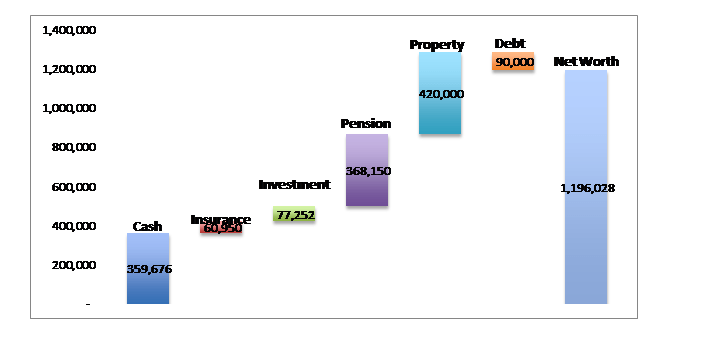

September Net Worth update

On to our Net Worth update for September. It is with some trepidation that I am now disclosing my family net-worth. I am probably one of the very first here in sunny Singapore to be disclosing this sensitive figure. But what the heck. Let’s just do it.

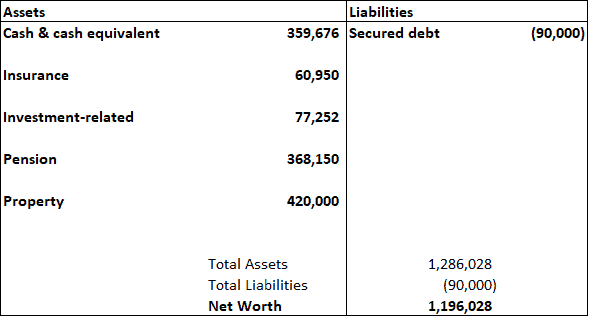

The bulk of our household asset is actually equally distributed between our house, pension and cash.

Our only liability is that of our house mortgage which is now approx SGD90k at a 25-year (remaining loan tenure) fixed-rate loan of 2.6%.

The above diagrams illustrate a simple net-worth flowchart as well as its historical trend.

While our current household net worth is close to SGD1.2m, I believe we are still some time away from being truly-retired. I am taking a 6-months hiatus from work to develop New Academy of Finance. In the interim, my wife is the only sole breadwinner. Yes. I told her that she has got to continue grinding in the rat race. Haha.

With that i wrap up my maiden Portfolio and Net Worth update for September.

Appreciate all who visits New Academy of Finance and I hope that this website can ultimately be a wonderful source of personal finance inspiration.

Till the next time!

With love, RT