In this article, I will be sharing a few ways to further juice up Philip Morris’s dividend yield, which is already at an attractive level of 6% at present. But first some background information on the counter.

Earlier this year, I wrote about Philip Morris as a 5.5% yielding stock that pays almost zero dividend withholding tax for Singaporean investors. Note that here in sunny Singapore, we are slapped with a 30% dividend withholding tax when we purchase US stocks that give dividends.

For example, if the US counter declares a US$1/share dividend, Singaporean investors will only receive US$0.70/share as 30% is being taxed. That is why dividend investing in US stocks is not a particularly popular strategy here in Singapore.

However, in that article, I have shared with my readers why investors in Philip Morris do not need to pay any dividend withholding tax which can be rather substantial for a stock that was yielding 5.5% at that time (if dividend withholding tax would have to be paid, it would reduce its net yield to 3.85%).

Readers can refer to this article: Philip Morris. The 5.5% yielder that pays almost zero withholding tax for the reason as well as identify other companies similar to Philip Morris where a Singaporean investor does not have to pay any or much dividend withholding tax. This can be found in the comments section (hint: many are however tech companies that do not pay much dividends in the first place, hence Philip Morris is unique in this sense).

The current yield of Philip Morris is now at an even more attractive 6.1%, which I will further demonstrate how you can increase the yield potential using options, in a generally safe manner.

Before I do that, let’s have a quick look at the business model of Philip Morris and check out if this “SIN” stock is one that you are comfortable investing in?

Philip Morris: A sin stock aiming to do good

To some, Philip Morris is considered a “SIN” stock that they will not engage with a 10-foot pole. Well, this is a cigarette stock that aims to achieve a “smoke-free future”, according to the company’s CEO, Andre Calantzpoulos.

You will be surprised to hear that from the CEO who runs one of the largest tobacco companies in the world. His vision is to have Philip Morris be the largest tobacco company but one that does not sell cigarettes!

Core business declining

Philip Morris has some of the best-known cigarette brands in the market which include Malboro and Benson & Hedges.

The company holds a dominant market share internationally and competes with other well-known companies such as British American Tobacco PLC and Imperial Brands.

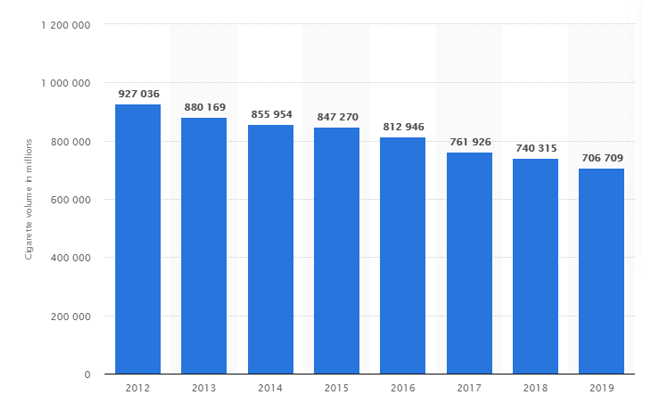

The challenge, however, is that this business is likely in a structural decline. It’s a dying business at least in terms of volumes where its cigarette volumes have declined from 927bn in 2012 to 706bn in 2019, according to data from Statista.

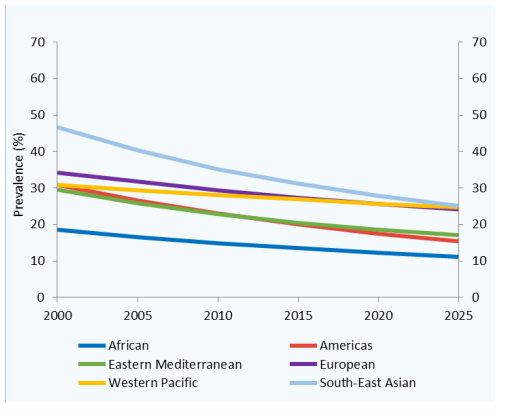

According to data from the WHO, until 2018, the number of tobacco users worldwide was on the rise every year. In 2018, the trend shifted. WHO projects that there will be fewer tobacco users in 2020 than in 2018 because rates of tobacco use are finally dropping fast enough to counter increases in tobacco user numbers due to population growth.

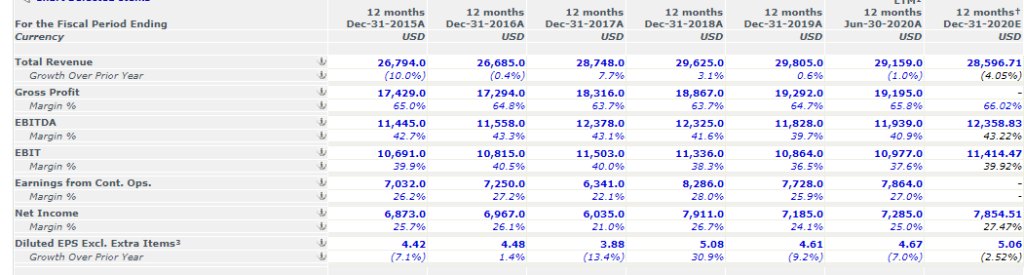

Even though cigarette usage has been on a constant decline all this while, what is quite remarkable is that Philip Morris has been able to maintain it’s top-line rather consistently, with some growth baked into it since 2015.

That has come from a steady price hike over the last decade and Philip Morris has used price increases to offset the dearth of smokers.

Focusing on IQOS – the future of “smoke-free” smoking?

Philip Morris knows that its core business is under tremendous pressure from a declining user base. It has tried to offset that decline focusing on cost control, where the company has reduced headcount from more than 90,000 pax back in 2013 to just above 70,000 pax today.

However, the solution for survival ain’t just about cost-cutting but one which involves developing a next-generation product that will help replace lost sales from a structurally declining product. That solution is its I Quit Original Smoking or better known as IQOS.

Philip Morris has argued that the usage of IQOS reduces the risk commonly associated with regular cigarettes and is counting on them to deliver the same “pleasure” that one gets from smoking but with less dangerous side effects.

Whether that claim is “real” is a different matter altogether and there will always be two differing views on this issue.

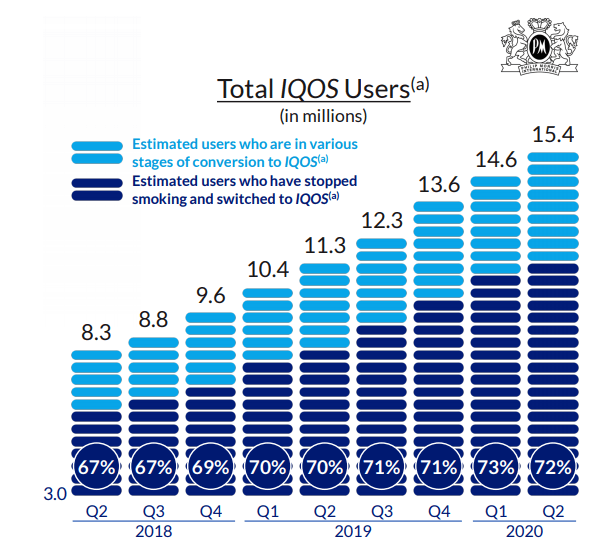

What matters is that IQOS demand is growing for Philip Morris and at a pretty rapid pace.

The total number of IQOS users has almost doubled in 2Q20 vs. 2Q18 levels as seen from the chart below.

Philip Morris has proven to be a recession-resilient business model as its business was little impacted by COVID-19 and the related economic downturn. One could argue that in such a stressful economic environment, the likelihood of adults turning to cigarettes to “relief their stress” might be higher.

Guidance and financials

Management has provided guidance of approximately US$5 in EPS for 2020. This is after adjusting for currency impact where the decline in foreign currencies relative to the USD is seen to have a US$0.30 negative impact on EPS.

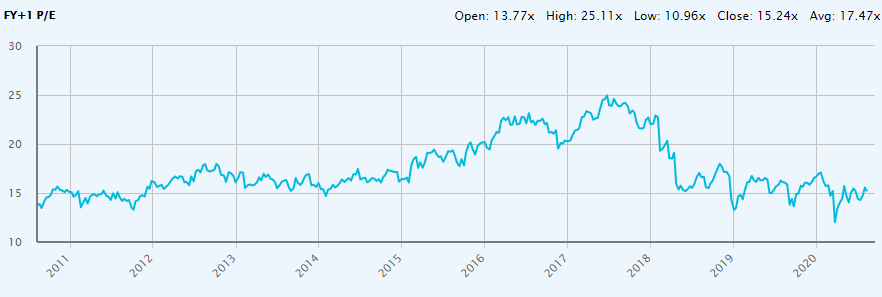

At the current price of c.USD$77/share, that translates to a forward PER multiple of 15x which is at the lower end of its past 10 years historical trading range.

Assuming an average forward PER multiple of 17.5x and using the dividend yield theory which I have written previously in this article, the fair value of Philip Morris might be in the region of US$90. This is similar to the median target price of US$89/share that the street has on the counter.

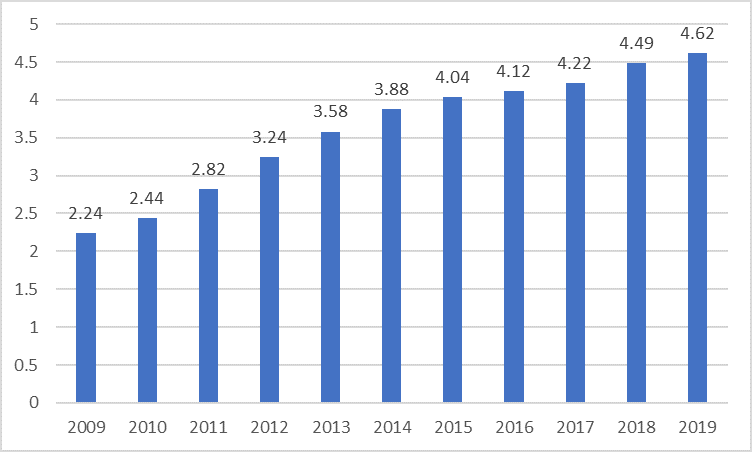

Philip Morris has been consistently increasing its dividends per share over the past, with 12 years of a consecutive dividend increase.

While some might voice concerns over its relatively high payout ratio which borders at 90% at present based on a dividend payment of c.USD$7bn/annum, the counter generates strong free cash flow amounting to USD$8-9bn each year which sufficiently covers the payment of its dividends.

A strong yielding company with not much growth

Philip Morris can be described as a dividend company, one which pays a relatively consistent dividend but lacks strong earnings growth. This is because its traditional cigarette business is in a structurally declining environment. It is thus banking on its IQOS product to pick up the slack.

So far IQOS has not been a disappointment. However, it remains to be seen if earnings growth moving forward will be strong enough to propel its share price higher from current levels.

Based on the dividend yield theory as well as considering the street’s consensus, Philip Morris’s share price might potentially face a strong resistant level at the USD$90/level.

How to increase Philip Morris’ yield from the current level

There are several ways in which one can increase the counter’s yield from the currently already attractive level of 6%.

Covered Call

If you are already a shareholder of Philip Morris with at least 100 shares of the stock, you can engage in a covered call strategy by selling 1 Call Options contract of Philip Morris stock at the potential resistance level of USD$90/share.

Assuming you wish to enter into 100 shares of Philip Morris at the current price of USD$77/share. By selling a call option expiring on 19 March 2021 (225 days) at a strike price of US$90/share, you will be entitled to a premium of USD$1.60/share.

Including the approx. USD$4.80/share in expected dividends for 2020, the total “dividend” potential from this covered call strategy will be approx. USD$6.40/share, thus increasing the “yield” of Philip Morris from the current level of 6% to 8.3%.

If the shares get called away on 19 March 2021, the capital gain potential will be (90-77)/77=17% for a total gain (dividend + premium + capital gain) of 25.3% over 225 days. The annualized return will thus be 41% (in actual case it will be slightly less as you will not receive the full dividend amount of 6% over 225 days holding horizon).

Selling a Cash Secured Put

If you are generally neutral on the counter and do not wish to lock up your capital by purchasing shares of Philip Morris outright, you can execute cash-secured put with a margin of safety on the counter.

What I meant by margin of safety is that one can be selling a March 2021 cash-secured put at a strike price of USD$72.50/share. With Philip Morris currently at USD$77/share, there is a buffer of approx. USD$4.50/share.

This strategy is suitable for someone who finds value in Philip Morris, not at the current price but USD$72.50, and is willing to purchase at least 100 shares of Philip Morris at that level. He/She can sell a cash-secured put, with an outlay of S$7,250, and receive a premium of S$525.

Net Cash outlay will be 7,250 – 525 = $6,725

Total % return if stock closes at $72.50 and higher upon expiration = 575/6725 = 7.8%

Annualized yield = 365/225 * 7.8% = 13%

Without outright ownership of Philip Morris stock, one can also generate a potential “dividend income” of 13%. The risk is of course Philip Morris stock correcting significantly below the price of USD$72.50 by which one will incur the associated capital losses, similar to owning the stock.

Buying a Deep ITM call option while Selling a covered call

Instead of buying the stock outright, when can also have control over Philip Morris stock by purchasing deep ITM call options where the Delta is at least 0.80 or higher.

In this pseudo (in real-life, not likely to execute due to low open interest) scenario with a March 2021 expiration, the strike 55 call with a delta of 0.91 trades at USD$22.45/contract which means that the outlay for 1 option contract is USD$2,245.

You essentially “own” 100 shares of Philip Morris at a fraction of its cost (USD$2,245 vs. USD7,700).

One can then execute a covered call strategy as described above without additional margin or cost. Assuming the same strike price of USD90/share, generating a premium of USD160, that translates to a yield of 7%.

Do note that in this case, as a call option holder of Philip Morris and not an actual shareholder, you are not entitled to the 6% core yield.

If shares of Philip Morris hit USD$90 or above upon expiration in March 2021, the call option contract would be worth USD$45/share or $4,500 per contract (intrinsic value).

With a net cost of 2,245 – 160 = 2,085, the total profit % on this trade will be (4,500-2,085)/2,085 = 116% over 225 days, translating to an annualized yield of 186%.

Conclusion

Philip Morris declining core business is well known but its IQOS growth story might just be accelerating and that could help offset its core business over the next decade.

Nonetheless, its dividend yield of 6% looks to be relatively secure and that is extremely attractive compared to other risk-free rates or close to risk-free products.

Based on the dividend yield theory, if Philip Morris DPS is sustainable at the current level, the fair value could be in the region of USD$90/share which is close to the street’s median price of USD$89/share.

Investors can purchase this 6% yielder on a pullback, with the comfort that the company’s business model should be relatively recession and COVID-proof, even if a second wave COVID outbreak is on the horizon (or already in play).

Finally, those who are open to using options can execute the above 3 options strategies I highlighted to put Philip Morris’ dividends on steroids.

Do note that options are leveraged products that come with their associated risk. I am painting a rather rosy picture in the above 3 examples, but while one’s ROI can be significantly magnified with the use of options, the same can be said of their losses.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- HYPHENS PHARMA: IS THIS PHARMA COMPANY UNDERVALUED?

- SEMBCORP INDUSTRIES: WHAT MIGHT BE ITS FAIR VALUE?

- SEMBCORP INDUSTRIES AND MARINE DEMERGER: WHAT YOU NEED TO KNOW AND WHAT TO DO

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 2]

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 1]

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.