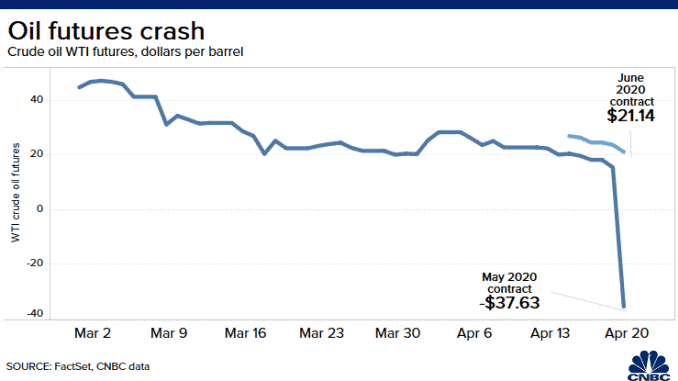

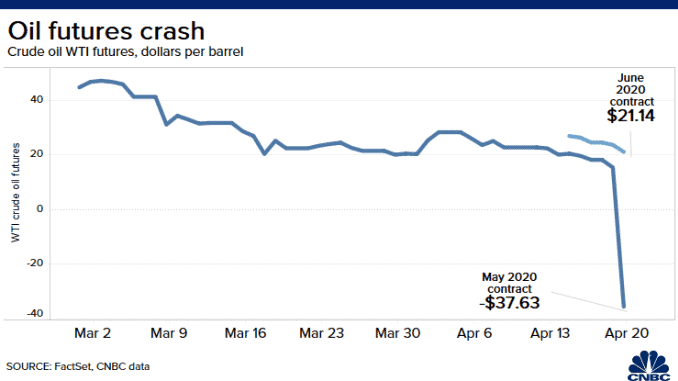

This week saw an unprecedented drop in oil prices to a negative level, almost -$40/barrel to be exact. Such a phenomenon has not happened in the past and it was largely the result of paper traders and Oil ETFs dumping their expiring May contracts “by all means” as buyers disappear.

Since then, WTI oil prices have recovered to roughly $17/barrel as of this writing, a positive figure but not a “champagne popping” price level.

Is time running out for Keppel Corp and Sembcorp Marine?

The significant collapse of oil prices does not bode well for both Keppel and Sembcorp Marine. Yes, they do not derive their revenue directly from the sale of oil but indirectly in the form of newbuild contracts for production/drilling-related assets.

The problem is that with oil prices that low amid an oil glut scenario, no oil company in their right frame of mind will be contracting large newbuild orders from yards in the near term, in my view.

Can the existing backlog of Keppel and Sembcorp Marine support revenue recognition?

As of the end-2019, the net order backlog of Keppel stood at S$4.4bn. With an annual breakeven revenue run-rate of approx. S$2-2.5bn, Keppel should be able to continue its shipyard operations for the next 2 years even with no new orders without incurring excessive losses for this division.

On the other hand, Sembcorp Marine’s net order backlog as of end-2019 stood at S$2.4bn. With an annual breakeven revenue run-rate of at least S$3bn on my estimate, the company will likely be out of revenue by the end of 2020 or potentially incurring a huge amount of losses this year if they wish to lengthen their revenue recognition period.

More critically for Sembcorp Marine, with a net debt to equity now close to 1.9x, it calls into question the company as a going concern.

Still waiting for restructuring

Investors have been speculating of consolidation between Keppel’s O&M division and Sembcorp Marine for some time, particularly since Temasek made an intent to take majority ownership of Keppel back in October 2019 which fuelled speculation that a re-organization of Singapore’s offshore yard industry is on the cards.

However, the closure of the majority stake in Keppel has been much longer than expected although Keppel maintains that transaction by Temasek remains valid.

For shareholders of Sembcorp Marine who has been banking on a merger, likely to be one spearheaded by Temasek, the wait continues to be an agonizing one, with time no longer on their side.

Sembcorp Marine: where is the light at the end of the tunnel?

With the company now forced to stop all on-site work with effect from April 21 until the end of the circuit breaker period due to COVID-19 spread in foreign worker dormitory, Sembcorp Marine will essentially be seeing a significant decline in its revenue for this period, a scenario similar to SIA.

This again could imply a record level of loss for 1Q20 or 1H20 (exempted from quarterly reporting) which could rival that of its 4Q19 losses of S$78m, even excluding the impact of accelerated depreciation now absent in 2020. Assuming 1H20 losses of S$150m, that could result in shareholder’s equity dropping to S$2bn, with its net gearing level exceeding 2x. Losses might, however, be lower due to government subsidies.

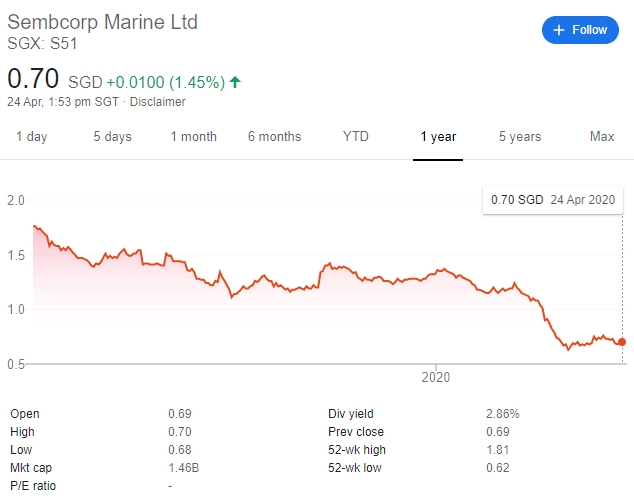

Sembcorp Marine’s share price has taken a beating since the start of 2020, falling from S$1.36 at the beginning of the year to the current level of S$0.70, valuing the company at S$1.46bn. This is approx. a 25% discount to its tangible book value, a multiple that is at a record low level, which seems to imply a certain level of attractiveness.

However, that might not be the case if the company’s assets are “inflated”. The company has S$4.25bn worth of PPE as of end-2019, a figure that has been on the rise these past few years despite significant weakness seen in its industry.

No impairments were made to its PPE which largely comprise of the long-term depreciated value of its shipyards. That might not be reasonable if this industry is now deemed to be in a structural decline, much like its shipping counterpart.

With no new orders and yards that are likely at extremely low capacity (even after the work-order halt is lifted), it is hard to imagine that the yards can continue to maintain their “stated” value on its balance sheet.

If a significant impairment exercise is finally taken in 2020, an S$1bn cut to PPE (23% reduction) could result in its Price to tangible book multiple increasing from the current 0.75x to 1.6x.

Of course, these numbers are just forecast. However, it is fair to say that our yards are currently on a weak footing, particularly for Sembcorp Marine which has a more than an even probability of not surviving this downturn without additional equity raising or help from the state. The South Korean government has just announced billions in emergency funding to the shipbuilding sector, one of seven key industries that can apply for a new $32.4bn relief fund.

Will Sembcorp Marine go the route of a sizable equity raising just like what SIA has done or will there be light at the end of the tunnel in terms of a merger with Keppel O&M? I sense that until the Temasek/Keppel transaction is completed, the likelihood of any major restructuring exercise involving both Keppel and Sembcorp Marine is low. However, a consolidation is likely still the best long-term solution for our local yards to remain competitive against both our Chinese and Korean counterparts whose industry has been undergoing their own consolidation this past couple of years.

The exemption from quarterly reporting for Sembcorp Marine is probably a “lifeline” for the company as their finances will not be scrutinized by the street for at least until August 2020 when it releases its half-year result.

However, with the lack of new contract announcements, it is not difficult to see that time is indeed a precious commodity for Sembcorp Marine at present. Shareholders who are holding on for potential restructuring activity might be sorely disappointed that it could ultimately be in the form of equity raising instead of yard consolidation between Keppel O&M and Sembcorp Marine.

That in itself is complicated by the fact that Sembcorp Marine’s parent, Sembcorp Industry which holds a 62% stake in the former, is not on great financial footing.

Conclusion

Keppel, with multiple business divisions, will likely survive the current bear market in oil. I sense that losses if any will be rather marginal and manageable for 2020. All eyes will be on the completion of Temasek taking a majority stake in the company. That could give hope to the second round of corporate activity involving Sembcorp Marine, whose time seems to be running out in today’s low oil price context where new orders are none to speak of.

However, the complication of putting a “real” value on Sembcorp Marine’s true worth might again delay the whole corporate merger process, with investors not making gains even at today’s seemingly low price level.

Investors might be better of buying into its parent, Sembcorp Industry, who will likely benefit from its divestment stake in Sembcorp Marine to become a true-blue utilities/energy entity, a corporate action which will likely see a re-rating in its market value.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 3 REASONS TO KEEP INVESTING EVEN IN A DOWNTURN

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- WHEN TO BUY STOCKS IN A RECESSION? THE IDEAL TIME TO PICK A BOTTOM

- HOW TO INVEST IN A RECESSION OR BEAR MARKET (2020 EDITION)

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “Is time running out for Keppel and Sembcorp Marine as oil collapses below zero?”

Hi

Correct me if I am wrong.I understand that Temasek have clear the 2b debt of sembmarine. So it is debt free?

Thank

victor

Hi Cheong wee,

Temasek giving Sembmarine free money? That doesnt sound very possible. Do you have any info on that?

Oh you are probably referring to the 2bn in refinanced loan from its parent Sembcorp Industry. However, that is still counted as a financial commitment with a 3.55% interest rate. So it is definitely still a financial liability.