NET WORTH UPDATES – 2019

Net worth updates November 2019 – $1.21m (+0.8%)

Hi all. Welcome to New Academy of Finance portfolio and net worth report!

This is where we look to provide transparency in terms of our financial well-being. To be honest, it is a little scary disclosing to the world what my household net-worth is like. I tend to be a pretty private person.

But since I have decided to embark on a new financial journey with the birth of this blog, me and the missus decided to challenge ourselves to provide as much financial information as possible as a means of accountability and HOPEFULLY inspiration to others.

September 2019 will be the very last month which I will be getting an income from my previous job, hence I am prepared for our Net Worth to take a hit over the coming months.

Ideally, we will like our net worth to be buffered by stronger investment performance. Due to the nature of my previous job (I am an equity analyst), I am not able to participate actively in the capital market as a result of compliance-related issues.

Hence most of the stocks currently in my/missus portfolio are legacy counters. There will be major changes over the coming months as I look to increasingly deploy more capital into the market.

Having said that, I remain extremely cautious about where the current global equity market stands.

November stock portfolio update

I will be providing more granular information about my stock portfolio as I increase the size of my holdings. With a number of stock additions this month, the value of the portfolio has increased to SGD$65,362. However, in terms of absolute returns, the portfolio was only up 0.30% for the month. However, this excluded the profits from Blue Prism which we took profit (more on this later).

SGX Portfolio

My SGX portfolio will be mainly structured towards dividend-generating counters. I have initiated a small position in Ascendas Reit and will be looking to increase my Reit asset allocation in the coming months.

I have also taken the opportunity to average down the cost of my holdings in Straco after the counter’s share price dropped due to news that the flyer will be suspended once again. I have written about why I am still buying more shares in Straco despite this negative news.

Due to the drawdown in the price of Straco, my SGX portfolio is the worst-performing in terms of geographical/market allocation. However, I tend to have a long-term view pertaining to counters in this portion of the portfolio whose key aim is to generate a stream of recurring dividend income.

Current annual passive dividend income: SGD$1,074

Near term annual passive dividend income target: SGD$5,000

NYSE/Nasdaq Portfolio

Counters in this portfolio are added with a long-term view of gaining capital appreciation instead of a dividend angle due to withholding taxes involved pertaining to US dividend stocks.

The key detractor was Idexx laboratories where the holding was down 5%. I have previously written about Idexx Laboratories in our Buffett series. This is a recession-proof stock centered on the pets healthcare market. We took a position in the counter when it was at USD$263/share with a long-term view that this counter can generate returns in excess of 8%/annum over the next decade.

Arista Network was the key outperformer with a gain of 6%. Its share price collapsed after its 3Q19 results where the company guided for an extremely weak 4Q19/2020 outlook. I have again written about why I am buying into Arista Network in a previous post.

Looking ahead, I will be looking to incrementally add on my position in this portfolio, with a view of identifying strong recession-proof counters with good long-term appreciation potential.

HKG Portfolio

We added one counter, China Maple Leaf Education Systems, which appreciated by 12% due to stronger-than-expected quarterly results that beat the street’s expectations.

Established in 1995 in Dalian, Maple Leaf operates China’s leading independent international schools and offers international education from preschool to high school level. It operates the largest network of private international schools in China and is also Canada’s first and largest offshore school system. Its schools provide a western academic setting and prepare students for admission to western universities (especially the Canadian ones) while incorporating Chinese educational traditions and culture.

I will be looking to provide more analysis on the counter ahead.

Counters sold

We have exited our position in Blue Prism, an LSE-based stock with a profit of around SGD$9k on an initial cost of approx. SGD$12k, representing c.75% total return for this counter. Funds from this counter will be re-deployed into the passive portfolio ahead.

Passive Portfolio

I have not included my Passive Portfolio holdings in this month’s report as the amount is still pretty negligible. The aim is ultimately to create a passive portfolio that will hold up to 60% of my total portfolio holdings. More information on this segment will be provided in the following monthly reports.

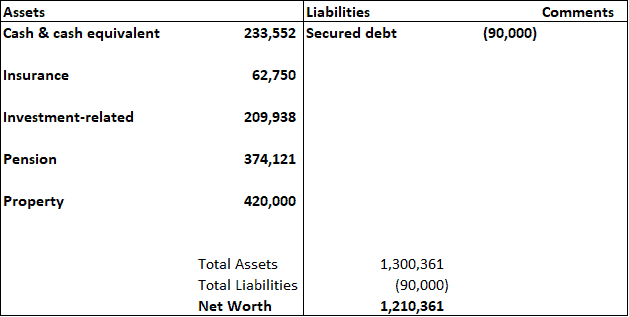

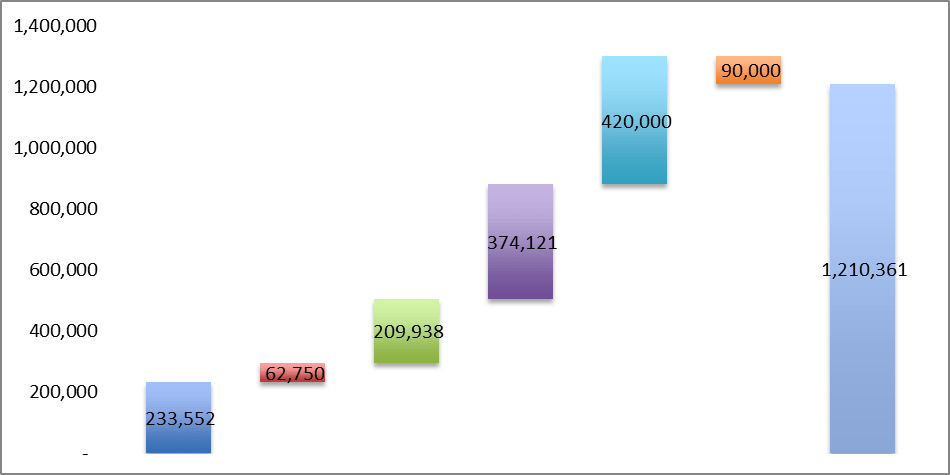

NOVEMBER NET WORTH UPDATE

Our household net worth increased by 0.8% to hit SGD$1.21m. This was mainly attributable to the profits from the sale of Blue Prism. Looking ahead for the month of December, the portfolio might get a slight upward bump from the annual interests received from me and the missus’ CPF/pension portfolio.

The difference between the “Investment-Related” amount of SGD$209k and my portfolio amount of SGD$65k is cash balances sitting in the brokerage account to be progressively deployed.

With that, I wrapped up the Portfolio and Networth update for November.

Appreciate all who visit New Academy of Finance and I hope that this website can ultimately be a wonderful source of personal finance inspiration.

Till the next time.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

5 thoughts on “NOVEMBER PORTFOLIO AND NET WORTH UPDATES”

Thanks for sharing 🙂 Always a pleasure reading people’s personal updates!

Hey Nick,

Thanks for dropping by and your kind comments.

You are definitely swimming against the current consensus of mainstream thought in that you take market timing into your decision making, pick individual stocks instead of index ETF’s and have a preference for dividend paying stocks. It will be interesting seeing how that serves you in the future. I expect you’ll do quite fine at it with your background.

Hey Steveark,

Thanks for the kind comments. Still too early to say how it might go but my intention is actually to gradually increase my passive holdings vs. active. Just biding my time. Thanks again for dropping by.

Great job crossing the million milestone in net worth! That’s really something.