While most Singaporeans would be familiar with the Central Provident Fund (CPF), most might still be unaware of the Supplementary Retirement Scheme (SRS). Check out the Ministry of Finance (MOF) comprehensive writeup on SRS

What is SRS?

This is a voluntary savings scheme that encourages one to save for retirement. As some would know, the main benefit of an SRS account is the tax relief that it accrues. For example, if you contribute an amount to your SRS account up to your SRS contribution cap by 31 Dec 2019, you will be able to enjoy tax relief in Year of Assessment 2020.

Currently that contribution cap is S$15,300 for Singapore Citizens and PRs while it is at S$35,700 for foreigners.

Is SRS only for the rich?

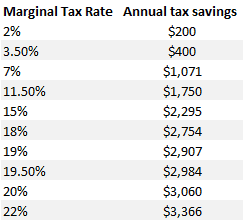

There might be some misconceptions that SRS only applies to high-income earners. While the benefits of SRS are more pronounced for higher-income earners (higher amount of tax savings), this does not mean that lower-income earners cannot benefit from SRS. The latter can opt to contribute a smaller amount to help offset some taxes. While the tax relief might not be as significant, reducing your income tax is always ideal, more so for the low-middle income population.

How is SRS relevant to a typical Singaporean and how are the tax savings impact like?

Let’s use 2 examples to illustrate. Do note that there is a tax relief cap of S$80,000 for each year of assessment.

Example 1: Male single Singaporean

Lets assume a typical single Singaporean male that generates a gross salary (before Employer Contribution) of S$5,000/month with a bonus of 2 months at the end of the year. He contributes 20% to his CPF.

This results in an Ordinary Wage contribution of S$5,000 * 12 months = S$60,000 and Additional Wage of S$10,000

His CPF Relief will be OW (S$60,000*20%) + AW (S$10,000*20%) = S$12,000+S$2,000 = S$14,000

Besides CPF relief, other key tax-deductible items include:

- Earned income relief – S$1,000

- NSman (self) relief – S$3,000

Total personal relief amount = S$14,000+S$1,000+S3,000 = S$18,000.

Chargeable income = S$70,000 – S$18,000 = S$62,000

He will fall under the 7% income tax band which requires a payment of S$550 for the first S$40,000 and 7% for the subsequent S$22,000 = S$1,540.

Total tax payable = S$1,540 + S$550 = S$2,090.

If he decides to allocate the max of S$15,300 into an SRS account, his chargeable income reduces to S$62,000 – S$15,300 = S$46,700

Total Tax payable = S$550 + (7% * S$46,700) = S$1,019

Total Tax savings = S$2,090 – S$1,019 = S$1,071/annum

Example 2: Female Singaporean with 2 kids

A working mother (2 kids) which generates a similar S$5,000/annum and 2 months of bonus. She also pays 20% to her CPF. Total Income = S$70,000

Key tax-deducible items:

- CPF relief – S$14,000 as calculated in example 1

- Earned income relief – S$1,000

- NSman wife relief – S$750

- WMCR on 1st child – (15% * S$70,000) = S$10,500

- WMCR on 2nd child – (20% * S$70,000) = S$14,000

Total Personal relief = S$40,250

Chargeable income = S$70,000 – S$40,250 = S$29,750

She will pay total tax of S$200

If she decides to allocate the max of S$15,300 into an SRS account, her chargeable income reduces to S$29,750 – S$15,300 = S$14,450

In this instance, she pays no tax but her total tax savings is only S$200/annum.

Conclusion: We have illustrated that a typical Singaporean single male generating S$70,000 in annual income could generate tax savings of S$1,071/annum by contributing to his SRS account. Do take note of the various tax-deductible items which could further reduce the tax savings potential of an SRS account as illustrated by the working mum example.

For a working mum with the same annual income, the tax savings incentive through investing in SRS typically is much lower as they tend to have higher tax-deductible items such as Working Mother Child Relief that can substantially reduce their chargeable income. In this scenario, the SRS account could be set-up with her spouse instead to maximize the total tax savings through the SRS account.

So should you be investing into a SRS account?

The short answer is YES, if you have excess capital that you can lock up for a relatively long period of time. Even if you fall under the lowest marginal tax category of 2% with maximum tax savings of S$200/annum, assume you can re-invest this S$200 into an investment that generates 5% average return over 30 years, that S$200 per annum contribution will translate to savings of S$13,952 after 30 years.

This savings will be more pronounced for the bulk of Singaporeans who fall under the 7% marginal tax rate that can generate maximum tax savings of S$1,071/annum. Based on the same assumption of 5% average return over 30 years, that S$1,071 per annum contribution will translate to savings of S$74,714 in savings after 30 years.

What can you do with funds in your SRS account

Your SRS funds can be used to invest in various investment assets such as Shares, REITS, ETFs, SGD fixed deposits, Endowment Insurance Plans, Unit Trusts and Singapore Savings Bonds. When you subsequently sell your investments, the returns on your investments funded by SRS will return to your SRS account.

The gains on your investments will accumulate tax-free.

When can I start withdrawing from my SRS?

SRS contribution is a voluntary scheme, so theoretically you can withdraw your funds anytime. However, if you withdraw any amount before the prescribed retirement age (currently at 62 years old), 100% of withdrawn amount will be taxed. In addition, there is also a 5% penalty.

Hence once you start contributing to your SRS account, you should be prepared not to touch this fund until you hit the retirement age of 62. However, there are circumstances where you can still have some monetary tax benefits even when you withdraw your funds early.

Example of early withdrawal

For example, if you stop working at age 45 (hence no income), you can withdraw S$15,300 and not be liable for any tax (Income of S$20,000 and below not subject to any tax). However, there is still the 5% early withdrawal fees which amounts to S$765. Read on.

If at age 44 (1 year prior to stopping of work), you contribute S$15,300 to your SRS account and assuming you are one that falls under the taxable income band of 7% tax rate, you will have accrue a tax savings of S$1,071. Now when you are 45 and decide to withdraw that S$15,300, you will only incur the 5% penalty which amounts to S$765 as highlighted

You will be saving S$306 extra even if you choose to withdraw early.

If you belong to a higher tax band, your savings will be even higher. However, such a scenario only make real economic sense if you generate enough income to at least fall under the 7% marginal tax rate category based on your chargeable income. You should only think about early withdrawal if you really need access to the funds in your SRS account.

If you can wait until you have crossed the prescribed retirement age of 62, the benefits will start getting increasing attractive.

What happens at age 62?

When you withdraw your savings once you hit the prescribed retirement age of 62, you will be taxed 50% of the withdrawal amount as taxable income. At this juncture, some might be wondering if it is worth all the hassle when ultimately, 50% of the fund will still be taxed.

If you have no other taxable income at this stage (let’s say you are already retired), then you can withdraw up to S$40,000 a year from your SRS account without paying any tax. This is because only 50% or S$20,000 will be considered taxable income and there is currently no tax on annual incomes S$20,000 and below.

What if I am still working at age 62 and already draw more than S$40,000/annum in income?

Unfortunately, 50% of the amount that you withdraw from your SRS account will be liable to a certain level of income tax (depending on how much you withdraw each year). However, you can look to spread out your withdrawal over a 10-years horizon so as to minimise the tax impact.

How to go about withdrawing your SRS funds

Let’s assume you have S$500,000 in your SRS account when you hit age 62

Scenario 1: Total Withdrawal of funds

If you choose to withdraw the full S$500,000, then S$250,000 will be subject to tax. You will fall under the 19.5% tax bracket where the first S$240,000 will be taxed at a flat S$28,750 amount and the subsequent S$10,000 will be taxed at 19.5% to bring your total tax payable to S$30,700.

Assume that this S$500,000 took you 32 years to accumulate based on a max annual contribution rate of S$15,300/annum, meaning almost zero appreciation (choose not to invest your SRS funds).

Again assume that you fall under the 7% marginal tax rate with a max tax saving of S$1,071/annum, you would have paid a total of S$1,071 * 32 years = S$34,272 in total tax during this period.

The tax benefit will hence be rather marginal and not worth locking up your funds for.

Scenario 2: Withdrawing S$40,000 each year to avoid paying substantial tax.

You can instead choose to withdraw S$40,000 each year without paying tax for the first 10-years. Subsequently, assuming the remaining fund is S$100,000, your taxable amount will then be S$50,000 (50% subject to tax), with a total tax payable of S$1,250 (S$550 fixed for first S$40,000 + 7% of S$10,000).

Compare this tax amount of S$1,250 in scenario 2 vs. S$30,700 in scenario 1 and its clear as day and night that you should not be withdrawing a lump sum from your SRS account.

Scenario 3: Spreading the S$500,000 into 10 equal payments.

Instead of withdrawing S$40,000/annum to not pay tax for each of the next 10-years, assume that you choose to withdraw S$50,000/annum for 10-years. This will imply that S$5,000 will be subject to tax each year (2% * S$5,000) = S$100 in tax payable.

Total tax payable after 10-years is S$1,000 with no remaining value in your SRS account. Scenario 3 will result in a slightly higher tax savings compared to Scenario 2 but the difference of S$250 over 10 years is generally negligible.

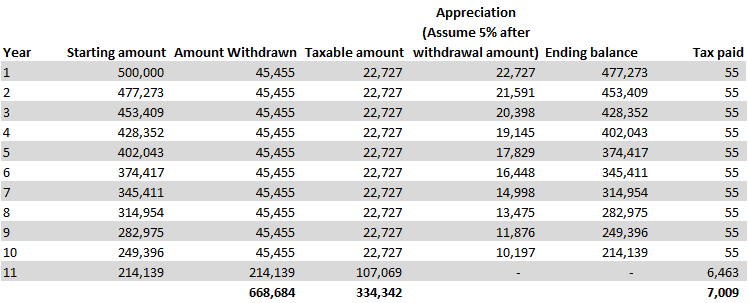

Scenario 4: Spreading the S$500,000 into 11 equal payments.

Compared to Scenario 3, this scenario will result in an ending balance in your SRS account. By splitting S$500,000 into 11 equal payments, this will result in S$45,454 in annual withdrawal rate. Out of this amount, you will be paying a total tax of (2% * S$2,727) = S$54.54/annum.

Total tax payable after 11 periods = S$54.54*11 = c.S$600.

By spreading out your payment into 11 periods (with ending cash balance in SRS) instead of 10 periods (no ending cash balance in SRS), you will be able to generate some cost savings of S$400.

However, the above scenarios assume a rather simplistic view that your SRS funds do not generate any appreciation over the 10-years horizon when you are drawing down on your fund (ie: SRS fund decline only by the amount you withdraw). However, that is unlikely to be the case if you vest your funds in an investment product.

This could result in your ending SRS amount being significantly larger than what you might have previously expected and hence resulting in higher tax amount to be paid at the end of the period.

Scenario 4b: Taking into account portfolio appreciation

Using Scenario 4 as a base example, if your SRS funds appreciate at a rate of 5% per annum, you might end up paying a total tax amount of c.S$7,009 vs. S$600 in tax.

Of course you would have gladly paid that additional S$6,400 in tax, given that your portfolio value increased by c.S$168,684 over the 10-years horizon. However, you can actually further reduce your taxes if you take some time to divide the total amount to be withdrawn each year by the number of periods remaining as illustrated in the table below.

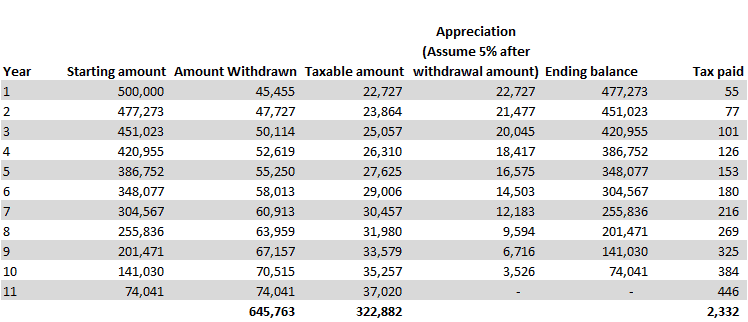

Scenario 5: Annual withdrawal amount based on remaining periods

Your tax amount will be reduced from S$7,009 to S$2,332! That’s a significant tax savings reduction. However, a savvy saver will note that the total amount withdrawn of S$645,763 in Scenario 5 is actually S$22,921 lower than Scenario 4b.

This slower portfolio appreciation more than negate the higher tax savings that you might have incurred in Scenario 5 vs. Scenario 4b. In fact, our analysis shows that as long as you expect your portfolio to appreciate at a rate in excess of 1%/annum, sticking with a fixed rate of withdrawal will be the ideal strategy, even if that entails paying a higher tax rate (which will be more than offset by greater capital appreciation).

Conclusion: Based on this simple analogy, we can conclude two key items: 1) Tax savings will not be substantial if you withdraw out your SRS funds on a lump sum basis after Age 62, 2) Its best to divide your withdrawal rate by 11 equal periods to fully maximise your tax savings and capital gains.

While contributing to your SRS account is the first step in helping to reduce your overall tax liabilities, the subsequent method to go about withdrawing the capital in your account once you hit the prescribed retirement age also plays a huge part in terms of your overall tax savings strategy!

For a middle-level income generator (using the example of the Single Male Singaporean) who typically pays S$2,000 in annual tax, instead of paying S$60,000 in tax over a 30 years horizon (assume no growth in income), that figure could be reduced to slightly in excess of S$30,000 by 1) contributing the maximum amount of S$15,300 every year to SRS account and 2) withdrawing the SRS funds (once available) in a strategic manner as illustrated in Scenario 4 (assuming no capital appreciation).

5 thoughts on “How you can maximize tax benefits through strategic SRS contribution and withdrawal”

Need to add that you must withdraw and close account after 10 years.

Investments need not be liquidated.

They can be transferred out by will be subject to tax.

If had great success in investments, then tax may come up to a lot (so will need to liquidate some investment to have cash to pay the tax).

Also, hope that after paying the tax, the investments don’t crash and then would be a pity in having paid a tax and further, suffer a loss in the investments.

Otherwise, if investments continue to do well, then it is a happy problem to have to pay tax for them.

Hi relac,

Thanks for the comment. Yes, 10 years is the period for full withdrawal. For investments, yes you don’t have to sell them and you can transfer them out (subject to tax as you mention). But the idea is for progressive divestment of your stakes such that you are able to withdraw out funds in such a way that for the first 10 years, you do not pay much tax. For the 10th year, if your portfolio performs very well, you will end up with a large sum that will be subject to tax. But as shown in Scenario 4, the capital appreciation amount will more than compensate for the higher tax being paid as compared to Scenario 5 (lower tax but also much lower capital appreciation).

POEMS doesn’t allow to invest SRS funds in share builder plan.

It costs $25 for each trade if we buy stocks with SRS.

Could you please suggest trading platform that is economically good to invest srs funds.

Hi Venkat,

You can use FSMOne to dollar cost average into unit trust investments using your SRS account.