Should you invest in the largest ETFs domiciled in the US?

If you are looking for the best ETFs to buy in the US, a good place to start might be to consider some of the largest ETFs that are listed in the US.

When it comes to defining the size of an ETF, we can look at it both from an angle of the ETF’s net asset value (NAV) or its asset under management (AUM). Before we delve into this topic, let’s have a quick refresher of what an ETF is.

ETF refresher

What is an ETF?

ETF is a type of security that involves a collection of securities, such as stocks that often track an underlying index although they can invest in any number of industry sectors or use various strategies.

They are similar to mutual funds, a key difference being that they are listed on exchanges, and ETF shares trade throughout the day just like an ordinary stock.

One of the key advantages of ETF is its ability to allow an investor to partake passively in a broad basket of stocks, hence a popular choice for diversification.

There are different types of ETFs which could include Bonds ETFs, indexed-stock ETFs, Industry-specific Stock ETFs, Commodity ETFs, Currency ETFs, and Inverse ETFs, etc.

Pros and Cons of ETFs

Pros

- Access to many stocks across various industries

- Low expense ratios unlike unit trusts

- Risk management through diversification

- Available to access to thematic ETFs

Cons

- Some ETFs might have high expense ratios

- Single industry focus ETFs limit diversification

- Lack of liquidity might hinder transactions

All in all, ETFs remain a particularly useful asset class for a new investor to start his/her investing journey without the hassle of selecting individual stocks which will expose them to unsystematic risk. This is a risk that is inherent in a specific company. By investing in a range of companies, unsystematic risk can be drastically reduced through diversification.

ETF’s NAV vs. AUM

An ETF’s net asset value (NAV) is not to be confused with the fund’s net assets under management (AUM).

The AUM is the actual investor dollars that are invested in all share classes of the fund while the NAV of the ETF is determined by adding up the market value of all assets in the fund, including assets and cash, then subtracting any liabilities. Most of the time, the price of the ETF corresponds closely with the NAV/share of the ETF, although there might be slight variations.

For example, an ETF that holds many large-cap mega stocks will have a high NAV. However, if not many people invest in it, its AUM will be comparatively low vs. an ETF with a smaller NAV.

Selecting the best ETFs

Instead of just looking at an ETF’s NAV when determining its size, it is also useful to look at the ETF’s AUM as a useful selection criterion.

Some of the largest ETFs by NAV also have high AUM. These ETFs tend to have a high trading volume which cuts down on the spread between the asking price and the buying price. Also, a higher AUM typically indicates a higher quality fund with a long track record of performance.

Lastly, these funds also have extremely low and competitive expense ratios, which makes them ideal passive holding candidates.

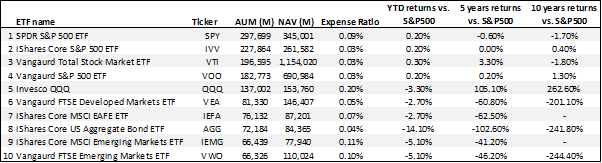

Without further ado, these are the Top 10 largest ETFs in the US, ranked by AUM followed by NAV. How have these ETFs performed relative to the S&P 500 over the past decade? Might there be better alternatives for your portfolio?

Largest ETFs in the US and how they compare against the S&P 500

The table above provides a quick summary of the largest ETFs in the US, screened using its AUM. The most invested ETFs listed in the US tend to also be those with the largest NAVs.

Stock Rover

One of the best stock screeners for the US market, Stock Rover is a screening platform that all serious fundamental investors should have.

There is a combination of equity and bond ETFs in the list. All of these ETFs have relatively low expense ratios, except for QQQ which has the highest expense ratio of 0.20% in this list.

However, with the benefit of hindsight, most investors would have gladly paid the higher expense ratio to partake in the extraordinary performance seen in the QQQ over the past decade, with its outperformance over the S&P500 a magnificent c.262% over the past 10-years.

On the other hand, the “honor” of worst-performing large-cap US ETF goes to VWO, which invests mainly in emerging market stocks. The performance of VWO has lagged that of the S&P500 by 244% over the past decade. On a YTD basis, its performance has also been relatively lackluster vs. S&P500.

The “best” large-cap ETF looks to be a close tussle between VTI and IVV, the former being the largest ETF by NAV in the world. Both ETFs have a very low expense ratio of 0.03% and while VTI performs better on a 5-years horizon, IVV has a more consistent performance on a YTD, 5-years, and 10-years horizon vs. the S&P 500.

Investors who want to partake in the S&P500 should select the IVV ETF over the more popular SPY ETF.

Additional Reading: 4 Best US ETFs for beginners to buy

Are there better ETF candidates?

Many of the highlighted largest ETFs by AUM and NAVs are not able to outperform the S&P500 consistently, except for the QQQ ETF which focuses on the tech sector. Even then, there are concerns over the hefty valuations of tech stocks of late, with the QQQ ETF underperforming the broader base S&P500 YTD.

Is there a large-cap ETF or ETFs that are more diversified in nature and have also shown to consistently outperform the S&P500 over the past decade?

Let’s take a quick look.

Best performing US ETFs that consistently outperform the S&P 500

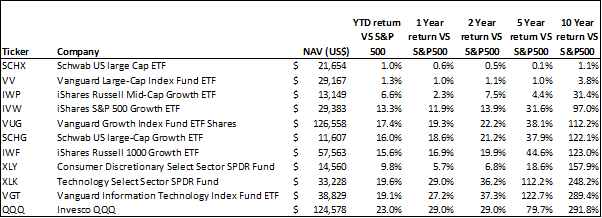

I have previously written another article that seeks to highlight the best performing large-cap ETFs which consistently outperform the S&P500 over the past decade.

These ETFs have outperformed the S&P500 consistently on a YTD, 1-year, 2-years, 5-years, and 10-years horizon. Investing in these large-cap ETFs (NAV>US$10bn) might potentially be a better alternative vs. investing in the S&P500.

The table below shows the original list of the 10 ETFs which were screened back in Aug 2020.

Out of these 10 ETFs, only SCHX has managed to maintain its outperformance over the S&P500 thus far in 2021, although just barely.

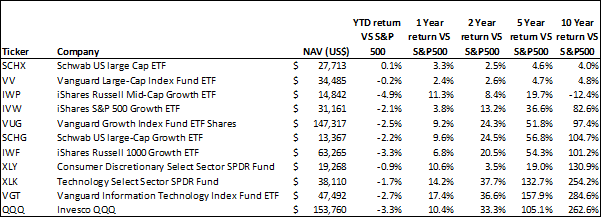

The table below shows the updated performances of these 10 large-cap ETFs as of 26 April 2021.

All of the above ETFs have seen an increase in their NAV since Aug 2020.

As highlighted, most of these ETFs, which focus on growth, have underperformed the broad-based S&P500 index ETF in 2021, except for SCHX which focuses on some of the largest stocks (based on market cap) in the US.

I will, however, not be overly hasty to write off these ETFs solely based on their YTD performances.

SCHX/VV might be better alternatives to large-cap index ETFs

While SCHX and VV, which both focus on large-cap stocks, have smaller NAV compared to the bigger ETFs such as SPY and IVV highlighted earlier, they have shown to be able to more consistently outperform the S&P500 over a 10-years horizon.

Both these ETFs also have extremely low expense ratios of just 0.03% (SCHX) and 0.04% (VV).

While the absolute outperformance vs. the S&P500 over a 10-years horizon is nothing to shout about for these 2 ETFs vs. growth ETFs such as the QQQ and VGT, it still makes sense to purchases these ETFs over their larger-cap counterparts, allowing the power of compounding to work its magic over a longer horizon.

Conclusion

The 10 largest ETFs in the US, based on both their AUM and NAVs, are potential candidates for your portfolio inclusion.

For investors looking to passively track the S&P500 performances, the IVV ETF is a low-cost, liquid ETF that has proven to track the index well over the past decade.

A better alternative might, however, be selecting the SCHX ETF which compose of the largest stocks that are included in the Dow Jones US Large-Cap Total Stock market index.

This ETF has shown greater consistency in outperforming the S&P500 index benchmark and might be a better ETF candidate vs. its larger market cap counterpart.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here on this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER STOCKS WRITE-UP

- Early Retirement Plan – A 9-Steps Ultimate Guide

- A step-by-step guide to figuring out your retirement sum

- How much to retire in Singapore?

- The IDEAL Retirement portfolio structure

- Don’t let Sequence of Returns Risk be your retirement pooper

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.