Investment Time Horizon

Understanding your investment time horizon is perhaps the single most helpful step to take in your investing journey.

Yet, amateur investors tend to make the mistake of overlooking their time horizon when they first step into the market. More alluring things like choosing the “best stocks” seem to be of the utmost importance to them. After all, this is a straightforward way that may yield higher returns in the future.

This way of thinking can lead new investors to huge financial losses. They may rush into an investment that has huge growth potential in the long term, neglecting the fact that their projected timeline is short. Unfortunately, a brilliant long-term investment may also be a terrible short-term investment.

How long is the projected future? What constitutes this future? It is these fundamental questions that are going to help you determine your time horizon, which in turn is the key to building a steady bedrock upon which your investments can flourish.

Read on to discover your investment horizon and how to pick the right assets to make up your portfolio. Discover also our favorite asset allocation ratio that makes up a balanced but growth-centric portfolio.

Step 1: What is “Time Horizon” and why is it so important?

Before we begin, let us review the definition of “time horizon”. In investing, time horizon simply refers to the amount of time an investor is planning to hold a portfolio. For different investors, this time can range from a few seconds to several decades.

Any investor worth her salt would have a good understanding of the concept of time horizon. This understanding is crucial because it helps to determine the optimal investment strategy and construct the appropriate portfolio allocation ratio. For different people, this ratio is different.

Step 2: How To Determine Your Time Horizon

What is your time horizon? The first step of your investing journey starts with figuring out the answer to this question.

Before you craft your portfolio, it may help to ask yourself the following questions:

- Is this a short-term or long-term investment?

- When am I planning to close this deal?

- What is the financial purpose of this trade?

- What is my expected return? Am I highly averse to risk?

The good news is, whatever your answers are, you can find a way to meet your financial goals as long as you understand your investment horizon.

Age, financial goals, and risk tolerance are major factors that influence how you would structure your portfolio, and whether you wish to lean towards the high-risk, high reward end, or stay in a relatively safe zone.

Age

Age is the most obvious factor in determining your time horizon. Generally speaking, the older you are, the shorter your time horizon.

A shorter investment horizon means that you should be exposed to less risk. Riskier financial assets may undergo more fluctuations, which makes it harder for your portfolio to recover in the short term.

On the other hand, if you are younger and have a longer timeline ahead of you, there is ample time for you to ride out the ups and downs of the market. This means that you can afford to invest in riskier investments that can yield higher rewards in the long run.

Increasing Lifespan, Longer Horizons

An interesting trend to note is that the average lifespan of Singaporeans is increasing. Between 1990 and 2017, the average life expectancy in Singapore rose 8.7 years, to 84.8 years.

With more of us living longer lives, we need to re-evaluate the way we approach our investments, from our time horizon to asset allocation strategy, to account for the additional years we will likely spend in retirement.

For instance, if you are 50 years of age today and considering investing, you still have a potential 20-30 year time horizon ahead of you.

In light of this, there would be a stronger case to take on slightly greater risk in exchange for higher expected returns. In this day and age, just because you are nearing retirement does not automatically mean you need to eliminate risk in your portfolio altogether.

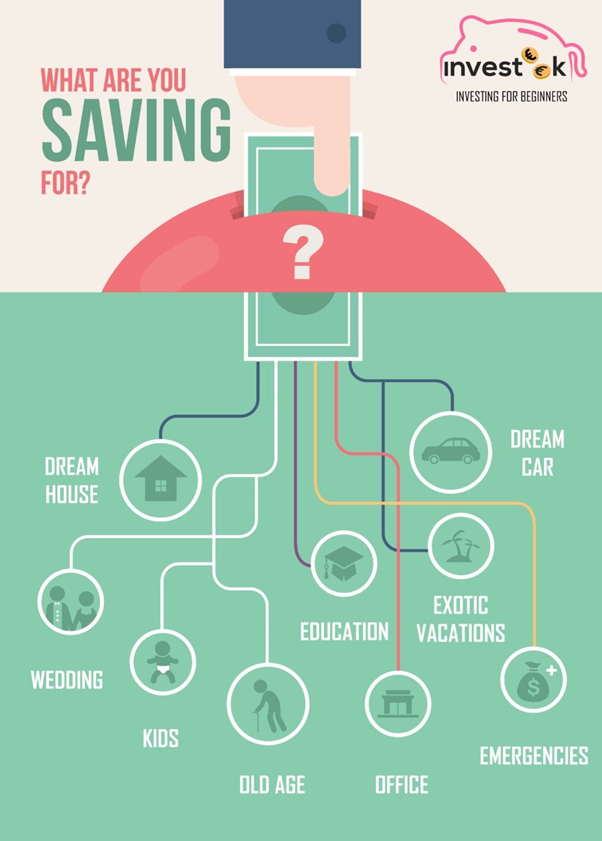

Financial goals

Your age helps you set out the big picture in your investment horizon. However, you are most likely not going to wait until the very end of retirement to sell all your assets. Most people have certain financial milestones along with their lives, and you can have more than a single time horizon depending on these goals.

Here are some financial milestones you may want to consider in your time horizons:

- Repaying your student loans

- Making a down payment on a home

- Purchasing your dream car

- Establishing a business

- Paying for your children’s tuition

- Going on a vacation

With so many goals in life, it could be a tad complicated to set out your investment horizons accordingly. Hence, a tried-and-tested strategy is to map out your financial milestones in the form of a timeline.

To do this, start by placing the projected date of your furthest financial goal, such as retirement, and one end of the timeline. This will help you figure out your longest time horizon. From there, you can begin to fill in other financial goals you would like to achieve along the way. This helps ensure your money is always available when you need it.

Here is a sample financial timeline you can make:

Risk Tolerance

Different people have different degrees of risk aversion, which can impact their investment strategy and asset allocation differently.

If you prefer the preservation of capital (the money you currently own) to the potential for higher-than-average returns, you are risk-averse.

An individual’s risk tolerance can be affected by a variety of factors, including their investment goals, experience, and their time horizon. As mentioned earlier, usually, the longer your time horizon, the more risk you can afford to take.

However, more often than not, risk aversion has little to do with the number of funds you have or even your age. At its core, risk tolerance is a personal choice, influenced by the “fear factor” or your fundamental investing values.

Step 3: Asset Allocation and Time Horizon

After you have determined your risk tolerance and mapped out your financial timeline, the next step is to pick the right assets to hold in accordance with your time horizons.

Asset allocation refers to the division of fractions of a portfolio across the different asset classes. The three main asset classes are stocks, bonds, and cash. Other popular ones include real estate and commodities.

Equities: stocks and exchange-traded funds (ETFs).

Fixed Income Securities: bonds and certificates of deposit

Cash and Equivalents: cash, money in savings accounts

Real Estate: REIT, property

Commodities: Gold, oil, etc.

The main reason for owning these different asset classes in your portfolio is because they have very little correlation and in some cases a negative correlation. Due to the volatility of recent markets, a broader allocation of assets is key to achieving long-term growth with a moderate level of risk.

How to allocate your limited funds to each of these asset classes will – again – be determined by your investment horizon.

Short-term

As a general rule, short-term goals are those less than five years in the future.

Investors with short-term time horizons usually own safe cash or cash-like investments. Certificates of deposit, savings accounts, and short-term bonds are all examples of short-term investment vehicles with more-or-less guaranteed returns.

The Extreme End of Short-term Investing

In recent times, an extreme form of short-term investing has gained popularity. These are trades with an ultra-short time horizon of hours or even minutes. Known as “day trading”, these trades are typically executed by experienced and well-funded people.

Medium-term

A medium-term time horizon is typically 5-10 years long.

With this much time, investors can afford to be exposed to more stocks and bonds, which are riskier. This will add an element of growth to your portfolio.

Are bonds still viable in today’s low-interest environment?

In the past, it was common advice for investors to allocate 60% of funds to equities and 40% to bonds or other fixed-income securities like certificates of deposit (CDs). This 60:40 ratio was considered to be a balanced portfolio that could weather risk and generate stable returns, which was indeed the case in the 1980s and 1990s.

However, a series of bear markets that started in 2000 coupled with historically low-interest rates have eroded the popularity of this rudimentary approach to asset allocation. Some professionals are now saying that a well-diversified portfolio must include more asset classes than just stocks and bonds.

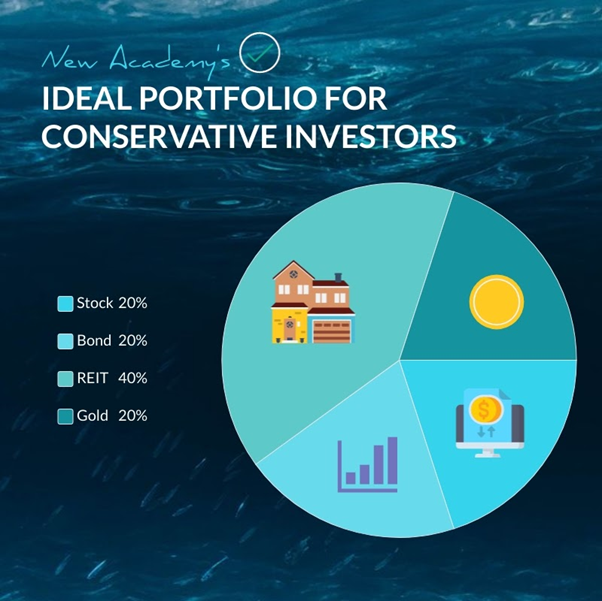

At New Academy, our favorite medium-term asset allocation for more conservative investors is as such:

Spelled out for you – 20% Equities, 20% Bonds, 40% REITs, and 20% Gold.

In this system, equities and REITs are the catalysts for growth, which naturally carry a higher risk. Having 20% of bonds functions as a hedge against falling stock prices (stocks and bonds are inversely related). And that 20% of the allocation to gold is a protection against inflation.

Long-term

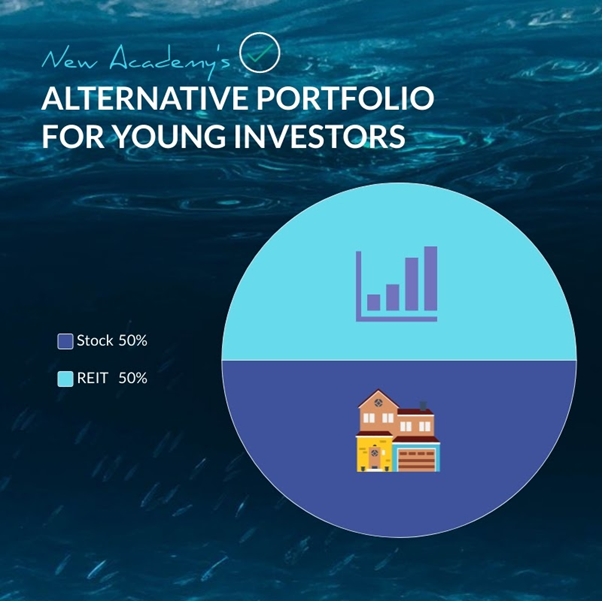

The above portfolio structure might be tailored to an investor who is nearing retirement. However, it is not the ideal strategy for a young investor who may be at the beginning of her investing journey.

Such investors have long-term horizons, usually 10 years or more. Over such long periods, heavy exposure to stocks and stock funds offers greater potential returns. In the event markets do tumble (and it will), you will have enough time to weather the storm and emerge stronger.

Jack Bogle, the founder of The Vanguard Group, proposed this simple rule of thumb for determining the perfect allocation to stocks: Subtract your age from 110. That’s how much, percentage-wise, you might want to keep in stocks.

So if you are 20 years of age, the ideal percentage of the equity to hold is, in theory, 90%, which is close to 100% of your entire portfolio.

Additional reading: How to achieve the ideal portfolio diversification

Alternatively, a 50:50 allocation of stocks and REITs could be considered, especially when accompanied by consistent reinvestment of dividends.

REIT refers to real estate investment trust, a high-yield and relatively safe investment. With dividend yields averaging twice those of stocks, some as high as 10% or more, REITs should play a role in any diversified growth and income-oriented portfolio.

You can read more about REITs here.

Step 4: Adjusting Your Portfolio Over Time

An important step new investors tend to overlook is that your time horizon shortens as time passes. As the years pass, it can be easy to forget that a long-term time horizon is not going to be long-term forever.

Let’s say an investor in their 20s starts saving for retirement (a goal with a long investment horizon) and picks a strategy heavily leaned towards exposure to stocks. As the investor nears retirement, they neglect to re-evaluate and adjust their asset allocation to reflect the now-shortened time horizon and the market crashes. Their nest egg is now worth drastically less.

An investor’s time horizon is constantly shifting with age, changes in appetite for risk, new financial goals, and more. So let us part with these last words: remember to review your time horizons periodically for an effective financial strategy, and a safer path to retirement.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Beginners Guide to CryptoCurrencies and how to get started in 2021?

- The Untold Secret To The Best Time To Invest

- Invest or Save? 5 Compelling Reasons Why You Should Invest Instead Of Save

- How to prepare for a bear market. A simple 3-steps process

- Thematic ETFs partaking in the hottest trends

- Decoding Basic Investing terms: A Beginner’s Guide (Part 2)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.