Investing in SPACs in 2021. What you need to know

This is a follow-up article on one of the hottest investment assets in 2020 that some readers might not be aware of.

I have previously given NAOF readers a brief overview of what SPACs are in this article: How to invest in SPACs like a Venture Capitalist

In this article, I will follow up on providing more details of Investing in SPACs in this All-In-One Guide to SPACs.

What are SPACs?

To put it simply, SPACs (Special Purpose Acquisition Companies) are shell companies (companies with no operating businesses) that are listed, whose purpose is to identify and purchase a private company and allow that private company to be “listed” in this process. This is also referred to as a “reverse merger”.

SPACs are sometimes referred to as blank check companies. These companies have been around for decades as a marginal part of the investment banking world. They have not been a popular method of listing historically, gaining the bad reputation of attracting fraudulent penny stock counters.

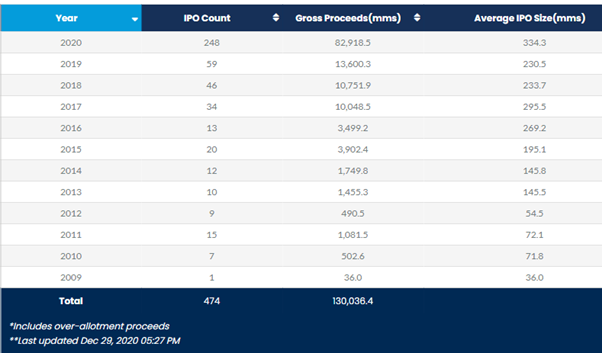

However, their popularity has exploded in 2020. According to SPAC Insider, 2020 is the year of SPACs, with a total amount of US$82.9bn in gross proceeds raised across 248 SPACs. That is way higher than the US$13.6bn gross proceeds raised in 2019 and US$10.8bn gross proceeds raised in 2018.

Things have gotten even crazier in 2021.

So far in 2021, almost 60 new SPACs have together raised about US$17bn in the first 2 weeks of January. On average, each of these year’s SPAC cohort has gained about 8%, according to Bloomberg data.

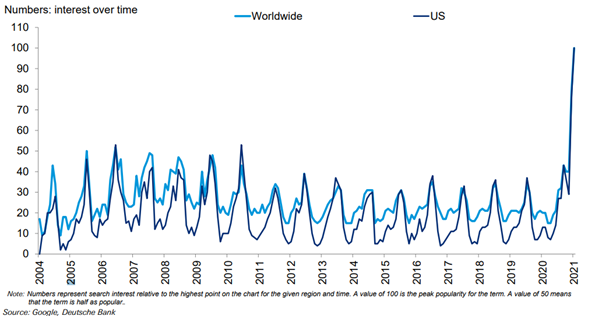

There has also been a huge increase in search stats for SPACs, according to data compiled by Deutsche Bank.

Why SPACs Exist

I have briefly talked about what SPACs are. Public listed shell companies. I will go into more technicalities of how exactly SPACs work in the next segment.

In this segment, I will like to briefly highlight why SPACs even exist in the first place.

The origin of SPACs

SPACs have been around for decades. Their predecessors – known as “Blind Pools” had a shady reputation on wall street in the 1980s because they were tied to penny-stock fraud.

The first SPAC was created in 1993 by investment banker David Nussbaum and lawyer David Miller. SPACs turned red hot for brief periods in the 1990s, then again in the 2000s, only to fade with market crashes or a surge in traditional IPOs.

New laws and regulations helped bolster their reputation, as did changes that made it easier for investors to get their money back before a deal went through.

The basic structure of SPACs

The basic structure is the same now as it was then. A typical SPAC goes public on a US exchange having raised money from investors with the promise of buying a private company.

Private companies are willing to be acquired by SPACs because such a process is often a quicker and more “pain-free” solution as compared to the traditional IPO process.

It allows the company to write an S-4 document (a document that registers any material information related to a merger or acquisition) rather than the more complicated S-1 filing (registration statement for a company that is usually filed in connection with an IPO)

An S-4 filing allows the company to disclose more about its future potential rather than its historical performances (often which there are none to speak off). These are private companies that are loss-making in general and the KEY reason why investors might be interested in them is to partake in their future GROWTH potential.

An S-4 filing will allow a company to describe its future growth potential, on items such as its future cash flow, etc. For a technology company, historical earnings and cash flow are not very relevant but they are often required to be disclosed and assessed in a traditional S-1 document.

This is probably the single distinguishing feature that matters for a private company that wishes to list through a SPAC vs. a traditional IPO.

There are other attractive features for a private company to list through a SPAC, such as:

- Since a SPAC is already public, a reverse merger allows a private company to become public when the IPO window is closed.

- Founders and other major shareholders can sell a higher percentage of their ownership in a reverse merger than they would with an IPO

- Founders can avoid the lock-up periods for selling newly public shares that are required for IPO.

- Founders do need to engage in roadshows that are often time-consuming

- It is “cheaper” to go public through a SPAC vs an IPO as the cost of listing is in-fact borne by SPAC shareholders (more on that later)

With that, let me briefly talk about how SPACs work.

How SPACs work

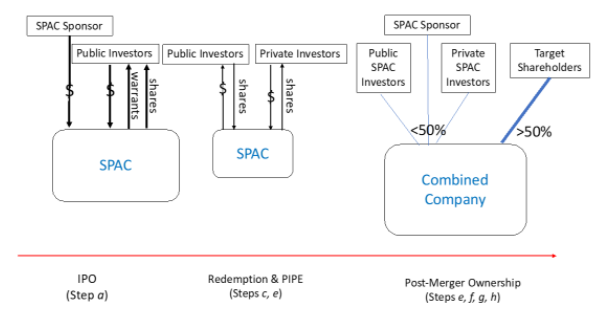

SPACs are companies that go public in a regular IPO, raising money from the public without any form of operating entity behind it.

So, the next question to ask is: Why will any investors be interested to invest in a blank check company?

That is because it provides these investors with the opportunity to be an early IPO investor. In a typical IPO, this is reserved only for high net worth and large institutions, people who are allowed to partake in these IPO at their “IPO price” and reaping that massive first-day gain when the counter starts trading.

Retail investors often do not get to partake in that huge upside. Think recent IPOs such as Airbnb where its share price doubled on the first day of trading.

Investing in these shell companies will allow retail investors to be an early investor, just like that of large institutions. The only key difference is that they are not told what “exactly” are they invested in.

It’s a shell company with the promise (by the sponsors) that the funds raised will be invested in a company in a particular industry/sector. For example, the sponsor of a particular SPAC will give a vague notion that capital raised for this SPAC will be used to fund a private company operating in the sexy EV segment, thus garnering lots of interest. Whether such a merger materializes at the end of the day is another question.

All this sounds inherently risky, and it is, so to make it more palatable to investors who are putting their money in with no promise about what might happen to it, there is a “sweetener” and an “escape hatch” attach to SPACs.

SPAC investors can choose to reject an acquisition

Investors in SPACs have an escape hatch. This “escape hatch” materializes in 2 ways. First, the SPAC sponsors have a fixed set of time, usually 2 years, to find a use of the capital which is kept in a trust fund.

If no suitable deal is ever found, that trust fund gets distributed back to SPAC shareholders. This value is essentially the $10/share that most SPACs start with. The estimated per-share redemption value is usually disclosed in filings along the way to keep shareholders updated.

So, if you invest in the SPAC at a price per share of $10, you have got no downside to this investment, only opportunity cost lost for the 2-years of wait.

However, in today’s bullish climate, most pre-merger SPACs will be trading at a substantial premium to its $10/share NAV. Investors buying into these SPACs at a price above $10 will see losses to their investments (Eg, buy at $12/share = loss of $2/share if no deal is done).

If the SPAC sponsors identify a potential target firm, they make a formal announcement. The day the public is notified about the potential acquisition is called the announcement date.

The second escape hatch is that investors in the SPAC have the right to vote on the deal right before it is being consummated, which gives them some power:

- If more than 50% of shareholders approve the acquisition and less than 20% of the shareholders’ vote for liquidation, then the merger transaction is approved and the acquired firm is listed on the stock exchange.

- If more than 50% approve the transaction, but more than 20% of shareholders want to liquidate their shares, then the escrow account is closed and the proceeds are returned to the shareholders.

Once a deal is done, the SPAC will bring in outside equity investors, typically from leveraged buyout firms, in what is known as Private Investment in Public Equity or PIPEs to raise additional capital.

SPAC investors get free warrants

I talked about the escape hatch entitled to SPAC investors for the risk they are taking. They are also entitled to a “sweetener” in the form of warrants.

Each SPAC goes public initially as a stapled unit, typically with a “U” at the end of the ticker.

For example, a recent SPAC that went public is the Softbank SPAC that is trading under the ticker of SVFAU (stapled unit)

That unit includes 1 share of equity (SVFA) which is what can be redeemed at the time of deal consummation and a portion of a warrant.

In general, each unit will have one warrant if the manager is not well-known enough to raise capital and or a half or a third of a warrant (or less) if that’s all that is needed to attract investors.

In the case of SVFAU, each unit is only entitled to 1/5 of a warrant. You need 5 units to be entitled to 1 full warrant share which you can exercise for $11.50/warrant (more on that later)

Within the first 2 months after the SPAC units go public, the units can be separated at the investor’s option (inform your broker of your intent to do so) and they will begin trading separately as regular equity shares (SVFA) and publicly traded warrants (SVFAW).

How does a SPAC warrant work?

A warrant is like a call option but with a few key differences. Most of the time, SPAC warrants are 5-years warrants (starting from the date the SPAC consummates a deal) that give you the right to buy the underlying stock at $11.50/share.

It is like a LEAPS option (long term option), just that in the case of the warrants, you are transacting directly with the company instead of with other shareholders of the company.

When you choose to exercise the warrant, you pay $11.50/share and this is new capital that goes to the company. 1 new share is created and this adds towards the total outstanding shares in the company. Exercising an option does not create new shares in the company.

One key point to note for SPAC warrants. There is typically an early redemption clause set in the contract, where the company will have the option to redeem your warrants if the shares trade above a certain level (typically $18/share for 20 days out of 30).

This is why you need to pay close attention to your warrants. Unlike in the case of options where all “ITM” (In-the-money) options are exercised automatically by your brokerage, these SPAC warrants DO NOT get exercised automatically, so they can expire worthless even if they are “ITM” and is valuable to you.

This is particularly true if the price of the underlying soars above $18 and the company thus have the right to redeem the warrants early (depending on the specifics as stated in the prospectus). If you are not paying attention and did not exercise the warrants before redemption, these warrants can be redeemed for “pennies” and you will be “giving” free money back to the company.

Take note of the fractional nature of the warrants. As highlighted earlier in the SVFAU example, its warrant is only effective for 1/5 of a share, so it will require 5 warrants plus $11.50 to exercise to give you 1 share of the underlying.

These SPAC warrants are traded on the market, with a W at the end of the ticker. So, in the case of SVFA, it will be listed as SVFAW.

Huge sponsors incentive to the detriment of SPAC shareholders

A primary criticism of SPACs is that the founder or sponsors of the SPAC typically receive a large stock allocation (20% post-IPO-equity) of the merged entity as part of the SPAC IPO.

These founder shares and warrants are often purchased for a nominal sum to cover expenses but entitle the management to purchase up to 20% of the deeply discounted shares outstanding following the IPO. This allows them to generate returns several times their original investments.

This results in a potential conflict of interest as it is in the sponsors’ wellbeing to conclude a merger, regardless of whether that merger is in the long-term best interest of shareholders of the SPAC.

Some recent SPAC IPOS have sought to reduce the conflict of interest.

For example, Pershing Square Tontine Holdings, the largest SPAC IPO to-date (raised $4bn in equity) and led by famed hedge fund manager Bill Ackman, structured its IPO so that the sponsors purchased $1bn of stock along with some warrants. Pershing Square expects the dilution to ordinary Class A shareholders to be in the region of 6% compared to the typical 20%.

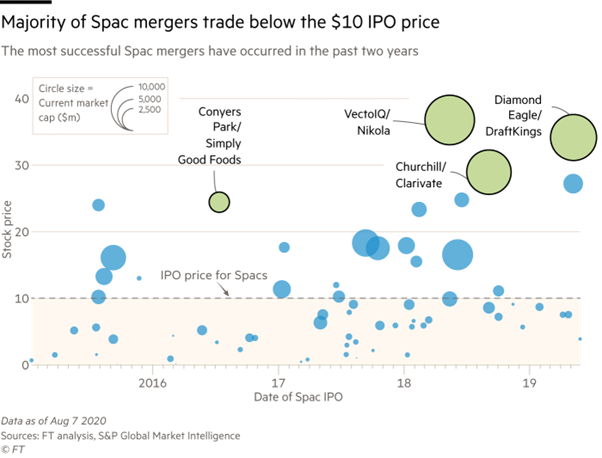

As a result of the strong dilution effect inherent in the SPAC structure, statistical evidence point to the underperformance of SPACs after the merger has happened and many eventually fall below their IPO price.

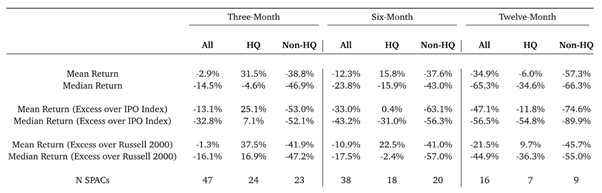

According to this research paper done by a Professor at Stanford Law School, the study looks at the post-merger performance of SPACs over 3, 6, and 12 months for SPACs that merged between Jan 2019 and June 2020.

By 3 months following a SPAC merger, median returns were –14.5% and median returns over the Russell 2000 or the IPO index were even lower.

6-month returns were worse and 12-month returns are worse still.

A reasonable inference is that targets negotiated prices or share exchanges based on the cash value of SPAC shares. This relationship strongly implies that poor post-merger SPAC performance reflects the cost of the dilution embedded in SPACs and that SPAC shareholders have generally borne that cost.

For those who are interested in finding out exactly why shareholders of SPACs are often at the short-end of the stick post-merger, do take a read at the research paper entitled: A Sober look at SPACs

This dated FT diagram also shows the majority of SPACs (especially the small ones) trade below their $10/share IPO price.

How to invest in SPACs

Investing in individual SPACs

Investors can invest in SPACs either by selecting individual securities or by investing in a SPAC ETF.

Investing in individual SPACs allows investors to focus only on those opportunities that look the most promising while having downside risk protection ($10/share).

This is because the funds that are raised in the SPAC IPOs are kept in a trust that is invested in government bonds until the merger is completed by which the funds will be released. At that point, shareholders have the option to liquidate their shares or sell them in the secondary market.

Investors are essentially assured that the original investment of $10/share is secured and hence it is unlikely that the share price will dip below $10/share for a prolonged period before the merger is completed.

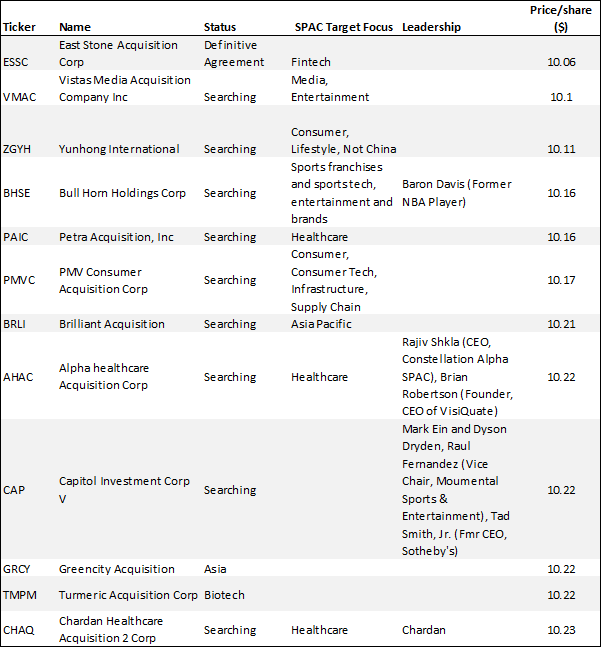

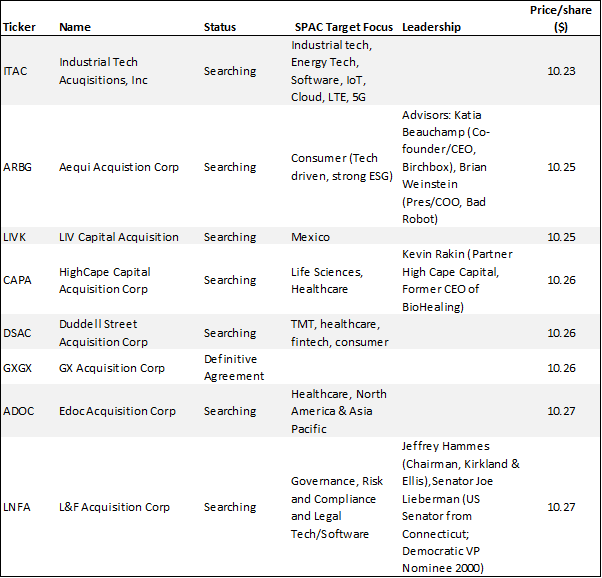

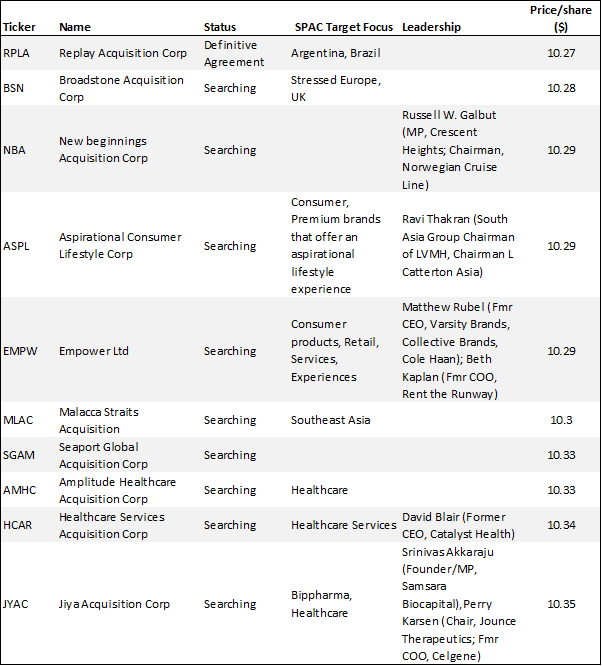

One strategy to invest in SPACs is thus to identify those SPACs that are trading near the $10/share price level which essentially means that the majority of your downside is protected and sell one week after an announcement has been made on a potential merger.

According to research done by Tim Jenkinson and Miguel Sousa, titled Why SPAC Investors should listen to the market, it has shown that such a strategy as detailed above generated a median return of 7.6%.

For those who are interested in such a strategy, I detail the handful of SPACs that are trading below $10.40/share in the table below as of 26 Jan 2021

A more common investment strategy would be to target those SPACs which are backed by strong sponsors with a good track record of finding good private acquisition targets.

For example, some of the more popular SPACs are backed by reputable sponsors to the likes of Chamath Palihapitiya, Bill Ackman, Softbank, Michael Klein, Harry Sloan, Marc Stad, etc.

The reason why investors are willing to “bid-up” the prices of these SPACs which are still searching for acquisition targets is that they believe that these “big name” sponsors have the track record of acquiring good companies to be injected into the shell companies.

It all comes down to reputation and track record. However, there is no guarantee that these big names founders can deliver at the end of the day. Investors need to be aware that they risk losing a portion of their capital (the difference between the price they paid and the support level of $10/share) if no deal is consummate after 2-years.

This will be a topic for another article.

Investing through SPAC ETFs

There are several SPAC ETFs available to investors. One Passive option is the Defiance NextGen SPAC Derived ETF (SPAK). It seeks to track the performance of the Indxx SPAC & NextGen IPO Index.

However, the main issue is that 80% of the ETF’s portfolio is vested in SPACs where the reverse merger has already taken place.

As we have shown previously, the majority of the SPACs tend to underperform after the reverse merger. This is an area which investors should be aware of.

One Active ETF that seeks to invest in the most promising SPACs is the SPAC and New Issue ETF (SPCX).

The SPCX was launched recently back in December 2020 and has surpassed $25m in assets under management and is up more than 15% since its debut.

Michael Klein’s Churchill Capital Corp IV is SPCX’s top holding.

Another alternative to SPCX is the actively managed The Accelerate Arbitrage Fund which is listed on the Toronto Stock Exchange. This fund invests in SPACs before they announced deals and also incorporates merger arbitrage which aims to capitalize on the spread between a target’s stock price and the offer price before a deal closes.

Are SPACs in a bubble?

Yes, I would think that SPACs are in “bubble” territory but there is no reason why the bubble cannot get bigger in the current climate of zero interest rates where hedge funds all over the world are seeking alternatives to increase their yield and returns.

The boss of Goldman Sachs, David Solomon, recently commented that the boom in equity issuance by SPACs isn’t sustainable.

“There will be something that will in some way, shape, or form bring the activity levels down over a period of time. Like many innovations, there is a point in time as they start where they have a tendency maybe to go a little bit too far and they need to be pulled back or rebalanced in some way”.

However, it is unlikely that the street will be heeding his advice anytime soon as they are busy making money from SPACs.

Goldman itself has got an active SPAC, GS Acquisition Holdings Corp (priced at $12.80) which is still pursuing a deal.

As I mentioned at the start of the article, the craze for SPACs has extended into 2021, with almost 60 new SPACs IPO raising about $17bn in total.

What might cause SPACs to lose their allure?

A sudden rise in interest rates might make raising SPACs more difficult because hedge funds would then have more attractive places to park their cash.

Another issue is that the more SPACs there are, the more likely it is that some will strike a bad deal or take a company public before it is ready. There are so many SPACs out there chasing for a “good deal” but there are just that many gems around for the picking.

As more negative media on SPACs hit the headlines because of a “rush job”, that might be when the speculative bubble will pop.

Conclusion

I hope that I have presented a comprehensive summary of what SPACs are all about in this article. The fad for SPACs will likely continue in 2021 as long as the “hot money” is still present. I will not be surprised that SPAC issuances in 2021 will beat the recording-setting 2020.

My strategy with regard to SPAC is to be nimble and recognize for a fact that investing in SPAC is a high-risk maneuver. At present, I tend to mostly partake in pre-deal IPOs (although there are some post-deal SPACs which I am interested in holding for the long-term), focusing on those with a good sponsor, although I am well aware of the risk associated with paying a “premium” for these SPACs.

Although these SPACs are trading at a substantial premium to their $10/share NAV, I am betting or essentially speculating that a deal will materialize much faster due to the sponsor’s track record of consummating deals.

I will be highlighting some of my personal favorite pre-deal SPACs in a separate article.

Note that post-deal, most SPACs tend to be less profitable or even loss-making. Given these SPAC’s poor track record, most investors should be wary of investing in them. Again, I will be highlighting some post-deal SPACs that might be worth a second look in a separate article.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update Nov 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.