Following the insiders

Insiders are the executive managers and directors who are in front of the financial and strategic decision making of their firm.

Hence insider trading activity could be an informative exercise to track because their trades tell us something about the potential “undervaluation” of the stock since these insiders know their business better than anyone else.

However, not all insider trades are “made equal”.

In this article, I will be commenting on the Three Do’s and Don’ts pertaining to insider trades and I will follow up with 3 Singapore companies that have been engaging in insider trades in the past week. Whether you choose to follow the insiders is up to you. I will be highlighting on one particular stock that I will be closely monitoring for a potential trade opportunity.

Three DO’s regarding insider trades

1. Take insider purchases in consideration but it is not the holy grail

Insider purchases can be an indication that the stock is undervalued and that is what prompts the executives who “know” what is going on to make these purchases. Some investors, due to biased emotional traits, might make the erroneous decision to sell out when the market gets volatile. This could also be due to the lack of knowledge of the firm which resulted in them not capitalizing on a potential strong buying opportunity and instead sell out of fear that they will lose even more money.

However, insider purchases should never be seen as the holy grail of investing or even more so for short-term trading. Insider usually buys with a long-term view in mind.

Evidence suggests that insiders tend to act far in advance of expected news. They do this in part to avoid the appearance of illegal insider trading. A study by academics at Pennsylvania State and Michigan State contend that insider activity precedes specific company news by as long as two years before the eventual disclosure of the news.

There might also be occasions where they themselves are emotionally attached to their company’s outlook which could cloud their purchase decision.

If you are a long-term investor in a particular stock with a positive view of its future prospect, insiders buying can help to reaffirm the positive stance you are taking but it should not be implied that the company’s stock price has bottomed.

2. Take insider purchases more seriously when done in a cluster

Many empirical papers have been written regarding the most informative insider trades. One of the most significant finds came from Alldredge et al, who found that clustered trades where multiple insiders are buying close to each other, outperformed solitary trades significantly.

This is intuitive because when many insiders buy their stock, the probability of undervaluation is higher. They can’t all be wrong. Can they?

Thus, if you are taking into account insider purchases in your investing strategy, clustered purchases are more informative than a solitary one.

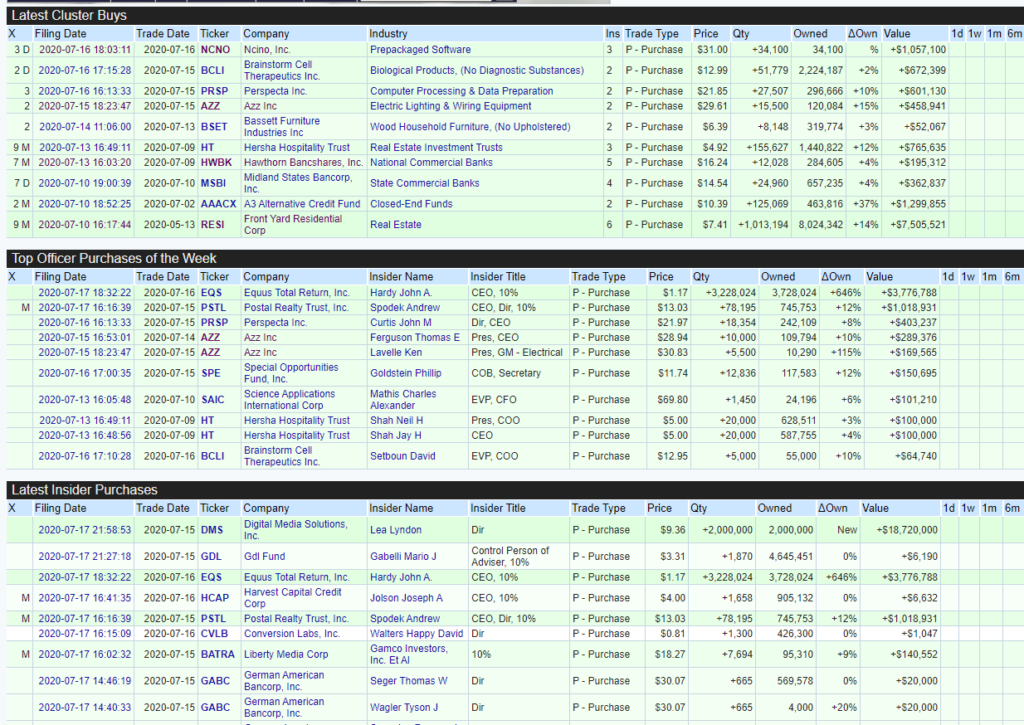

A particularly useful website that you can use is openinsider.com where they also show trades in clusters as seen from the table below as well as top officer purchases in addition to the latest insider purchases.

A company that might be interesting to observe is AZZ which is in the business of steel fabrication. A commoditized business nonetheless although there are two recent purchases recently by officers in the company, one by the CEO and one by the GM of the electrical division.

I would however not be dabbling with a company in the steel industry.

3. Take insider purchasing more seriously when done by officers

Directors know less about a company’s outlook than executives. Key executives are the CEO and CFO. Hence when the CEO or CFO starts purchasing stocks in the company, it could mean that the stock is undervalued.

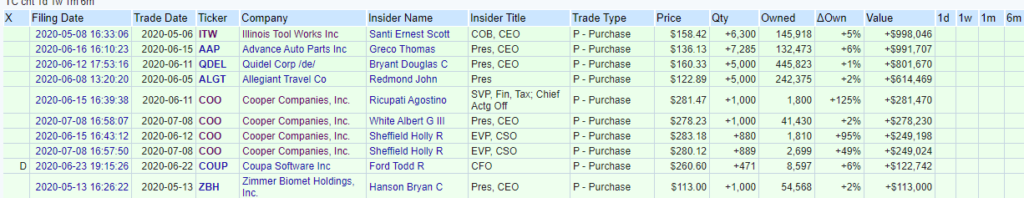

Take for example in the table below where three different officers purchased shares in Cooper companies, Inc over a short duration of 1+ months. These stocks were purchased at a cost of around US$280/share while Cooper’s share price is currently trading at around US$290/share. Is there potentially more upside?

Another company is Illinois Tool Works which is a rather popular Fortune 200 industrial company that is often seen as a bellwether of the economy. Its CEO purchased shares at US$158/share even after its share price has rebounded strongly from the March low of c.US$110/share. The shares are currently trading at US$182.

Three Don’ts regarding insider trades

1. Don’t give attention to routine purchases

There could be occasions where the insiders just purchase their stock regularly because they believe in their company without trying to buy solely at undervalued prices. These “routine” trades, defined as a trade which happened in the same month for at least three years, outperform much less as compared to opportunistic trades.

According to a paper by Cohen et Al, the firm found that opportunistic trades earn a significant abnormal return of 5.8% annually while routine trades are not indicative of future returns. Thus, if you are looking at the insider purchases of a particular company, have a look at the regularity of them.

2. Don’t deny low-value purchases

Purchases need not be in the millions for them to be considered “substantial” and thus worth following. In reality, many empirical researchers have contradicted this statement by proving that the value purchased has no significant impact on the number of shares purchased.

While the purchase amount might be a small fraction of the management’s net worth, it does not mean that they are any less informative.

3. Don’t ignore insider sales after a large price correction

Insider sells for a multitude of reasons. It could take advantage of options granted to them or it could just be wealth diversification. Many insiders such as Mark Zuckerberg and Tim Cook sell shares regularly. Jeff Bezos sold a huge chunk of Amazon just before its share price lifting off. Hence such sales might not tell us anything concrete about the stock’s valuation.

However, it might be a red flag when management is selling off in drove even after a huge price correction which the latter event should theoretically present “value” in the company. This could mean that the company’s management is bearish on the future outlook of the company and will not even want to capitalize on the opportunity to buy its shares at a “discount”

Let’s take a look at 3 Singapore companies with recent insider trades. Should you be following their purchases? These companies will be rank from lowest transaction value to the highest.

Singapore company with insider trades #3: Dutech Holdings

Management of Dutech Holdings bought a total of 380k shares during the past week amounting to a net value of $112k. This means that the shares were purchased at an average price of S$0.295/share. The current share price of Dutech is at S$0.28.

Dutech is an interesting company that most would not be familiar with. It is a SAFE company. By that I mean the company is a global leading manufacturer of high-security products such as ATM safes, banking safes, commercial safes, etc.

While the company’s revenue has been on a steady uptrend due to acquisitions, the net profit has been more volatile over the years.

Based on the current share price, the company is trading at approx. 6.4x trailing PER with a 3.5% forecasted yield.

Singapore company with insider trades #2: SATS Ltd

The CEO of SATS Mr. Alex Hungate purchased 36,000 shares worth S$98k at an average price of approx. $2.73 while another director Tan Soo Nan purchased 16,200 shares worth S$46,000 at an average price of S$2.84.

SATS is quite a well-known company but it is one that is currently facing tremendous headwinds due to global air travel almost coming to a halt. The outlook for the company over the next year is inevitably going to be a very challenging one.

However, the purchase by its CEO, who has led the company to great strides over the past 5-6 years, is a show of confidence that the company’s fundamentals remain stable.

I like SATS but I am also clearly aware of the challenges that the company is currently facing which will likely result in substantial losses in the upcoming results. This is probably a stock worth accumulating for the long term but not one that is prime for a quick rebound in the coming days or months.

Singapore company with insider trades #1: Raffles Medical

A substantial shareholder, Global Alpha Capital Management, a Canadian based discretionary asset manager, purchased 615,100 shares valued at S$578k. This represents an average purchase price of S$0.94.

Raffles Medical’s share price has been hard hit since peaking at c.S$1.6+/share about 5 years ago. Since then, its share price has been in a downtrend. This is likely due to a tapering of its earnings performance which has been clouded by start-up costs associated with its new hospital as well as its foray into China which has yet to borne fruits.

The company’s share price dipped to a low of S$0.73/share in the March sell-off but has since recovered to the current level of S$0.92/share.

There seems to be momentum building up for Raffles Medical and this will be one stock that I will be keeping a close eye on for a potential breakout, likely on positive news on China (if that happens).

Conclusion

Insider trades are pretty helpful information that one can use to follow the “smart” money, essentially people in the loop. Their actions might represent that the company is currently undervalued in their opinion.

However, such trades might only bear fruits over a medium to long-term horizon and hence might not be very suitable for short term trading purposes, especially if taken on a standalone basis. Key management will avoid purchasing shares before a major “positive” news flow which will raise credibility and legality issues.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 1]

- BEST STOCK BROKERAGE IN SINGAPORE [UPDATE MAY 2020]

- VALUE INVESTING IN SINGAPORE: 10 SG VALUE STOCKS THAT MIGHT MAKE SENSE

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “3 Singapore Companies with insider trades in the past week. Should you be following?”

What are some free sources to find out inside trades for companies listed in SGX?