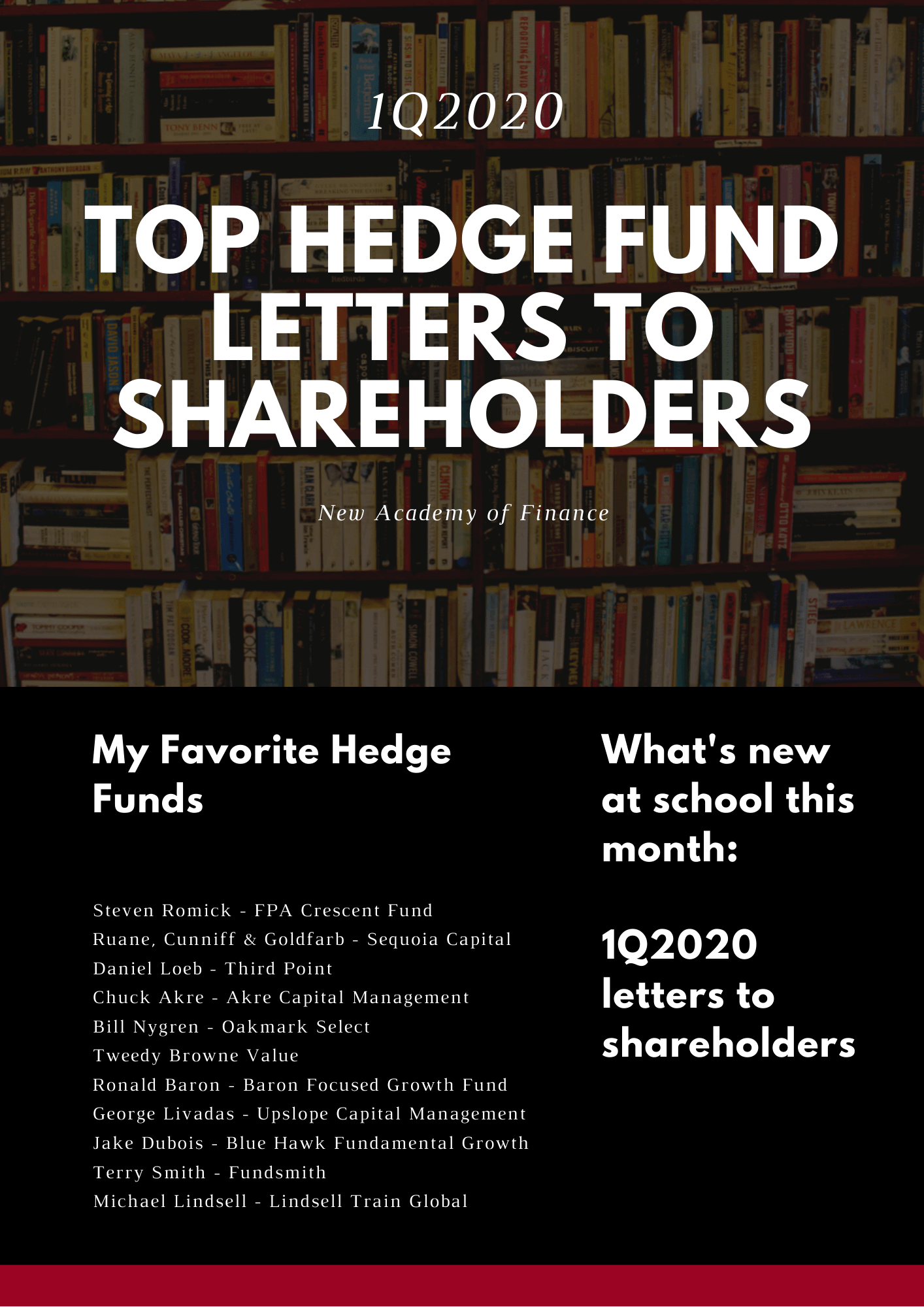

1Q2020 Hedge Fund Letters

Starting from 1Q2020, I look to compile some of the top hedge fund letters to shareholders which is an excellent place to source for new investing ideas from the best minds in investing.

These letters are from the top Investment hedge funds, some of them the very best when it comes to value investing while some are potential up and coming funds.

I have been following many of these hedge funds for a while and they have been an excellent source of new investing ideas for me. When compiling this list, I look to provide additional information such as the Top 3 buy/sell counters which these hedge funds made in the latest quarter, their current Top 3 stocks position as well as their latest quarterly fund performance.

In 1Q20, many hedge funds have been hit by one of their worst, if not the worst quarterly performance in their operating history due to COVID-19. It will be interesting to read about their thought processes and how they look to position their portfolio in the coming year.

I will also provide a short snippet of their individual hedge fund commentaries.

[supsystic-tables id=5]

Do scroll to the end of the table and click on Download to get the latest Investment Gurus letters.

Steven Romick – FPA Crescent Fund

Fund performance was not outstanding with the fund down close to 20% in 1Q20. However, they are excited about the portfolio right now due to the compelling valuation of the banks that they own. 6 key points which are currently headwinds but could become tailwinds in future

- Value managers which means making an investment that has an appropriate margin of safety

- Quality and low-volatility indices have outperformed for much of the last decade, pushing prices to valuation levels too high to give them comfort that there is a reasonable margin of safety

- Funds’ net equity exposure to foreign companies has increased from 20.3% at end-2017 to 37.2% today

- Now is the time to seek ideas in the universe comprised of the over-leveraged and economically challenged in the high-yield bond arena

- Accumulating cash due to finding few attractive risk/reward propositions

- Underperform against balanced funds (60% equity skewed towards growth stocks and 40% investment-grade bonds) which they are often benchmarked against but the tide could turn ahead as growth slows and investment-grade bonds end up as junk.

Ruane, Cunniff & Goldfarb – Sequoia Capital

The fund urge investors to be mindful of the crucial distinction between the price of a stock and the value of a business that represents the foundational principle of their approach to investing.

Added to their holdings in Arista, Booking, Carmax, Credit Acceptance, Schwab, UnitedHealth and Wayfair.

Trimmed investments in Alphabet, Amazon, Berkshire, Constellation ,Jacobs and Liberty Broadband.

The only setting in which investors reliably buy at the bottom, sell at the top or go to cash at the right moment is a cocktail party.

Daniel Loeb – Third Point

Did not ascribe adequate probability to a full-blown global pandemic in their scenario analysis around COVID-19. Portfolio susceptiable to the sharp market decline for four key reasons:

- equity exposures were at a beta-adjusted 65% net

- 45% of long exposure was to non-US equities

- Concentrated high conviction portfolio where the top 20 positions represented roughly 85% of NAV

- almost 10% exposure in aerospace, airline and auto-related names

Have significantly re-positioned the portfolio in March.

Dismayed by the Fed’s unprecedented step of purchasing high-yield bonds including “fallen angels” and ETFs. It does nothing to support an economic recovery but will simply prop up asset prices in the short-term.

It highlighted that Sony is in a strong financial position to weather the storm with a net cash balance sheet and large equity investments that could be easily monetized. Sony’s Gaming business is currently experiencing accelerating growth trends driven by the “stay at home” economy. Remains one of the cheapest large-cap tech stocks in the world with market-leading positions in several growing end markets. Has an intrinsic value of 11k yen per share for Sony.

Chuck Akre – Akre Capital Management

One of the funds which outperform the market during the 1Q20 selldown, the fund decline by 11% vs. the broader market decline of 20%.

Has been growing its cash hoard prior to the COVID-19 pandemic which they did not foresee. Think about “shock absorbers”. The three best shock absorbers are:

- Owning exceptional businesses

- paying reasonable valuations for them and

- building cash when paying reasonable valuations proves elusive.

Put additional cash to work during the crisis with cash declining from 17% at year end-2019 to just over 10% as of March 31st. Since neither they nor anyone else knows where or when stocks will see their bottom, they have spooned rather than shoveled cash into select positions, mindful of the extremes to which price and value can become decoupled in times like this.

Bill Nygren – Oakmark Select

Funds performed poorly in both absolute and relative terms as the companies they thought were cheapest before the decline tended to be those that were viewed as benefitting the most from a continued strong economy.

Typically at Oakmark, they buy stocks pried at less than 60% of their estimate of business value and sell them when their price exceeds 90% of that value. During the crisis, they were selling stocks priced at 60% of more of their estimate of business value and buying companies priced at less than 40%.

Don’t consider market timing to be a skill of theirs, so instead, they consistently encourage portfolio rebalancing. That means selling assets that have performed well such as Treasury bonds and using the proceeds to buy assets that have underperformed, like stocks.

Oakmark anticipates their trading activity to remain at an elevated level as they continue to adjust to changing stock prices and capture the tax losses created by the downturn. They only invest in those companies that they believe are being managed to maximize long-term business value per share.

Tweedy Browne Value

The Tweedy Browne Value fund was down more than 20% in 1Q20 as their financial, media, energy and industrial cyclical stocks faced the steepest declines. This included stocks such as Bangkok Bank, Wells Fargo, SCOR, WPP, ConocoPhillips, Total ,Royal Dutch, Safran, G4S and CNH Industrial.

The fund initial analysis of any company always considers the real risks of investing. This is the risk of permanent capital loss. They look hard at the balance sheet and stay far away from highly leveraged businesses. This is especially true during periods of deep economic uncertainty like the one we are in now.

They examine a company’s balance sheet by looking at their bank covenants, debt repayment schedules, credit market access, and cash flows.

The fund established new positions in companies such as Autoliv, a Swedish company that is an industry leader in passive safety products for the automobile industry; Delta Air Lines, the strongest competitor in the consolidating US airline industry which we now know that Warren Buffett sold out; and Shanghai mechanical, an electrical and mechanical manufacturing business.

Uncover a number of new bargains in Japan, including Astellas Pharmaceutical, Yamaha Motor Company, Kuraray, and ADEKA Corporation.

Ronald Baron, Andrew Peck – Baron Asset Fund

Good risk-adjusted-performance allowed the Fund’s Institutional Shares to receive a five-star rating from Morningstar Inc.

Stock selection in the Industrials, Health Care, and Real Estate sectors and lack of exposure to the Energy sector which was down sharply alongside the price of oil, added the most value. The shares of Verisk Analytics, Inc outperformed after the company sold its capital intensive Geomni business while retaining potential upside related to Geomni’s aerial imagery analytics, which was well received by investors.

Within healthcare, higher exposure to strong performing health care equipment stocks through sizable positions in IDEXX Laboratories, DexCom, and Teleflex Incorporated added value.

The top contributors to performance for the quarter included Veeva Systems, DexCom, Clarivate Analytics, SBA Communication, and Equinix.

Top detractors included Gartner, Vail Resorts, Guidewire Software, Arch Capital Group and TransUnion.

Throughout its 30-plus year history, Baron Asset Fund has been a long-term investor in businesses that they believe will benefit from long-lived secular growth trends with sustainable competitive advantages, led by exceptional management teams.

George Livadas – Upslope Capital Management

The fund was down only -2% as a result of significant hedges in place. By most measures, the cheapest stocks are small/mid-cap value stocks. While there is a temptation to load up on stocks of low-quality businesses in the early stages of a market snap-back, this is a mistake, given:

- the prevalence of value traps

- the long-term benefits of owning steadily growing and competitively advantaged businesses with solid balance sheets at attractive prices

Find longs that fall in a sweet spot: well-managed businesses with sustainable competitive advantages and staying power but irrationally tagged by investors as “junk”. Two stocks fit the bill. First is Evercore, a world-class M&A advisory franchise that happens to be cyclical at a crisis level valuation. Second is Crown Holdings, a global beverage/food can business that they have been both long and short in the past.

Sold businesses with at least two of the following: 1. below average execution during good times, 2. full balance sheet and/or 3. operations in/near the direct line of fire of COVID-19. Gartner, Hilton Grand Vacations, and STORE Capital all fit the bull.

Jake Dubois – Blue Hawk Fundamental Growth

The fund net return was -10%. the fund is encouraged due to 4 reasons:

- Believe that this extended period of Work from Home and social distancing will create some lasting changes in behavior after the dust settles, including the acceleration of trends in eCommerce, online dating, digital video games, streaming services, cloud software, and other geographic-neutral professional tools.

- Their quality bias and emphasis on balance sheets means they can remain aggressive and look to be long-term liquidity providers when the short-term liquidity needs of other investors create dislocations in the market.

- Found some wonderful bargains in this environment in both new and existing holdings.

- Bucket of short selling opportunities has significantly expanded as an economic stock has led to insolvency becoming the most likely result for a growing list of companies after yrs of over-reliance on debt, lack of financial discipline, and excessive risk-taking.

Believe this is the time to invest in long/short-mid/large quality growth or what they term as to quality growth “modern value”. When they look at the opportunity set, they think typical “value” sectors will be under pressure for some time, driven by oil, potential recessionary pressures, and potentially weaker housing. Smaller companies will face challenges in these tough times due to comparatively fewer resources and less access to funding, hurting small caps, VC, and potentially a portion of Emerging SaaS.

Ultra-low rates combined with increased credit risk potentially calls into questions the risk/reward tradeoff of investing the incremental dollar in Fixed income, although there certainly will be opportunities there.

Nobody knows what’s going to happen in the stock market in the near term. But that’s not what’s important. In 3 to 5 years’ time, you are not going to look back at your investment and say. “Ahh, I should have waited longer. I could have gotten in 5% lower.” The goal is to just to make sure the opportunity is attractive in an absolute sense, rather than aiming for the perfect time in a relative sense.

Terry Smith – Fundsmith

Terry Smith is one of the most well-known and well-respected UK fund managers and rightfully so. The Fundsmith Equity Fund was down -8% in 1Q20, significantly better than the broad base indexes.

Terry Smith was immensely skeptical of the view that so-called value stocks could protect you in a downturn. He has never been a believer in the philosophy that so-called “value” investments would perform well or protect your investment in an economic and market downturn.

Shares in companies that are lowly rated are so mostly for good reasons. Because their businesses are heavily cyclical, highly leveraged, they have poor returns on capital and/or face other structural or management issues. It does not sound like a combination likely to protect the business and your investment in difficult times and so it has proven thus far.

Believe that a third of his portfolio will endure this year with increased revenues – Microsoft, Clorox and Reckitt Benckiser for example.

Seeing opportunities and have bought two new holdings which they have been following for some time and which have been hard hit in this market because of China exposure and a classic “glitch”. Base on the records, that is Nike and Starbucks.

Michael Lindsell – Lindsell Train Global

A close competitor to Terry Smith in the UK, Michael Lindsell is another well-known fund manager in the UK space. In 1Q20, the fund was down 11%.

Their investment approach steers them clear from capital intensive manufacturing businesses, those reliant on commodity prices to sustain revenues and those dependent on high operational leverage. Some of their companies have super strong balance sheets with no net debt and almost all others sustain prudent levels of debt matched by strong cash flows.

Continue to believe that Disney, Juventus, Celtic, WWE are likely to be the worst affected with the shutdown of their various forms of live entertainment.

Diageo, Brown Forman and Heineken will all suffer from the fall in sales in on-premise locations offset to some extent by increasing off-premise sales.

e-Bay’s online site should benefit from increased activity with physical retailers closed.

Mondelez, Unilever, Pepsi and kao all sell everyday goods to a wide range of consumers.

PayPal seems relatively immune from events other than a slowdown in transaction and payment volumes.

For those investing newbies who feel that reading these hedge fund letters is too much to digest, perhaps you can start with reading some of the investment blogs in this list of Top 75 Singapore Investment Blogs that are compiled by feedspot. New Academy of Finance is honored to be one of the featured blogs in this list as well.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here on this website.

SEE OUR OTHER STOCKS WRITE-UP

- BUFFETT SERIES: IDEXX LABORATORIES

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- BUFFETT SERIES: DISNEY

- 46 STOCKS IN BUFFETT PORTFOLIO

- BUFFETT SERIES: MCDONALD

- STRACO: IS IT A GOOD BUY NOW?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.