Table of Contents

GLD vs GLDM. Bullish Trading Pattern Forming.

Gold’s performance has been relatively lackluster in 2022, notwithstanding the fact that inflation has been soaring last year.

Shouldn’t higher inflation be a boon for gold, an asset class that is often viewed as an inflation hedge?

The 2 main reasons why gold did not perform as well as expected in a rising inflation environment are, in my humble view, are:

- Rapidly rising interest rate environment which is not great for gold since gold is a non-yielding asset and there are thus better higher yielding alternatives for an investor to consider.

- A strong US Dollar tends to impact gold’s price performance negatively.

While the Fed rates remain at a relatively elevated level (c.5%) and are not expected to decline anytime soon, the market now expects rising rates to end, with a final 25 bp hike in the next Fed meeting.

That is positive for Gold. What is more favorable for Gold is a weakening US Dollar of late, with the dollar index having peaked in late 2022 and has since declined by almost 10% from its peak.

Investors have likely priced in the “premium” associated with higher interest rates for the US dollar. Unless we get a nasty surprise from the Fed, stemming from higher-than-expected interest rate increments in the coming Fed meetings, the US dollar is unlikely to strengthen much hereon.

Again, a weaker dollar is a boon for Gold.

Gold is up approx. 7% YTD and last week, this precious metal briefly crossed $2,000/ounce. Might this be a precursor to finally breaking its all-time record level of $2,070/ounce achieved back in 2020?

More interestingly, its technical pattern looks like it is forming a massive cup and handle formation that spans over a decade.

Interested in our FREE Video Guide on the Best ETFs to get started in? Click HERE to get access!

This is arguably the single most bullish trading pattern. The confirmation signal for a massive bullish move is for price to break above the handle and the pattern is complete, with the uptrend continuing.

This bullish move is supported by the 2 major factors that I have highlighted earlier: 1) Interest rates have likely peaked and 2) the weakness seen in the US dollar.

What is the easiest way to partake in the rebound of gold and possibly play its current price uptrend?

Gold ETFs. And in this article, I will be highlighting 2 popular ETFs and the differences between them.

GLD vs GLDM.

The 2 Gold ETFs that I will be highlighting in this article are the very popular SPDR Gold Trust ETF (GLD) and its sister ETF, the SPDR Gold MiniShares Trust (GLDM)

Both GLD and GLDM are exchange-traded funds (ETFs) that are listed and traded on the stock exchanges and can be easily bought and sold by retail traders throughout the day. They are both issued by State Street.

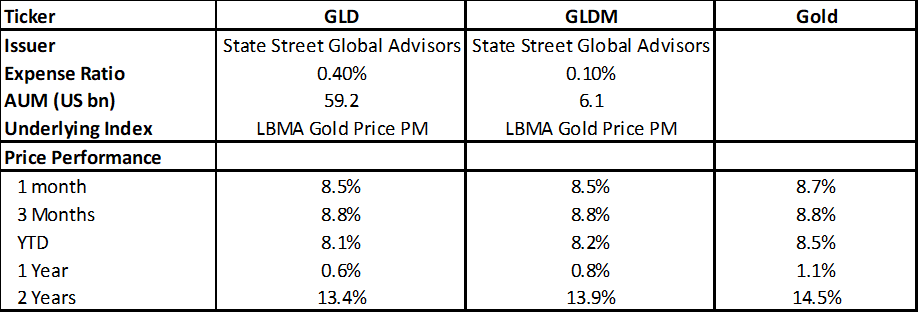

GLD tracks the performance of the underlying gold prices (LBMA Gold Price PM) but according to Investopedia, it does have a tracking error of around 0.93%. This tracking error is the difference between the price of the ETF and the underlying spot price of gold. It is caused mainly by the expenses charged for managing the fund (expense ratio), transaction costs, etc.

GLDM also seeks to track the performance of underlying gold prices (LBMA Gold Price PM). Compared to GLD, the tracking error for GLDM is likely lower due to its lower expense ratio. The expense ratio of GLDM is only 0.10% while that of GLD is one of the highest among gold ETFs at 0.40%.

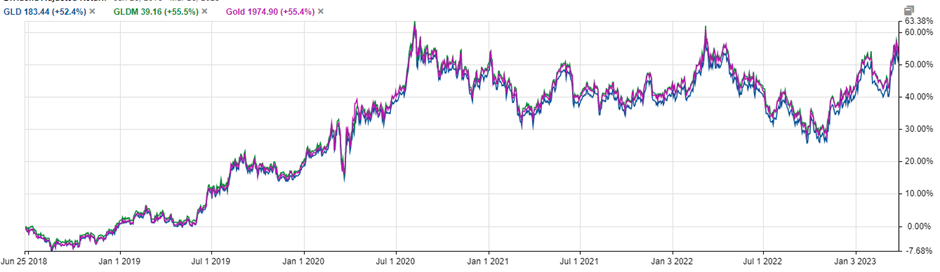

As can be seen from the price chart above of GLD vs GLDM vs Gold Price (since June 2018, the inception of GLDM ETF), the tracking error of GLD vs. Gold Price is -3% over this period while that of GLDM vs Gold is actually at +0.1%.

From this example, it is pretty evident that retail investors should be paying more attention to the less popular GLDM ETF to partake in the price appreciation of Gold vs. the more popular GLD ETF.

The table below highlights the key differences of GLD vs GLDM and their price performance vs. actual gold prices

GLD vs GLDM. Which to choose?

A simple comparison between these 2 popular gold ETFs, both issued by State Street, shows that investors should be paying more attention to the less well-known GLDM ETF to play the rebound in gold prices.

Not only is the share price of GLDM lower (which makes it easier for a single share purchase vs. the higher price GLD), but more importantly, the recurring expense ratio of GLDM ETF is much lower at 0.10% vs. GLD’s higher expense ratio of 0.40%.

However, GLDM ETF is only available on the US stock exchange. On the other hand, the GLD ETF is listed on the Singapore Stock Exchange, the Tokyo Stock Exchange, The Stock Exchange of Hong Kong, and the Mexican Stock Exchange.

For Singaporean investors who solely trade on the Singapore Stock Exchange, the cheaper GLDM ETF is not available for purchase.

Availability of options

For investors like myself who deal with options, only the GLD ETF has options available while GLDM ETF does not.

This is a major disadvantage for the latter since options can be a great way to increase the “yield” potential of Gold ETF.

I highlighted earlier that gold as an asset class, does not have any yield. Consequently, gold-related ETFs also do not have dividend yield.

Nonetheless, one can create his/her own stream of synthetic yield using options on gold ETFs like the GLD ETF through strategies such as the Covered Call Strategy as well as The Wheel Strategy.

Leverage way to play gold rebound

One way to take leverage exposure to gold is through the gold miners, specifically through the VanEck Vectors Gold Miners ETF (GDX), which invests in a basket of gold miners.

Gold miners are leveraged to the price of gold. During the right conditions, they can outperform the price of gold by 2-3x.

I shall leave the discussion of trading the GDX ETF in a separate article or video. However, those who are interested can refer to a previously written article on trading gold using options for > 100% ROI return.

Additional Reading: Cheapest Gold ETFs

For those who are interested in creating a portfolio of ETFs, do check out this Guide on ETFs where I highlight some of my personal preferences.